Cinzia Miotto contributed to this article.

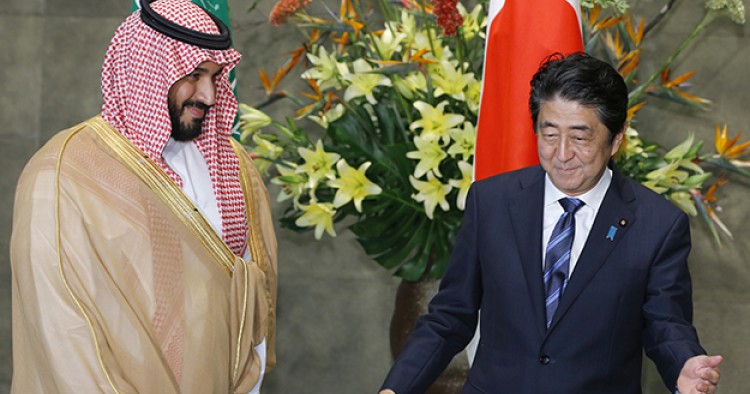

In late August and early September, Deputy Crown Prince Mohammad bin Salman led a Saudi delegation to Tokyo to meet with Japan’s political leadership and business elite.[1] The visit underscored not only Saudi Arabia’s interest in seeking Japanese investment in Vision 2030, but also Riyadh’s view of Japan as a country with a historically close relationship with the kingdom. At this juncture, the leaders of both Saudi Arabia and Japan view their bilateral ties as crucial for protecting each others’ short- and long-term interests. From Riyadh’s perspective, the potential for Vision 2030 to successfully diversify the kingdom’s economy beyond its traditional oil sector will depend on the world’s wealthiest and most technologically advanced nations investing in Saudi Arabia. Japan, a powerhouse with the fourth largest economy in the world and no historical baggage in the Arab world, naturally fits into Saudi Arabia’s ambitious Vision 2030. As Japan’s top supplier of crude oil, Saudi Arabia’s long-term stability is significant for Tokyo, which wants to ensure undisrupted flows of oil continue to fuel its economy. Thus, it is in Japan’s interest to ensure Riyadh’s Vision 2030 is a success, and the kingdom is able to maintain economic stability into the 21st century.

Japan’s Growing Interest in the Middle East

While exploiting niche opportunities in the Middle East, Japan has played a historically passive role in the region based on its cultural orientation. Tokyo’s priority in the Middle East has been securing a steady flow of hydrocarbon resources to power its economy while maintaining neutrality in regional wars and desiring to pursue positive relations with all state actors.

Today, however, as seemingly endless conflicts continue to rage across the Arab world, Japanese officials have taken stock of how the Middle East’s geopolitical instability threatens their country’s national interests. Indeed, Japan’s interdependence with the Middle East and its vulnerability to turmoil in the region is not new. The Iranian Revolution of 1979 and the Iran-Iraq war (1980-1988) created major challenges for Japan’s Middle East foreign policy, which focused on guarding its trade and investment interests with Persian Gulf countries, including Iran (where Japan had its largest private overseas investment at the time of the Shah’s ouster), while maintaining neutrality in local conflicts and supporting U.N.-backed peace initiatives.[2] For decades, Japan’s post-war constitution prohibited the country’s military from engaging in offensive actions. Tokyo’s military footprint in the region was primarily limited to the deployment of the Japan Self-Defense Forces (J.S.D.F.) on humanitarian, reconstruction, and peacekeeping missions such as in Iraq and the Golan Heights.[3], [4]

At this juncture, however, Japan is signaling an increased interest in using its military power to protect the country’s access to energy supplies from the Arabian Peninsula and greater Middle East. In late 2008, Japan deployed a military reconnaissance battalion for operations off the coasts of Djibouti, Kenya, Oman, and Yemen.[5] In 2011, Japan established a military base in Djibouti—Japan’s first on foreign soil since World War II, which Tokyo officials decided last year to make permanent.[6] Approximately 600 J.S.D.F. members currently use the African country’s ports to operate naval vessels and a land facility.[7] Given that roughly 10 percent of the ships which transit the Bab-el-Mandeb (the strait situated between Djibouti, Eritrea, and Yemen linking the Gulf of Aden to the Red Sea) are Japanese, it was logical for Japan to extend its military presence to a country strategically situated at the Red Sea’s southern gate.[8]

