Egypt's energy policy is helping to change the terms of the global debate on climate change by demonstrating that there is a basic compatibility between developing domestic natural gas resources and developing renewable energy sources. Disproving the dogma that natural gas and renewables are in a zero-sum competition, Egypt is advancing as a leader in renewable energy development while also increasing its offshore natural gas production capacity. Finding a synergy between natural gas development and green energy transition, Egypt will likely use its position as host of the 2022 U.N. Climate Change Conference (COP27) this November in Sharm el-Sheikh to give greater voice to those nations, particularly key nations in Africa, that seek a larger role for natural gas in the energy transition process. In this manner, Egypt will play an important leadership role in brokering a reconciliation between Africa and Europe, which until very recently has discouraged investment in natural gas development.

In the run-up to COP27, Egypt scored an important diplomatic achievement in promoting the simultaneous development of natural gas and renewable energy resources when it signed an agreement with the European Union (EU) on April 10, 2022 to reinforce their cooperation regarding both liquified natural gas (LNG) and renewable energy-produced green hydrogen supplies between Europe and Africa. The agreement was jointly announced in Cairo by Egypt’s Foreign Minister Sameh Shoukry and European Commission Vice-President Frans Timmermans, the EU's leading official for the European Green Deal, the European Climate Law, and international negotiations on climate change. Brussels’ engagement of Cairo reflects Egypt's leadership in establishing a new paradigm for the role of natural gas development in the effort to combat climate change. With Europe's support for Egypt's program to become a global leader in the production of green hydrogen and its derivatives like green ammonia, Cairo will continue to exert a central influence on the direction and pace of energy transition in the Middle East and North Africa (MENA) region and beyond.

Bridging the Political Divide Between Natural Gas and Renewables

The differing views between Europe and many emerging market nations over how to combat climate change sharpened into a bitter divide at the 2021 U.N. Climate Change Conference (COP26) held in Glasgow, U.K. — the most significant Climate Change Conference since the 2015 COP21 in Paris that produced the “Paris Agreement,” in which the parties agreed to implement measures to reduce global warming to 1.5 degrees. The two-week COP26 Glasgow conference concluded on Nov. 12, 2021 and closed the “Paris rulebook,” resolving the outstanding elements of the 2015 Paris Agreement, and it did so in a manner that discouraged natural gas infrastructure investments worldwide.

Africa in particular took issue with the European-led discouragement of natural gas investment. Sub-Saharan Africa's power consumption per capita (excluding South Africa) is a mere 180 kWh, compared to Europe's 6,500 kWh. Africa views natural gas as vital for desperately needed electrification for development and already bristled at the European Green Deal, the EU's €1 trillion ($1.08 trillion) initiative to de-carbonize Europe and promote energy transition abroad, given its objective of reducing natural gas investment worldwide. According to Bloomberg New Energy Finance, funding for gas-to-power projects in emerging markets had already dropped by 10% in 2020 compared to the previous year. Senegal, one of Africa's new aspiring natural gas players with 1.13 trillion cubic meters of reserves, is in the process of developing its offshore gas resources to satisfy its own domestic energy needs and to export LNG internationally. Taking sharp aim at the Europe Union, Senegal's President Macky Sall, who chairs the African Union, declared that cutting funds for new gas exploration would be "a fatal blow" for emerging African countries.

About two months later on Feb. 2, 2022, the EU reclassified natural gas as being "in line with EU climate and environmental objectives and will help accelerating the shift from solid or liquid fossil fuels, including coal, towards a climate-neutral future." Although far from universally accepted among proponents of the European Green Deal, Brussels' turnaround was not a nod to Africa's concerns but came as a result of Europe experiencing a 400% increase in the price of natural gas during 2021. The EU's effort to end its dependency on Russia for more than 40% of its natural gas following Moscow's Feb. 24, 2022 invasion of Ukraine has created an even greater sense of urgency about redefining Europe's policy on natural gas development as the EU and its member states scramble to find alternative gas supplies, which will likely come in the form of LNG.

The April 10 EU-Egypt agreement on LNG and green hydrogen resulted from these circumstances. Seeking to strike a new balance between promoting the development of renewable energy and procuring reliable and affordable supplies of LNG, the EU turned to Egypt, which has pioneered a synergy between LNG and renewable energy development.

