Natural gas is a plentiful, versatile and relatively clean-burning energy source — features that were highlighted in the International Energy Agency’s (IEA) special report in 2011 titled “Are we entering the Golden Age of Gas?”[1]

Although the “golden age” has not arrived due to slower than expected demand growth, natural gas nonetheless plays a significant role in the global energy mix. International markets for natural gas — fragmented regionally and with differing price-setting mechanisms — are undergoing profound changes. The foundation is being laid for the emergence of a more globally integrated gas market, and the rapid expansion of the seaborne liquified natural gas (LNG) trade, which has forged links between distant markets, is a major reason why.

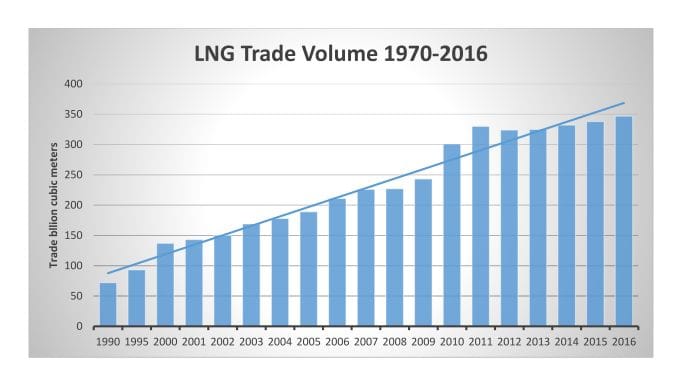

A staple fuel source for many Asia Pacific countries for years, LNG is increasing in importance in other regions as well. As of the end of 2017, 40 countries are importing LNG and 19 countries are LNG exporters. The volume of LNG traded worldwide has quadrupled in the past two decades and could double over the next two.[2] Yet, the massive addition of LNG export capacity has outstripped demand growth, resulting in a glut that has weighed down prices. And as a wave of fresh supply capacity is set to come online, when and how the LNG market rebalances is uncertain.

Qatar — an LNG powerhouse — has dominated the Asia Pacific market, the world’s largest LNG-importing region. However, the Asian market is in a state of flux, as is the entire global LNG sector. This article explores the major changes taking place in international LNG markets, with particular attention to how Qatar is being affected by, and is adapting to them.

LNG is playing an increasing role in the global energy mix

Global demand for LNG has risen by an annual average of five-to-six percent since 2000.[3] LNG supply has likewise surged, with massive new capacity being added primarily in Australia and the United States.[4] As a result, LNG has emerged as the fastest growing traded commodity.[5]

Source: Adapted from International Gas Union (IGU) 2017 World LNG Report.

Source: Adapted from International Gas Union (IGU) 2017 World LNG Report.

LNG’s increasingly prominent role in the global energy landscape has been catalyzed by the development of non-conventional gas; major gas discoveries around the world, both onshore and offshore; the build-out of regasification infrastructure; the emergence of new technologies such as Floating Storage and Regasification Units (FSRUs) and Floating Liquified Natural Gas (FLNG) production facilities; the rise of spot and short-term trade; the evolution of the shipping market, specifically the increase in both the number and size of vessels; and the potential of new applications, such as using LNG to fuel both marine and land transport.

The international LNG market is expanding but is unbalanced

From 1990 to 2011, global demand for LNG soared. There followed several years of stagnant consumption, until in 2016 demand rebounded. The return to growth has been propelled by robust Chinese and Indian demand. In fact, China, which first imported LNG in 2006, is the biggest source of new demand, as economic growth and government policies promoting the use of cleaner fuels have boosted LNG imports.[6]

Emerging markets are also driving new demand. A dozen small emerging buyers, which collectively import almost as much as China, are a “new force in the global LNG market.”[7] Among these market entrants are Pakistan and Bangladesh, which are seeking to tap cheaper LNG by using floating import terminals that can be built more quickly and require less up-front investment than traditional onshore facilities.

Meanwhile, the volume of global liquefaction capacity is increasing, with new facilities coming online and new suppliers entering the market. The United States has become the largest driver of supply growth.[8] In early 2016, Cheniere began the first exports of U.S. pipeline gas from the Sabine Pass export terminal, with LNG cargoes destined for South America, Asia and, more recently, Europe. Australia and Russia are increasing output as well, with major facilities in or approaching the commissioning phase. Also adding to global supply are incremental volumes from existing facilities in Nigeria and Angola. Greenfield projects in Equatorial Guinea, Mozambique and Canada are coming online as well.[9] And new onshore regasification facilities are scheduled to start operations during 2018 in China, India, Japan, Singapore and Greece.[10]

However, the current market is oversupplied. Experts are divided as to when, where and at what price the coming new wave of LNG supply will be absorbed. Some observers expect the LNG supply-demand imbalance to persist for at least the next three to five years.[11] And while many experts project a positive consumption growth trajectory in the medium term,[12] the timing and circumstances under which an LNG rebalance might occur is difficult to predict with confidence, given the number of market uncertainties, including those related to the energy picture in Asia and the Middle East.

