The GCC governments still cover over 40% of the cost of domestic electricity production. Yet, electricity subsidy bills alone do not reflect the full extent of their economic losses. Once the forgone revenues from the export of natural gas and oil used to meet rising domestic energy demand are added in, the total economic cost of the GCC’s electricity is too great to ignore.

The Gulf Cooperation Council (GCC) governments expect 2023 to be a good year. With oil prices projected to reach $120 at some point in 2023, the GCC states have officially forecast fiscal surpluses — some of the highest they have seen since the last oil price plunge in 2014-16. Yet, their expected revenues could be even higher if not for energy subsidies and the inefficient domestic uses of these exportable commodities. Electricity generation, in particular, continues to be a revenue drainer.

The exorbitant cost of generating electricity in the Gulf

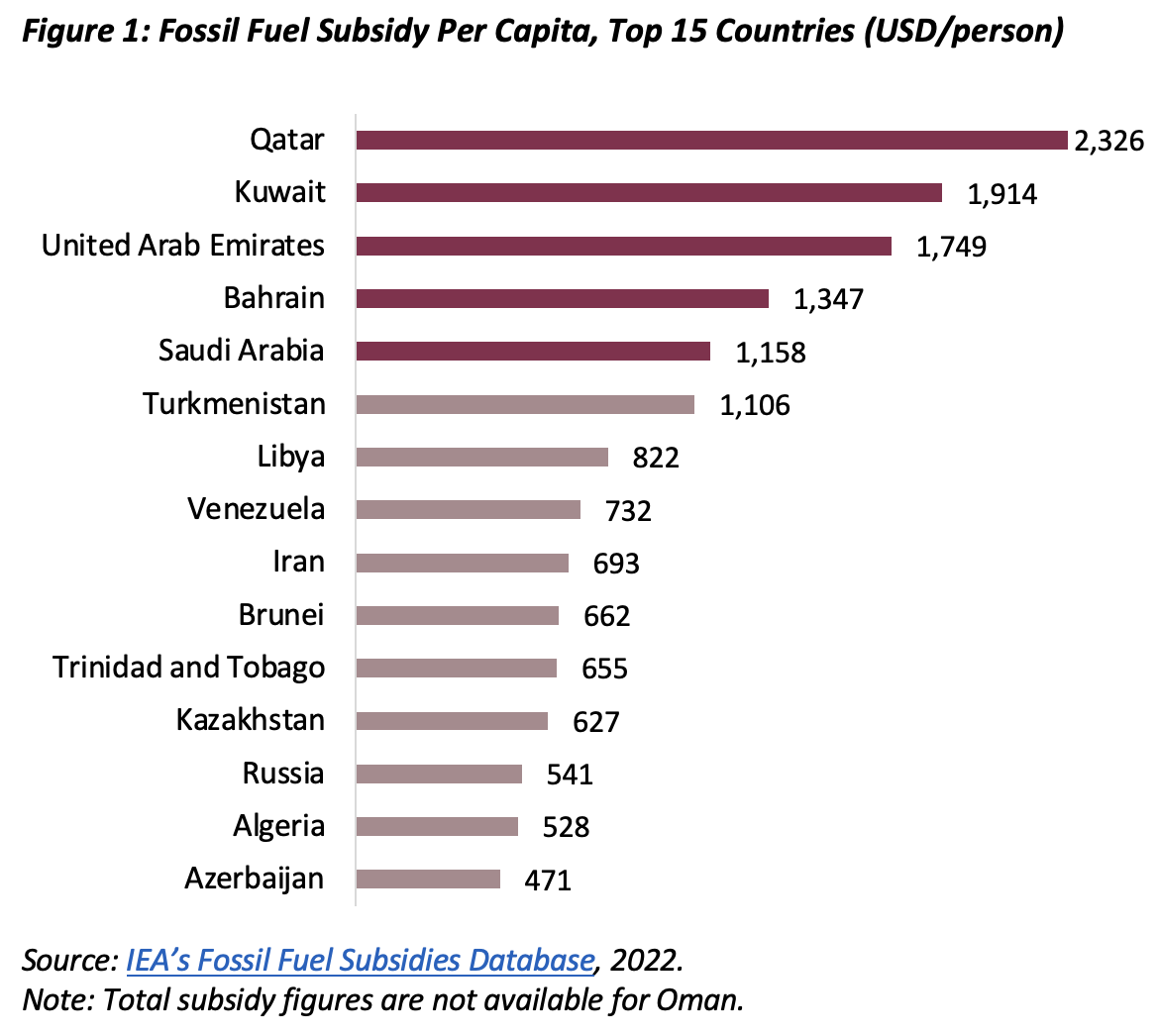

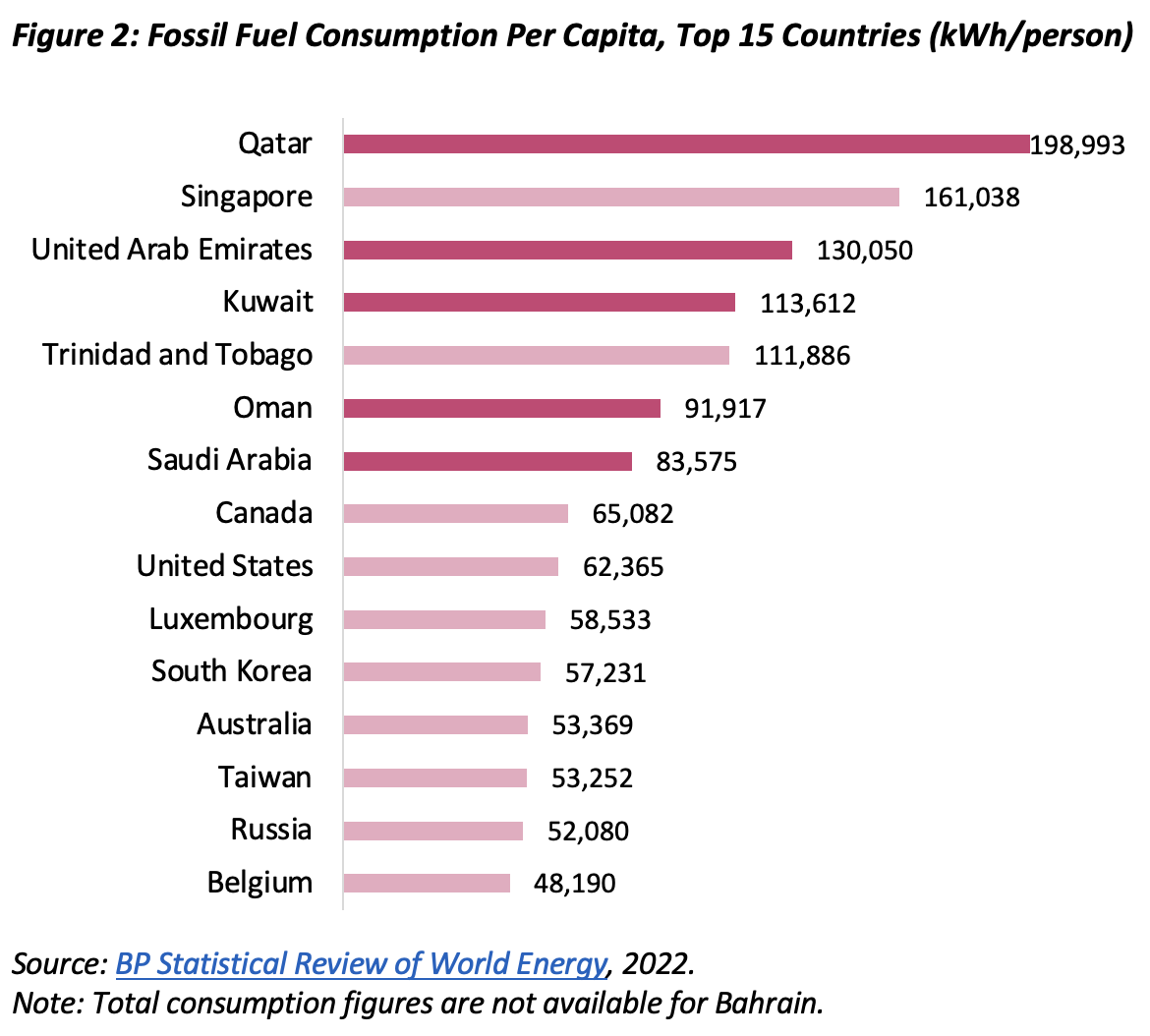

Home to over 29% of the world’s proven oil reserves and 21% of natural gas reserves, the GCC is unquestionably rich in hydrocarbons. But rapid economic development and energy subsidization have transformed these countries’ potentially lucrative energy exports into undervalued domestic consumption. Nearly one-third of oil and over two-thirds of natural gas produced in the Gulf is consumed domestically, constituting some of the world’s highest per capita consumption and subsidy rates. The International Energy Agency (IEA) estimates that, in 2021, the GCC’s fossil fuel subsidies reached $76 billion or around 4.5% of their collective $1.7 trillion GDP. The GCC states top the world chart when it comes to fossil fuel subsidies per capita (see figure 1), encouraging record-high energy consumption per capita rates (see figure 2). Qatar, by far, has the world’s highest fossil fuel consumption and subsidy per capita, mainly owing to a small population relative to its massive liquified natural gas (LNG) production capacity.

