Summary

The hydrocarbon-rich Gulf states are located in the heart of the global sunbelt, endowing them with some of the greatest solar resources in the world. Peak load hours in these countries also align well with daily and seasonal solar radiation levels. Nevertheless, actual deployment of renewable power, including solar, is among the lowest in the world, even though output has increased significantly over the past five years.

This paper analyzes why solar power has seen some success in a few states, while in others there has been little momentum. To address the question, the authors undertake a qualitative, case-based inquiry into solar power development through data collected from interviews with solar power developers in the Gulf. Our findings are two-fold: They shed light on the role of and differences in regulatory regimes across the Gulf in shaping variations in solar deployment; they also reveal the pathways or mechanisms through which regulatory regimes have an impact on solar power deployment. In so doing, the paper presents policy-relevant implications for solar power in the Gulf and contributes to the wider literature on business-state relations in the region.

The policy brief summarizing this research can be found here.

Introduction

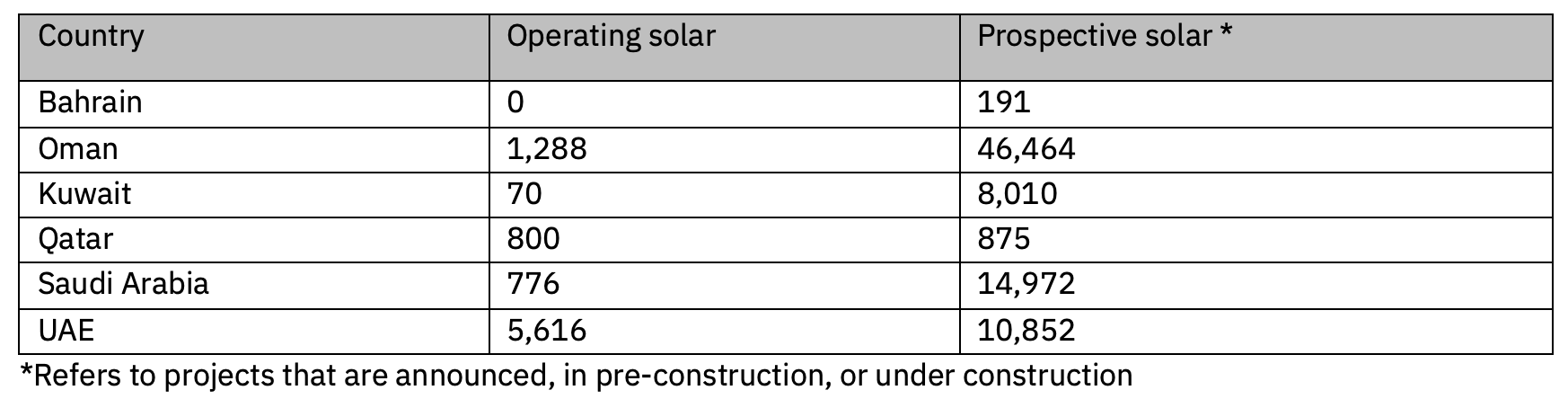

The Middle East region is home to solar and wind resources that are above the global average. Nevertheless, it lags behind all other regions in actual deployment of solar and wind power, generating a mere 0.9% of global renewable power in 2023, compared to 1.6% in Africa, the second slowest adopter.1 The six countries of the Gulf Cooperation Council (GCC), Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, are a microcosm of this trend. Endowed with exceptional solar resources that are two to three times higher than much of Europe2 — for instance Oman and Saudi Arabia are ranked 6th and 7th globally for practical photovoltaic (PV) potential3 — most have thus far underperformed in terms of the gap between operating and prospective solar power (Table 1).