The Asian and Middle East LNG markets are evolving

Asia and the Middle East occupy important positions in the global LNG landscape. Both regions account for sizable shares of global LNG exports. In 2016, Asia represented 38.6 percent of total exports, compared to 35.3 percent for the Middle East.[13] Asia and the Middle East are also LNG-importing regions. While Asia has long been the number one destination for LNG cargoes,[14] the Middle East has evolved from an export-dominated LNG market to a fast-growing demand center.[15]

Source: Adapted from BP Statistical Review of World Energy 2017.

Asian gas markets have been dominated by long-term contracts with oil-indexed pricing, and by seaborne trade. In recent years, not only has demand for LNG increased in Asia, but so too has Asian LNG-importing countries’ dependence on more distant and more diversified supply sources.

All three of Asia’s “mature” LNG markets (i.e., Japan, South Korea, and Taiwan) are changing, though in different ways. Japan — the country that began importing LNG in 1969 in order to diversify its energy mix, pioneered the seaborne gas trade, and drove demand through the 1990s — remains the world’s largest LNG consumer. However, Japanese LNG consumption over the next few years is uncertain; a lot will depend on what happens to its shuttered nuclear power plants and investment in renewable energy capacity. By contrast, the near-term outlook for LNG demand looks brighter and clearer in the case of South Korea, where since assuming office in May 2017 President Moon Jae-in has taken steps to raise power production by LNG in order to reduce heavy reliance on coal and nuclear electricity generation;[16] and Korea Gas (Kogas) announced that it will build the country’s fifth LNG-import terminal in the Port of Dangjin.[17]

Both China and India, which together exhibited the strongest LNG demand growth in 2016 and are expected to be major sources of incremental global demand, are ramping up regasification capacity.[18] However, gauging the extent of their future LNG demand is difficult. Unlike Japan and South Korea, China, for example, has multiple sources of gas supply, including indigenous resources and imports through pipelines.

In Southeast Asia, which is well endowed with natural gas resources, Malaysia and Indonesia are major LNG exporters. But according to some projections, both countries could become importers by 2022, due to rising domestic demand and declining output at mature fields.[19] By 2035, Southeast Asia as a whole is expected to become a net importing region.[20] The Philippines and Vietnam, though currently self-sufficient in gas, will soon start importing LNG.[21] In light of this development, they are seeking to boost LNG receiving capacity,[22] while Singapore, besides expanding its existing LNG importing facility, is seeking to become a major LNG trading hub.[23]

The Middle East LNG market is likewise evolving. Holding 40 percent of the world’s total proved natural gas reserves, the region has traditionally been associated with large-scale exports of LNG. Qatar, which has nearly one quarter of the world’s gas liquefaction capacity,[24] is the largest LNG exporting country and accounts for about 30 percent of global trade.[25]

Recently, however, the Middle East has become one of the world’s fastest growing demand centers.[26] The region shifted from being responsible for less than two percent of total LNG imports in 2014 to more than eight percent in 2016.[27] The lion’s share of the increase has been due to demand from new market entrants, namely Egypt and Jordan. The latter two countries, together with Pakistan, accounted for two-thirds of total regional LNG imports in 2016. Abu Dhabi, previously an exporter, has joined the LNG importers’ club. Morocco may follow suit. Bahrain and Sharjah are also planning to do so.[28] Meanwhile, the region’s established importers — Turkey, Kuwait, and Dubai — are increasing their volumes to meet rising energy demand.

