Japan’s energy policy is at a turning point. Seven years ago, the country experienced a devastating earthquake and tsunami that severely damaged the Tokyo Electric Power Company (TEPCO) Fukushima Daiichi nuclear power plant. The accident led to the shutdown of all 54 of Japan’s nuclear power reactors[1] and to a revision of the country’s energy policy.

Japan’s long-term energy policy will reach an important landmark if, as expected, the Ministry of Economy, Trade and Industry (METI) finalizes the revamped national energy strategy in the coming months. At the center of deliberations and debate is the issue of how to achieve a “balanced energy mix.” This article discusses Japan’s struggle to attain this goal and how the country’s energy relations with the Middle East have evolved since the March 2011 Fukushima nuclear accident.

Japan Energy After “Shocks”

Imported oil spurred Japan’s growth from the mid-1950s until 1973. By then, oil imports accounted for nearly three-quarters of the country’s electricity production.[2] Since then, Japan has experienced three energy “shocks.” The first was the 1973-74 oil crisis, which led to the diversification of Japan’s electricity mix, with nuclear power, imported coal and liquefied natural gas (LNG) displacing much of its reliance on oil.[3] The second occurred in 1979-80 due to decreased oil output stemming from the Iranian Revolution, and marked the Japanese government’s commitment to short- and long-term alternative energy strategies.[4]

The third shock occurred on March 11, 2011, when the Great East Japan Earthquake struck off the coast of Miyagi prefecture. The earthquake and ensuing tsunami destroyed coastal towns and villages, caused nearly 16,000 fatalities, and damaged the reactors at the Tokyo Electric Power Company (TEPCO) Fukushima Daiichi power plant, resulting in the contamination of a wide area and the evacuation of hundreds of thousands of residents.[5]

The Fukushima disaster caused public confidence in industry and government to plummet.[6] It ignited a fiercely partisan blame game.[7] It revived the debate in Japan about energy security. And it set in motion an extensive government review of energy policy, a process that included soliciting public participation in a national dialogue on the future of nuclear power.[8] However, it did not quickly catalyze a major energy policy overhaul.

Japan’s Post-Fukushima Energy Policy

Less than a year before the Fukushima Daiichi accident, the Japanese Cabinet had formally approved a national energy policy that sought to boost the country’s dependence on nuclear power. The disaster prompted a host of emergency measures, though none whose consequences have been as far-reaching as the shutdown of all of the country’s commercially operable nuclear power plants.[9]

After the disaster, the ruling Democratic Party (DPJ) considered,[10] but stopped short of clearly committing to phasing out nuclear power by 2039.[11] The 4th Strategic Energy Plan (SEP)[12] adopted under the administration of Liberal Democratic Party (LDP) Prime Minister Shinzo Abe in April 2014 called for minimizing the dependency on nuclear power and accelerating the introduction of renewable sources.[13]

Japan’s government took a number of steps to cope with the sudden loss of the nuclear baseload generating capacity. Some efforts focused on reducing power demand. Others sought to increase the supply of electricity, in part by restructuring the electric power system. Still others entailed measures to prepare for the eventual resumption of operations of the country’s nuclear power plants.[14]

Yet, since the Fukushima accident, Japan has grown increasingly reliant on fossil fuel imports (i.e., coal, gas and oil) for its electricity generation. Substituting imported fossil fuels for nuclear power generation has led to increased electricity prices for consumers, higher government debt, and substantial revenue losses for electric utilities. In the three years following the Fukushima disaster, Japan spent an additional annual average of about $30 billion for fossil fuel imports and experienced a record $116 billion (12.8 trillion yen) trade deficit in 2014.[15]

Towards a “Balanced Energy Mix”?

Japan’s 2015 “Long-term Energy Supply and Demand Outlook”[16] — based on the principles of energy security, efficiency, environment and safety (3Es + S) — envisages a “balanced energy mix.” However, this objective has been exceedingly difficult to achieve. Nearly all of the nation’s nuclear reactors are still idle, and extensive use of renewable energy remains a distant goal.

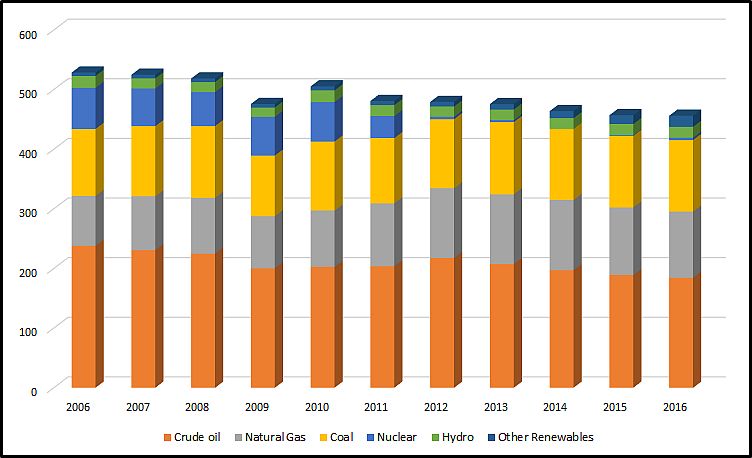

Figure 1. Japan Energy Consumption by Fuel 2006-2016 (in mt oil equiv) Source: BP Statistical Review of World Energy June 2017.