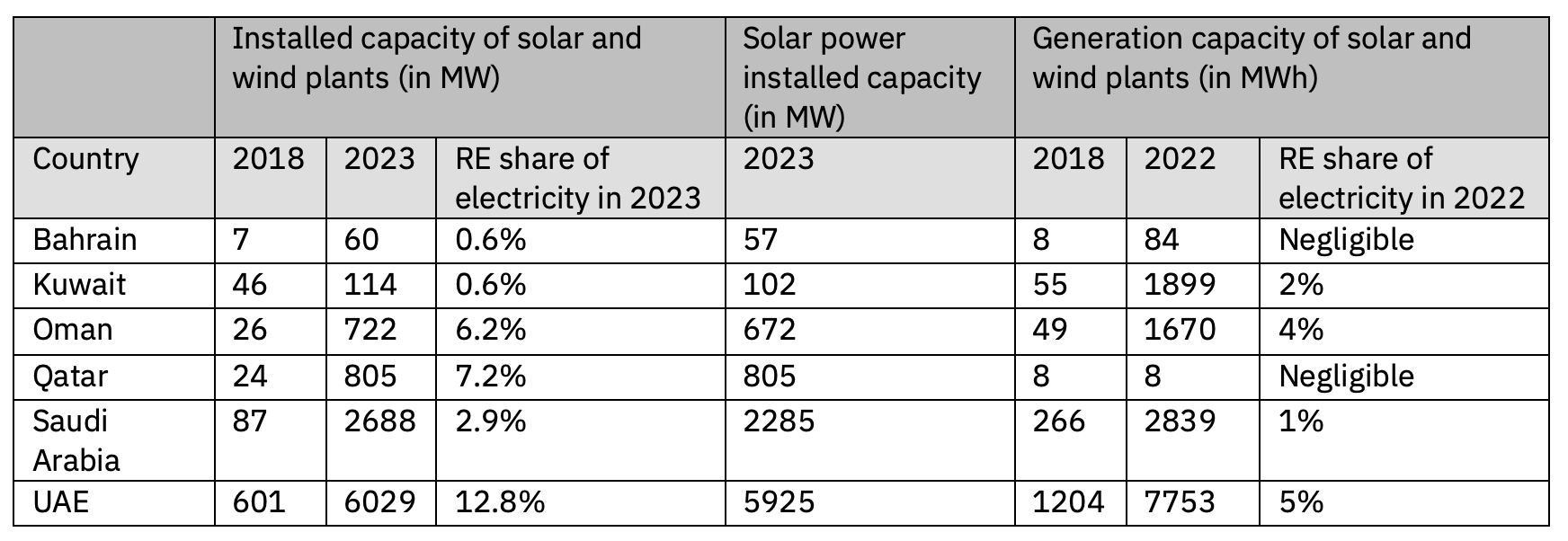

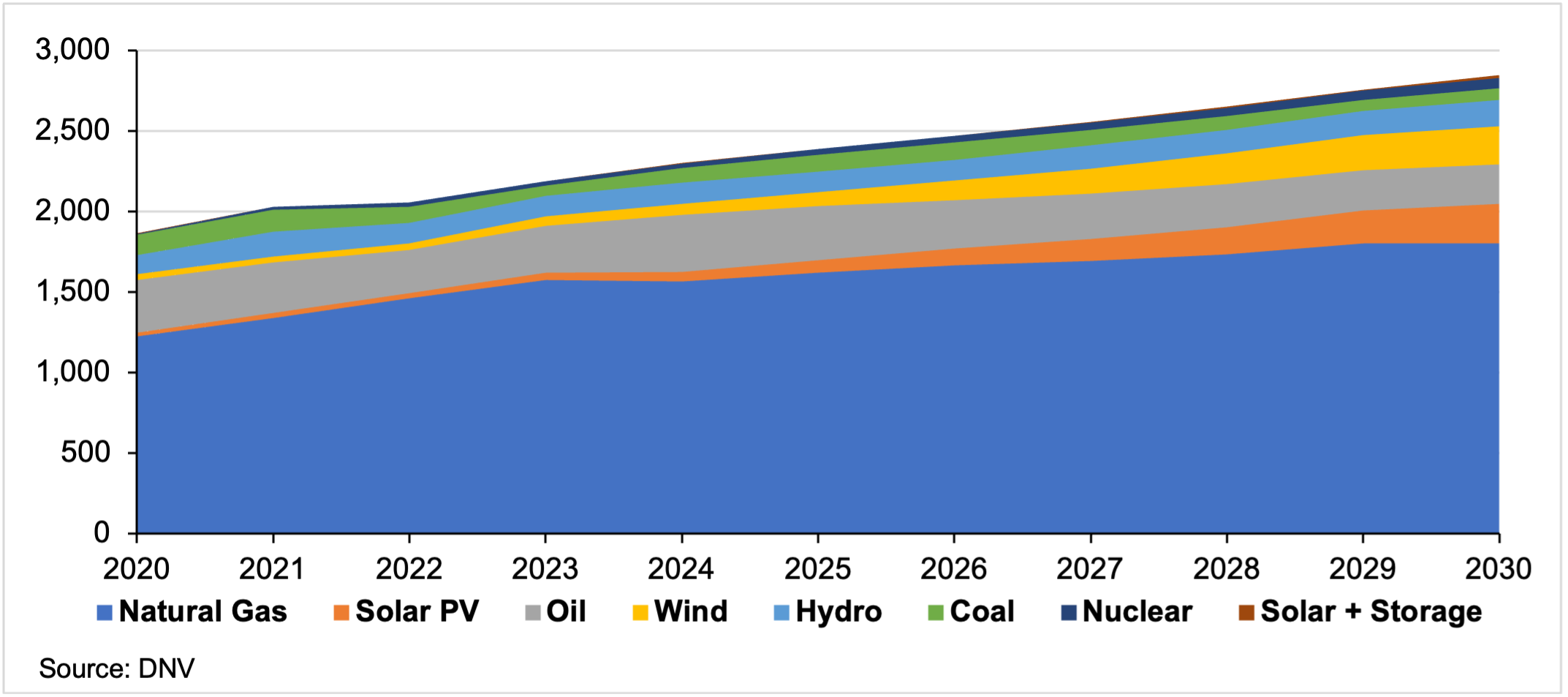

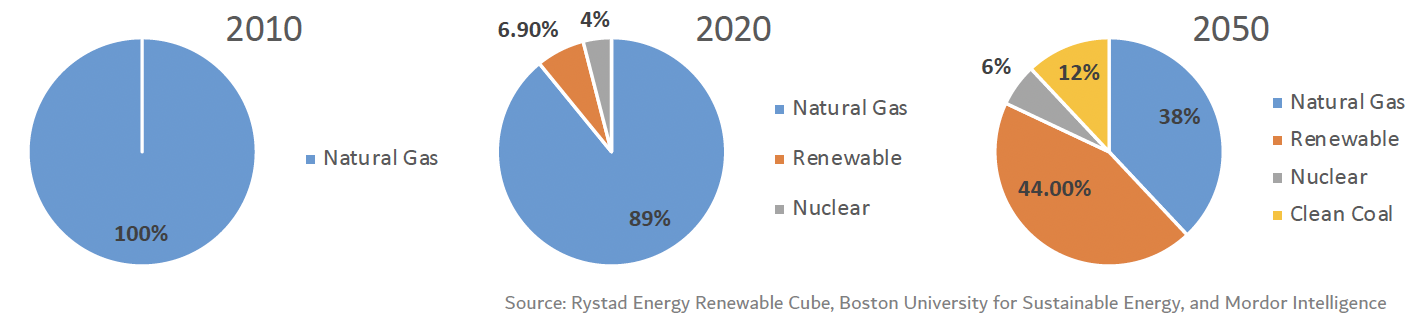

The exception to the underperformance trend is the UAE, which has fulfilled half of its prospective solar power and leads its GCC peers in generating 4% of renewable electricity in 2021 or 6% if low carbon nuclear-generated electricity is included, ahead of second place Oman at 2% (Table 2). As the frontrunner in deployment, the UAE accounts for more than 60% of the region’s total renewables capacity and close to 70% of renewable energy investments.4 At the same time, it should also be acknowledged that during the past few years, all the Gulf states have increased the share of renewable power in their domestic energy mixes, albeit from a low base (see Table 2). This share is expected to increase and will result in changes to the domestic power mix, although the role of fossil fuels will continue to be dominant (see Figures 1 and 2).