Geopolitical forces and LNG market dynamics are interlinked

While the LNG trade is largely a function of decisions taken for commercial reasons, geopolitical considerations are far from irrelevant. Qatar, a small state sandwiched between powerful neighbors — Saudi Arabia and Iran — that are locked in a fierce rivalry, has used its vast gas resources to forge strategic partnerships. As a consequence, Qatar has not just amassed enormous wealth but has also enhanced its security and acquired the ability to project political influence regionally as well as internationally.[29]

The continued expansion of the international LNG sector is bound to confront participants with new and unanticipated opportunities as well as risks. On the positive side of the ledger, the fast-growing international LNG trade has already contributed to global gas supply diversity. This development, coupled with the seaborne mode of transport, which allows for LNG cargoes to be shipped over great distances, has relaxed the grip of dependency associated with piped gas. Meanwhile, the growing LNG spot market promises to make the natural gas market more adaptable to localized disruptions. In addition, the flexibility that LNG lends to the gas market could alter the bargaining positions of participants.[30] It is for this very reason that American allies in Central and Eastern Europe and in Asia have been clamoring for U.S. companies to make more LNG available — an appeal that aligns with the Trump administration’s pursuit of ‘American global energy dominance.’[31]

At the same time, however, the expansion of the international LNG trade has added a new dimension to existing maritime security risks. LNG cargoes, like oil shipments, are subject to potential disruption by piracy, terrorism, and inter-state conflict. The world’s busiest LNG shipping lanes — the intra-Pacific and Middle East-Asia routes — are highly exposed.[32] Export and transit vulnerabilities include the Strait of Hormuz and the Strait of Malacca, both of which are strategic conduits for LNG cargoes, as they are for oil. LNG tankers traverse other maritime “choke points,” such as the Strait of Aden and the Suez Canal. About 40 percent of global LNG, including nearly half of Qatar’s global shipments, moves through the South China Sea.[33] Nearly 45 percent of the gas consumed by India — the world’s fourth-largest importer — is carried by sea.[34] LNG production and export facilities are potential targets of terrorism or susceptible to attack in time of war. Qatar’s Ras Laffan facility, the largest and most strategically vital single terminal in the region with over a thousand sailings of LNG carriers per year, is not immune from cyberattack or other possible unconventional threats.[35]

LNG giant Qatar is facing challenges on multiple fronts

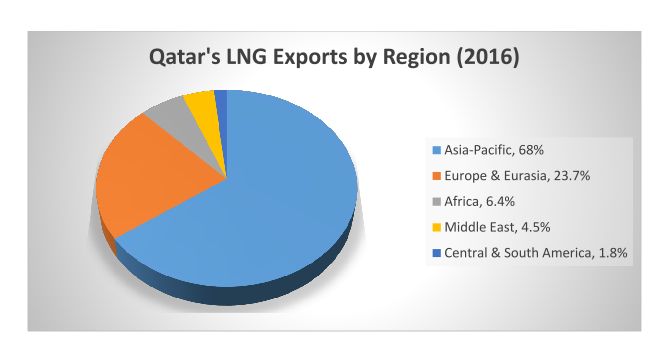

Benefiting from an established infrastructure, low production costs, and strategic location, Qatar is the largest global LNG exporter — a position it has occupied for over a decade. The total volume of LNG exported by Qatar in 2016 accounted for a third of the world’s supply.

Source: Adapted from BP Statistical Review of World Energy 2017.

Source: Adapted from BP Statistical Review of World Energy 2017.

However, Qatar faces challenges on multiple fronts. Supply-side pressure constitutes one such challenge. Qatar’s global market share has been declining.[36] According to the International Gas Union (IGU), Qatar will likely cede its leading position to Australia in the next few years,[37] as the latter’s export volumes are expected to rise sharply in 2018–19, underpinned by higher production at Gorgon, as well as the completion of the three remaining LNG projects under construction — Wheatstone, Icthys and Prelude.[38] The United States, too, is on track to challenge Qatar for global leadership among global LNG exporters.[39]

Asia is a key focal point of intensifying competition for market share. Over 65 percent of Qatar’s LNG exports are consumed by the Asia Pacific region. Qatar supplies more than half of Taiwan’s and India’s LNG imports, as well as 37 percent of Korea’s and 15 percent of Japan’s.[40] Thus, Qatar has played the primary role in forging links between the Asian and Middle East LNG markets. However, Australia is banking on capturing a larger slice of the Asian market by capitalizing on the proximity of its liquefaction facilities and on the elimination of trade barriers through the signing of free trade agreements (FTAs) with Japan, China and South Korea.[41] Meanwhile, with the expansion of the Panama Canal, U.S. LNG exports to Northeast Asia have become more cost-competitive. Eventually, Qatar could also face competition from Iran, which for now is only a marginal player in the LNG trade.[42]

Thus, today’s LNG market is decidedly different from when Qatar signed long-term contracts with Asian buyers nearly two decades ago. As competition for market share has stiffened, in the context of persistent low oil prices, the balance of power has shifted from LNG producers to buyers. India was among the first countries in Asia to renegotiate a long-term deal when, in December 2015, Petronet reworked its 25-year agreement with Qatar’s RasGas, cutting the price almost in half.[43]

