Hydrogen (H2) is gaining increasing recognition as a key contributor to the global energy transition. The International Energy Agency (IEA) has described hydrogen as a “versatile energy carrier” that could play a significant role in decarbonizing the global economy across a range of sectors.[1] Meanwhile, governments and energy companies alike are placing large wagers on hydrogen in efforts to lower greenhouse gas emissions.

The Gulf Arab states are among a growing number of countries that have released or been working on national hydrogen strategies aimed at developing hydrogen technologies and markets. Saudi Arabia and the United Arab Emirates (UAE) are leading the pack — positioning themselves to carve out major roles as hydrogen exporters, much as they have done in the global oil trade. Qatar appears to be following suit. Concurrently, Japan, China, and South Korea — the top destinations for Saudi and Emirati crude oil — seem set to emerge as major hydrogen importers. Thus Gulf-Asia energy interdependence could acquire a new and important dimension, provided further cost reductions can be achieved and other challenges mitigated if not overcome.

The Hydrogen Economy – An Old Idea Whose Time Has Come?

The term “hydrogen economy” refers to an economy that relies on H2 for a substantial fraction of a nation’s energy and services. The idea of a hydrogen economy is not new. On the contrary, hydrogen has long been heralded — some would say, hyped — as a tantalizing alternative to fossil fuels.[2]

Visions or fantasies aside, in fact, hydrogen has been used in petroleum refining, glass purification, pharmaceuticals, and fertilizer production for several decades. Reduced renewable energy costs, maturing hydrogen production technology and growing importance placed on cutting emissions has drawn increasing interest from governments and the private sector.

Hydrogen has multiple advantages. The fuel is light, storable, reactive, and has high energy content per unit mass, which means it can be readily produced at industrial scale. It can also be stored for relatively long periods of time.

Hydrogen can be burned in turbines or used in fuel cells to generate electricity and power electric vehicles, and can serve as a source of domestic and industrial heat as well as a feedstock for industrial processes. In fact, hydrogen has a wide range of industrial applications, from refining to petrochemicals. Hydrogen is perhaps best suited to decarbonize certain energy-intensive difficult-to-abate sectors of the economy, specifically heavy road freight, shipping, aviation, chemicals, cement, and iron and steel manufacturing.

Hydrogen has been produced on an industrial scale for decades. Regional hydrogen markets are well-established, with value chains firmly in place. Historically, hydrogen has long served as an intermediate product for the synthesis of outputs such as ammonia. But with mid- and long-term climate commitments having become more ambitious, interest in and demand for hydrogen as chemical storage, energy carrier, and feedstock for industrial production is growing.