Not all uses of oil and gas in the Gulf are economically efficient. The costliest domestic use of energy in the region is for electricity generation. On average, only 12% of the energy consumed within the GCC is used to generate electricity. Still, electricity subsidies alone make up nearly 40% of the value of these countries’ energy subsidies.

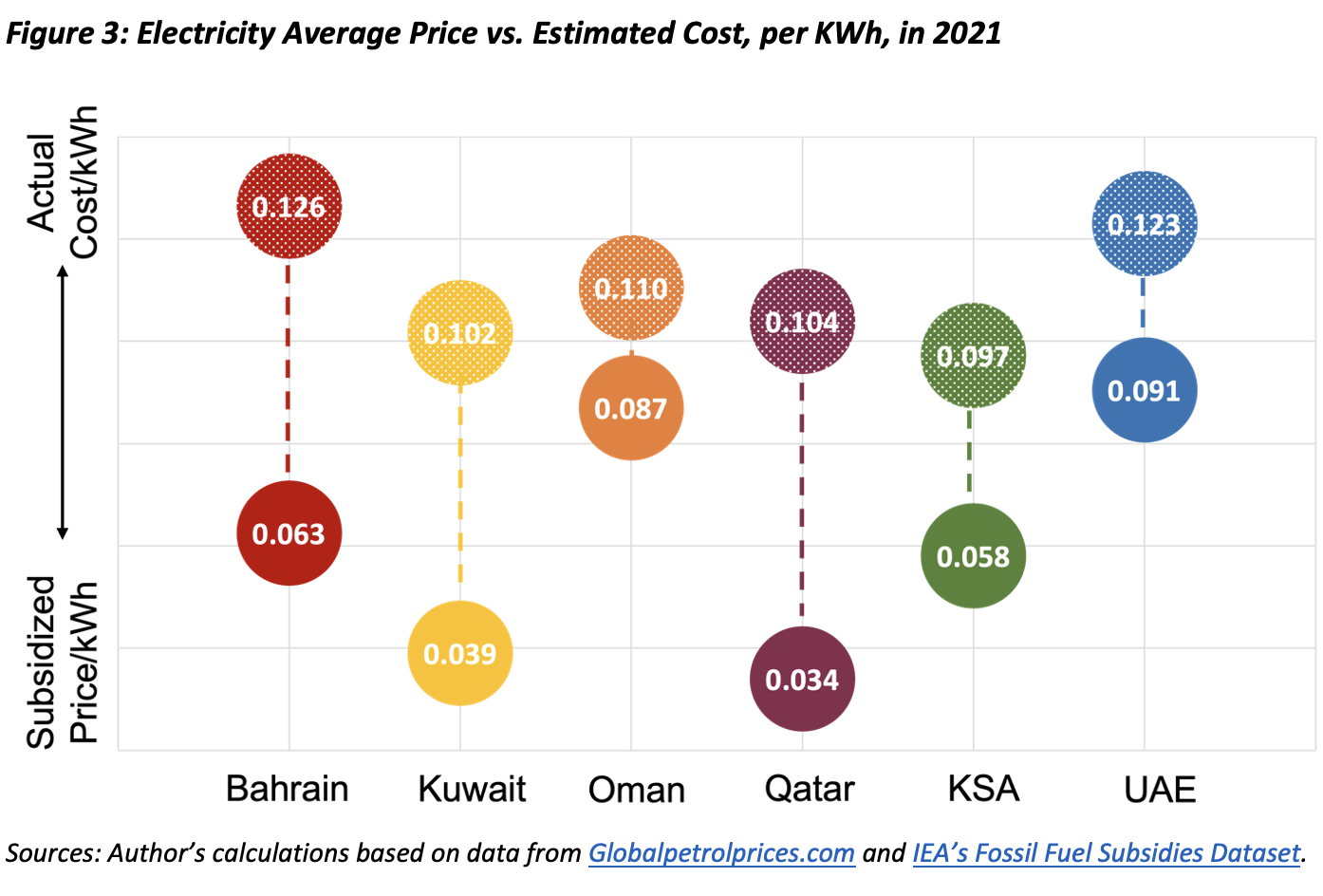

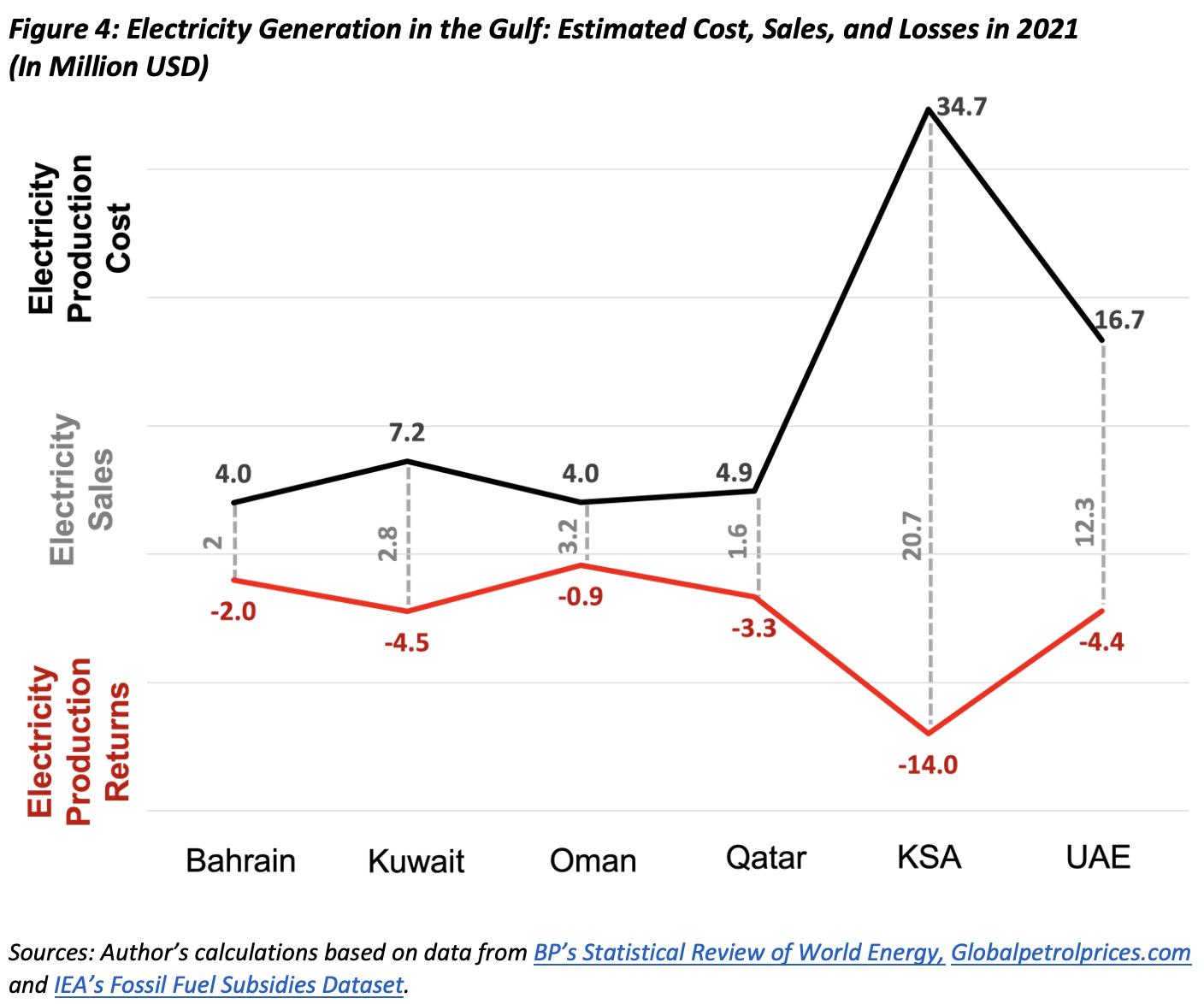

The GCC’s average actual cost of generating electricity is estimated to be around $0.11 per kWh, in contrast to the average subsidized price of $0.06 per kWh (see figure 3). While none of the GCC states profit from generating electricity, some bear more losses than others (see figure 4). Saudi Arabia loses the most from generating electricity, mainly because it generates the most, though its subsidy per capita rate is not the largest in the Gulf. In 2021, the kingdom lost nearly $14 billion generating subsidized electricity for its domestic economy. By comparison, Oman lost the least — about $857 million in 2021 — as its subsidized price is closest to the actual cost of electricity production.