In 2012, Prime Minister Yoshihiko Noda spoke about Japan's need to deploy the J.S.D.F. to the Strait of Hormuz for minesweeping and escort operations in case the key shipping route closes.[9] Last July, Japan passed a law permitting the J.S.D.F. to engage in military operations targeting foreign combatants, which raises important questions about the future role of its military outside of its own neighborhood, most importantly in the Middle East and the Horn of Africa.[10] Within the context of extremists such as ISIS and al-Qaeda, which have killed several Japanese nationals over the years, and continue to threaten Japan’s interests in the Middle East and Africa, Tokyo is likely to turn to its security relations with Saudi Arabia and other Gulf Cooperation Council (G.C.C.) members to ensure security of strategically vital straits. To encourage such stability and protect busy trade routes, Japan seeks to assert a more active role in the region as a promoter of conflict resolution. Unquestionably, Japan, which sources much of its oil from Riyadh, has high stakes in Saudi Arabia maintaining stability and achieving its goals as laid out in Vision 2030.

However, as Japan also has interests in post-sanctions Iran, Tokyo must carefully navigate the Middle East’s geopolitical fault lines as the country further engages with the region. At the same time, Riyadh’s commitment to deepening relations with Japan’s main competitor in East Asia—bin Salman visited China before and after his visit to Japan—will compel Saudi Arabia to balance its ties between Tokyo and Beijing. In spite of the inherent risks associated with doing business in the Middle East, Japan’s foreign minister, Fumio Kishida, has expressed Tokyo’s will to contribute to stability in the region by continuing to engage in broad trade and investment, as well as in talks with Saudi Arabia regarding the Syrian crisis.[11]

A Brief History of Riyadh-Tokyo Relations

Saudi-Japanese relations date back to the 1930s, when Saudi Arabia’s first king and his envoy visited Japan to attend the inauguration ceremony of the Tokyo Mosque. Since Riyadh and Tokyo established official diplomatic relations in 1955, government officials from both countries have made frequent visits over the decades. Throughout the second half of the 20th century, Saudi-Japanese trade (mainly of oil and petrochemicals to Japan and technology to the kingdom) and several bilateral treaties and agreements such as the Comprehensive Partnership toward the Twenty-First Century (1975) and the Japan-Saudi Cooperation Agenda (1998) cemented strong bilateral economic relations.[12]

As is the case with Riyadh’s relationships with other East Asian nations, energy and trade have served as the foundation of Riyadh’s deep ties with Tokyo. Japan’s thirst for oil and gas, coupled with the country’s dearth of hydrocarbon resources, has made Tokyo highly dependent on Persian Gulf states for 80 percent of its oil consumption.[13] Japan’s oil and gas demands have surged since the 2011 Fukushima disaster, which forced the country to shut down its nuclear reactors and rely on other sources of energy. The kingdom’s oil supply to Japan also increased after 2012, picking up the slack when Tokyo complied with international economic sanctions imposed on Iran. This resulted in Iranian oil exports to Japan dropping 60 percent within a year; Iran’s market share of oil exports to Japan falling from 7.8 percent in 2011 to 5 percent last year (down from a 16 percent peak in 2003).[14] Meanwhile, Saudi Arabia increased its market share and further solidified its role as the Asian country’s most important supplier of oil. As of April, Japan sourced 41 percent of its oil imports from the kingdom, up from 31.1 and 34 percent in 2011 and 2014, respectively.[15],[16],[17]

A new opening between Riyadh and Tokyo occurred in February 2014, when then-Crown Prince Salman bin Abdulaziz visited Tokyo (his first visit as Riyadh governor was in the 1990s).[18] Not only did Abdulaziz, who would ascend to the throne 11 months later, sign three key agreements in economic and defense affairs, he also signed an important memorandum between the Saudi Arabian General Investment Authority (S.A.G.I.A.) and Japan’s Cooperation Center for the Middle East.[19] In addition, Japan and Saudi Arabia agreed to accelerate talks for civil nuclear cooperation that could enable Japanese manufacturers to export nuclear reactors to the country via contractual arrangements with the King Abdullah City for Atomic and Renewable Energy (K.A.-C.A.R.E.). At the time, Saudi editors praised the Japanese approach as a good example for Arab states to follow.[20]