The H2 “Color Spectrum”: Cost Condundrum and CO2 Challenges

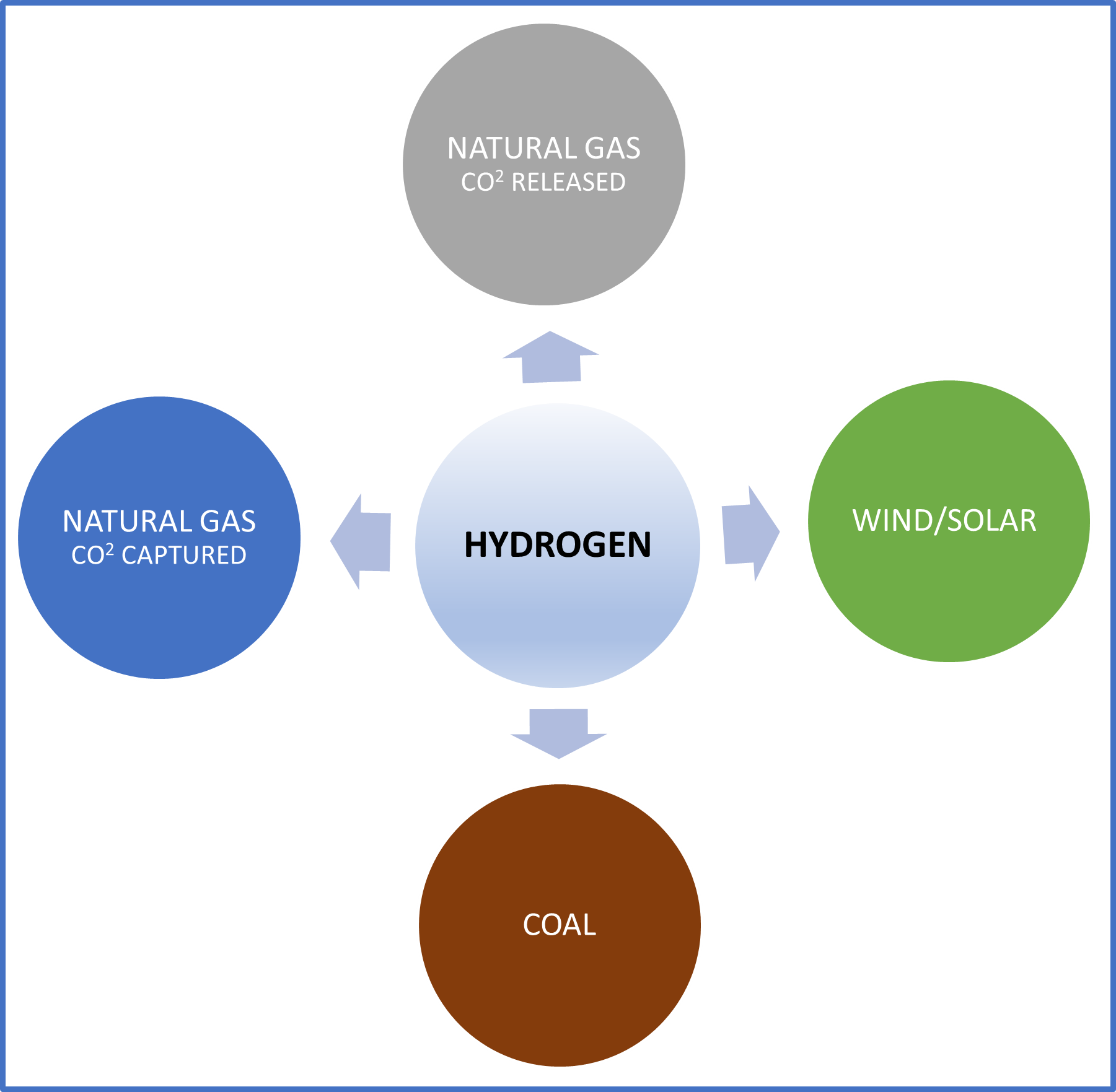

There are four main sources for the commercial production of hydrogen: natural gas, oil, coal, and electrolysis. Color codes, or labels, used within the energy industry to differentiate between types of hydrogen based on the technology used to produce each. [See figure below.] The oldest way of producing hydrogen is by transforming coal into gas. Nowadays, though, nearly all of the hydrogen produced for industrial use — in refineries and manufacturing plants — is so-called “gray” hydrogen.

![]() Gray hydrogen principally is derived from natural gas bonded with carbon through a process involving water called “steam reforming” that generates large volumes of CO2. Hydrogen is considered “blue” when the emissions generated from the steam reforming process are captured and stored underground through industrial carbon capture and storage (CSS), thereby providing a “low carbon” energy source — though not a carbon neutral source as around 10-20% of the generated CO2 cannot be captured.[3]

Gray hydrogen principally is derived from natural gas bonded with carbon through a process involving water called “steam reforming” that generates large volumes of CO2. Hydrogen is considered “blue” when the emissions generated from the steam reforming process are captured and stored underground through industrial carbon capture and storage (CSS), thereby providing a “low carbon” energy source — though not a carbon neutral source as around 10-20% of the generated CO2 cannot be captured.[3]

“Green” hydrogen is a clean form of H2 that is produced using electricity generated from renewables such as wind or solar; that is, splitting water by electrolysis, such that the hydrogen is used and oxygen vented into the atmosphere with no negative impact. Producing hydrogen from renewable energy sources without CO2 as a by-product therefore makes green hydrogen, which can be stored for a long time and transported over considerable distances, the “fuel of the future”. But only around 0.1% of hydrogen produced globally is currently green.[4]

For there to be a dramatic scaling up in green hydrogen’s production and use, costs will need to come down, massive investments will be required, and substantial progress in competing energy storage alternatives will have to be made. The most critical factor for the cost of green hydrogen is the price of the green electricity used in the electrolysis process,[5] while the second largest is the cost of electrolysis facilities. To be sure, wind and solar have come a long way in the past two decades in terms of cost reductions. Nevertheless, researchers have found that clean hydrogen still costs too much to enable it to be widely deployed.

At the present time, gray hydrogen is cheaper than either blue or green H2 while clean hydrogen is 2-3 times more expensive than the blue version.[6] Some experts have forecast that clean hydrogen could be economically competitive on an industrial scale within a decade.[7] Similarly, the IEA projects that the cost of clean hydrogen will drop 30% by 2030.[8] But not everyone has jumped on the green hydrogen bandwagon. Skeptics point not just to costs but to other disadvantages as well as safety risks.[9] Some consider clean H2 “inescapably”[10] or “grossly”[11] inefficient. It is unclear when clean hydrogen might become affordable and profitable, and whether some of these other challenges can be overcome or mitgated.