Source: BP Statistical Review of World Energy June 2017.

Japan’s current energy policy assumes that nuclear power will play a significant role. However, the future of nuclear power in Japan is deeply uncertain. In the immediate aftermath of the Fukushima disaster, nuclear policy-making — marked by mass public unpopularity, fissures within the upper ranks of the LDP,[17] and deep divisions within the so-called “nuclear village” (i.e., big business, key government ministries, electrical utilities)[18] — was mired in political gridlock.[19] Today, nuclear-related issues continue to be contentious. The government’s plan to generate 20-22 percent of the country’s electricity by 2030,[20] which has long seemed overly optimistic, might be beyond reach.

Nevertheless, Japanese businesses regard the restart of nuclear power plants as essential to their competitiveness and to Japan’s economic well being — a view broadly shared by the ruling LDP, which since retaking power in December 2012, has been strongly committed to nuclear energy. Prime Minister Abe believes nuclear power is a viable and stable source of energy that the country simply cannot do without.[21] In his January 2013 address to the Diet, Abe pledged to restart nuclear plants once they met the stringent safety guidelines for resuming operation instituted after Fukushima.[22] He has been pushing for a full return to nuclear power ever since.[23]

Though nuclear energy was a key issue in the October 22, 2017 House snap election,[24] which took place amidst heightened tension with North Korea and with the political opposition in disarray, Abe’s LDP and its coalition partner, Komeito, registered a decisive electoral victory.[25] Yet, despite the tailwind supplied by the results at the polls, the Abe administration continues to face resistance to and ambivalence about nuclear power generation. The main opposition in the Lower House, the Constitutional Democratic Party of Japan (CDP), reportedly aims to submit a bill calling for a nuclear phase out. Prominent political figures such as former Prime Ministers Junichiro Koizumi and Morihiro Hosokawa have taken the position that nuclear power plants should not be restarted and that renewable energy resources should be increased.[26] There are even signs of dissent within Prime Minister Abe’s cabinet.[27]

Within Japanese society, for whom the Fukushima disaster was a chastening experience, opposition to nuclear power generation remains high. In a Mainichi Shimbun survey conducted in March 2017, 55 percent of respondents opposed the resumption of operations of idled reactors.[28] Because their concerns about nuclear power are focused on cost as well as safety, the Japanese public appears to favor a gradual reduction of dependence, as opposed to an immediate abandonment of nuclear power. At the same time, though, the public appears to be firmly against the building of new plants.[29]

The revival of nuclear power has also been met with resistance at the prefectural (regional) and local levels. Last December, Japan’s Nuclear Regulation Authority (NRA) cleared two TEPCO reactors at the Kashiwazaki-Kariwa plant in Niigata Prefecture for restart.[30] However, Niigata Governor Ryuichi Yoneyama, who must approve resumption of reactor operations, reportedly stated he will not render a decision until the prefectural government has completed its own assessment of the causes of the Fukushima accident — a process that could delay the resumption of operations by three or four years.[31] While theoretically the central authorities could then threaten to reduce grant awards to Niigata,[32] it is not clear which side will blink first.

Meanwhile, dozens of lawsuits and injunction requests have been filed across Japan over safety concerns. In March 2016, a Japanese court ordered that Kansai Electric’s No. 3 and No. 4 reactors at the Takahama nuclear plant be taken offline — an order that remained in place for a year until being overturned on appeal.[33] Last December, the Hiroshima High Court delivered a blow to the government’s push to bring idled plants back online when it reversed a ruling that had cleared the way for the restart of a reactor at the Ikata nuclear power plant.[34]

Nuclear Regulation Authority (NRA) Chairman Toyoshi Fuketa has acknowledged that Japan might not meet its electricity generation targets.[35] There are several reasons to suggest that his skepticism is justified. First, utilities face tougher rules to protect reactors. Second, Japan must address the problem of an aging inventory of reactors. Nearly half of them have been in use for more than 30 years. Current Japanese law stipulates that once reactors have reached their planned lifespan of 40 years, they are to be decommissioned.[36] Thus, many of Japan’s nuclear reactors will soon have to be replaced or supplemented with new ones that have high output capacity. Third and related, the approval process for extending the operating life of idled reactors is likely to be difficult.[37]