Table 1: Operating vs. Prospective Utility-Scale Solar Power (MW)5

Table 2: Solar and Wind Power in the Gulf: Installed Capacity vs. Generation Capacity6

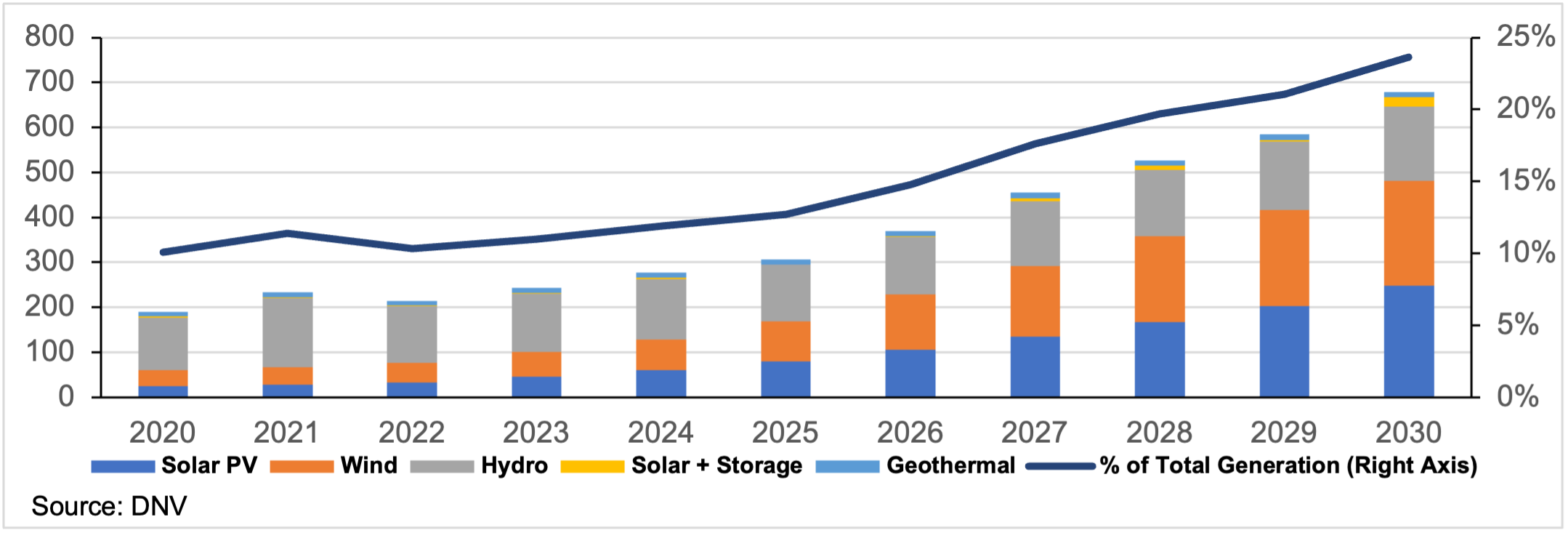

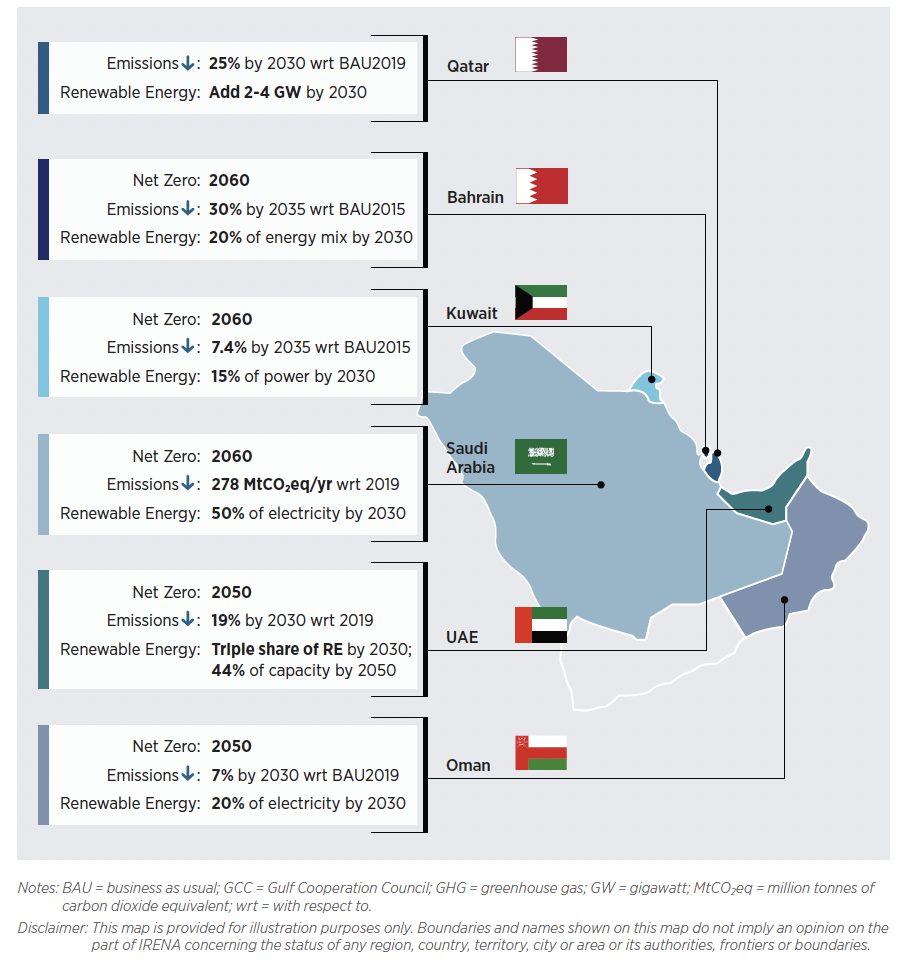

The strategic and economic objectives of increasing deployment of solar in the GCC are clear and well-understood; these include economic development, economic and revenue diversification, and climate priorities (see literature review in section 2). For the most part, they have been institutionalized in various country-specific economic visions, renewable power targets, projections for power procurement, roadmaps for low carbon hydrogen, climate pledges such as nationally determined contributions, and net-zero declarations (see Figure 3). Indicative of the extent to which such strategic priorities drive renewable energy, respondents from the UAE and Saudi Arabia to a 2023 Bloomberg survey of energy professionals ranked “stakeholder pressures for faster transition” as the top consideration in reaching net zero over and above grid integration and supply chain issues identified by other respondents.7 More recently, we see the addition of domestic manufacturing capacity in solar power components with foreign investment as a Gulf state priority within economic diversification.8

Figures 1 and 2: MENA Power Evolution Mix; MENA Renewable Power Growth (TWh/yr)9

Facilitating the implementation of strategic and economic objectives is a set of enabling conditions within most of the Gulf countries (see literature review in section 2). Between 2015 and 2021, for example, all GCC countries except Kuwait recorded significant improvements in their renewable energy regulatory frameworks.10 These conditions have reduced the operational risks and lowered the costs associated with nascent renewable energy for power developers.