The Blue Hydrogen “Bridge”

Developing blue hydrogen production, which utilizes natural gas, carbon capture and storage technology is commonly viewed as a bridge in the transition to a green hydrogen economy. Globally, production capacity of blue hydrogen is expected to grow significantly over the next decade.[12]

But, as with clean hydrogen, the blue hydrogen pathway is obstructed by cost considerations and disadvantages of its own.[13] The main cost driver for blue hydrogen is the price of natural gas, which varies around the world. The second-most important driver is the cost of capturing and reusing or storing the carbon emissions. Those who support blue hydrogen in conjunction with zero-carbon hydrogen insist there are cost benefits and that there is evidence the technology could capture up to 90% of CO2 from hydrogen production. Skeptics respond that the blue hydrogen production route is not climate neutral, as CCS technology is unproven at scale and is expected to reach at best 85-95% efficiency.[14] Bloomberg NEF projects that blue hydrogen will have a cost advantage until 2030[15] — a scenario which, if proven correct, suggests that blue H2’s role as a bridge to clean hydrogen might be short lived.[16]

Yet, despite these misgivings and uncertainties, hydrogen enthusiasm is running strong. A growing number of countries have released or been working on national hydrogen strategies aimed at developing hydrogen technologies and markets.

Asia Pacific and Europe currently dominate hydrogen demand creation. In Europe, there is strong interest in green hydrogen at the European Union (EU) and Member States levels. Germany, France, Portugal, the Netherlands and Spain all have released green hydrogen strategies and set national targets. Germany has moved to establish hydrogen as a decarbonization option.[17] At the heart of the EU Strategy for Energy System Integration and the Hydrogen Strategy for a Climate-Neutral Europe.

Japan, China, and South Korea have launched hydrogen strategies as well. Japan, which presented its hydrogen strategy in December 2017 and two years later updated its Strategic Road Map for Hydrogen and Fuel Cells, is the frontrunner. Japan recently announced its intention to be carbon neutral by 2050 and to build the world’s first full-scale hydrogen supply chain within a decade. In March 2020, the world’s largest renewable powered electrolyser commenced operation at the Fukushima Hydrogen Energy Research Field. Japan’s Suiso Frontier, the world’s first vessel designed to carry hydrogen, is set to start shipping hydrogen from Australia later this year. There is further transportation capacity in the pipeline, with Kawasaki aiming to build two commercial-scale ships to import hydrogen by 2030 and an additional 80 hydrogen carriers by 2050.

Meanwhile, China, the world’s largest hydrogen producer — accounting for almost one-third of the world’s total production — has focused the development of its hydrogen strategy on the transport sector. In 2020, Sinopec, the world’s biggest refiner by capacity, started to accelerate the construction of an integrated hydrogen energy industry chain. According to the firm’s Chairman Zhang Yuzhou, Sinopec has “set hydrogen as the main direction of the company’s new energy development.”[18]

South Korea, which announced announced its Hydrogen Economy Roadmap in early 2019, has prioritized the automative sector. In January 2020, the Korean National Assembly passed the Hydrogen Law (Hydrogen Economy Promotion and Hydrogen Safety Management Law), laying the legal foundations for the government's hydrogen commitment and implementing safety standards for facilities. Korea Shipbuilding is developing a hybrid carrier that can transport LPG and CO2. The Korean Ministry of Trade, Industry and Energy is reportedly considering Saudi Arabia among several other countries for a role as its hydrogen production base.

Hydrogen has drawn increasing interest not only from national governments but also from international oil companies (IOCs). The number of companies with carbon-free energy goals that have embraced hydrogen is growing. BP’s “new mission” of becoming a net zero company by 2050.[19] ExxonMobil, Chevron, Royal Dutch Shell,[20] Total SE,[21] and Repsol are scaling up investments in hydrogen. BP is working on plans for a major blue hydrogen facility in Teeside, UK.[22]

Interest in hydrogen is building within the international shipping industry as well. Approximately four-fifths of global trade by volume is carried by ships at sea.[23] Hydrogen is expected to be a core decarbonization strategy for meeting the International Maritime Organization’s primary greenhouse gas (GHG) goals to reduce international shipping emissions by at least 50% by 2050 with zero emissions targeted by the end of the century.[24] This use — as a marine fuel and commodity or cargo — is likely to be in the form of hydrogen-derived ammonia.[25] The latter is emerging as the zero-carbon fuel of choice in joint ventures to produce green and blue hydrogen by shipping giants such as Maersk and Hyundai.