In recent years, Riyadh-Tokyo relations have also expanded in the security, general industry, educational, and cultural spheres, with ministerial meetings occurring in the areas of cultural affairs, military cooperation, and maritime security. Industrial cooperation has been increasing since the establishment of the “Japan-Saudi Arabia Industrial Cooperation Task Force” in 2007, which aimed to diversify industrial development.[21] Recent bilateral meetings in Japan have also resulted in the signing of MoUs for small and medium-sized enterprise cooperation and investment cooperation in a variety of industries.[22]

Saudi-Japanese trade relations are also growing, with Japan currently Saudi Arabia’s second largest trading partner. From 2004 to 2014, Saudi exports to Japan increased from $13.1 to $42.5 billion with Japan becoming the destination of 10.9 percent of Saudi exports and the kingdom’s second largest export partner last year.[23], [24], [25] During the same interval, Japanese exports to Saudi Arabia rose from $3.8 to $7.41 billion with Japan becoming the kingdom’s sixth largest import partner. Saudi Arabia is Japan’s top source of oil, which accounted for 41.6 percent of Japan’s total oil consumption in April.[26] In the first half of 2016, Saudi oil shipments to Japan increased by 8 percent compared with 2015. Saudi Aramco is negotiating with Japan for the renewal of the lease of oil-storage tanks in Okinawa, which would enable Aramco to reduce freight costs and increase shipping flexibility to compete for an increasing share of the Asian market.[27] Moreover, Aramco, which is investing in petrochemical plants and in the enhancement of its own refineries, has almost completed a petrochemical plant within its joint refinery with Japan’s Sumitomo Chemical in Rabigh.[28] Aramco also owns 15 percent of the Japanese oil refining company Showa Shell Sekiyu, which holds a one-third share of Royal Dutch Shell.

Despite being based primarily on energy-related trade, bilateral economic relations are set to diversify and expand in the future.

Japan’s Role in Vision 2030

Today, the Saudi leadership sees Japan as having the potential to play an important role in Vision 2030. Tokyo’s approach of merging public and private sectors (also known as Public-Private Partnerships or PPPs) is attractive to Saudi Arabia, as PPPs are new territory for the kingdom.

Japan seeks to help Saudi Arabia achieve its Vision 2030, but in a variety of specific fields, such as finance, industry, and the development of business.[29] Tokyo is narrowing the arena of assistance it can provide to Riyadh to areas that help bring Japanese excellence to Saudi management and fiscal instruments. Japan’s former keiretsu system, a model devised in the 1960s of informal corporate structures linking organizations through business relationships and shareholdings, enables Tokyo to uniquely understand the Saudi system of royal patronage—a mechanism for the kingdom’s royal family to distribute positions and wealth among Ibn Saud’s descendants. This lens into the Saudi business community helps Tokyo make key decisions in how to assist the kingdom achieve its goals,[30] as Japanese businessmen who have worked in the Middle East still view the region, particularly Saudi Arabia, within this framework. Japan sees transforming Saudi society as essential to Vision 2030’s success, and thus are directing its engagement to specific sectors that can help facilitate that change, particularly with respect to gender issues. At the turn of the century, Japan’s female labor participation was low by O.E.C.D. standards, with many concluding that this was simply an unchangable outcome of Japanese culture. Yet “womenomics,” a key pillar of Prime Minister Shinzo Abe’s strategy for boosting Japan’s G.D.P., has remarkably increased the percentage of Japanese women in the workforce, even surpassing the United States. From 1999 to 2016, Japan’s female labor participation steadily rose from 57 to 66 percent.[31] Japan’s success in terms of gender diversity in the economy can serve as a template for other countries suffering from low female labor participation, such as Saudi Arabia, which ranked extremely low by global (and even Gulf Arab) standards at 10 percent in 1999.[32] Nonetheless, largely attributable to limited gender reforms under King Abdullah, which permitted Saudi women to work in the retail and hospitality sectors, this figure is now at 22 percent.[33], [34]

Determined to increase the percentage of Saudi women in the workforce to 30 percent, bin Salman envisions women playing a more dominant role in the kingdom’s economy. Although many make moral and social arguments for increasing female labor participation in the Saudi economy, there is also a cogent argument for doing so: to increase the nation’s productivity outside of the oil sector. Maintaining the status quo comes with an economic price tag, given the human capital potential offered by including more women in the workforce. Unquestionably, the kingdom’s economic growth outside of the oil sector will largely depend on unleashing the potential of Saudi women to help diversify the economy in the years ahead.