That the combination of strategic imperatives and favorable enabling conditions has not resulted in higher levels of solar power deployment in the GCC is the crux of our research puzzle. This is because it brings to the fore questions regarding the extent of implementation shortcomings and hence bureaucratic efficacy, the remaining barriers to deployment, as well as the economic, political, and social trade-offs to reducing these barriers.

To address these questions, the authors consider macro-level explanations but, crucially, also offer firm-centric perspectives of the barriers to scaling up solar power deployment. The choice to focus on solar power is based on the fact that it accounts for almost all of renewable power deployment thus far; it is also expected to contribute to the bulk of new capacity additions through to 2030 in the GCC (see Figures 1 and 2).11 The primary data was gathered through interviews mostly with renewable power developers based in the GCC and with other energy stakeholders (such as a utility company and a renewable energy intergovernmental organization) in the region. This was complemented by secondary data including journal articles, company reports, government publications, and newspaper articles. More broadly, our research is situated within the academic literature on the political economy of renewable energy and the evolving role of state-business relations in the Gulf. Energy and the technologies associated with its different forms are, after all, an inherently political matter with implications for the power of incumbent and future stakeholder groups,12 including solar power developers.

The remainder of the paper proceeds as follows. Section 2 reviews the relevant literature on solar power deployment in the GCC, focusing on the objectives of and barriers to this policy as well as the role played by the state and private businesses in this field. Section 3 provides an overview of the main GCC power markets along with their evolving regulatory landscape and stakeholders. Section 4 presents and analyzes the interviews with Gulf-based renewable/solar power developers and other energy stakeholders. The aim is to determine the significance of regulations as well as the pathways through which they impact faster and broader uptake of solar power. The final section concludes with thoughts on policy-relevant directions and on potential avenues of research.

Literature Review

Objectives and Enabling Conditions for Solar and Renewable Energy

The strategic objectives to scale up and deploy solar and other forms of renewable energy in the GCC are largely endogenous in nature, rather than a response to external pressures regarding climate responsibilities.13 These strategic objectives include the following:14

-

To meet an increasing demand for electricity by a growing resident population, industrial and commercial projects, seawater desalination plants, and electrification of road transport;

-

To maximize the volume of oil and gas available for profitable international exports;

-

To increase energy security and self-sufficiency through the generation of indigenous renewable power, thereby reducing oil and gas import dependency;

-

To reduce the carbon footprint of industrial exports to ensure continued market access to lucrative but carbon-constrained markets such as Europe;

-

To drive the creation of a post-oil economy through local content requirements for renewable power projects; and

-

To address climate change challenges domestically and globally (see Figure 3), and in the process leverage the resulting benefits for a social license to operate (for national oil and gas companies) and for projecting “soft power” influence.15

Figure 3: GCC Key Climate Change Policies16

The above strategic objectives are complemented by a set of enabling conditions found in most GCC countries, including:17

-

Excellent solar and good wind resources, as previously mentioned;

-

Abundance and availability of free or low-cost desert land to site utility-scale solar plants, with land-constrained Bahrain a possible exception. This is important since solar generation requires at least 10 times more land per unit of power produced than oil- and natural gas-fired power plants, due to the former’s lower power density;18

-

Well-designed and transparent auctions that attract competitive proposals from pre-qualified local and international power developers. These auctions have played a crucial role in encouraging ever lower bids for solar power in the Gulf;

-

Long-term power purchase agreements of 20-25 years offered by state-owned offtakers (usually public utilities) that are endowed with explicit or implicit sovereign risk guarantees;

-

Favorable financing conditions that make the financial landscape for utility-scale power projects particularly enticing, including low interest rates, extended loan durations of over 20 years, high levels of interest from local and international banks, low currency risks for foreign investors thanks to the peg maintained by most GCC countries to the US dollar, and high debt-to-equity ratios; and

-

Improvements in the policy and regulatory environment for business more generally and for renewable energy more specifically that impact the pace and scale of solar deployment.

Discussing the drivers and enabling factors of solar and renewable energy uptake in the GCC is beyond the scope of this paper. However, for the purpose of providing a context to the focus of our research — barriers to increasing solar energy development — we have included them in the literature review.