Besides struggling with the sustainability of nuclear power generation, Japan is also grappling with the surging cost of recycling spent nuclear fuel.[38] To date, there is no consensus about how to dispose of Japan’s growing stockpile of irradiated nuclear fuel as well as with weapon-usable separated plutonium.[39]

Oil and gas were primarily used to offset immediate shortfall from the nuclear shutdowns. From the mid-1970s onwards, the share of electricity production from oil sources had fallen steadily and steeply to 9 percent on the eve of the Fukushima disaster. The accident resulted in a sharp, though temporary, reversal of this trend.[40] Within a year of the accident, liquified natural gas (LNG) began to play an increasingly prominent role in filling the energy “gap.” According to the US Energy Information Agency (EIA), LNG became “a fuel of choice for power generation to substitute for the lost nuclear generation.”[41] LNG imports surged by 25 percent from 2010 to 2014.[42] Today, LNG accounts for more than three-quarters of the increased electricity production from fossil fuels.[43]

Figure 2. Japan Power Generation by Primary Energy Source (2016)

Source: Adapted from Japan Ministry of Economy, Trade and Industry (METI) data.

Source: Adapted from Japan Ministry of Economy, Trade and Industry (METI) data.

In the immediate aftermath of the Fukushima accident, Japan did not experience any significant increase in coal demand for power generation, because coal-fired plants had already been running baseload at a high utilization rate. Over the past several years, however, Japan has stepped up coal-fired power generation to replace nuclear plants that went offline.[44] Amidst the continuing struggle to revive nuclear power generation, utilities companies have sought to generate electricity the cheapest way — and have leaned on coal to do so. Among OECD countries, Japan is an exception to the general shift away from coal power, with plans to build approximately 45 new thermal coal power plants.[45] Although METI has instituted new efficiency standards for power plants, they do not apply to projects already under development; moreover, compliance, in any case, is purely voluntary.[46] Meanwhile, Japanese government and industry are backing emerging coal technologies, which they are planning to market abroad in addition to implementing at home.[47] In fact, Japan is already the world’s leading public financier of overseas coal plants and technology.

However, Japan’s rapid expansion of coal has called into question its commitment to tackling climate change. Japan’s emphasis on coal-fired plants prompted harsh criticism by environmental advocacy NGOs during the climate change “conference of the parties” (COP) in Bonn, Germany last November.[48] There has been pushback at the domestic level as well. Environment Minister Koichi Yamamoto warned that the Chubu Electric Company’s plan for a coal-fired plant in central Japan should be reexamined if the utility cannot map out concrete steps to cut carbon emissions by 2030 and later.[49] Meanwhile, climate advocates such as the Kiko Network have been trying to slow down or stop new coal power projects, in order to buy time for incentives to take effect that might boost the share of renewable energy sources in Japan’s energy mix.[50]

The renewable energy market has been growing rapidly over the past decade, particularly solar photovoltaic (PV) and wind power generation, assisted by a Feed-in Tariff scheme (FIT) instituted in July 2012.[51] But fossil fuel use is likely to continue to be the predominant energy source for electricity generation, at least in the short-to-medium term. So, let us see how these developments have shaped, and might implicate Japan-Middle East energy relations.

Japan and the Middle East: Energy Partners in Times of Uncertainty

The Fukushima disaster coincided with the Arab Spring uprisings and with the diplomatic struggle to resolve the dispute over the Iranian nuclear program. Since then, as Japan has wrestled with the energy security-related and other challenges flowing from the March 2011 calamity, the Middle East has been gripped by violence and global energy markets have been in flux.

The Fukushima accident and its after-effects have not fundamentally changed Japan-Middle Eastern energy relations. Japan continues to be heavily dependent on the Middle East for oil and LNG. In 2016, Gulf producers accounted for 83 percent of Japan’s oil imports, while Qatar met 15 percent of the country’s LNG requirements. As for Middle East producers, Japan — the world’s third-largest net oil importer and top destination for LNG — is still a premium market.

Figure 3. Japan Sources of Oil Imports (2016)

Source: BP Statistical Review of World Energy June 2017.

Figure 4. Japan's Sources of Imported Natural Gas (2016)

Source: BP Statistical Review of World Energy June 2017.

Source: BP Statistical Review of World Energy June 2017.

Nor have any of the myriad crises and conflicts that have beset the Middle East in recent years, with the exception of the turmoil in Libya, hampered Japan’s access to vital oil and gas supplies from the region. Iran did not act on its threats to close the Strait of Hormuz. The P5+1 and Iran found a diplomatic solution to the nuclear dispute. Despite the Saudi-led effort to isolate Qatar, LNG deliveries to Japan have continued.

However, Japan’s effort to compensate for the loss of nuclear power did impact the volume of oil and gas imports from the region as well as spur efforts to further develop supply contingency measures. In 2011 and 2012, Japan increased imports of crude oil for direct burn in power plants.[52] Gulf producers, particularly Saudi Arabia, stepped up to meet Japan’s additional requirements.