GCC Energy Producers and the Emerging Asia Pacific Hydrogen Market

Asia Pacific is the largest and fastest-growing region in the H2 generation market.[26] Whereas potential hydrogen importers from Europe have declared a preference for green hydrogen, China, Japan, and South Korea have a more diversified gray-blue-green strategy that could mesh well with the goals of aspiring blue hydrogen exporters, notably Gulf producers.

Although GCC countries use large quantities of gray hydrogen based on natural gas, the Middle Eastern market is now primarily focused on the prospects for blue and green hydrogen. Saudi Aramco and Abu Dhabi National Oil Co (ADNOC) are warming to the idea that they might be able to establish themselves as key suppliers in the nascent hydrogen industry[27] thanks to an abundance of potential solar power, favorable geology, energy-intensive industries clustered with existing H2 production facilities, significant CO2 storage capacity, and well-developed infrastructure such as natural gas.[28]

In early 2020, Dii and its partners — Acwa Power, NEOM, Thyssenkrupp, Abu Dhabi Future Energy Company (Masdar), MAN Energy Solutions, MASEN and Fraunhofer — launched the MENA Hydrogen Alliance, a platform for public and private sector actors as well as science and academia to kick-start local hydrogen economies and explore export revenue opportunities.[29] This was followed by the establishment of the Abu Dhabi Hydrogen Alliance, a joint effort between Mubadala Investment Company (Mubadala), the Abu Dhabi National Oil Company (ADNOC), and ADQ, with the intention of positioning Abu Dhabi as a leader in low-carbon blue and green hydrogen.[30]

Saudi Arabia is leading the region in green H2 uptake. In January 2020, operations began on the $400 million hydrogen production site and 16 km pipeline in Yanbu. The next month, Air Products Qudra, a joint venture of Air Products (US) and Qudra Energy, a subsidiary of Vision Invest, a Saudi firm, began constructing a 150,000 tonne/year SMR to produce hydrogen at Jubail Industrial City. Later that year, Saudi Arabia’s ACWA Power signed a $5 billion agreement with US Air Products to develop the world’s largest green hydrogen-to-ammonia project, Neom Helios, powered by wind, solar, and storage capacity.

In September 2020, growing out of a joint effort between Aramco and Institute of Energy Economics, Japan (IEEJ), in partnership with SABIC,[31] Saudi Arabia sent the world’s first ever blue ammonia cargo to Japan to be used to produce emissions-free electricity[32] — a transaction regarded by some observers as “an important milestone in the future trade of ammonia as an energy vector.”[33] Since then, Saudi Aramco has signed an MoU with South Korea’s Hyundai Heavy Industries Holding Company to provide liquid petroleum gas (LPG) to convert to blue hydrogen.[34] Aramco signed another MoU with Japan’s largest refiner, Eneos Corporation (Eneos), to consider development of a CO2-free hydrogen and ammonia supply chain.[35] Aramco also is reportedly planning to “expand and intensify” cooperation with China on research in areas including blue hydrogen and ammonia, synthetic fuels and carbon capture utilization and storage.[36]

UAE, too, is making a strategic push to capitalize on hydrogen.[37] Green hydrogen facilities construction projects are already planned and underway. In February 2018, Dubai Electricity and Water Authority (DEWA), Siemens, and Expo 2020 Dubai launched a pilot project to build the MENA region’s first solar-based hydrogen electrolysis facility at Mohammed bin Rashid Al Maktoum (MBR) Solar Park. This past January, Abu Dhabi-based renewable energy company Masdar joined forces with Abu Dhabi’s Energy Department and four other energy firms — including Japan’s Marubeni — to develop an electrolysis facility to produce green hydrogen for the transport industry.[38] The same month, Abu Dhabi National Oil Company (ADNOC), the country’s biggest energy producer, struck a fuel ammonia cooperation deal with Japan’s Ministry of Economy, Trade and Industry (METI). In March, Masdar signed an agreement with Malaysia’s state-run Petronas to join forces in developing renewables and hydrogen.[39] The same month, Abu Dhabi National Oil Company (ADNOC), the country’s biggest energy producer, and South Korea’s GS Energy agreed to collaborate on potential development of new value chains for blue hydrogen and carrier fuels, such as blue ammonia.[40] UAE, which primarily through ADNOC and Emirates Steel, already has mature carbon capture, use, and storage capabilities is looking to further develop them in its drive to become a major blue hydrogen producer.[41]