Barriers to Increasing Solar and Renewable Energy Deployment

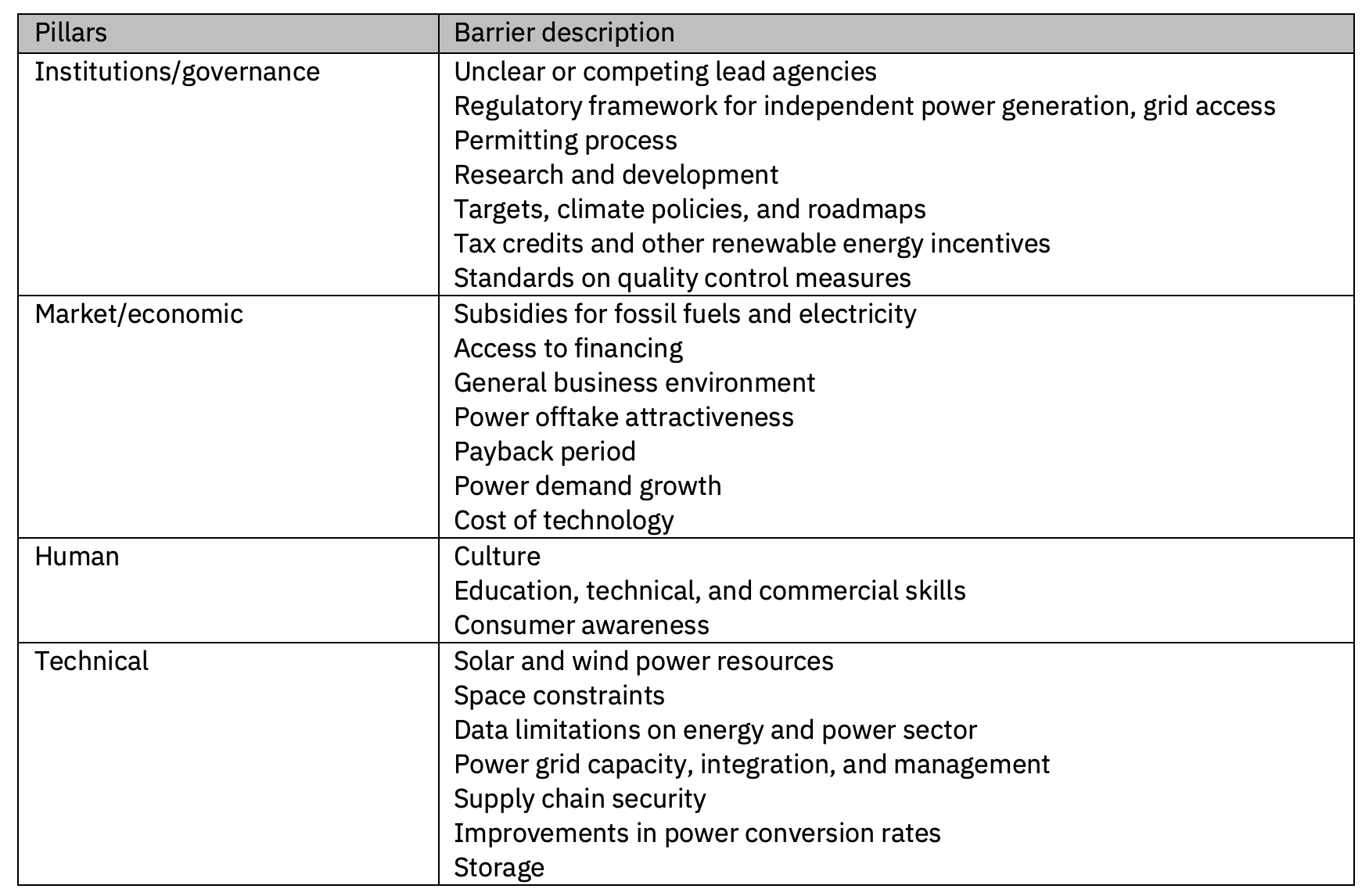

In the GCC, challenges to the wider and faster deployment of renewable energy, including solar, may be categorized as institutional, market, technical, and cultural or alternatively infrastructural, institutional, and human capital.19 Table 3 provides a breakdown of the elements that make up each of these categories. Regardless of the framework used, most authors agree that fossil fuel subsidies, despite recent reforms to reduce the scope and level, are arguably the single most significant detriment to the commercial case for distributed generation and also to utility-scale renewable power plants “hindered by legacy reliance on fossil energy-based generation and lack of consideration for the opportunity costs of using fossil fuels to meet domestic energy demand.”20

The implication is that not all barriers are equally impactful in terms of their significance for renewable energy uptake. In the US, for example, community opposition is frequently cited as among the top causes of solar and wind project cancelations or delays.21 This, however, does not appear to be relevant in the GCC context: In a 2015 survey, for example, public opposition to renewables was ranked as the lowest of eight investment risks while long permitting time “due to inefficiencies in the bureaucracy” was identified as the highest risk.22

Table 3: Barriers to Solar and Renewable Energy in the Gulf23

The significance of barriers can also evolve over time. The prohibitive cost of solar power was the largest obstacle to its commercialization in the first decade of this century. However, the 15% per annum decrease in the cost of solar PV technology between 2010 and 2020 resulted in the rise of installed capacity by 25% per year.24 Arguably, market or cost barriers have become less important today than technical barriers such as grid capacity and balancing for intermittent renewable energy.25 In the GCC in 2006, legal and policy frameworks supportive of renewable energy were absent according to one study; today, all states have implemented some form of regulatory framework, although clarity and consistency of application continue to be concerns.26

Some authors attribute most of the barriers to renewable energy deployment to the practice of “late rentierism” or “Khaleeji capitalism” in the Gulf states and are, consequently, pessimistic about the chances for a rapid uptake of solar and renewable energy since the latter appears to be inimical to the prevailing model of state-society relations.27 Other studies, however, argue that due to co-benefits — in terms of job creation, industrial development, and expanding stakeholder networks — renewable energy in fact improves the resilience of the rentier model and, by extension, are optimistic about higher levels of deployment.28 In any case, it is important to acknowledge that barriers not directly attributable to rentierism are also very relevant in the Gulf, such as geography, upfront costs of solar installations, and cultural practices.29

Our research aims to contribute to the existing literature on barriers in three ways. First, we focus on regulatory barriers, defined as national and sub-national levels of policies, laws, frameworks, and standards that impact the renewable power sector, including sourcing, financing, production, distribution, and consumption. Previous research has concentrated on technical, market, and institutional challenges, while studies on regulatory matters have been less common.30 At the same time, the regulatory environment is widely regarded as the foremost facilitator (or conversely, barrier) to the wider and faster uptake of renewable energy. Prominent research organizations such as the World Resources Institute noted that “governments will play a critical role in scaling renewable energy capacity by providing regulatory frameworks,” and the Oxford Institute for Energy Studies argued government policy and regulation are the “most important driver[s]” of the energy transition.31 In a survey of over 800 global energy professionals by Bureau Veritas in 2023, 98% of respondents cited regulatory issues as the top barrier to a transition toward a low-carbon energy system.32 Likewise, renowned energy analyst Daniel Yergin observed that “this energy transition is … different from others in that it is driven by public policy and not as much by economics and technology.”33 Within the Gulf, respondents working at a sub-national public utility, Dubai Electricity & Water Authority, weighted policies and regulations as much more significant than grid reliability or environmental factors in terms of renewable energy uptake in a study conducted in 2022.34 In the case of Kuwait, delays in adopting and scaling up renewable energy were attributed to “the lack of laws or legislations specifying the entity that should oversee renewable energy.”35

Second, the existing literature on challenges to renewable energy in the GCC tends to either be a general discussion about barriers, which sometimes distorts challenges faced by distributed power, or has a specific focus on the latter, or offers explanations for variations among GCC states.36 Our paper will not only identify and discuss the various pathways through which regulatory-related barriers impact solar power uptake in the GCC but will also disaggregate primary data to reflect the extent to which perspectives diverge between developers active in the utility-scale and distributed generation sectors. This could be useful for policy-makers so that policies can be accurately and specifically tailored to encourage investment by power developers differentiated by firm size and market segment.