Other large buyers have also adopted measures to liberalize the market. In the case of Japan, many of whose LNG contracts with Qatar are due to expire in the early-2020s, antitrust regulators recently issued an investigative report that could spell the end of highly restrictive destination clauses.[44] In March 2017, Japan banded together with South Korea and China to secure more flexible supply contracts.[45] Japan subsequently launched a $10 billion public-private campaign to develop LNG-import infrastructure in emerging Asian markets.[46] Shortly thereafter, Japan signed a memorandum of cooperation with India aimed at establishing a “liquid, flexible and global” LNG market.[47]

In addition to coping with these competitive pressures, Qatar must also contend with LNG demand uncertainty. Should LNG consumption in Europe not grow as strongly as projected, Qatari and U.S. cargoes would likely be redirected to Asia, intensifying competition in that regional market. The outlook for the Japanese LNG market, which already is contractually oversupplied, is also uncertain, as Kansai Electric, Kyushu Electric, and perhaps other utilities are expected to recommission nuclear power plants, which likely would depress LNG demand.

Qatar’s rift with some of its Arab neighbors has also tested the country’s resilience.[48] The Saudi-led economic blockade on Qatar has been costly.[49] Yet, Qatar has skillfully adjusted to it by, among other things, rerouting trade and financial transactions. The blockade has not interrupted the flow of Qatari LNG exports.[50] Qatari vessels traversing the Suez Canal have not faced restrictions.[51] When Abu Dhabi imposed a port ban on Qatari ships and cargo, Oman quickly stepped into the breach.[52]

Indeed, Qatar’s resilience and adaptability is also evident in the approach taken to respond to changing LNG market dynamics. Prioritizing market share over price, Qatar has employed various measures:

➢ First, Qatargas and RasGas have merged and now operate under a single entity in an effort to cut costs.[53]

➢ Second, Qatar has stepped up efforts to increase market share in Europe[54] and to supply new and emerging markets, including in the Middle East, where Qatargas’ exports more than doubled from 6 percent in 2012 of its total exports to 13 percent in 2016.[55]

➢ Third, Qatar has secured long-term contracts with new customers, such as Pakistan and Bangladesh.[56]

➢ Fourth, Qatar has displayed a willingness to modify existing long-term contracts in order to defend its market share.[57]

➢ Fifth, Qatar has established itself as the leading source of spot and short-term supplies of LNG to global markets.[58]

➢ Sixth, Qatar has launched a number of initiatives to diversify business activities within the LNG sector, including the creation of a marketing entity to manage its external LNG volumes and to invest in overseas projects (e.g., possibly in Morocco, Cyprus and elsewhere).[59]

➢ Seventh, Qatar’s boldest step to drive high-cost suppliers out of the market was its April 2017 production expansion decision, which ended the 12-year moratorium on development of the North Field and earmarked new volumes for export.[60]

Conclusion

The global LNG sector is in a state of flux. Asia, the world’s largest LNG-importing region as well as the leading destination for Qatari LNG exports is a key battlefield in a global market that is currently oversupplied and increasingly competitive.

By 2020, the size of global LNG trade is projected to grow by 50 percent compared to volumes in 2014.[61] Global liquefaction capacity is expected to expand rapidly over the next five years as well.[62] By many estimates, the shale gas revolution has given the United States the ability to become a sustained gas exporter.[63] And there are many indications that a shift to a more openly traded global LNG market might be underway.

However, the future outlook for the LNG market is anything but clear. Is global LNG demand growing more slowly than anticipated? Will LNG pricing mechanisms converge across regions and bring more price transparency? Can the United States become a long-term sustainable, competitive supplier into global markets? If so, what would be the implications for market structure, pricing and trade patterns?

Against the backdrop of these longer-term market uncertainties and nearer-term challenges to its LNG dominance, Qatar has found itself in the crosshairs. Yet, bolstered by low-cost production, economies of scale, and its geographical position between markets, Qatar has reached deep into its toolkit and is fighting back to defend market share more deftly and effectively than might be commonly recognized.

[1] International Energy Agency (IEA), Are We Entering a Golden Age of Gas? World Energy Outlook 2011 Special Report, accessed October 14, 2017, http://www.worldenergyoutlook.org/media/weowebsite/2011/WEO2011_GoldenA….