However, these losses do not fully encompass all that had been sacrificed by burning hydrocarbons to generate subsidized electricity. The forgone revenue of the best alternative use of oil and gas must be considered when attempting to estimate the opportunity cost of electricity. Assuming that lucrative energy exports are the best alternative use of the Gulf’s energy resources, the GCC’s opportunity cost of generating electricity could be defined as the difference between the value of energy exports (i.e., forgone profits) and the revenues from generating electricity (i.e., current losses).

The billions forgone in potential energy revenues

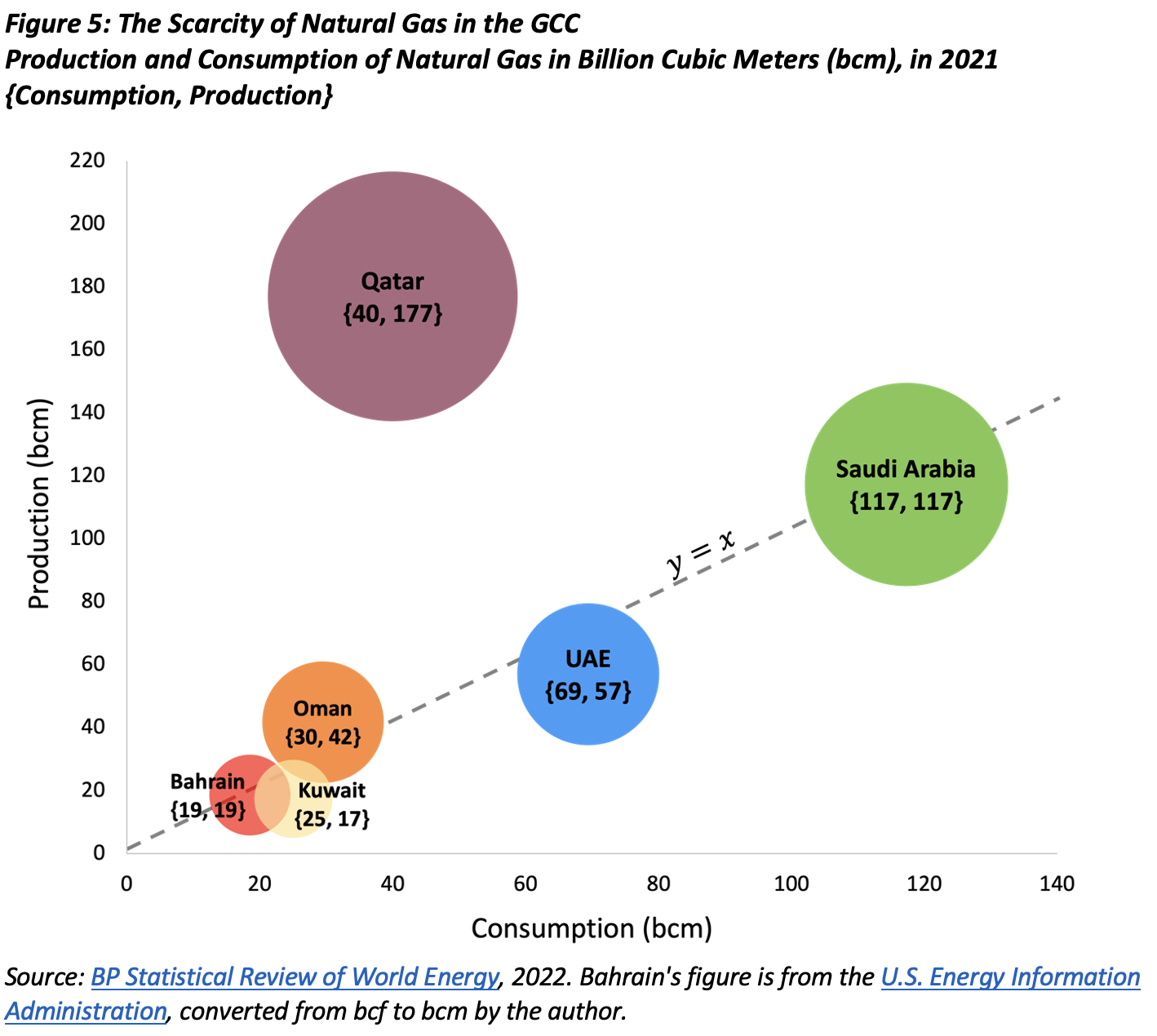

Although the Gulf states are energy abundant, nearly all are deficient in the energy source most needed to generate electricity: natural gas (see figure 5). Only Qatar and, to a lesser extent, Oman have natural gas surpluses beyond their domestic consumption needs. Bahrain's natural gas production scarcely meets its domestic demand, while Saudi Arabia, the UAE, and Kuwait do not produce enough natural gas to meet their demand. The UAE and Kuwait resort to importing the commodity, but Saudi Arabia and Bahrain do not, though they appear interested in doing so in the future. Instead of importing natural gas, Saudi Arabia burns oil to fuel the remainder of its electricity needs, making it the world’s most reliant country on oil for electricity generation.