Based on data from the Ministry of Labor, the number of Saudi women employed in the private sector increased from 50,000 to 400,000 between 2010 and 2014, with the majority of these jobs being in the construction, hospitality, retail, and wholesale sectors.[35] As Saudis are determined to decrease their reliance on oil, growing these sectors are focal points of Vision 2030. Hospitality, for example, is an important non-oil industry that offers the Saudis an opportunity to decrease dependency on its traditional hydrocarbon sector, particularly given the country’s ambition to boost the tourism revenue and attract 1.5 million tourists within four years.[36] Retail is another sector that is continuing to grow in Saudi Arabia, despite low oil prices.[37] The country’s potential to further grow these non-oil industries will largely depend on the extent to which the kingdom can overcome obstacles to female employment.

Nevertheless, the Japanese are cautiously assessing Saudi planning and goals. Privately, Japanese businessmen tend to view investments in Saudi Arabia related to Vision 2030 as high risk with certain areas of the bilateral economic relationship being off-limits. One Japanese interlocutor, who is a senior advisor to Tokyo, addressed Japan’s concerns about the kingdom’s economic problems, out of control defense spending, regional challenges (Iran, Syria, and Yemen) and the threat of Salafist-jihadist forces, chiefly Islamic State and al-Qaeda, within the kingdom. “We Japanese see the kingdom as in a very dangerous position. Our sensibilities are being tested by the kingdom’s ambitious program. We want to help of course. But we maintain our cautious optimism that al-Saud will achieve only some goals of the ambitious program.”[38]

Japan announced that it will not invest in Saudi Aramco’s initial public offering, despite previous discussions on the topic between officials from Riyadh and Tokyo earlier this year. An adviser to Abe stated that Japan has more interest in investing in non-energy sectors in Saudi Arabia, as they are key points of the Vision 2030 plan. The Japanese government believes that it is more important to invest in the development of new technologies and manufacturing industries in Saudi Arabia—sectors that Japanese companies would contribute to.[39]

The kingdom and Japan’s relationship has deepened in the financial sector. The Japan Bank for International Cooperation (J.B.I.C.), Japan External Trade Organization (J.E.T.R.O.), Ministry of Economy, Trade and Industry (M.E.T.I.) all play a role in the overall Japanese assessment of Saudi Arabia and where best to assist the kingdom in a mutually beneficial relationship. Last March, J.B.I.C. signed two overseas investment loan agreements worth $490 million with Saudi Methacrylates Company to support the activities of Japan’s Mitsubishi Rayon, which owns half of S.A.M.A.C.’s shares in Saudi Arabia.[40] Furthermore, in May, J.B.I.C. signed a $1.17 billion loan agreement in favor of the Saudi company Eastern Petrochemical Company (S.H.A.R.Q.) to finance the third expansion of one of the world's largest ethylene glycol and polyethylene production projects.[41] Finally, the October announcement of the Saudi-Japanese “SoftBank Vision Fund” technology investment pool to be based in London is further evidence of how Tokyo sees Saudi Arabia as a valuable collaborative partner. Saudi Arabia's top sovereign wealth fund, the Public Investment Fund (P.I.F.), will invest up to $45 billion over the next five years, while Japan’s SoftBank expects to bankroll at least $25 billion.[42]

Balancing Between Saudi and Iran

Being so dependent on foreign sources of gas and oil, Japan simply cannot afford to rely primarily on any single source to satisfy its energy needs. Concurrent with Iran’s recent reappearance in the global oil trade, Japan is again eyeing Iran for an increased portion of its oil needs. Japan has demonstrated its full support of the revitalization of Iran’s oil industry in the post-sanctions era, given its low financing costs and technical expertise in the field. The Japanese government allocated $10 billion to finance projects and attract financial investors to Iran.[43] Bilateral trade is set to also extend to the natural gas market because Iran owns one of the world’s largest gas fields (the South Pars) and it will continue to gain additional technology and knowledge to boost its production potential.