Egypt's Synergy Between Natural Gas and Renewable Energy Development

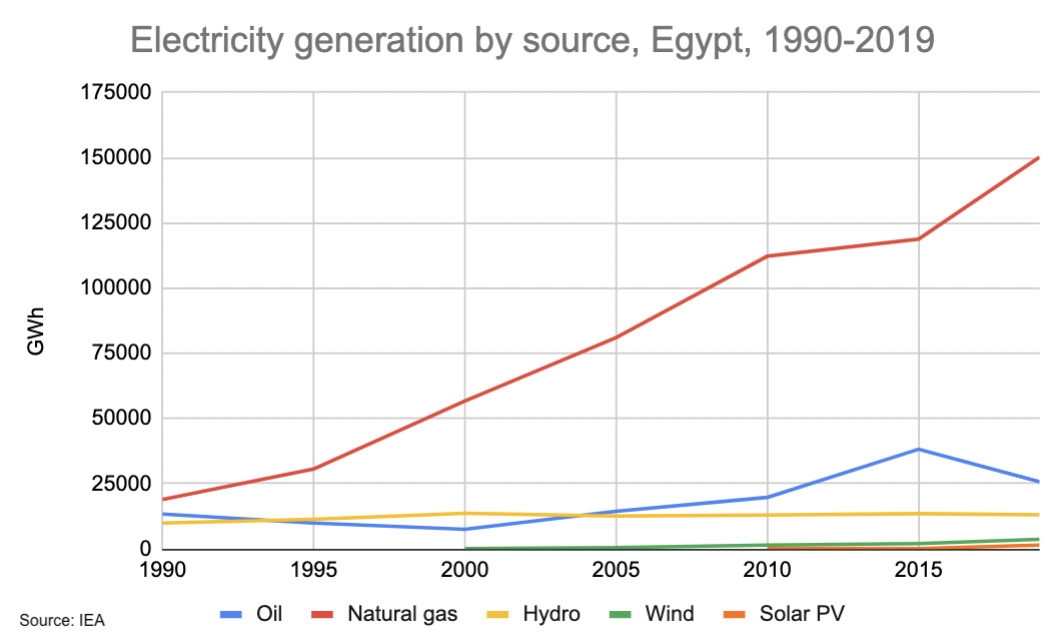

Egypt's rise as a regional energy power is a major achievement for the Middle East's most populous nation, long mired in economic woes and accustomed to regular power cuts and blackouts. Egypt has not only demonstrated the compatibility between developing natural gas and renewable energy resources in tandem, but also that natural gas development can catalyze the accelerated development of renewable energy. In 2019, thanks to production from its large offshore natural gas deposits, Egypt achieved natural gas self-sufficiency and became a net energy exporter in the form of LNG. The anticipation of natural gas self-sufficiency spurred Cairo's concurrent advances in developing renewable energy resources. Natural gas and renewables together have created a marketable electricity surplus that is set to grow significantly in the near future as Egypt's additional renewable energy projects and nuclear power come online.

Egypt's surplus electricity, in turn, prompted the development of electricity interconnections to Europe, the Middle East, and sub-Saharan Africa. While initially most of the electricity exports sold via the interconnections will be generated from natural gas, commonly referred to as “gas-by-wire,” these interconnections are sparking further investment in renewable energy development, having established the transmission infrastructure for an electricity export market. Given its strategic location in the eastern Mediterranean, Egypt is positioned for the long term to play an important role in servicing electricity markets on three continents.

Egypt's transformation into an inter-regional energy power resulted from the convergence of four main factors during Egyptian President Abdel-Fattah el-Sisi's eight years in office: new offshore natural gas discoveries, fiscal reform, renewable energy resources development, and the construction of electricity interconnections. The game-changing event that set these factors into motion was the August 2015 discovery of Egypt's massive Zohr natural gas field by the Italian energy major Eni. The largest eastern Mediterranean gas find to date with 850 billion cubic meters of gas in place, Zohr's development meant that Egypt could become energy self-sufficient and the eastern Mediterranean region collectively had marketable volumes of natural gas for export using Egypt's existing liquefaction plants. By 2020, Zohr accounted for 40% of Egypt’s total daily gas production. Between 2016 and 2018, the German manufacturing conglomerate Siemens built three combined-cycle gas power plants in Egypt with a total capacity of 14.4 gigawatts (GW), enough to supply 40 million Egyptians with reliable electricity. During the same timeframe in which Egypt developed the Zohr field and installed the gas-fired power plants, it also built the massive Benban solar park outside of Aswan, touted as the world’s largest operational photovoltaic (PV) solar park. With an installed capacity of 1.8 GW, the $4 billion solar complex consists of about 40 solar plants developed by over 30 foreign companies from 12 countries and will prevent an estimated 2 million tons of annual carbon dioxide emissions.

By June 2019, with only about half of Benban's capacity operational, Egypt's total installed capacity stood at 58.4 GW, according to the Egyptian Electric Holding Company (EEHC). In November 2019, Egypt’s largest wind power generation complex, the 262.5-MW Ras Ghareb wind farm near the Gulf of Suez, also came online. The wind power facility generates enough electricity to supply 500,000 households. The electricity produced by the Benban solar park and the Ras Ghareb wind farm themselves are equivalent to around 16% of Egypt's surplus capacity. By 2020, Egypt had reversed its 6-GW electricity generation capacity deficit and turned it into a surplus of 13 GW.