In the wake of the Fukushima calamity, Japan has sought to enhance its energy security partly through forging a number of strategic oil storage deals. Tokyo and Riyadh have an arrangement whereby Japan provides free oil storage in return for a priority claim on the stockpiles in the event of an emergency. In 2012, Japan renewed a similar storage-lease deal it had made three years earlier with the UAE’s Abu Dhabi National Oil Company (ADNOC).[53]

Since 2013, it is mainly LNG that has replaced oil use for electricity generation;[54] and it has been Qatar that has played a key role in fueling Japan’s power sector. Yet, with the switch from oil to LNG (and coal) to make up the shortfall in nuclear output, Japan’s oil consumption has resumed its downward trend, due to the country’s shrinking, aging population and improving fuel efficiency. This latter trend, in conjunction with other global demand-side factors contributed to the stubborn worldwide oil supply glut which, since mid-2014 and until very recently, has depressed prices. While low oil and LNG prices have substantially eased Japan’s fuel import bill,[55] they have added to its Middle East partners’ fiscal woes.[56]

Figure 5. Japan's Electricity Production 2006-2016 (TW-h) Source: BP Statistical Review of World Energy June 2017.

Source: BP Statistical Review of World Energy June 2017.

Prior to, and even after the Fukushima disaster, Japan sought to leverage its nuclear capabilities to secure cooperation and technology transfer deals with Middle Eastern countries.[57] The Fukushima disaster initially put a crimp in these plans, as Morocco, Tunisia, Algeria and Jordan all set out to reassess their plans. More recently, however, there has been a resurgence of interest in nuclear power within the region, with programs in various stages of development. Last December, Egypt and Russia signed an agreement officially launching a nuclear power plant project at El Dabaa.[58] The first of four units at the Barakah nuclear power station in the UAE is slated to soon enter commercial operation.[59] Saudi Arabia is expected to award a contract for construction of two reactors by the end of this year.[60] For Japan, however, the seemingly brightening commercial prospects in the civilian nuclear sector in the Middle East are offset by the fact that the field is crowded with other serious contenders, including South Korean, French, Russian, Chinese and American firms.[61]

Conclusion

Japan is a a country of scarce natural resources and limited strategic options. The Fukushima calamity complicated the country’s search for a “balanced energy mix” and, if anything, amplified its dependence on oil and natural gas sourced from the Middle East.

The North American “shale gas revolution” has offered Japan the promise of diversifying its supplies of LNG and, coupled with other factors, has enhanced its ability to move away from long-term contracts and oil-indexed gas prices. Meanwhile, within the Middle East — a region to which Japan, because of its energy import requirements, remains tethered — the implementation of the JCPOA and lately the defeat of the so-called Islamic State (ISIS) have been welcome developments. So, too, have been the unfurling of ambitious plans by the Gulf Arab states to diversify their economies and thereby head off potential instability that would further compromise Japan’s energy-security interests.

Yet, the prospects for stability in the Middle East, with which Japan’s own future is so tightly entwined, are uncertain. Indeed, the Middle East is still roiling, with no end in sight in the war in Yemen, fighting in Syria still raging, an intra-GCC rift pitting Japan’s top oil supplier (Saudi Arabia) against its second-leading LNG provider (Qatar), and the ill effects of a fierce Saudi-Iranian rivalry rippling across the region. At the same time, China’s expanding energy footprint in the Middle East and growing presence in the Indian Ocean is the cause of some apprehension in Tokyo. And while recent indications of continued US engagement in the region — long a strategic priority for Japan — are reassuring, they have been partially offset by the Trump administration’s confrontational approach to Iran and controversial formal recognition of Jerusalem as the capital of Israel and decision to relocate the US Embassy from Tel Aviv.

Seven years after the Fukushima Daiichi nuclear disaster, Japan’s struggle with its impact and after-effects persists. The country’s aim of achieving a “balanced energy mix” as of yet is unfulfilled, while the role of nuclear power remains highly contentious, fossil fuels continue to be an important source of energy, and dependence on oil and gas imports is still heavily concentrated in the Middle East.

[1] Only five have resumed operation since regulators allowed recommissioning in August 2015.

[2] The World Bank, “Electricity Production from Oil Sources,” accessed January 3, 2018, https://data.worldbank.org/indicator/EG.ELC.PETR.ZS?locations=JP.

[3] See for example, Richard J. Samuels, “Sources and Uses of Energy,” in Patrick Heenan (ed.), The Japan Handbook (London, UK and New York: Routledge, 1989) 54.

[4] Ronald A. Morse, “Japan’s Energy Policies and Options,” in Ronald A. Morse (ed.), The Politics of Japan's Energy Strategy: Resources—Diplomacy—Security (Berkeley: University of California, Institute of East Asian Studies, 1981) 11.