The paper’s third contribution is with regard to methodology. Scientific-technical papers aside, bibliometric reviews, their use to create frameworks for assessment, and surveys constitute the majority of the methodology employed in current studies on barriers to renewable energy. We have chosen to rely on interviews for our primary data to elicit more in-depth perspectives from energy industry insiders than a quantitative survey, which tends to capture a snapshot in time. Our research also targets a specific group of participants — GCC-based power developers — since they are the ones on the ground who originate, evaluate, and carry most of the investment risk. As far as we are aware, this is the only academic work that leverages original interviews with power developers from the region. Comparatively, other studies on barriers in the GCC renewable power sector have relied on data from energy professionals representing a mix of different energy sub-sectors such as academia, research organizations, project developers, consultants, and government entities or from a different target group like public utilities.37

State-Business Relations

As noted earlier, “late rentierism” and its iterations such as “internationalized” rentierism are said to characterize state-society relations in the Gulf states. Key features of this model include selective economic liberalization and globalization in contrast to the more dirigiste approach in the past, a commitment to hydrocarbon-underwritten diversification, a private sector that is dependent to a significant degree on state spending and other forms of patronage, and a dominant role for the state in economic development.38

Despite the latter characteristic, the private sector has been allowed to participate in the deployment of utility-scale solar and wind power, albeit with minority shares and in collaboration with state-owned entities. A typical example was Qatar’s al-Kharsaah power plant, the country’s first utility-scale solar project that provided part of the electricity to cool soccer stadiums hosting the 2022 World Cup — its owners are foreign partners Total and Marubeni (40%) and Qatari state-owned entities (60%).39 The private sector has also been allowed to lead the rollout of distributed solar power projects. This is because the much smaller volume of distributed generation — and its private sector actors — is unlikely to undermine the centrality of a hydrocarbon-based economy and the power of current stakeholders of a state-directed economic model. Besides, companies specializing in distributed solar emerged out of well-established family businesses or industrial conglomerates. Examples include Yellow Door (a spin-out of Adenium Energy, owned by the Saudi AK Bakri family conglomerate and based in Dubai), Siraj Power (co-founded by prominent Emirati businessman Abdul Ghaffar Hussain of Green Coast Enterprises and based in Dubai), and SAFEER (a joint venture between Total Energies and Riyadh-based Zahid Group). Consequently, they are likely to be mindful of the traditional dependence of business on state procurement contracts and on policies that enable the recruitment of plentiful and affordable labor, including for the installation of rooftop solar panels.40

Through interviews with a subset of the business community, namely state-owned and private power developers based in the GCC, our paper will provide empirical evidence of the evolving role of state-business relations. This contributes to ongoing debates about the significance of the middle class for liberal democratic systems and as a counterweight to authoritarianism in the Gulf. The weight of scholarly opinion with regard to the latter suggests that business in the GCC will continue to remain subservient to an increasingly ascendent state.41

Renewable Power Markets in the GCC: Regulatory Structure and Stakeholders

This section of the paper sets out to:

-

Identify who the key players are in GCC power markets;

-

Describe how power markets function in the GCC; and

-

Demonstrate how regulation of power generation and distribution is changing.

Key Players in Gulf Utility-Scale Solar Development

Several utility-scale solar power developers have been involved in projects across the GCC states. These developers play a significant role in the development, construction, and operation of large-scale solar projects. What makes the Gulf renewable power landscape perhaps different from that of Europe or the United States is the prevalence of state-owned or partially state-owned power developers and state-owned utilities. Notable utility-scale solar power developers in the GCC include:

-

ACWA Power (Saudi Arabia): ACWA Power is the most prominent power and water developer based in Saudi Arabia with numerous utility-scale solar and wind projects across the GCC and beyond in emerging markets. It is partially owned (44% of listed shares) by the Saudi sovereign wealth fund, the Public Investment Fund.42

-

Masdar (UAE): Masdar, based in Abu Dhabi, UAE, is a pure-play renewable energy company that has developed utility-scale solar and wind projects in the UAE, in other GCC countries, and across Central Asia, the Middle East, and Africa. Masdar is fully owned by three UAE government entities: the Abu Dhabi National Oil Company (ADNOC), the Abu Dhabi National Energy Company PJSC (TAQA), and Mubadala Investment Company, a sovereign wealth fund of the emirate of Abu Dhabi.43

-

ENGIE (Qatar and UAE): ENGIE is a global energy company headquartered in France that operates in fields of electricity generation and distribution, natural gas, nuclear, renewable energy, and petroleum. The company is known for its focus on sustainable and low-carbon energy solutions and is involved in utility-scale solar projects in Qatar and the UAE. The firm is publicly listed with many individual and institutional investors, and roughly 20% of its shares are held by the French state.44

-

Dubai Electricity & Water Authority (DEWA): DEWA, the government-owned utility company in Dubai, is actively involved in renewable energy projects, particularly solar. It has initiated and developed utility-scale solar projects such as the Mohammed bin Rashid Al Maktoum Solar Park.

-

Saudi Power Procurement Company (SPPC): SPPC is involved in the procurement of power projects in Saudi Arabia. It plays a role in overseeing the competitive tendering processes for utility-scale solar projects.

-

Saudi Renewable Energy Development Office (REPDO): REPDO is responsible for implementing Saudi Arabia's National Renewable Energy Program. It oversees the development of utility-scale projects, including solar, through competitive procurement processes.

Key Domestic Players in Gulf Distributed Solar Power Development

Some notable distributed solar power developers in the GCC include:

-

Yellow Door Energy (UAE): Yellow Door Energy specializes in both distributed and utility-scale solar projects. The company focuses on providing solar solutions for commercial and industrial clients.

-

SirajPower (UAE): SirajPower is a distributed solar developer that offers turnkey solar solutions for businesses and industries. The company provides services such as design, installation, and maintenance.

-

AES Solar (Saudi Arabia): AES Solar is involved in distributed solar projects in Saudi Arabia. The company focuses on providing sustainable energy solutions, including solar power, to various sectors.

-

Smart4Power (UAE): Smart4Power is a Dubai-based company that offers energy efficiency and renewable energy solutions, including distributed solar projects. They work with commercial and industrial clients to implement sustainable energy solutions.

-

Enova (UAE): Enova is a provider of energy and facilities management services. They offer distributed solar solutions along with other energy efficiency services for businesses.

-

Reem Capital (Saudi Arabia): Reem Capital is involved in renewable energy projects, including distributed solar installations, in Saudi Arabia. The company aims to contribute to the kingdom's sustainability goals.

-

Desert Technologies (Saudi Arabia): Desert Technologies is a Saudi company that operates in the solar energy sector. While they are involved in utility-scale projects, they may also participate in distributed solar projects.

-

Haala Energy (Saudi Arabia): It is an engineering, procurement, and construction firm that specializes in distributed solar PV for the domestic market.

-

Enerwhere (UAE): It provides hybrid mini-grid systems and distributed solar installation for mining operations, manufacturing, island or off-grid locations, and solar power systems for agricultural pumping, irrigation, and cold storage.

-

Power Services Group (Qatar): Power Services Group is involved in various energy services, including distributed solar solutions. The company provides engineering, procurement, and construction services for energy projects.