[2] BP Energy Outlook 2035, February 2016, 58, accessed October 24, 2017, http://www.bp.com/content/ dam/bp/pdf/energy-economics/energy-outlook-2015/bp-energy-outlook-2035-booklet.pdf.

[3] Shell LNG Outlook 2017, 3-4, accessed October 14, 2017, http://www.shell.com/energy-and-innovation/natural-gas/liquefied-natura….

[4] Ibid.

[5] It is important to note that despite the enormous increase in LNG trade over the past several decades, international gas trading continues to be dominated by cross-border pipelines.

[6] Shell LNG Outlook 2017, 3-4.

[7] Teddy Kotts and Akos Losz, “They Might Be Giants: Emerging LNG Importers Are Reshaping the Waterborne Gas Market,” Columbia University SIPA Center on Global Energy Policy, November 16, 2017, accessed November 21, 2017, http://energypolicy.columbia.edu/research/report/they-might-be-giants-e….

[8] Clifford Krauss, “Boom in Liquified Natural Gas Is Shaking Up the Energy World,” New York Times, October 16, 2017; and Ed Crooks, “Cheniere’s energy shipment turns US into gas exporter,” Financial Times, January 10, 2016, accessed November 18, 2017, https://www.ft.com/content/f1773832-b5ee-11e5-b147-e5e5bba42e51.

[9] In Australia, Chevron’s Wheatstone project is in its commissioning phase. The Prelude floating LNG facility, operated by Shell, and the Ichthys venture by Japan’s Inpex are due to start production in 2018. Dominion Energy’s Cove Point LNG terminal in Maryland is in its commissioning phase. Another three U.S. LNG export plants are scheduled to begin operations later in 2018.

[10] Sindre Knutsson and Iben Frimann-Dahl, “LNG: Churning it out,” Petroleum Economist, November 16, 2017, accessed December 3, 2017, http://www.petroleum-economist.com/articles/midstream-downstream/lng/20….

[11] Iván Martén and Juan Vázquez, “New Strategies for a Changing LNG Landscape,” BCG Focus, November 17, 2017, accessed November 18, 2017,http://image-src.bcg.com/Images/BCG-New-Strategies-for-a-Changing-LNG-L….

[12] See, for example, International Association for Natural Gas (CEDIGAZ) Medium and Long Term Natural Gas Outlook 2017, reported in “CEDIGAZ highlights the growing role of natural gases in a diversifying energy outlook,” Oil Review, July 11, 2017, accessed November 18, 2017, http://www.oilreviewmiddleeast.com/gas/cedigaz-highlights-the-growing-r….

[13] International Gas Union (IGU), 2017 World LNG Report, accessed October 14, 2017, 4, https://www.igu.org/sites/default/files/103419-World_IGU_Report_no%20cr….

[14] BP Energy Outlook 2017, 55, accessed October 14, 2017, https://www.bp.com/content/dam/bp/pdf/energy-economics/energy-outlook-2….

[15] Karen Thomas, “The Middle East and North Africa: thirsty for LNG,” LNG Shipping World, September 12, 2017, accessed November 20, 2017, http://www.lngworldshipping.com/news/view,the-middle-east-and-north-africa-thirsty-for-lng_49109.htm; and Luke Stobbart, “Middle East Emerges as LNG Destination,” Platts, March 2017, accessed September 28, 2017, https://www.platts.com/IM.Platts.Content/InsightAnalysis/IndustrySoluti….

[16] “South Korea LNG demand set to rise on new leader moving against coal,” Platts, May 15, 2017, accessed November 27, 2017, https://www.platts.com/latest-news/natural-gas/seoul/south-korea-lng-demand-set-to-rise-on-new-leader-27830214; Damon Evans, “Shift in South Korea energy policy brings boon for LNG,” Nikkei Asian Review, May 18, 2017, accessed November 27, 2017, https://asia.nikkei.com/Business/Trends/Shift-in-South-Korea-energy-policy-brings-boon-for-LNG; and Anjli Raval, “Natural Gas South Korea’s energy shift targets increased LNG supply,” Financial Times, July 10, 2017, accessed November 20, 2017, https://www.ft.com/content/fb27d9a4-6547-11e7-9a66-93fb352ba1fe.

[17] Xiaolin Zeng, “KOGAS plans fifth LNG terminal in South Korea,” IHS Fairplay, September 29, 2017, accessed November 20, 2017, https://fairplay.ihs.com/commerce/article/4292261/kogas-plans-fifth-lng….

[18] International Gas Union (IGU), 2017 World LNG Report, accessed October 14, 2017, 11, 46-47 https://www.igu.org/sites/default/files/103419-World_IGU_Report_no%20cr….