Egypt's surplus capacity then spurred investment in electricity interconnection — most notably the 2-GW Euro-Africa interconnector to transport electricity from Egypt to Europe via Cyprus and Greece. Egypt also made significant upgrades to its electricity interconnections with Africa. In December 2019, President el-Sisi announced that Egypt was prepared to export 20% of its surplus electricity to African nations. Sudan, Egypt’s neighbor to the south, has a 60% rate of access to electricity. Egypt and Sudan’s grid connection became operational in April 2020, and will reach 300 MW upon completion. Through Libya and Sudan, Egypt could theoretically export electricity to neighboring countries such as Chad, whose rate of access to electricity stood at only 12% in 2018.

Egypt's burgeoning electricity interconnections with Europe, Africa, and the Middle East are giving rise to further investment in power generation from renewable sources. In June 2019, renewables, solar, and wind accounted for 3.8% of Egypt's installed capacity with 2.23 GW (hydropower similarly accounted for only 4.8% or 2.38 GW). Egypt’s 2035 Integrated Sustainable Energy Strategy aims to boost power production from renewable sources to 10 times that level to account for 42% of Egypt's installed capacity by 2035. Cairo’s ambitious energy policy calls for 61 GW of installed capacity from renewables: 32 GW from PV solar power, 12 GW from concentrated solar power, and 18 GW from wind power. Far from being in a zero-sum game competition, Egypt's recent energy policies demonstrate that natural gas has encouraged the expansion of renewables. Now Egypt seeks to build on the growing momentum of its renewables sector to become a global leader in the production of green hydrogen and its derivatives.

Egypt's Expanding Green Hydrogen Horizons

Egypt is expected to officially announce its national low-carbon hydrogen strategy sometime between June and the November COP27 climate summit, which it will hosting. In early March 2022, the European Bank for Reconstruction and Development (EBRD) signed a memorandum of understanding (MoU) with Egypt to provide guidelines for the country’s low-carbon hydrogen strategy to promote cost-effective green hydrogen production and export. In 2021, Cairo had already set into motion a few initial green hydrogen projects and the EBRD will assess these initial projects as well as potential hydrogen production in Egypt, valuing the storage and transportation of hydrogen and its derivatives.

Indicative of Cairo's commitment to green hydrogen, the government signed an agreement one year earlier in March 2021 with the Belgian conglomerate DEME, already involved in Egypt's Mediterranean port capacity expansion, to conduct feasibility studies for the production and export of green hydrogen. DEME, with expertise in offshore oil and gas production as well as offshore wind power production, will reportedly be involved in determining the optimal locations for hydrogen production hubs. Locating Egypt's green hydrogen facilities is a critical task. Although water consumption accounts for only a small share of the total cost of green hydrogen production, the supply of water as an input becomes a critical issue in a country like Egypt where water is a highly scarce resource. Egypt's average annual rainfall is only 33.3 mm, with most of its rain falling on the Mediterranean coast. Given its high evaporation rate and lack of permanent surface water across large swaths of its territory, water resource availability is a perennial challenge for Egypt. It relies on the Nile River to provide approximately 90% of its freshwater consumption of about 65 billion cubic meters, around 80% of which is used in agriculture.

Egypt cannot easily afford to divert significant volumes of its scant freshwater resources for green hydrogen production. The electrolysis process used to produce green hydrogen by splitting water into its oxygen and hydrogen constituents requires 9 kilograms of water for every kilogram of hydrogen. Egypt's estimated 2019 “gray” hydrogen production, i.e. hydrogen produced from natural gas, totaled 1.82 million tons. To produce this amount as green hydrogen would require approximately 16.22 million cubic meters of water. To use seawater as an alternative would require desalination since seawater would damage the electrolyzers used for green hydrogen as well as produce chlorine as a by-product. Using desalinated seawater for green hydrogen production means that Egypt's new facilities would need to be located near the coast, requiring the expertise of a company like DEME, a world leader in dredging and coastal marine infrastructure.

One of Egypt's most promising green hydrogen projects will be constructed on the western shore of the Gulf of Suez. The Norwegian renewable energy company Scatec and Dutch-Emirati fertilizer producer Fertiglobe have partnered with the Sovereign Fund of Egypt and the Egyptian construction giant Orascom to build a green hydrogen facility in the industrial zone of the Red Sea port of Ain Sokhna, near Fertiglobe's subsidiary Egypt Basic Industries Corporation (EBIC). The facility's 100-MW polymer electrolyte membrane electrolyzer will be one of the world's largest upon the plant's expected inauguration of operations in November 2022. As majority stakeholder, Scatec will build and operate the Ain Sokhna facility with Fertiglobe enjoying a long-term off-take agreement for the plant's green hydrogen output as a feedstock for EBIC's green ammonia production.

