Saudi Aramco, the world’s largest energy company and second most valuable firm after Apple, announced a record $161 billion in profits for 2022, up 46% from the previous year. The company attributed the increase to higher crude prices and wider margins in the downstream sector. Civil society activists panned these soaring petroleum-sector earnings, contending that fossil fuel use is the largest driver of anthropogenic climate change. Although Aramco professes to invest in green or energy transition projects, it could use some tangible shorter-term deliverables in that space: small-scale liquefied natural gas (ssLNG) development in particular could fit the bill.

A consistent and structured domestic deployment of LNG as a transport and power-generation fuel would lower the kingdom’s carbon footprint as well as improve air quality by reducing vehicle exhaust, mainly particulate and nitrous oxide emissions. According to Aramco, the gas resource base already exists; and clearly, the capital is available. Furthermore, the technology is de-risked. Developing the ssLNG value chain would not only provide tangible economic and environmental benefits for both Aramco and the kingdom but also allow the country to showcase its domestic expertise and resources while addressing environmental, social, and governance (ESG) issues in the near term.

Aramco has publicly stated its desire to expand gas production, and the development of the ssLNG value chain would notably offer the company an opportunity to further commercialize Saudi resources as well as gain valuable experience in the LNG sector. Finally, implementing low-risk, cleaner fuel options from an existing resource base compliments the company’s dual priorities of extending the life of (cleaner) crude oil and ensuring lasting demand for petrochemicals/plastics.

Introduction

The global LNG business has long been dominated by conventional large-scale liquefaction plants and purpose-built carriers that deliver LNG volumes via long-term contracts to import conglomerates and multinational firms supplying gas to produce electricity for national or municipal power grids. However, over the past 10 years, ssLNG has emerged and grown into a valuable commercial area. Output from conventional single-train LNG plants ranges from 3.0 million tons per annum (mtpa) to more than 7.7 mtpa (e.g., Qatar mega trains). Small-scale liquefaction trains typically generate less than 10% of the LNG volume of conventional large-scale trains, yielding between 0.1 and 0.25 mtpa per train. The LNG from these smaller-scale operations is then shipped to market via containerized International Standard Organization (ISO) tanks or bunker barges rather than over sea via the large, dedicated LNG carriers. To date, volumes generated by ssLNG plants primarily provide fuels for maritime and road transport, displacing diesel and marine fuel oils, as well as for power generation for off-grid locations.

Deployment in Saudi Arabia

The main drivers encouraging the adoption of LNG as a transport and power fuel are the needs to reduce air pollution and greenhouse gas (GHG) emissions. Saudi Arabia’s air quality has been deemed unsafe by the World Health Organization, with vehicle exhaust, hydrocarbon processing, and desalination operations generating the largest proportion of man-made atmospheric pollutants in the kingdom.

To mitigate this, ssLNG projects (namely, those producing less than 1.0 mtpa) could be constructed in various producing regions, with the LNG product distributed via rail, ship, and truck to a network of fueling stations and isolated demand centers, where it would be offered as a cleaner, more environmentally friendly transport fuel. With ssLNG plants located strategically across the Eastern Province and the produced LNG distributed via ISO tanks, the kingdom could foster a shift away from diesel-powered long-haul trucks and heavy fuel oil/crude oil-burning power plants.