[5] See for example, Becky Oskin, “Japan Earthquake & Tsunami of 2011: Facts and Information,” Live Science, September 13, 2017, accessed January 3, 2018, https://www.livescience.com/39110-japan-2011-earthquake-tsunami-facts.h….

[6] Quoted in Ashok Tuteja, “Tokyo to diversify energy mix as Japanese turn against N-technology,” The Statesman, October 17, 2017, accessed December 17, 2017, http://www.thestatesman.com/world/tokyo-to-diversify-energy-mix-as-japanese-turn-against-n-technology-1502508693.html. See also Tatsujiro Suzuki, “Japan’s contaminated Fukushima debate four years on,” East Asia Forum, March 8, 2015, accessed December 17, 2017, http://www.eastasiaforum.org/2015/03/08/japans-contaminated-fukushima-d….

[7] Jeff Kingston, “Ousting Kan Naoto: The Politics of Nuclear Crisis and Renewable Energy in Japan,” Japan Focus 9, 39 (2011): 1-16, accessed January 3, 2018, http://apjjf.org/-Jeff-Kingston/3610/article.pdf.

[8] For a good discussion of public participation in the review, see Philip White, “Japan’s 2012 National Debate on Energy and Environment Policy: Unprecedented but Short-Lived Public Influence,” Electronic Journal of Contemporary Japanese Studies 15, 2 (2015), accessed January 3, 2018, http://www.japanesestudies.org.uk/ejcjs/vol15/iss2/white.html.

[9] Japanese regulators ordered reactors that had been temporarily offline due to routine inspection, maintenance and repairs reactors to remain idle. During the ensuing 14 months, they ordered the suspension of operation of the rest of the country’s nuclear power fleet. The Nuclear Regulation Authority (NRA), created in the aftermath of the crisis, instituted strict new safety standards. To date, only five nuclear power plants have resumed operation since regulators allowed recommissioning in August 2015.

[10] EEC, “Options”; and National Policy Unit (NPU), “Options for Energy and the Environment: The Energy and Environmental Council Decision on June 29. 2012 [Outline],” July 2012, http://www.cas.go.jp/jp/seisaku/npu/policy09/sentakushi/pdf/Report_Engl…; and Risa Maedra and Aaron Sheldrick, “Japan Aims to Abandon Nuclear Power by 2030s,” Reuters, September 14, 2012, http://www.reuters.com/article/2012/09/14/us-japan-nuclear-idUSBRE88D05520120914, October 22, 2013; IEEJ e-Newsletter, no. 6 (September 20, 2012), 3, http://eneken.ieej.or.jp/en/jeb/1209.pdf; and Hiroku Tabuchi, “Japan Sets Policy to Phase Out Nuclear Power Plants by 2040,” New York Times, September 14, 2012, accessed January 2, 2018, http://www.nytimes.com/2012/09/15/world/asia/japan-will-try-to-halt-nuc….

[11] Richard Katz, “Noda’s Confused Nuclear Policy,” East Asia Forum, October 26, 2012, accessed January 3, 2018, http://www.eastasiaforum.org/2012/10/26/nodas-confused-nuclear-policy/; and Shinji Kakuno, “Future Energy Policy of Japan,” http://apecenergy.tier.org.tw/database/db/ewg44/EWG44/7_FutureEnergyPolicyofJapan.pdf.

[12] Government of Japan, Ministry of Economy, Trade and Industry (METI), “Strategic Energy Plan,” April 2014, accessed January 3, 2018, http://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/4th_strategic_energy_plan.pdf,

[13] Justin McCurry, “Japan seeks to reverse commitment to phase out nuclear power,” The Guardian, January 11, 2013, accessed January 3, 2018, https://www.theguardian.com/environment/2013/jan/11/japan-reverse-nuclear-phase-out; Osamu Tsukimori and Mari Saito, “Japan Approves Energy Plan Reinstating Nuclear Power,” Reuters, April 11, 2014, http://www.reuters.com/article/2014/04/11/us-japan-energy-nuclear-idUSBREA3A02V20140411. See also “Cabinet Decision on the New Strategic Energy Plan,” April 11, 2014, http://www.meti.go.jp/english/press/2014/0411_02.html.

[14] Masatsugu Hayashi and Larry Hughes, “The Policy Responses to the Fukushima Nuclear Accident and Their Effect on Japanese Energy Policy, Energy Policy 59 (August 2013): 90; and Energy and Environment Council (EEC), “Immediate Supply-Demand Stabilization Measures,” July 29, 2011, accessed at http://www.cas.go.jp/jp/seisaku/npu/policy09/pdf/20110908/20110908_en.pdf, 5 November 2013.