Egypt is the world's seventh largest ammonia producer, just behind Saudi Arabia, which is the largest producer in the MENA region. In terms of storage, storing green hydrogen as green ammonia is one of the cheapest options. Already a major ammonia producer, Egypt could utilize part of its existing ammonia storage and transportation infrastructure for green ammonia. While ammonia is used in several industrial processes, including the manufacture of plastics, textiles, and dyes, the most common use is as one of the essential components of fertilizers. As such, green ammonia is likely to form a central part of Egypt's low carbon hydrogen strategy for both domestic use and exports.

Furthering Egypt's ambitions to become a green hydrogen hub, EEHC signed an MoU in August 2021 with Siemens, which built the country's combined-cycle gas power plants, to jointly develop a hydrogen-based industry in Egypt with export capabilities, intended to maximize hydrogen production based on renewable energy sources. The initial development phase will entail a pilot project with an electrolyzer capacity of 100 to 200 MW, which Siemens believes "will help to drive early technology deployment, establish a partner landscape, establish and test regulatory environment and certification, setup off-take relations, and define logistic concepts.”

However, for Egypt to replace its entire gray hydrogen production with domestically produced green hydrogen is a tall order in the near term. To do so, Egypt would need an estimated 21 GW of electrolyzer capacity, or roughly 100 times the capacity currently under construction. While Cairo builds up its green hydrogen capacity, it is likely to opt for a combination of green hydrogen and so-called blue hydrogen — hydrogen produced from natural gas like gray hydrogen but where carbon capture processes are applied to reduce CO2 output. In July 2021, Eni, one of Egypt's leading natural gas partners, signed an agreement with EEHC to assess the technical and commercial feasibility to produce both green hydrogen and blue hydrogen. In the case of blue hydrogen, Eni is eyeing the possibility of using Egypt's depleted natural gas fields for the storage of CO2 produced by carbon capture. Egypt is currently the world's sixth largest producer of urea, also used in nitrogen-based fertilizers, and could relatively easily use the captured CO2 for urea manufacture.

Conclusion

Egypt's gray hydrogen production is responsible for putting 20 million tons of CO2 into the atmosphere every year. Reducing that carbon footprint through replacement with green hydrogen would make a positive contribution to combatting climate change. Along the way, Egypt is likely to develop its blue hydrogen production capacity as a transitional measure, reflecting its general orientation of using its natural gas resources as a “bridge fuel” in the transition to green energy. Egypt's commitment to green hydrogen shows that the prospect of transition is real, just as Egypt demonstrated that developing its offshore natural gas reserves for domestic use and LNG export did not deter it from concurrently developing large-scale solar and wind power projects. With natural gas ensuring self-sufficiency in its domestic power supply and then creating a surplus, Egypt was further motivated to develop its electricity interconnection with Europe, Africa, and the Middle East to create the transmission infrastructure for an electricity export market. This, in turn, is catalyzing the accelerated development of Egypt's renewable resources. Cairo is now aiming to create 61 GW of installed capacity from renewables by 2035, more than the equivalent of its entire current gas-fired power generation capacity.

The EU’s April 10, 2022 agreement to support Egypt's development of both LNG and green hydrogen bears testament to the diplomatic influence of Cairo’s program of concurrently developing its natural gas and renewable energy resources. Having already redefined the terms of the international debate on energy transition by exemplifying the possible synergy between developing natural gas and renewables, Egypt can preside over the 2022 U.N. Climate Change Conference in Sharm el-Sheikh as more than a host but also as a key advocate for the larger role for natural gas in the process of energy transition, brokering a new energy relationship between Europe and the nations of Africa and the Middle East. Both through its energy diplomacy and the further development of its renewable energy and green hydrogen production capacities, Egypt will be one of the primary actors over the next decade determining the shape and pace of energy transition in the MENA region and thereby also influencing the course of energy transition in Europe and Africa.

Professor Michaël Tanchum is a non-resident fellow with the Middle East Institute's Economics and Energy Program. He teaches at Universidad de Navarra and is an associate senior policy fellow in the Africa program at the European Council on Foreign Relations (ECFR). He is also a senior fellow at the Austrian Institute for European and Security Policy (AIES). The author would like to thank Markus Keuper and Katsumi Watanabe Morales for their research assistance. The views expressed in this piece are his own.

Photo by Oliver Weiken/picture alliance via Getty Images.

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.