Both utility-scale and distributed power generation play important roles in the overall GCC energy landscape, contributing to a diversified and resilient energy system. The choice between the two depends on factors such as resource availability, project economics, grid infrastructure, and energy policy. State-owned utilities often prefer not to have competition from feed-in sources of distributed power generation as it dilutes their sources of revenue generation and can also create uncertainty in the amount of electricity on the grid system at any given time.

Distributed power, also known as decentralized or on-site power generation, involves smaller-scale electricity generation that is located closer to the end-users or the point of consumption. Distributed power sources are typically located near the demand centers (or on rooftops of industrial or commercial sites, or at the site of large projects under construction in remote areas), reducing transmission and distribution losses, and can improve grid resilience, especially in emergencies and high-demand periods. Common examples include rooftop solar panels, small wind turbines, combined heat and power systems, and battery energy storage systems.

Power Markets and Distribution

Electricity is sold and traded through various mechanisms and markets, depending on the regulatory framework, market structure, and policies in a particular region. The two primary models for electricity trading are bilateral contracts and organized wholesale markets as follows:

-

Bilateral contracts involve direct agreements between electricity buyers and sellers. These contracts are negotiated privately, and the terms can vary widely. A key feature of bilateral contracts is often a long-term agreement that specifies the quantity, price, and terms of electricity delivery over an extended period. These are referred to as power purchase agreements (PPAs) between generators and utilities.

-

Electricity might also be traded on a wholesale market where buyers and sellers use a centralized platform to trade competitively, sometimes on longer-term or forward markets, or more immediate delivery on a spot market. A regional transmission organization might facilitate this trade, especially in grid systems that connect across federal or state boundaries. Examples are Nord Pool in Europe, the Indian Energy Exchange (IEX), and PJM Interconnection in the US.

In the GCC, electricity markets are in different stages of development, and the specific mechanisms vary from country to country. Bilateral contracts are commonly used for electricity trading within the GCC where electricity generation, transmission, and distribution are managed by centralized agencies or state-owned utilities. The state often regulates and oversees the electricity sector, and trading may occur through government agencies responsible for energy affairs. Governments or utilities may sign long-term PPAs with independent power producers (IPPs) for the purchase of electricity. Some GCC countries are just beginning to explore or implement electricity spot markets. These markets allow for real-time or day-ahead trading where electricity prices are determined by supply and demand.

Regulatory bodies and energy authorities in GCC countries play a key role in shaping the electricity market structure and trading mechanisms. Feed-in tariff (FiT) and net metering are two different mechanisms used to incentivize and promote the deployment of renewable energy systems, particularly solar PV systems, at the residential or commercial level:

-

A FiT is a policy mechanism that provides a fixed payment rate for each unit of electricity generated by a renewable energy system, typically solar panels. The payment is guaranteed over a set period, often ranging from 10 to 25 years. FiTs are designed to provide a financial incentive to renewable energy system owners, making the investment in such systems more attractive. System owners receive a guaranteed income for every unit of electricity they generate, irrespective of whether they consume the electricity on-site or export it to the grid. Such incentives are often used to encourage the deployment of small-scale renewable energy systems, especially in the early stages of a country's transition to renewable energy.

-

Net metering is a billing arrangement that allows owners of solar PV systems (or other renewable energy systems) to offset their electricity consumption costs by exporting excess electricity to the grid. Net metering involves a two-way meter that measures both electricity consumption from the grid and excess electricity fed back into it. Excess electricity generated is credited to the system owner's account, reducing their electricity bill or providing compensation. Net metering allows system owners to use the electricity they generate on-site before exporting any surplus. In contrast, FiT system owners receive a fixed payment for each unit of electricity generated, regardless of whether they consume it on-site or export it to the grid.