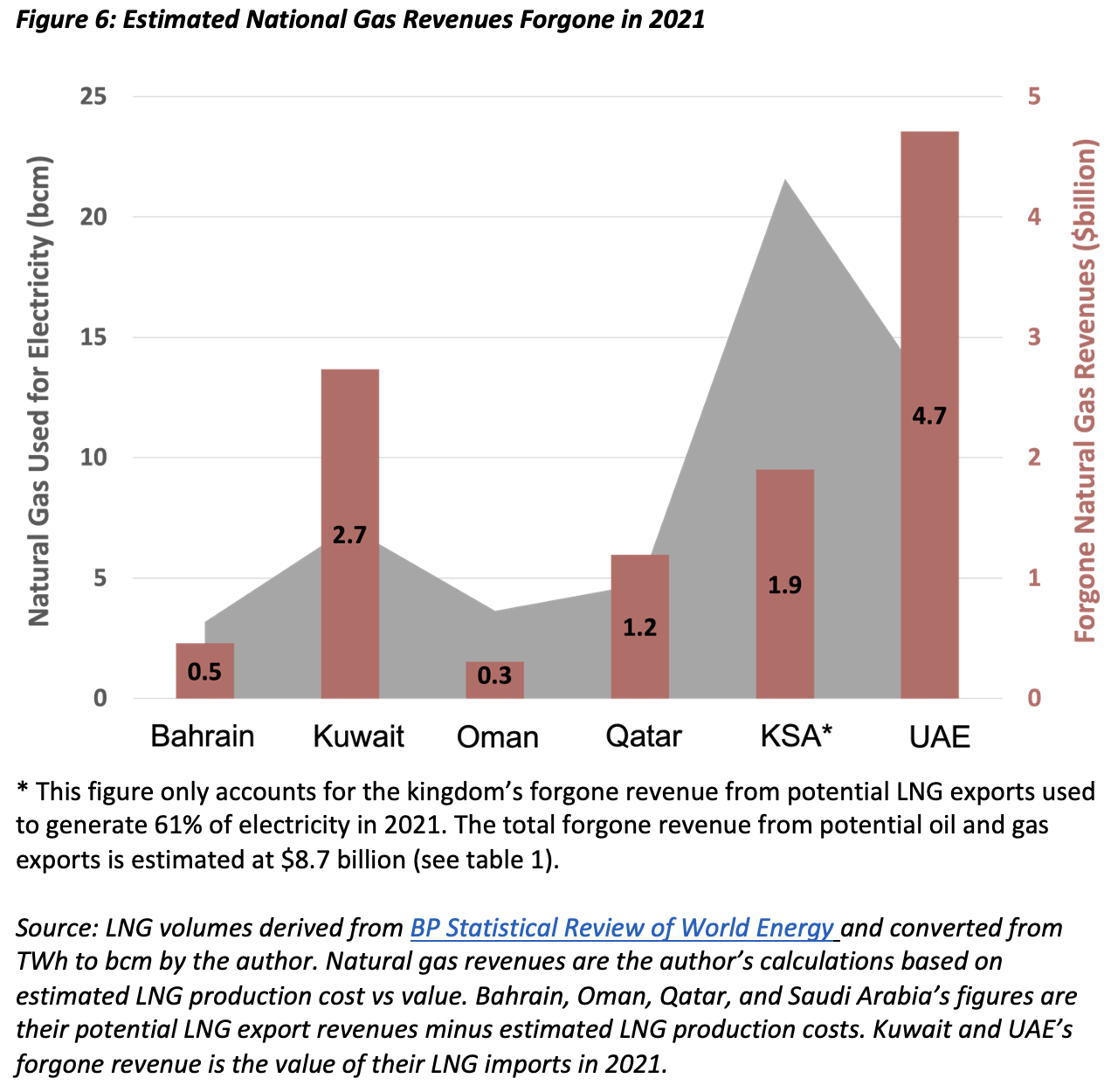

These differences in natural gas abundance mean that the forgone revenue of the best alternative use of the energy resource also differs by country. For states that export energy resources (or those that could theoretically), the best alternative use is the potential export value minus the cost of production (and transportation). For states that import energy to generate electricity, the forgone revenue is the value of imports. Over 99% of electricity in Bahrain, Kuwait, Oman, and Qatar is gas-powered. Nearly 94% of the UAE’s electricity is gas-powered, while the remainder is from nuclear, solar, and coal. Because Saudi Arabia’s natural gas production is insufficient to meet domestic demand, and since the kingdom does not import natural gas, in 2021, 61% of Saudi Arabia’s electricity was gas-powered, and the remaining 39% was oil-powered.

Qatar’s LNG production cost is around $4 per million metric British thermal units (MMBtu), and Saudi Arabia’s is closer to $7.3 per MMBtu. The rest of the GCC states presumably fall somewhere in the middle. Transportation costs should also be considered (around $0.7 per MMBtu). Converting these estimates to cubic meters brings the per unit cost of LNG production and transportation to $0.16 for Qatar, $0.28 for Saudi Arabia, and an average of $0.23 for the rest of the GCC.

At these LNG estimated costs, the GCC collectively forwent over $10 billion in potential LNG revenues in 2021 to generate subsidized electricity. Unsurprisingly, importers (the UAE and Kuwait) bear the highest economic cost by procuring an energy resource at market prices only to use it to generate subsidized electricity. Expectedly, the country with the lowest LNG production cost (Qatar) forgoes the highest export revenue among the natural gas producers because it has the most significant difference between market price and production cost.

Since Saudi Arabia uses both oil and natural gas to generate electricity, a more elaborate calculation is needed to account for the remaining 39% of oil forgone (approximately 100 million barrels). In 2019, Saudi Aramco claimed it had the world’s lowest oil production cost at $2.8 per barrel. If it costs an additional $1 to transport a barrel of oil (on average), the kingdom’s estimated cost of oil exports is around $3.8 per barrel. Considering the 2021 average oil price of $71 per barrel, we can deduce that Saudi Arabia could have made $6.8 billion from the oil it burned generating electricity in 2021 had it exported it. This brings Saudi Arabia’s combined oil and gas forgone revenue to nearly $9 billion.