[19] “Indonesia projected to become net LNG importer by 2022,” O&G Link, May 29, 2017, accessed December 7, 2017, https://oglinks.news/article/37fe11/indonesia-projected-to-become-net-l….

[20] Hiroshi Kotani and Yuichi Shiga, “Southeast Asia in midst of LNG terminal construction boom,” Nikkei Asian Review, November 8, 2016, accessed October 14, 2017, https://asia.nikkei.com/Business/AC/Southeast-Asia-in-midst-of-LNG-term….

[21] The Philippines has plans for a regasification facility that it expects to complete by 2020, while Vietnam has two in advanced planning stages.

[22] Hiroshi Kotani and Yuichi Shiga, “Southeast Asia in midst of LNG terminal construction boom,” Nikkei Asian Review, November 8, 2016, accessed October 14, 2017, https://asia.nikkei.com/Business/AC/Southeast-Asia-in-midst-of-LNG-term….

[23] International Energy Agency (IEA), WEO-2017 Special Report: Southeast Asia Energy Outlook 2030, accessed November 14, 2017, https://www.iea.org/publications/freepublications/publication/WEO2017Sp….

[24] International Gas Union (IGU), 2017 World LNG Report, 20.

[25] Ibid.

[26] Kuwait was the first to turn to LNG imports in 2009 to help meet seasonal gas needs for power generation, soon after followed by Dubai.

[27] “The Middle East comes into its own as a LNG demand center,” Platts, January 19, 2017, accessed November 20, 2017, http://blogs.platts.com/2017/01/19/middle-east-lng-center/.

[28] Karen Thomas, “The Middle East and North Africa: thirsty for LNG,” LNG Shipping World, September 12, 2017, accessed November 20, 2017, http://www.lngworldshipping.com/news/view,the-middle-east-and-north-afr….

[29] Jim Krane and Steven Wright, “Qatar ‘rises above’ its region: Geopolitics and the rejection of the GCC gas market,” Kuwait Programme on Development, Governance and Globalisation in the Gulf States, No. 35, London School of Economics and Political Science (March 2014) 9; and Samuel Ramani, “China’s growing security relationship with Qatar,” The Diplomat, November 16, 2017, accessed December 7, 2017, https://thediplomat.com/2017/11/chinas-growing-security-relationship-wi….

[30] Joseph Nye, “The changing geopolitics of energy,” The Strategist, November 2017, accessed November 22, 2017, https://www.aspistrategist.org.au/the-changing-geopolitics-of-energy/.

[31] “Trump to Urge European Allies to Dump Russia, Buy U.S. Gas,” RFE/RL, July 4, 2017, accessed November 27, 2017, https://www.rferl.org/a/trump-urge-eastern-european-allies-poland-dump-….

[32] International Gas Union (IGU), 2017 World LNG Report, 13.

[33] U.S. Energy Information Administration (EIA), “Almost 40% of global liquefied natural gas trade moves through the South China Sea,” November 2, 2017, accessed November 17, 2017, https://www.eia.gov/todayinenergy/detail.php?id=33592#.

[34] Government of India, Ministry of Petroleum and Natural Gas, “Indian Petroleum and Natural Gas Statistics” (2014-15): 10.

[35] Regarding a cyberattack on RasGas in August 2012 that shut down the company’s website and e-mail servers but reportedly did not affect the operational computers that control gas production and delivery, see Camilla Hall and Javier Blas, “Qatar group falls victim to virus attack,” Financial Times, August 30, 2012, accessed December 3, 2017, https://www.ft.com/content/17b9b016-f2bf-11e1-8577-00144feabdc0.

[36] For a good discussion of Qatar’s role in and adjustments to the LNG market as of mid-2015, see Naser al-Tamimi, “Navigating Uncertainty: Qatar’s response to the global gas Boom,” Brookings Doha Center Analysis Paper 15 (June 2015), accessed November 20, 2017, https://www.brookings.edu/wp-content/uploads/2016/06/English-PDF-3.pdf.

[37] 2017 World LNG Report, 9.

[38] Government of Australia, Department of Industry, Innovation and Science, Resources and Energy Quarterly (September 2017): 57-58, accessed November 20, 2017,

[39] International Energy Agency (IEA), Market Report Series: Gas 2017; and U.S. Energy Information Administration (EIA), “United States expected to become a net exporter of natural gas this year,” Today in Energy, August 9, 2017, accessed November 27, 2017, https://www.eia.gov/todayinenergy/detail.php?id=32412.