Japanese companies have expressed their willingness to invest also in the production of automobiles, railways, aircrafts, and infrastructure. In light of this, and presuming there is no substantive change in the nature of bilateral relations between Riyadh and Tehran, Tokyo will undoubtedly face some challenges pursuing closer relations with Saudi Arabia. But this is not the first time one of Riyadh’s trading partners has also engaged Tehran. Indeed, a host of Western and Asian countries which have maintained deep ties with the kingdom for decades face this geopolitical dilemma of having to balance their exploration of an increasingly normalized relationship with Iran, while continuing to invest in their deep ties with Saudi Arabia and other G.C.C. states.

Saudi Stability the Key

The stakes are high for both Riyadh and Tokyo albeit for different reasons. If the kingdom fails to decrease its economic dependence on oil for 90 percent of its revenue, the prospects for long-term stability in Saudi Arabia are dim. The goals of Vision 2030 are only achievable with adequate foreign investment, and the House of Saud continues to search for sources of capital in all corners of the world. Having visited the U.S. and France earlier this year to secure Western investment in Vision 2030, M.B.S.’ visit to China and Japan underscores the importance of establishing and maintaining economic relations with all of the world’s major economies in an effort to achieve the kingdom’s ambitious domestic agenda.

Even if oil prices rise, the Saudis recognize that relying on their hydrocarbon sector for stability and prosperity is not a sustainable strategy given that the kingdom’s reserves will deplete in seven decades, if production levels remain steady.[44] Not only does stability depend on Vision 2030, but the success of these reforms will depend on security and peace in the short-term. Yet, there are growing challenges that post a threat to Saudi instability, including terrorist cells linked to al-Qaeda and Islamic State, missile attacks from Yemen, an exacerbating geopolitical rivalry with Iran, and internal sectarian tensions in the country’s oil-rich Eastern Province. Beyond foreign threats to stability, the Saudi leadership must continue navigating carefully with respect to its austerity measures for fear of a potential backlash from segments of the society at a time when low oil prices and financial constraints may weaken the monarchy’s social contract with its subjects.

Japan’s own economic stability is interdependent with that of the Middle East, where Saudi Arabia has for decades been an anchor of a conservative regional order. As a host of factors both outside and within Saudi Arabia challenge the kingdom’s stability, Japan will continue to play an important role in Vision 2030 given Tokyo’s high stakes in the G.C.C. countries maintaining cohesion and continuing to serve as Japan’s top oil and gas suppliers. Beyond the Gulf Arab states, Tokyo has stakes across the greater MENA region and has become increasingly invested in the resolution of a host of conflicts, from Syria to Palestine, Libya to Afghanistan, and Iraq to Yemen, for the purpose of furthering Japan’s economic interests. To promote such interests, Japan must deepen its ties with the major players in the Arab world in order to find solutions to transnational security threats and pursue common objectives. It is only logical to conclude that Tokyo will maintain its relationship with Riyadh as a vital partner throughout the future, and Saudi Arabia will view Japan an important player in Vision 2030.

[1] Habib Toumi, "Saudi Deputy Crown Prince in Japan: One Perfect Picture as Two Cultures Meet," Gulf News, September 1, 2016, http://gulfnews.com/news/gulf/saudi-arabia/saudi-deputy-crown-prince-in….

[2] Juzo Kimura, Japan's Middle East Policy: Impact of the Oil Crises, report, Kobe University Repository, 1985, http://www.lib.kobe-u.ac.jp/repository/00166912.pdf.

[3] David Fouse, Japan's Dispatch of the Ground Self Defense Force to Iraq: Lessons Learned, report, Asia-Pacific Center for Security Studies, July 2007, http://apcss.org/wp-content/uploads/2011/03/Japans-Dispatch-of-the-GSDF….

[4] Jonathan Watts, "End of an Era as Japan Enters Iraq," The Guardian, July 25, 2003, https://www.theguardian.com/world/2003/jul/26/iraq.japan.