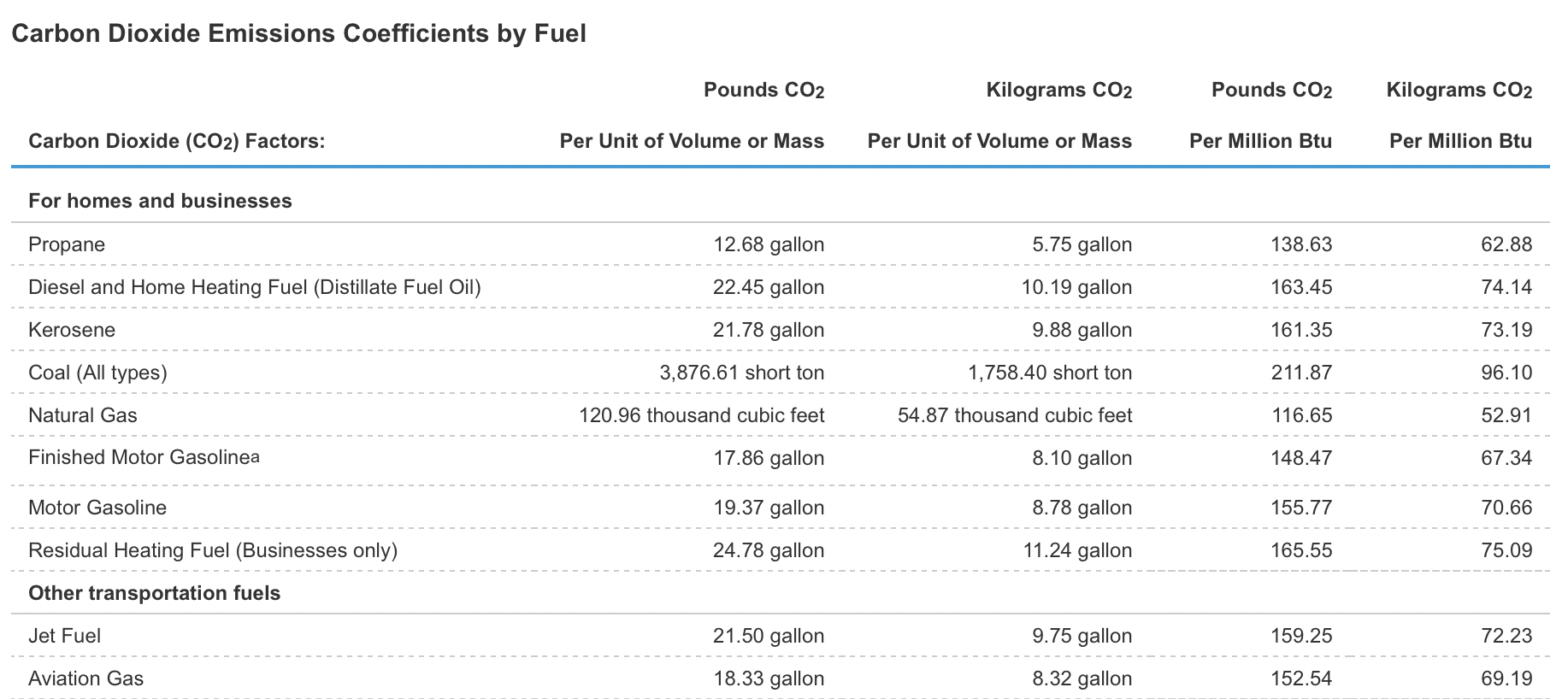

The capital expenditure (CapEx) required for a single 0.25 mtpa ssLNG plant ranges from $75 million to $150 million, depending on various parameters, and produces approximately 360,000 gallons of LNG per day, enough to fully supply 1,500 long-haul trucks (each equipped with a 240 gallon tank). Moreover, ssLNG technology is commoditized, de-risked, and takes only 18-24 months to construct. Saudi Arabia’s $161 billion in oil profits could fund more than 1,000 new ssLNG plants; however, just an estimated 20 plants would be sufficient for an initial phase that would supply enough fuel to convert a substantial number of long-haul trucks and provide fuels for isolated off-grid power plants. Implementing just 10 ssLNG plants would potentially remove 15,000 diesel-powered trucks (somewhere around 10%, extrapolating from the relatively size of the Saudi and U.S. economies) from the Saudi transport sector. Assuming 223 tons of CO2 is released on a yearly basis per truck, this would translate to preventing almost 3.5 million tons of CO2 reaching the atmosphere annually. According to the British-based electricity company National Grid, “LNG produces 40% less carbon dioxide (CO2) than coal and 30% less than oil, which makes it the cleanest of the fossil fuels.” While Cummins, a multinational engine manufacturer, states, “Natural gas has many sustainability benefits, including 13%-17% lower well to wheel greenhouse gas (GHG) emissions and 27% lower CO2 emissions than petroleum.”

In Saudi Arabia, the power/electricity and transport sectors have the highest GHG per capita footprint (see Figure 1). And Mordor Intelligence estimates that the country’s freight and logistics sector is forecasted to attain a compound annual growth rate (CAGR) of 4.6%. Both these industrial sectors are thus a logical target for conversion to LNG as a fuel. Without such a shift, domestic demand for diesel, high sulfur fuel oil (HSFO), and crude oil for power will continue to grow, increasing the kingdom’s GHG emissions. The development and implementation of an ssLNG business plan with LNG distributed via ISO tanks will offer the country an opportunity to reduce the highly polluting diesel, crude, and HSFO in the two fastest growing economic sectors. In 2020, crude burn for domestic use peaked in August at 702,000 barrels per day (bpd), declining to 335,000 bpd by February 2021, as OPEC+ eased export quotas for its members, according to the Riyadh-based Joint Organisations Data Initiative (JODI). Reducing domestic crude and fuel oil burn would free up capital for deployment to value-building initiatives such as ssLNG as well as lower carbon emissions if displaced by LNG (see Figure 2).