Interest in hydrogen also has been stirring in the other Gulf Arab states, though they have yet to develop hydrogen strategies. Oman’s efforts thus far have been focused on specific green hydrogen schemes, most notably the state-owned oil and gas company OQ’s plans to build a 25 GW wind-solar complex in the Al Wusta Governorate.[42] The participation of Enertech, a unit of the Kuwait Investment Authority in that project, signals that Kuwait, like its GCC neighbors, is exploring opportunities in hydrogen. Kuwait National Petroleum Company’s (KNPC) Clean Fuels Project to upgrade downstream operations included construction of a new hydrogen plant at the Mina Abdullah Refinery.[43] The Kuwait Institute for Scientific Research (KISR) successfully launched an experimental prototype of an electric vehicle powered by solid hydrogen. Yet, in and of themselves, these initiatives do not indicate that the development of a hydrogen strategy is imminent. As for Qatar, hydrogen produced by the steam reforming of natural gas may one day play a greater role in the country’s export portfolio. For the time being, however, expanding LNG capacity appears to be Qatar’s highest priority.[44] The MoU recently signed between Bahrain’s Oil and Gas Holding Company (nogaholding), the National Oil and Gas Authority’s investment arm, and Air Products suggests that Bahrain is a sign that Bahrain has begun to assess its hydrogen options.[45]

Conclusion

Hydrogen’s profile is rising. The number of hydrogen projects is growing and installed electrolyser capacity is expanding worldwide. Globally, there are 228 hydrogen projects across the value chain.[46] By some estimates, the global hydrogen generation market could reach $201 billion by 2025 from roughly $130 billion in 2020.[47] Projections as to how much of world energy demand the “hydrogen economy” can meet vary, from IRENA’s conservative estimate of 6%[48] to that of a July 2020 report by Goldman Sachs stating that green hydrogen could supply up to 25%.[49]

The best strategies to combat hydrogen’s challenges and unlock its vast potential are still being developed. In the meantime, though, national governments are rolling out their hydrogen strategies, new hydrogen projects are being planned and are underway, and surveys of senior oil and gas professionals attest to growing interest in investment in or development of hydrogen.[50]

Asia Pacific is likely to emerge as the largest hydrogen generation market. Japan is leading the way, with South Korea and others following suit. China, with its massive demand for decarbonization technologies, could play a crucial in the development of a global hydrogen economy — accelerating the worldwide adoption of hydrogen as it did solar. India has recently taken various initiatives to increase the use of hydrogen in the counry’s energy mix.[51]

All six GCC states have begun to assess the viability of developing hydrogen as a sustainable fuel in the transport sector as well as an avenue to the transition to a lower carbon energy mix. With their combination of low-cost gas resources and low-cost renewable energy as well as other advantages, the Gulf states are strong candidates to emerge as major exporters of blue and green hydrogen. Saudi Aramco and UAE’s ADNOC are making a push to do just that — positioning themselves to build upon their well-established and extensive energy ties with the Asia Pacific.

Momentum appears to be building both in the Gulf and Asia Pacific to seize the opportunities and take on the challenges of transitioning to a hydrogen economy. An expansive vision of the future is one where green hydrogen effectively trades places with fossil fuels, resulting in a remaking of the global energy-geopolitical map. A narrower vision is one where blue hydrogen extends the life of oil/gas and associated infrastructure while high costs and other barriers along the pathway to a green hydrogen economy lowered or removed. It is in seeking to translate the latter vision into reality that a promising partnership between the Gulf and Asia Pacific might be forged. But much will depend on government policies and industry initiatives in shaping future markets and driving technology development.

[1] International Energy Agency (IEA), “Hydrogen,” last updated May 21, 2021, https://www.iea.org/fuels-and-technologies/hydrogen.

[2] Lawrence W. Jones, “Toward a Liquid Hydrogen Fuel Economy,” paper presented at the University of Michigan Environmental Action for Survival Teach-In, March 13, 1970, https://deepblue.lib.umich.edu/bitstream/handle/2027.42/5800/bac5758.0001.001.pdf?sequence=5&isAllowed=y.

[3] Michael Liebreich, “Liebreich: Separating Hype from Hydrogen – Part One: The Supply Side,” BloombergNEF, October 8, 2020, https://about.bnef.com/blog/liebreich-separating-hype-from-hydrogen-part-one-the-supply-side/.