[5] Fouad Farhaoui, "Japan’s Interests Between The Gulf Of Aden, Africa And Yemen – Analysis," Eurasia Review, February 29, 2016, http://www.eurasiareview.com/29022016-japans-interests-between-the-gulf….

[6] M.O. Farah, "Japan Opens Military Base in Djibouti to Help Combat Piracy," Bloomberg, July 8, 2011, http://www.bloomberg.com/news/articles/2011-07-08/japan-opens-military-….

[7] Ben Ho Wan Beng, "The Strategic Attractions of Djibouti," The Strategic Attractions of Djibouti, March 18, 2016, http://nationalinterest.org/blog/the-buzz/the-strategic-attractions-dji….

[8] Ibid.

[9] Takeo Kumagai, "Japan Mulls Sending SDF Escort Vessels to Strait of Hormuz: Report," Platts, February 16, 2012, http://www.platts.com/latest-news/oil/tokyo/japan-mulls-sending-sdf-esc….

[10] Fouad Farhaoui, "Japan’s Interests Between The Gulf Of Aden, Africa And Yemen – Analysis," Eurasia Review, February 29, 2016, http://www.eurasiareview.com/29022016-japans-interests-between-the-gulf….

[11] Musaid Al-Zayani, "Japan’s Foreign Minister: Saudi Arabia Plays Key Role in Region’s Stability," Asharq Al-Awsat, September 2, 2016, http://english.aawsat.com/2016/09/article55357610/japans-foreign-minist….

[12] George G. Eberling, Future Oil Demands of China, India, and Japan: Policy Scenarios and Implications(Lexington Books, 2014), https://books.google.com/books?id=uzD7AwAAQBAJ&dq=saudi japan trade bilateral&source=gbs_navlinks_s.

[13] Jonathan Berkshire Miller, "Japan’s Strategic Ties with Iran," Al Jazeera, February 18, 2016, http://studies.aljazeera.net/en/reports/2016/02/201621864717335576.html.

[14] Ibid.

[15] Takeo Kumagai, Daniel Colover, and Gawoon Phillip Vahn, "Analysis: Saudi Arabia Reinforces Strategy with 10-year High Japan Crude Sales," Platts, June 2, 2016, http://www.platts.com/latest-news/oil/tokyo/analysis-saudi-arabia-reinf….

[16] John Boyd, "Japan Looks To Fourth Industrial Revolution To Help Reach 'Impossible' GDP Target," Forbes, July 24, 2016, http://www.forbes.com/sites/jboyd/2016/07/24/japan-looks-to-fourth-indu….

[17] Jonathan Berkshire Miller, "Japan’s Strategic Ties with Iran," Al Jazeera, February 18, 2016, , http://studies.aljazeera.net/en/reports/2016/02/201621864717335576.html.

[18] "Crown Prince Salman Highlights Saudi–Japanese Ties," Asharq Al-Awsat, February 21, 2014, http://english.aawsat.com/2014/02/article55329214.

[19] MD Rasooldeen, "Riyadh, Tokyo Pledge '100-year Partnership'" Arab News, February 20, 2014, http://www.arabnews.com/news/528426.

[20] Abdulrahman Al-Rashed, "Saudi-Japanese Ties: Lessons from the East – Rashed," Saudi-US Relations Information Service, February 27, 2014, http://susris.com/2014/02/27/saudi-japanese-ties-lessons-from-the-east-….

[21] "Japan-Saudi Arabia Industrial Cooperation Task Force," Japan Cooperation Center for the Middle East, http://www.saudiarabia-jccme.jp/english/about/industrial_01.html?PHPSES….

[22] "Kingdom, Japan Sign 7 MoUs in Different Fields," Saudi Gazette, September 2, 2016, http://saudigazette.com.sa/saudi-arabia/kingdom-japan-sign-7-mous-diffe….

[23] Royal Embassy of the Kingdom of Saudi Arabia, Tokyo, "Messages from Leaders of Saudi Arabia and Japan," news release, April 2005, http://www.saudiembassy.or.jp/50years/files/arabiae.pdf.

[24] The Observatory of Economic Complexity, http://atlas.media.mit.edu/en/profile/country/sau/#Imports.

[25] The World Fact Book, https://www.cia.gov/library/publications/the-world-factbook/fields/2050….