[40] “Diplomatic Spat in the Middle East Has East Asia Worried,” The Korea Economic Daily, June 8, 2017, accessed September 28, 2017, http://english.hankyung.com/business/2017/06/08/0636461/diplomatic-spat….

[41] “Australia closing in on Qatar as world’s top LNG exporter,” Reuters, October 5, 2017, accessed November 20, 2017, https://www.reuters.com/article/australia-resources-forecast/australia-….

[42] Iran has the world’s largest proven gas reserves. Over the past year, there have been several indications of Iran’s ambition to engage in the international LNG trade, including an agreement to supply gas to Oman and a deal with the Norwegian company Helma Vantage to charter and deploy a floating LNG (FLNG) unit. See Bijan Khajehpour, “Iran’s path to becoming an LNG exporter,” Al Monitor, November 14, 2017, accessed November 21, 2017, https://www.al-monitor.com/pulse/originals/2017/11/iran-energy-sector-lng-supply-export-resumption.html; and Irina Slav, “Iran Prepares to Export LNG to Boost Trade Relations,” OilPrice.com, November 17, 2017, accessed November 21, 2017, https://oilprice.com/Latest-Energy-News/World-News/Iran-Prepares-To-Exp….

[43] “Petronet, RasGas agree new LNG price, penalty waived,” LNG World News, January 4, 2016, accessed November 21, 2017, http://www.lngworldnews.com/petronet-rasgas-agree-new-lng-price-penalty…; and Debjit Chakraborty and Rajesh Kumar Singh, “RasGas, Petronet Revise LNG Contract to Lower Indian Prices,” Bloomberg News, December 31, 2015, accessed November 20, 2017, https://www.bloomberg.com/news/articles/2015-12-31/rasgas-petronet-revi….

[44] Government of Japan, Japan Fair Trade Commission (JFTC), “Survey on LNG Trades,” Chapter 4, Ensuring of Fair LNG Trades, June 27, 2017, accessed December 3, 2017, http://www.jftc.go.jp/en/pressreleases/yearly-2017/June/170628.files/17….

[45] Ian Lewis, “A buyer’s LNG market,” Petroleum Economist, May 17, 2017, accessed November 17, 2017, http://www.petroleum-economist.com/articles/midstream-downstream/lng/20….

[46] Karen Thomas, “Japan Inc Bets US$10bn on Asian LNG,” LNG World Shipping, October 17, 2017, accessed November 17, 2017, http://www.lngworldshipping.com/news/view,japan-inc-bets-us10bn-on-asia….

[47] See Government of Japan, Ministry of External Trade and Industry (METI), “Memorandum of Cooperation on Establishing a Liquid, Flexible and Global Liquefied Natural Gas Market between the Ministry of Economy, Trade and Industry of Japan, and the Ministry of Petroleum and Natural Gas of Republic of India,” Press Release, October 2017, accessed November 27, 2017, http://www.meti.go.jp/press/2017/10/20171018001/20171018001-1.pdf. See also Tommy Wilkes and Nidhi Verma, “India, Japan to team up to get more flexible LNG deals,” Reuters, October 11, 2017, accessed November 27, 2017, https://www.reuters.com/article/us-india-japan-lng/india-japan-to-team-….

[48] On June 5, 2017, Saudi Arabia, along with the United Arab Emirates, Bahrain, and Egypt severed diplomatic ties with Qatar over several allegations, including that Doha had been supporting terrorism. Regarding the 13 demands issued by the coalition, see “Arab states issue ultimatum to Qatar: close Jazeera, curb ties with Iran,” Reuters. June 23, 2017, accessed december 3, 2017, https://www.reuters.com/article/us-gulf-qatar-demands-idUSKBN19E0BB; Patrick Wintour, “Qatar given 10 days to meet 13 sweeping demands by Saudi Arabia,” The Guardian, June 23, 2017, accessed December 3, 2017, https://www.theguardian.com/world/2017/jun/23/close-al-jazeera-saudi-arabia-issues-qatar-with-13-demands-to-end-blockade; and “What are the 13 demands given to Qatar?” Gulf News, June 23, 20917, accessed December 3, 2017, http://gulfnews.com/news/gulf/qatar/qatar-crisis/what-are-the-13-demand….

[49] See, for example, “Qatar ‘uses $38bn to support economy’ during Gulf crisis,” BBC News, September 14, 2017, accessed December 3, 2017, http://www.bbc.com/news/world-middle-east-41267815.