[4] IEA, The Future of Hydrogen: Seizing today’s oppoprtunities (June 2019), https://www.iea.org/reports/the-future-of-hydrogen.

[5] “Blue Hydrogen,” Global CCS Institute (April 2021): 10-17, https://www.globalccsinstitute.com/wp-content/uploads/2021/04/Circular-Carbon-Economy-series-Blue-Hydrogen.pdf.

[6] International Renewable Energy Agency (IRENA), “Making Green Energy a Cost-Competitive Climate Solution,” December 17, 2020, https://www.irena.org/newsroom/pressreleases/2020/Dec/Making-Green-Hydrogen-a-Cost-Competitive-Climate-Solution#:~:text=Today%2C%20green%20hydrogen%20is%202,electrolyser%20and%20its%20operating%20hours.

[7] Gunther Glenk and Stefan Reichelstein, “Economics of converting renewable power to hydrogen,” Nature Energy 4 (2019): 216-222.

[8] IEA, The Future of Hydrogen.

[9] https://twitter.com/SeanCasten/status/1291448749483601927; Liebreich, “Liebreich: Separating Hype from Hydrogen”; and Leigh Collins, “Governments are being ‘sold a pup on blue hydrogen from methane,’” Recharge, February 14, 2020, https://www.rechargenews.com/transition/governments-are-being-sold-a-pup-on-blue-hydrogen-from-methane-/2-1-756185.

[10] “After many false starts, hydrogen power might now bear fruit,” The Economist, July 2, 2020.

[11] ETI Chief Engineer Andrew Haslett, quoted in “Is hydrogen the missing piece in the energy jigsaw to meet 2050 targets?” Energy Technologies Institute, October 5, 2018, https://www.eti.co.uk/news/is-hydrogen-the-missing-piece-in-the-energy-jigsaw-to-meet-2050-targets.

[12] J. Robinson and Joe Fisher, “Cost, logistics offer ‘blue hydrogen’ market advantages over ‘green’ alternative,” S&P Global Platts, March 19, 2020, https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/031920-cost-logistics-offer-blue-hydrogen-market-advantages-over-green-alternative?utm_campaign=corporatepro&utm_medium=contentdigest&utm_source=bluehydrogen.

[13] John Atkinson, Toward Deep Decarbonization: Transformational technologies essential to the clean energy transition, FP Analytics Special Report, June 1, 2021, https://foreignpolicy.com/2021/06/01/climate-clean-technology-decarbonization-batteries-hydrogen/?_ga=2.134473463.706581795.1623523521-2085190773.1618966790.

[14] Collins, “Governments are being ‘sold a pup on blue hydrogen from methane.’”

[15] “‘Green’ Hydrogen to Outcompete ‘Blue’ Everywhere by 2030,” BNEF, May 5, 2021, https://about.bnef.com/blog/green-hydrogen-to-outcompete-blue-everywhere-by-2030/.

[16] Miranda Willson and David Iaconangelo, “Is renewable hydrogen set to revolutionalize the grid?” E&E News, August 5, 2020, https://www.eenews.net/stories/1063685097.

[17] Federal Republic of Germany, National Hydrogen Strategy, June 2020, https://www.bmbf.de/files/bmwi_Nationale%20Wasserstoffstrategie_Eng_s01.pdf

[18] Quoted in Oceana Zhou and Cindy Liang, “Sinopec to leverage hydrogen to reach carbon neutrality,” S&P Global Platts, March 29, 2021, https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/032921-sinopec-to-leverage-hydrogen-to-meet-carbon-neutrality-by-2050.

[19] Carolyn Davis, “BP Upends Upstream, Downstream Organization, Sets 2050 Net Zero Emissions Goal,” Natural Gas Intelligence (NGI), February 12, 2020, https://www.naturalgasintel.com/bp-upends-upstream-downstream-organization-sets-2050-net-zero-emissions-goal/.

[20] Shell, Hydrogen: Towards Net-Zero Emissions, https://www.shell.com/energy-and-innovation/new-energies/hydrogen.html.

[21] Carolyn Davis, “Energy Operators Eyeing Myriad Blue and Green Hydrogen Opportunities,” Natural Gas Intelligence (NGI), March 25, 2021, https://www.naturalgasintel.com/energy-operators-eyeing-myriad-blue-and-green-hydrogen-opportunities/.

[22] “BP is working on a huge ‘blue hydrogen’ facility in the UK,” CNBC, March 18, 2021, https://www.cnbc.com/2021/03/18/bp-is-working-on-a-huge-blue-hydrogen-facility-in-the-uk.html.