[26] "Analysis: Saudi Arabia Reinforces Strategy with 10-year High Japan Crude Sales," Platts, June 2, 2016, http://www.platts.com/latest-news/oil/tokyo/analysis-saudi-arabia-reinf….

[27] Osamu Tsukimori and Yuka Obayashi, "Saudi Aramco, Japan to Expand Okinawa Crude Storage Deal," Reuters, September 1, 2016, http://uk.reuters.com/article/uk-japan-saudi-aramco-idUKKCN1174ZQ.

[28] Emi Urabe, "Sumitomo Mitsui Seeks Role in Saudi Aramco’s IPO, Chairman Says," Bloomberg, September 1, 2016, http://www.bloomberg.com/news/articles/2016-09-01/sumitomo-mitsui-seeks….

[29] "Saudi-Japan Business Forum for Vision 2030 Held in Tokyo," Asharq Al-Awsat, September 2, 2016, http://english.aawsat.com/2016/09/article55357629/saudi-japan-business-….

[30] Rob Steven, Japan and the New World Order(Springer, 2016).

[31] Kathy Matsui, "‘Womenomics’ Continues as a Work in Progress," Japan Times, May 25, 2016, http://www.japantimes.co.jp/news/2016/05/25/business/economy-business/w….

[32] Gassan Al-Kibsi et al., Moving Saudi Arabia’s Economy beyond Oil, report, December 2015, http://www.mckinsey.com/global-themes/employment-and-growth/moving-saud….

[33] Jonathan Chew, "Women Are Taking over Saudi Arabia's Workforce," Fortune, August 10, 2015, http://fortune.com/2015/08/10/women-saudi-arabia/.

[34] Matt Clinch and Hadley Gamble, "Saudi Arabia Unveils 15-year Plan to Transform Its Economy," CNBC, April 25, 2016, http://www.cnbc.com/2016/04/25/saudi-arabias-government-officially-unve….

[35] Gassan Al-Kibsi et al., Moving Saudi Arabia’s Economy beyond Oil, report, December 2015, http://www.mckinsey.com/global-themes/employment-and-growth/moving-saud….

[36] Eleanor Dickinson, "Saudi Vision 2030 Aims to Double Tourism Sector by 2020," Gulf Business, June 8, 2016, http://gulfbusiness.com/saudi-vision-2030-hopes-double-hotel-sector/.

[37] Andrew Scott, "Saudi Retail Sector Is Its Success Story," The National, January 19, 2016, http://www.thenational.ae/business/retail/saudi-retail-sector-is-its-su….

[38] "Interview with Japanese Senior Advisor to Japan MOFA," interview by author, October 2016.

[39] "Abe, Saudi Prince Vow Cooperation on Economic Plan," The Japan Times, September 1, 2016, http://www.japantimes.co.jp/news/2016/09/01/business/saudi-delegation-s….

[40] "Saudi Methacrylates Company's (SAMAC) Alpha 2 Project, Saudi Arabia," http://www.chemicals-technology.com/projects/saudi-methacrylates-compan….

[41] Mohammed Al Kasayer, "SHARQ RAISES US$ 2.43 BILLION (SAR 9.11 BILLION) FOR ITS THIRD EXPANSION PROJECT," Sabic, May 21, 2006, https://www.sabic.com/me/en/newsandmediarelations/news/2006/20060521--S….

[42] Its should be noted that the P.I.F.’s investment in SoftBank will be based on the ARAMCO IPO, thus Saudi Arabia’s actual investment in this joint venture with Japan is yet to be determined.

Andrew Torchia and Thomas Wilson, "Saudi Arabia, SoftBank Aim to Be World's No. 1 Tech Investor with $100 Billion Fund," Reuters, October 14, 2016, http://www.reuters.com/article/us-saudi-japan-funds-idUSKCN12D339.

[43] "Japan to Invest $10b in Iran," The Iran Project, July 30, 2016, http://theiranproject.com/blog/2016/07/30/japan-invest-10b-iran/.

[44] Anthony Dipaola, "Saudi Arabia Sees Its Oil Reserves Lasting Another 70 Years," Bloomberg, October 11, 2016, http://www.bloomberg.com/news/articles/2016-10-11/saudi-arabia-sees-its….

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.