Figure 1

Figure 2

An immediately available energy transition option

Solar and wind power also offer low-carbon footprints, but large-scale deployment is many years off. While solar energy technology is developing quickly, technical challenges remain, including the problem of mitigating the obscurative effects of fine grained dust and particulates suspended in the Saudi air. On the other hand, ssLNG is a proven technology that can be implemented today; and utilizing gas for power is three times more efficient than liquids power generation, with CO2 from the former emitted at the level of 0.97 pounds per kilowatt hour (lb/kwh) versus 2.44 lb/kwh for petroleum power. With increasing demand-side pressure and growing GHG levels in Saudi Arabia’s expanding economy, an aggressive strategy that includes implementing LNG as a fuel that can be generated from low CapEx, small footprint ssLNG plants and delivered via mobile ISO tanks is not only logical but would provide a quick win for Saudi society, industry, and the broader economy.

Conclusions and the way forward

Developing an ssLNG sector is complementary to the country’s longer-term, more complex energy transition efforts. This segment of the LNG space is less capital intensive, holds lower commercial and technical risk, and can be implemented within three years, compared to more conventional, large-scale projects. It, thus, presents an opportunity for the kingdom, Aramco, and the Saudi Public Investment Fund (PIF) to align and deliver a cleaner fuel option while reducing GHG emissions.

In addition to the two primary environmental drivers that support ssLNG development in the country — air pollution and GHG reduction — other positive factors encouraging such an approach are also worth considering:

- Saudi Arabia has the opportunity to develop a flexible, technically de-risked, non-capital-intensive new business sub-sector that can capitalize on existing domestic upstream gas resources while utilizing established in-country supply chains and technical expertise. Phase one could bring to market 300-500 million standard cubic feet per day (mmscfd) of gas production.

- Developing the ssLNG value chain will, in turn, stimulate the economy as the value chain is built out. The construction of ssLNG plants, fabrication of ISO and truck tanks, development of distribution networks, and subsequent operations of this infrastructure will increase the utilization of Saudi nationals, increasing job opportunities in the country.

- As Saudi Arabia develops the ssLNG value chain and implements the LNG volumes delivered to end users via ISO tanks, Aramco could expand the service to neighboring countries such as Bahrain and Jordan, which are short of gas.

- Implementing the ssLNG concept, including delivery to isolated liquid-burning power plants via ISO tanks, will displace liquid hydrocarbons, releasing those incremental volumes for sale on the global market.

- The displacement of HSFO used to generate electricity will reduce foreign capital outflows. The kingdom imports more fuel oil during the summer, as power demand surges for air-conditioning and desalination. In the summer of 2021, the kingdom burned more than 700,000 bpd of oil for power generation.

- Developing the ssLNG value chain will build essential experience and provide critical expertise within the LNG sector. Aramco has considered expanding into the LNG space for several years, internationally and domestically. With successful implementation of ssLNG, the company could much more easily delve into the conventional LNG business as well, minimizing the costly learning curve.

- Committing and building an ssLNG sector, including implementing LNG as a transport and power fuel, reducing diesel consumption in long-haul trucking, and displacing liquid fuel for power generation, will enhance both Saudi Arabia’s and Aramco’s international reputation.

Saudi Aramco is in a unique position to single-handedly develop and implement an ssLNG business in the country, with tangible results within 3-5 years. Requiring minimal CapEx compared to conventional oil and gas projects and a shorter project delivery timeline, the company can quickly pursue ssLNG to improve air quality in the country. A funding commitment will ensure that LNG displaces HSFO and crude oil in power plants, removes dirty diesel-burning long-haul trucks and coastal marine vessels, and increases employment for Saudi nationals. Public support from the government would drive Aramco to deliver. Developing and implementing ssLNG in the country would again reaffirm the company’s leadership in the energy sector.

Wayne Ackerman has more than 30 years’ experience in the upstream exploration and production sector and major capital project development, including LNG. He is also the founder and president of Ackerman and Associates Global Consulting, LLC, and a member of the Advisory Council for the Program on Economics and Energy at the Middle East Institute (MEI).

Photographer: Chris Ratcliffe/Bloomberg via Getty Images

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.