[15] International Energy Agency (IEA), Energy Policies of IEA Countries: Japan 2016 Review, accessed January 5, 2018, 9, 22, http://www.iea.org/publications/freepublications/publication/EnergyPoli….

[16] Government of Japan, Ministry of Economy, Trade and Industry (METI), Long-term Energy Supply and Demand Outlook, July 2015, accessed January 5, 2018, http://www.meti.go.jp/english/press/2015/pdf/0716_01a.pdf.

[17] Tsuyoshi Sukuki, “Koizumi's Call for Nuclear-Free Japan Raises Speculation about His Intent,” Aera, 2 October 2013, http://ajw.asahi.com/article/behind_news/politics/AJ201310020073.

[18] IEEJ e-Newsletter, no. 19 (August 16, 2013), 3, http://eneken.ieej.or.jp/en/jeb/130816.pdf; IEEJ e-Newsletter, no. 21 (September 13, 2013), 3, http://eneken.ieej.or.jp/en/jeb/130913.pdf; IEEJ e-Newsletter, no. 23 (October 15, 2013), 3, http://eneken.ieej.or.jp/en/jeb/131015.pdf, 6 September 2014; and IEEJ e-Newsletter, no. 25 (November 15, 2013), 3–4, http://eneken.ieej.or.jp/en/jeb/131115.pdf.

[19] Jacques E.C. Hymans, “After Fukushima: Veto Players and Japanese Nuclear Policy,” in Frank Baldwin and Anne Allison, eds., Japan: The Precarious Years Ahead (New York: Social Science Research Council and New York University Press, 2015) 110-138.

[20] Long-Term Energy Supply and Demand Outlook, April 2015, http://www.meti.go.jp/english/press/2015/pdf/0716_01a.pdf.

[21] “Shinzo Abe says Japan ‘cannot do without’ nuclear power, on eve of Fukushima disaster,” South China Morning Post, March 11, 2016, accessed December 17, 2017, http://www.scmp.com/news/asia/east-asia/article/1922953/shinzo-abe-says….

[22] Martin Fackler and Hiroko Tabuchi, “Japan to Begin Restarting Idled Nuclear Plants,” The New York Times, February 28, 2013, accessed January 5, 2018, http://www.nytimes.com/2013/03/01/world/asia/japan-to-begin-restarting-….

[23] Justin McCurry, “Fukushima operator can restart nuclear reactors at world’s biggest plant,” The Guardian, October 4, 2017, accessed December 17, 2017, https://www.theguardian.com/environment/2017/oct/04/fukushima-operator-….

[24] Yuriko Koike, Governor of Tokyo and leader of the newly formed Kibo no To (Party of Hope), campaigned on a platform pledging to institute policies that would revitalize the economy while phasing out nuclear power by 2030 and increasing renewables’ share of the energy mix to just under a third. By contrast, Abe backed a full return to nuclear power. See “Nuclear energy policy emerges as key difference between Abe and Koike,” Japan Times, September 30, 2017, accessed December 17, 2017, https://www.japantimes.co.jp/news/2017/09/30/national/politics-diplomac….

[25] Japan may be able to meet nuclear energy target after Abe win - IEEJ,” Reuters, October 23, 2017.

[26] Shinichi Sekine, “Koizumi to introduce ‘bill’ to abandon nuclear energy,” Asahi Shimbun, December 22, 2017, accessed January 2, 2018, http://www.asahi.com/ajw/articles/AJ201712220043.html.

[27] See the account of a recent speech by Foreign Minister Taro Kono, reported in isabel Reynolds and Chisaki Watanabe, “Japan Minister’s Clean Energy Critique Fuels Abe Succession Talk,” Bloomberg, January 16, 2018, accessed February 5, 2018, https://www.bloomberg.com/news/articles/2018-01-16/japan-minister-s-cle….

[28] “55% oppose restarting nuclear reactors, 26% in favor: Mainichi survey,” The Mainichi, March 13, 2017, accessed December 19, 2017, https://mainichi.jp/english/articles/20170313/p2a/00m/0na/006000c.

[29] Atsuko Kitada, “Public opinion changes after the Fukushima Daiichi Nuclear Power Plant accident to nuclear power generation as seen in continuous polls over the past 30 years,” Journal of Nuclear Science and Technology 53, 11 (2016): 1686-1700; Matthew Penney, “Nuclear Power and Shifts in Japanese Public Opinion,” Japan Focus, February 2012, accessed December 19, 2017, http://apjjf.org/-Matthew-Penney/4707/article.html; and Akiko Iimura and Jeff Scott Cross, “Influence of Safety Risk Perception on Post-Fukushima Generation Mix and its Policy Implications in Japan,” Asia & The Pacific Policy Studies 3, 3 (2016): 518-532; and Michio Miyasaka, “Taking public opinion seriously in post-Fukushima Japan,” in Friedo Zölzer, Gaston Meskens, eds., The Ethics of Environmental Health (London, UK: Routledge, 2017): 103-114.