[23] Jan Hoffman et al., Review of Maritime Transport 2018, UNCTAD Secretariat, https://unctad.org/system/files/official-document/rmt2018_en.pdf.

[24] International Maritime Organization (IMO), Initial IMO GHG Strategy, https://unfccc.int/sites/default/files/resource/250_IMO%20submission_Talanoa%20Dialogue_April%202018.pdf.

[25] Georgios Plevrakis et al., Pathways to Sustainable Shipping, American Bureau of Shipping (ABS), 2020, https://absinfo.eagle.org/acton/attachment/16130/f-c1979537-0fdb-4f55-85cb-7d50deafe1cc/1/-/-/-/-/ABS%20Sustainability%20Outlook%20II_Pathways_low-res.pdf.

[26] “Asia-Pacific Hydrogen Demand Will Continue to Grow,” Stratas Advsors, February 17, 2020, https://stratasadvisors.com/Insights/2020/02182020-Asia-Pacific-Hydrogen.

[27] Ian Simms, “Adnoc and Aramco lead Gulf NOCs blue hydrogen drive,” Hydrogen Economist, March 18, 2021, https://pemedianetwork.com/hydrogen-economist/articles/strategies-trends/2021/adnoc-and-aramco-lead-gulf-nocs-blue-hydrogen-drive; Oliver Klaus, “Corporate Strategy: Mideast Gulf NOCs Eye Hydrogen Market,” Energy Intelligence Finance, March 3, 2021, https://www.energyintel.com/pages/eig_article.aspx?DocID=1099142; Adal Mirza and Ieva Paldaviciute, “Mideast Gulf oil firms aiming for hydrogen dominance,” Argus, January 22, 2021, https://www.argusmedia.com/en/news/2179705-mideast-gulf-oil-firms-aiming-for-hydrogen-dominance.

[28] Qamar Energy, Hydrogen in the GCC: A Report for the Regional Business Development Team Gulf Region, commissioned by the Netherlands Enterprise Agency, November 2020, https://www.rvo.nl/sites/default/files/2020/12/Hydrogen%20in%20the%20GCC.pdf.

[29] Dii Desert Energy, https://dii-desertenergy.org/mena-hydrogen-alliance/.

[30] “Abu Dhabi plans three-pronged alliance to export hydrogen for fuel,” Reuters, January 17, 2021, https://www.reuters.com/article/emirates-economy-energy-hydrogen-int/abu-dhabi-plans-three-pronged-alliance-to-export-hydrogen-for-fuel-idUSKBN29M0B5.

[31] Institute of Energy Economics, Japan (IIEJ), “World’s first blue ammonia shipment opens new route to a sustainable future,” Setember 27, 2020, https://eneken.ieej.or.jp/data/9135.pdf.

[32] Verity Ratcliffe, “Saudi Arabia Sends Blue Ammonia to Japan in World-First Shipment,” Bloomberg Green, September 27, 2020, https://www.bloomberg.com/news/articles/2020-09-27/saudi-arabia-sends-blue-ammonia-to-japan-in-world-first-shipment.

[33] Michel Noussan et al., “The Role of Green and Blue Hydrogen in the Energy Transition: A Technological and Geopolitical Perspective,” Sustainability 13, 298 (2021): 20.

[34] Harles Lee and Manish Panashar, “S Korea's Hyundai Heavy, Aramco sign blue hydrogen cooperation project,” S&P Global Platts, March 4, 2021, https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/030421-s-koreas-hyundai-heavy-aramco-sign-blue-hydrogen-cooperation-project.

[35] Takeo Kumagai and Claudia Carpenter, “Japan's ENEOS signs MOU with Aramco to develop hydrogen, ammonia supply chain,” S&P Global Platts, March 25, 2021, https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/032521-japans-eneos-signs-mou-with-aramco-to-develop-hydrogen-ammonia-supply-chain.

[36] Verity Ratcliffe, “Aramco Aims to Partner With China on Blue Hydrogen, CEO Says,” Bloomberg, March 21, 2021, https://www.bloomberg.com/news/articles/2021-03-21/aramco-likely-to-partner-with-china-on-blue-hydrogen-ceo-says.

[37] Anthony Di Paola, “UAE Aims to Become Blue Hydrogen Powerhouse to Cut Emissions,” Bloomberg Green, January 19, 2021, https://www.bloomberg.com/news/articles/2021-01-19/uae-can-be-major-low-cost-blue-hydrogen-producer-adnoc-ceo-says.