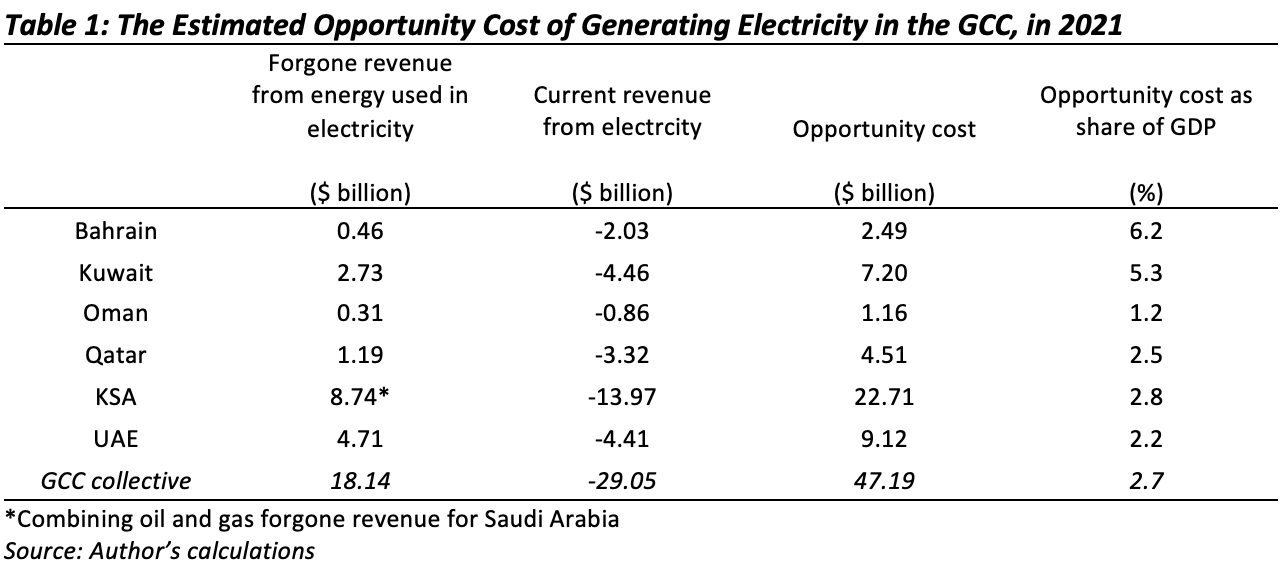

The opportunity cost of electricity

Subtracting the Gulf’s estimated forgone revenue from exporting energy from the current losses of generating electricity, it is possible to estimate the opportunity cost of electricity (see table 1) for all GCC states. Saudi Arabia naturally bears the highest cost, not only because it generates more electricity than the rest of the GCC combined, but also because it is the only one that relies on oil so heavily in its utility functions. Saudi oil may be cheap to produce (and therefore to burn domestically), but it becomes rather precious when considering the potential return on exports. Though Saudi Arabia’s opportunity cost is estimated at nearly $23 billion in 2021, this figure is barely 3% of the Saudi economy and thus understandably inconsequential.

Following Saudi Arabia, the UAE and Kuwait forgo the most revenue because they are LNG importers. By importing an energy commodity and selling it below its value, these states are fully aware of their inefficiencies. However, while this cost is approximately 5% of Kuwait’s economy (a noticeable nuisance), it is merely 2% of the UAE’s (a little more than it makes from value-added taxes).

Although Qatar’s subsidized price is the lowest in the GCC, Qatar’s electricity is not cheap when considering the opportunity cost of its natural gas. Being the richest in natural gas did not spare Qatar approximately $4.5 billion in 2021, generating electricity instead of exporting this sliver of domestically consumed natural gas. Considering that most of its neighbors are gas-scarce (and three already import natural gas from it), Qatar may be misunderstood as a natural electricity supplier for the Gulf and the surrounding region. The GCC Interconnection Authority’s ambitions to develop a common electricity market will likely be futile if the expectation is put heavily on Qatar. Even at slightly above breakeven prices, exporting electricity to neighbors would not be economical for Qatar when factoring in the opportunity cost of natural gas.

Comparatively, Bahrain feels the opportunity cost of generating electricity most acutely because it is a noticeable burden on the government’s budget (6% of the small kingdom’s economy). Should Bahrain begin to import LNG while maintaining electricity subsidies, this burden will only increase. In contrast, Oman bears the smallest opportunity cost because its electricity prices are closest to actual costs and because it generates the second least amount of electricity in the region. If Oman’s electricity demand were to rise while subsidies remain, then the sultanate’s opportunity cost would increase notably.

Reforms on the horizon?

All in all, the Gulf’s opportunity cost of generating electricity is estimated at around $48 billion in 2021 alone. Though this analysis was focused on 2021 as a base year, the concept of the opportunity cost implies that the higher energy prices get, the more the GCC states sacrifice profits by burning fuel domestically to produce subsidized electricity. Put differently, the GCC’s 2023 opportunity cost will likely be much higher than 2021’s.

With the forgone $48 billion in mind, the Gulf’s so-called “bet” on renewable energy makes a bit more sense. Saudi Arabia hopes to meet half of its electricity demand through renewables by 2030, while the UAE is working to generate 44% from renewables (mostly nuclear) by 2050, and Qatar is set to supply 20% of its electricity through solar energy by 2030. The GCC states are also making incremental attempts at reducing their electricity subsidies (a move that seems inevitable for many of these states). Developing renewable energy and introducing subsidy cuts would award the Gulf governments some of the forgone revenue of exported fuel or save them some of the cost of imported fuel used to generate electricity, but while the former policy is economically costly, the latter is politically contentious. Notwithstanding the value that the Gulf states undoubtedly see in subsidizing electricity, their desire to implement both reforms will only increase as domestic demand for electricity rises and further encroaches on lucrative oil and gas exports.

Glnar Eskandar is a Ph.D. candidate at Qatar University’s Gulf Studies Program, specializing in the region’s economy.

Photo by Artur Widak/NurPhoto via Getty Images

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.