[30] “Two Niigata nuclear reactors run by Tepco clear new safety standards, a first for the company since the Fukushima crisis,” Japan Times, December 27, 2017, accessed January 5, 2018, https://www.japantimes.co.jp/news/2017/12/27/national/two-niigata-nucle….

[31] “TEPCO reactors in Niigata OK’d, but restarts may still take years,” Asahi Shimbun, December 27, 2017, accessed January 5, 2018, http://www.asahi.com/ajw/articles/AJ201712270026.html.

[32] “Tokyo could cut 1.2 billion yen in grants to Niigata for idle reactors,” Asahi Shimbun, December 28, 2017, accessed January 5, 2018, http://www.asahi.com/ajw/articles/AJ201712280035.html.

[33] “Court overturns injunction on Takahama nuclear plant,” Asahi Shimbun, March 28, 2017, accessed December 28, 2017, http://www.asahi.com/ajw/articles/AJ201703280059.html.

[34] Stephen Stapczynski, “Japan Court Bars Restart of Nuclear Reactor Shut After Fukushima,” Bloomberg, December 12, 2017, accessed December 17, 2017, https://www.bloomberg.com/news/articles/2017-12-13/japan-court-bars-ope….

[35] Osamu Tsukimori and Aaron Sheldrick, “Japan nuclear regulator says restart approval pace unlikely to speed up,” Business Insider, November 7, 2017, accessed December 17, 2017, http://www.businessinsider.com/r-japan-nuclear-regulator-says-restart-a….

[36] Takashi Tsuji, “Japan’s aging fleet of reactors spell trouble for energy blueprint,” Nikkei Asian Review, October 7, 2017, accessed December 17, 2017, https://asia.nikkei.com/Politics-Economy/Economy/Japan-s-aging-fleet-of….

[37] “Tokai nuclear plant operator files request to extend operation of aging reactor,” Japan Times, November 24, 2017, accessed December 17, 2017, https://www.japantimes.co.jp/news/2017/11/24/national/tokai-nuclear-pla….

[38] “Japan’s MOX program faces tough questions as recycling costs balloon for spent atomic fuel,” Japan Times, December 17, 2017, accessed December 18, 2017, https://www.japantimes.co.jp/news/2017/12/17/national/japans-mox-progra….

[39] Ibid.

[40] The share of electricity production from oil sources in 2012 doubled to 18 percent, before returning to its pre-Fukushima level the next year. See The World Bank, “Electricity production from oil sources (% total),” accessed January 11, 2018, https://data.worldbank.org/indicator/EG.ELC.PETR.ZS?locations=JP.

[41] US Energy Information Agency (EIA), International Energy Outlook 2016, 39, accessed January 11, 2018, https://www.eia.gov/outlooks/ieo/pdf/0484(2016).pdf.

[42] International Gas Union (IGU), IGU World Gas LNG Report — 2016 Edition, 12, accessed December 28, 2017, http://www.igu.org/download/file/fid/2123.

[43] Ministry of Finance, Trade Statistics of Japan, accessed December 28, 2017, http://www.customs.go.jp/toukei/srch/indexe.htm?M=13&P=0,2,,,,,,,,1,0,2….

[44] “Obstacles grow for coal power in Japan,” Nikkei Asian Review, August 17, 2017, accessed December 17, 2017, https://asia.nikkei.com/Politics-Economy/Policy-Politics/Obstacles-grow-for-coal-power-in-Japan?page=2; and Government of Japan, Ministry of Economy, Trade and Industry (METI), “Japan’s New Coal Policy Towards 2030,”

[45] For a map of proposed coal plants, see “Japan Coal Plant Tracker,” accessed December 18, 2017, http://sekitan.jp/plant-map/en. For a list, see http://sekitan.jp/plant-map/en/v2/table_en.

[46] Kiko Network, “The Road from Paris: Japan’s Progress Towards Its Climate Pledge,” Natural Resources Defense Council (NRDC), November 2017, 12, accessed January 5, 2018, https://www.nrdc.org/sites/default/files/paris-climate-conference-japan….

[47] Grace Guo, “Why Is Asia Returning to Coal?” The Diplomat, February 17, 2017, accessed December 17, 2017, https://thediplomat.com/2017/02/why-is-asia-returning-to-coal/.

[48] “Editorial: Japan's coal-fired power plant plans could sabotage climate image,” The Mainichi, November 21, 2017, accessed December 18, 2017, https://mainichi.jp/english/articles/20171121/p2a/00m/0na/019000c

[49] Yuka Obayashi, “Japan environment minister urges Chubu Elec coal-fired power project be reconsidered,” Reuters, August 1, 2017, accessed December 18, 2017, https://www.reuters.com/article/us-japan-environment-coal/japan-environ….