[50] International Monetary Fund (IMF), World Economic Outlook October 2017, 3, 60, accessed December 7, 2017, https://www.imf.org/en/Publications/WEO/Issues/2017/09/19/world-economi….

[51] Costas Paris and Nikhil Lohade, “Regional Rifty Hits Container Shipments to Qatar, but Not LNG Exports,” Wall Street Journal, June 7, 2017.

[52] Zainab Calcuttawala, “Qatar Unfazed by Saudi Blockade,” OilPrice.com, September 15, 2017, accessed December 7, 2017, https://oilprice.com/Energy/Energy-General/Qatar-Unfazed-By-Arab-Blocka….

[53] Hadeel Al Sayegh and Rania El Gamal, “Qatar's new LNG giant to start operations Jan. 1 - industry sources,” Reuters, November 30, 2017, accessed December 3, 2017, http://www.kitco.com/news/2017-11-30/Qatar-apos-s-new-LNG-giant-to-star….

[54] “Qatar taking ‘aggressive’ stance in Europe to mitigate LNG risks,” Hellenic Shipping News, December 10, 2016, accessed November 22, 2017, http://www.hellenicshippingnews.com/ qatar-taking-aggressive-stance-in-europe-to-mitigate-lng-risks/.

[55] Mohammad Shoeb, “Qatargas Mideast exports doubled in 5 years,” The Peninsula, December 5, 2017, accessed December 7, 2017, https://www.thepeninsulaqatar.com/article/05/12/2017/Qatargas-Mideast-e….

[56] “Qatar Signs 15-year Agreement to Supply Bangladesh with LNG,” Qatar Tribune, September 25, 2017, accessed November 20, 2017, http://www.qatar-tribune.com/Latest-News/qatar-signs-15-year-agreement-to-supply-bangladesh-with-lng; and Iftikhar A. Khan, “Abbasi defends LNG contract with Qatar,” Dawn, October 27, 2017, accessed November 20, 2017, https://www.dawn.com/news/1366550.

[57] See the revision of the terms of the 25-year contract between Qatargas and PetroChina in “Qatar agrees new amendments to LNG contracts,” The Economist Intelligence Unit, September 4, 2015, accessed December 7, 2017, http://country.eiu.com/article.aspx?articleid=1403477324&Country=Qatar&….

[58] “Spot LNG trading makes up 18% of total LNG volumes in 2016: GIIGNL,” Platts, March 27, 2017, accessed December 7, 2017, https://www.platts.com/latest-news/natural-gas/london/spot-lng-trading-….

[59] Karen Thomas, “Qatar eyes global LNG investment,” LNG World Shipping, February 14, 2017, accessed December 7, 2017, http://www.lngworldshipping.com/news/view,qatar-eyes-global-lng-investment_46524.htm; and “Qatar Petroleum seeks international projects in Cyprus, Morocco: CEO,” Reuters, February 6, 2017, accessed December 7, 2017, https://www.reuters.com/article/us-qatar-petroleum/qatar-petroleum-seek….

[60] Mohammed Sergie, “Qatar to Drill in World’s Biggest Gas Field After 12-Year Freeze,” Bloomberg, April 3, 2017, accessed September 28, 2017, https://www.bloomberg.com/news/articles/2017-04-03/qatar-to-drill-in-world-s-biggest-gas-field-after-12-year-freeze; and Anna Shiryaevskaya and Kelly Gilblom, “Qatar Flexing LNG Muscle Puts U.S., Australia Plants at Risk,” Bloomberg Markets, July 6, 2017, accessed September 28, 2017, https://www.bloomberg.com/news/articles/2017-07-06/qatar-flexing-lng-mu….

[61] BP Energy Outlook 2017, 56, accessed October 14, 2017, https://www.bp.com/content/dam/bp/pdf/energy-economics/energy-outlook-2….

[62] “Rampant LNG Supply Growth To 2021,” BMI Research, August 17, 2017, accessed October 24, 2017, https://www.bmiresearch.com/articles/rampant-lng-supply-growth-to-2021; “Report: Global LNG liquefaction capacity projected to more than double by 2021,” Hydrocarbons Technology, April 12, 2017, accessed November 18, 2017, http://www.hydrocarbons-technology.com/news/newsreport-global-lng-lique….

[63] Stephanie Yang and Alison Sider, “New milestone: The US is now a net exporter of natural gas,” Wall Street Journal, November 28 2016, accessed October 14, 2017, http://www.wsj.com/articles/new-milestone-the-u-s-is-now-a-net-exporter….

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.