[38] Dania Saadi and Marish Panashar, “INTERVIEW: UAE to focus on blue hydrogen to capitalize on oil and gas industry,” S&P Global Platts, May 18, 2021, https://www.spglobal.com/platts/en/market-insights/latest-news/agriculture/051821-interview-uae-to-focus-on-blue-hydrogen-to-capitalize-on-oil-and-gas-industry.

[39] “Asia too alluring for Middle East oil producers to drop the ball on hydrogen,” Hellenic Shipping News, March 17, 2021, https://www.hellenicshippingnews.com/asia-too-alluring-for-middle-east-oil-producers-to-drop-the-ball-on-hydrogen/.

[40] “ADNOC and Korea’s GS Energy Explore Opportunities to Grow Abu Dhabi’s Hydrogen Economy and Carrier Fuel Export Position,” ADNOC press release, March 4, 2021, https://www.adnoc.ae/en/news-and-media/press-releases/2021/adnoc-and-koreas-gs-energy-explore-opportunities.

[41] Anthony Di Paola, UAE targets carbon capture hydrogen to reduce greenhouse emissions, World Oil, https://www.worldoil.com/news/2021/1/19/uae-targets-carbon-capture-hydrogen-to-reduce-greenhouse-emissions#:~:text=The%20Middle%20Eastern%20country%20will,OPEC%20member's%20oil%20and%20gas.

[42] Laura Paddison, “Oman plans to build world’s largest green hydrogen plant,” The Guardian, May 27, 2021, https://www.theguardian.com/world/2021/may/27/oman-plans-to-build-worlds-largest-green-hydrogen-plant; and https://www.argusmedia.com/en/news/2215970-oman-to-develop-green-hydrog…

[43] Jason Saundalker, “Fluor led JV announces completion of clean fuels project in southern Kuwait,” ME Construction, August 19, 2020, https://meconstructionnews.com/42964/fluor-led-jv-announces-completion-of-clean-fuels-project-in-southern-kuwait.

[44] Simone Foxman and Verity Ratcliffe, “Qatar outlines plan to lead global LNG exports for the next 20 years,” Bloomberg, February 17, 2021, available at https://www.worldoil.com/news/2021/2/17/qatar-outlines-plan-to-lead-global-lng-exports-for-the-next-20-years.

[45] “Bahrain, Air Products to study hydrogen economy,” TradeArabia.com, November 26, 2020, http://www.tradearabia.com/news/OGN_375646.html.

[46] McKinsey & Company, Hydrogen Insights 2021 Report (February 2021): 6, https://hydrogencouncil.com/wp-content/uploads/2021/02/Hydrogen-Insights-2021-Report.pdf; and Amanda Battersby, “Green hydrogen’s share of global H2 market could jump to 10% by 2030: Fitch Solutions,” Upstream, May 24, 2021, https://www.upstreamonline.com/energy-transition/green-hydrogens-share-of-global-h2-market-could-jump-to-10-by-2030-fitch-solutions/2-1-1014844.

[47] Markets and Markets, Hydrogen Generation Market, Febuary 2021, https://www.marketsandmarkets.com/Market-Reports/hydrogen-generation-market-494.html.

[48] IRENA, “Hydrogen: A Renewable Energy Perspective,” September 2019, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Hydrogen_2019.pdf.

[49] Goldman Sachs, Carbonomics: The Rise of Clean Hydrogen, July 8, 2020, https://www.goldmansachs.com/insights/pages/gs-research/carbonomics-the-rise-of-clean-hydrogen/report.pdf.

[50] DNV-GL, “'Heading for Hydrogen: The oil and gas industry’s outlook for hydrogen, from ambition to reality,’” March 21, 2021, https://www.dnv.com/oilgas/hydrogen/heading-for-hydrogen.html.

[51] “India to spend $200 mln in next 5-7 years to promote hydrogen use,” Reuters, April 15, 2021, https://www.reuters.com/world/india/india-spend-200-mln-next-5-7-years-promote-hydrogen-use-2021-04-15/; Sambit Mohanty and Kshitiz Goliya, “From IOC to Reliance: India’s hydrogen ambitions get stronger by the day,” S&P Global Platts, July 17, 2020, https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/071720-from-ioc-to-reliance-indias-hydrogen-ambitions-get-stronger-by-the-day; and Zainab Mansoor, “UAE’s ADNOC keen to explore hydrogen market with India’s public, private sectors,” Gulf Business, April 15, 2021, https://gulfbusiness.com/uaes-adnoc-keen-to-explore-hydrogen-market-with-indias-public-private-sectors/.

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.