[50] Daniel Hurst, “Japan opens up to possibility of increasing renewable energy,” Asia Times, December 10, 2017, accessed December 17, 2017, http://www.atimes.com/article/japan-opens-possibility-increasing-renewa….

[51] Keiji Kimura, “Feed-in Tariffs in Japan: Five Years of Achievements and Future Challenges,” Renewable Energy Institute, September 2017, accessed December 18, 2017, https://www.renewable-ei.org/en/activities/reports/img/pdf/20170810/REI….

[52] BP Statistical Review of World Energy 2013.

[53] “Asian Persian Gulf storage deals continue amid global oil glut,” Platts, December 19, 2014, accessed January 5, 2018, https://www.platts.com/latest-news/oil/dubai/asian-persian-gulf-storage-deals-continue-amid-26965617; “Saudi Aramco to add 1.9 mln barrels of crude oil to its Japan storage,” Reuters, September 11, 2017, accessed January 5, 2018, .https://www.reuters.com/article/japan-saudi-aramco/saudi-aramco-to-add-….

[54] In 2016, LNG accounted for 42 percent of Japan’s electricity, up from 29 percent in 2010. http://www.nbr.org/downloads/pdfs/eta/PES_2013_handout_kihara.pdf

[55] John Baffes et al., “The Great Plunge in Oil Prices: Causes, Consequences and Policy Responses,” World Bank Policy Research Note PRN/15/01 (2015): 33, accessed January 5, 2018, https://www.worldbank.org/content/dam/Worldbank/Research/PRN01_Mar2015_….

[56] See for example, “Japan-GCC trade plunges 41.7% in H1 due to decline in crude price,” Emirates 24|7, October 19, 2015, accessed January 5, 2018, http://www.emirates247.com/business/economy-finance/japan-gcc-trade-plu….

[57] The first nuclear power plant in the Middle East, Iran’s Bushehr plant in Iran, was launched in 2011. Construction of the Barakah power plant in UAE began the next year. The first Turkish nuclear power plant at Akkuyu could follow in 2019. See Carole Nakleh, “Nuclear Energy’s Future in the Middle East and North Africa,” Carnegie Middle East Center, January 28, 2016, accessed January 5, 2018, http://carnegie-mec.org/2016/01/28/nuclear-energy-s-future-in-middle-east-and-north-africa-pub-62562; and “UAE, Japan sign up for nuclear cooperation,” World Nuclear News, May 2, 2013, January 5, 2018, http://www.world-nuclear-news.org/NP-UAE_Japan_sign_up_for_nuclear_coop….

[58] “‘Notice to proceed’ contracts signed for El Dabaa,” World Nuclear News, December 11, 2017, accessed January 5, 2018, http://www.world-nuclear-news.org/NN-Notice-to-proceed-contracts-signed….

[59] Ashwani Kumar, “First reactor at UAE nuclear power plant ‘almost ready,’” Khaleej Times, January 31, 2018, accessed February 7, 2018, https://www.khaleejtimes.com/nation/First-reactor-at-UAE-nuclear-power-…-.

[60] Caline Malek, “Construction of UAE’s first nuclear reactor complete but operation delayed to 2018,” The National, May 5, 2017, https://www.thenational.ae/uae/government/construction-of-uae-s-first-nuclear-reactor-complete-but-operation-delayed-to-2018-1.42360; “Saudi Arabia to extract uranium for ‘self-sufficient’ nuclear programme,” Middle East Monitor, October 30, 2017, https://www.middleeastmonitor.com/20171030-saudi-arabia-to-extract-uranium-for-self-sufficient-nuclear-programme/; Reem Shamseddine and Jane Chung, “Exclusive: Saudi Arabia plans to launch nuclear power tender next month - sources,” Reuters, September 14, 2017, https://www.reuters.com/article/us-saudi-nuclear-exclusive/exclusive-saudi-arabia-plans-to-launch-nuclear-power-tender-next-month-sources-idUSKCN1BP1M7; “Russia, Egypt sign deal to construct nuclear power plant,” DW, November 12, 2017, http://www.dw.com/en/russia-egypt-sign-deal-to-construct-nuclear-power-plant/a-41745535; Dave Forest, “Is This The Newest Nuclear Player In The Middle East?” OilPrice.com, September 7, 2017, https://oilprice.com/Alternative-Energy/Nuclear-Power/Is-This-The-Newest-Nuclear-Player-In-The-Middle-East.html; and Leonard Hyman and William Tilles, “Nuclear Power’s Resurgence in the Middle East,” OilPrice.com, December 18, 2017, accessed January 5, 2018, https://oilprice.com/Alternative-Energy/Nuclear-Power/Nuclear-Powers-Re….

[61] Hyman and Tilles, “Nuclear Power’s Resurgence in the Middle East.”

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.