Washington is once again leaning hard on Baghdad to narrow the space for Iran’s proxy networks, pairing new terrorist designations and sanctions with a sharper diplomatic line that demands the disarmament of non-state militant groups operating outside the purview of the Iraqi state.

The message from the United States is that post-war stabilization, American investment, energy cooperation, and access to dollars all hinge on Iraqi willingness to curb the most powerful Iran-aligned factions. Yet this campaign runs up against US equities that tie America to Iraq’s economy. Major US energy companies have expanded upstream positions and signed conventional and liquefied natural gas (LNG) deals meant to ease Iraq’s chronic power shortfalls as well as reduce its dependence on Iranian energy imports.

Iraqi oil receipts still move through the US Federal Reserve system, an instrument of pressure but also a channel Washington is loath to weaponize to the point of destabilizing a government in Baghdad it still needs for counterterrorism cooperation and regional management. The upshot is a policy that mixes threats with inducements, while trying not to spook global energy markets or undercut US firms on the ground. That balancing act will get harder as Baghdad’s next parliament grapples with the legal status and fiscal footprint of the Hashd al-Shaabi (Popular Mobilization Forces, PMF) — an arena where every strand of the US-Iran rivalry now converges.

What Tehran has at stake in Iraq’s parliamentary elections

For Iran, Iraq is strategic depth, political sanctuary, and economic lifeline all at once. The results of the November 11 Iraqi elections and the subsequent coalition jostling will decide who in Baghdad controls the budgetary levers, internal security appointments, and committees that could codify, or constrain, the Iran-backed PMF’s autonomy. They will also determine whether a prime minister emerges who can manage Washington without alienating the Shi’a Coordination Framework, an umbrella bloc of Iraqi Shi’a parties partially supported by Tehran but united in their opposition to the movement of the influential Shi’a cleric Muqtada al-Sadr. Finally, the votes, once counted, will establish whether the Sunni and Kurdish blocs can translate the Sadrists’ boycott of the elections into greater leverage for themselves over government formation.

Tehran will demand a cabinet dominated by the Shi’a establishment but will certainly tolerate a Shi’ite prime minister who courts Washington and Gulf capitals or even Ankara. Indeed, such a Washington- and Gulf-friendly Iraqi government may even be preferable for Tehran since it could act as a bridge between Iran and the US and the Arab world. Still, the Iranian side will expect Baghdad to observe certain red lines: no wholesale disarmament of core pro-Iran factions, no major hostile alignment on US sanctions policy on Iran, and no open door for Israeli or US kinetic action via Iraqi soil. Just as important will be the electoral math around state contracting and US dollar currency access. Iran’s sanctions-battered economy leans on Iraqi trade, banking channels, and licit and illicit procurement routes.

An Iraqi parliament inclined to police those conduits under US pressure would tighten the vise; whereas, a parliament content to muddle through would keep Iran’s arteries open. Tehran’s calculus, therefore, blends ideology with pragmatism: preserve deterrence and its network of Arab proxies and allies on the one hand but diversify its political partners and lower the profile of the most radioactive brands on the other. The central Iranian goal in this balancing act is to keep the system breathing while avoiding a big open fight with the Americans on Iraqi soil, as Iran is still recovering from the many blows it and its regional proxies have received since October 7, 2023.

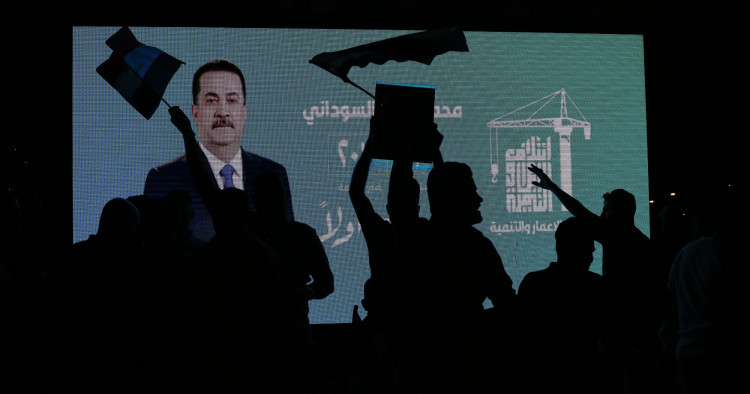

The latest results, from November 18, show that Prime Minister Mohammed Shia al-Sudani’s Reconstruction and Development Coalition secured the largest share of seats — 46 out of 329 — in Iraq’s parliamentary elections. But winning the plurality is only the beginning. Forming a government may still take months as rival blocs negotiate alliances amid US-Iranian tensions and long-running disputes over the role of Iraq’s Iran-aligned militias. In short, the Iraqi election will not crown a winner in the US-Iranian rivalry over Iraq so much as set the rules for the next season of competition. If this electoral outcome ultimately produces a familiar governing coalition, expect a subtler version of the status quo: more paperwork than pyrotechnics, more bureaucratic choreography than bold reform, and no fundamental shift in Iraq’s strategic alignment.

Can Washington and Tehran co-exist in Iraq?

US-Iranian co-existence is possible in Iraq because all three principals — Baghdad, Washington, and Tehran — need it more than they admit, thus requiring only a little subterfuge. Prime Minister Sudani has pursued persuasion, not confrontation with the PMF militias, curbing cross-border fire while insisting the state must hold the gun. The United States wants those militias folded into accountable chains of command or at least parked in politics. Iran wants its armed options across the border preserved — but does not want them to be so overt and active that they invite a pretext for external strikes or snap sanctions on Iraq’s dollar lifelines that Tehran depends on to an extent.

That convergence has produced a quiet Iranian experiment inside Iraq: press select factions to de-emphasize their military wings, build out party political machines, and burrow deeper into ministries and provinces. It is not demobilization so much as mutation. Some PMF groups will resist because arms are their identity and bargaining chip. Others — the Badr Organization is the exemplar — can present civilian faces and pursue political control through ballots and budgets while cloaking their militia in the colors of the state.

Washington’s signaling complicates but does not negate that pathway. Senior US officials have reportedly warned that any armed interference by Iraqi militants in reaction to US or Israeli regional operations — such as strikes against Hizballah, Hamas, or the Houthis — would prompt a response. Such admonishments are intended to de-risk the aftermath of Iraq’s November 11 vote while the results are still being assessed and a government is being assembled. They do not, however, answer the longer-term question: to what extent can Washington accept “party-first, militia-second” entities embedded in Iraqi institutions if their strategic alignment remains with Tehran?

Can militias become politicians?

Co-existence will hold so long as those non-state entities avoid kinetic embarrassments, and so long as Iran’s strategic deterrence posture leans more on missiles and political engineering in Baghdad than on spectacular proxy attacks. If either side misreads the other — Tehran believing it has more impunity than it does, or Washington believing sanctions can rewire Iraqi politics — co-existence fractures.

If that co-existence fails, Iranian operators do not expect the United States to persist with polite fictions. They assume Washington will tolerate “absorption” of PMF elements under a defense-ministry façade only so long as those units stay quiet and politically house-trained. The moment that Iraqi factions intrude on US or Israeli operations, whether by harassing American assets or trying to widen a regional fight, Tehran’s reading is that Washington will escalate selectively: targeted strikes on offending actors, sharper terrorism designations, tighter dollar controls and banking scrutiny, and less restraint for Israeli action against Iraqi-based assets. In other words, the US accepts the veneer of disarmament until it becomes a liability; then it shifts to punishment, not pretense.

That expectation helps explain Iran’s current push to move marquee groups further into electoral politics and ministries while keeping redundant deterrents in reserve. Tehran believes Washington is unlikely to crash Iraq’s economy, or eject American energy interests, over the PMF question alone, but the US is very likely to harden the sanctions/kinetic mix if proxies miscalculate. Hence Iran’s preference for “party-first” — i.e., political sphere — behavior in Baghdad and missile-centric signaling limited to the regional level: preserve influence relatively cheaply, avoid giving the US a proximate casus belli, and keep the fiction of integration credible enough that Washington lives with it, until it does not.

The PMF’s next chapter, and why Iran’s influence is likely to endure

The future scenarios for the PMF fall along a familiar spectrum, but the center of gravity sits in the messy middle. The US might well be willing to go along with the fiction of absorption under a defense ministry chain of command as might many Sunni and Kurdish actors, yet this would leave Iraqi sovereignty compromised and the state de facto dominated by the Hashd al-Shaabi.

Tehran seems content that true dissolution is probably fantasy. The most likely path is continued semi-institutionalization: incremental personnel audits, partial integration of select PMF brigades, stricter budget controls at the center, and political rewards for commanders who keep their men on a tight leash. The Iraqi parliament may shelve maximalist legal upgrades under outside pressure, but that will not unwind facts on the ground. The PMF is woven into provincial governance, logistics, construction, and patronage systems; removing it would pull threads that hold the post-ISIS order together.

Iran understands this intimately. Even if Baghdad makes symbolic gestures — pausing a bill, rotating a controversial commander, tightening end-use monitoring on US equipment — Tehran can preserve influence via layered redundancy: longstanding parties with serviceable national brands, second-tier formations able to pivot between garrison and campaign office, and a next generation of “cleaner” political faces who speak the language of state-building.

In practice, that means acting less like fighters and more like officials — trading rocket launches for budget meetings, and military parades for procurement process paperwork. Given Washington’s reluctance to invest the resources needed to counter Iran’s obstructionism, a more realistic path is to contain rather than dismantle the existing ecosystem — rewarding ministries that professionalize and tying financial access to concrete steps that make the armed components smaller, poorer, and more predictable over time. Neither Tehran nor the Iranian-backed PMF networks are going to voluntarily surrender their capacity for violence except under overwhelming military pressure, which the United States and its partners are wisely unwilling to apply. Short of a full-scale confrontation with Iran’s network in Iraq, gradually chipping away at the PMF’s influence and tightening the circle of state actors who can credibly claim resources and legitimacy may be the next-best option.

No matter what, in the short term at least, Iran’s influence is likely to persist through political and bureaucratic channels, even as Washington tests whether leverage over access to dollars, commercial deals, and security training for the regular Iraqi Security Forces can narrow the PMF’s field of action. Co-existence, one can argue, remains the rational choice given the relative strength of the key players in Iraq. The danger is that each side, convinced it can lock in an advantage during the post-election scramble, pushes just hard enough to tip Iraq back from politics to the gun.

Alex Vatanka is a Senior Fellow at the Middle East Institute in Washington, DC.

Photo by Ameer Al-Mohammedawi/picture alliance via Getty Images

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.