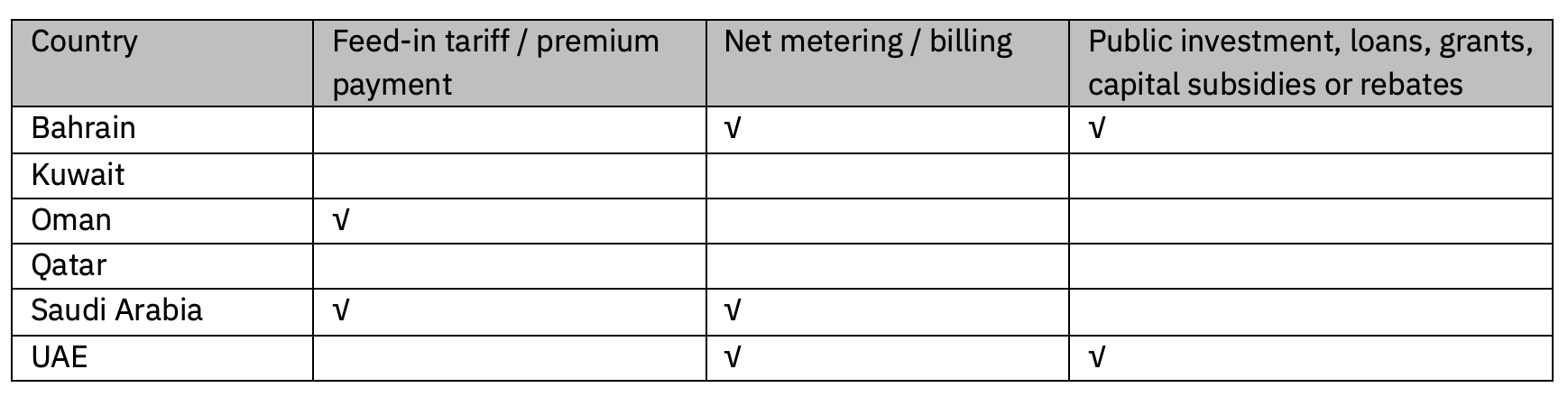

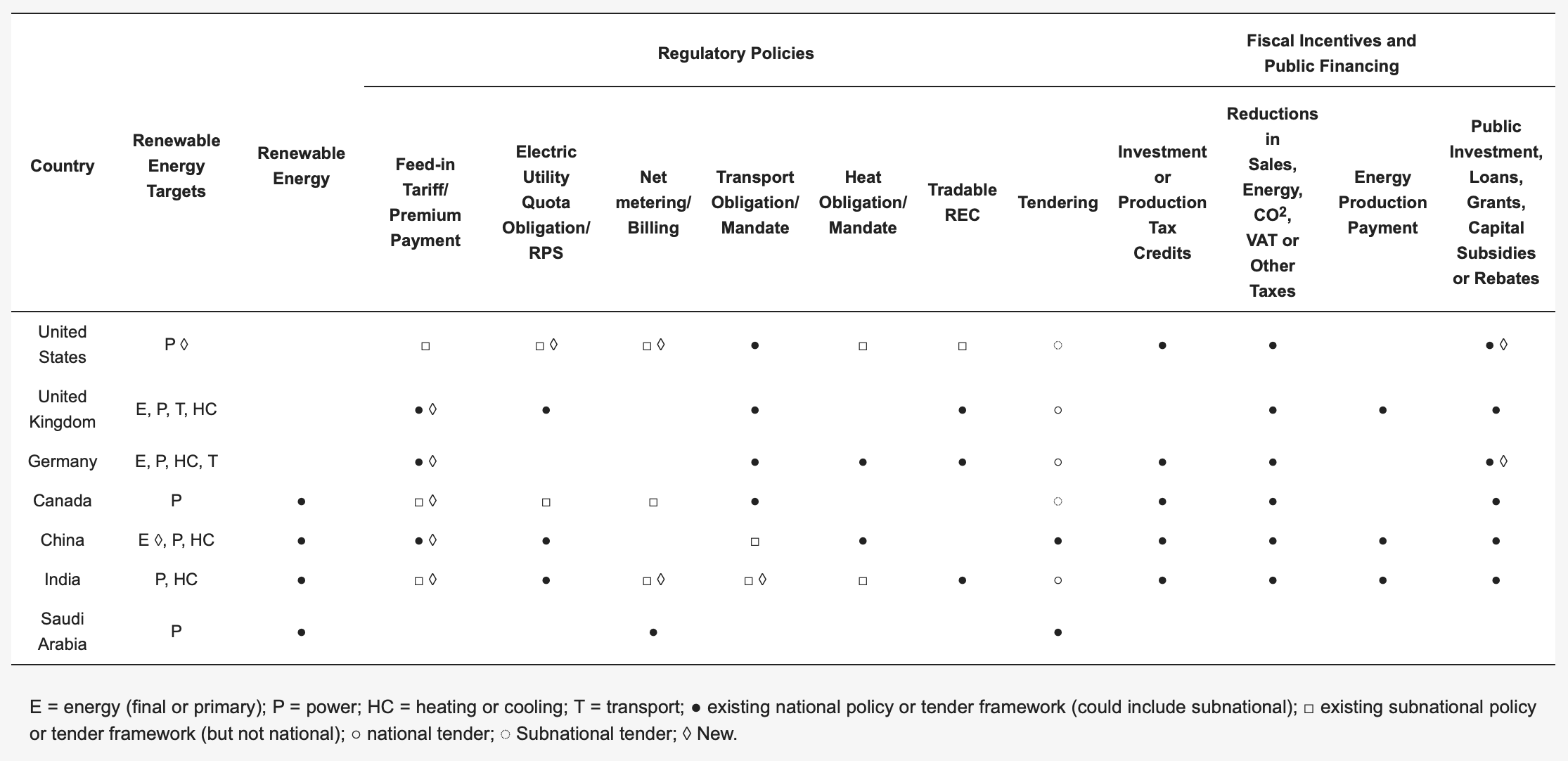

As highlighted in Table 4, there is heterogeneity in the types of renewable power incentive programs offered by different GCC states.

Table 4: Renewable Power Incentive Programs45

GCC countries are also exploring or working toward grid interconnection with neighboring countries. This can facilitate cross-border electricity trading and enhance regional cooperation in the energy sector. The headquarters of the GCC Interconnection Authority (GCCIA) is in Saudi Arabia. The GCC commissioned a study in 1986 on the idea of connecting electricity grids across the Middle East, and the GCCIA was formed in 2001. By 2012, all six GCC states connected to a shared grid.46 In late 2023, Iraq was connected via Saudi Arabia at the initiative of a US-brokered power-transmission agreement.47 According to the World Bank, electricity trade could save the Arab world $17-25 billion and reduce required capacity by 33 gigawatts (GW) through better mutual utilization of existing capacity.48 The GCCIA further estimates that GCC power trading could achieve savings of up to $24 billion by 2038.49 The GCCIA envisions the SuperGrid becoming a vital link connecting not only the GCC countries but also neighboring regions, including connections to Jordan and Egypt. Some challenges facing the GCCIA include differences in the regulation of energy sectors in each of the GCC’s six member countries, as well as the differences in their domestic power mix, both in terms of the availability of excess power generation and in the adoption of renewables.

Reforms to Regulatory and Energy Policies

The following section outlines some key features of energy regulatory environments and reforms underway in the more vibrant power sectors of the Gulf.

Saudi Arabia

Saudi Arabia has been exploring market reforms to diversify its energy sector and introduce competitive elements. The establishment of a spot market is seen as a step toward achieving these objectives. Another is to develop a competitive market for the procurement of renewable energy through the National Renewable Energy Program (NREP). Part of the NREP includes having REPDO spearhead the development of 30% of the targeted capacity through a competitive tendering process open to all developers, including foreign entities.50 Bids by power developers would win based on their lowest levelized cost of electricity, an economic measure used to compare the lifetime costs of generating electricity across various generation technologies. Then, only one buyer — the SPPC — will purchase the electricity from those IPPs, which creates a legal separation of generation from transmission and distribution facilities to enhance the competition of IPPs and the national utility’s power plants.51 The IPPs are offered long-term PPAs with fixed FiTs, providing a guaranteed payment for the electricity generated by their projects.

Saudi Arabia’s sovereign wealth fund, the PIF, oversees the development of the remaining 70% of the capacity through bilaterally negotiated deals with international partners for project development.52 Currently, ACWA Power is the key developer through the PIF.

The Electricity and Cogeneration Regulatory Authority (ECRA) in Saudi Arabia plays a central role in regulating the electricity sector and overseeing market developments. ECRA is involved in shaping the regulatory framework for potential spot market operations. That market would need to be integrated into the broader grid supply and demand operations, and requires the creation of market rules, pricing mechanisms, and trading platforms. It is worth noting that one of the objectives of Vision 2030, the kingdom’s long-term economic development plan, is the expansion of the financial sector, both to facilitate job creation as well as to increase the availability of financial products (from equities to mortgages to tradeables, including commodities and forward-sales of products like electricity) to further grow the Saudi economy.

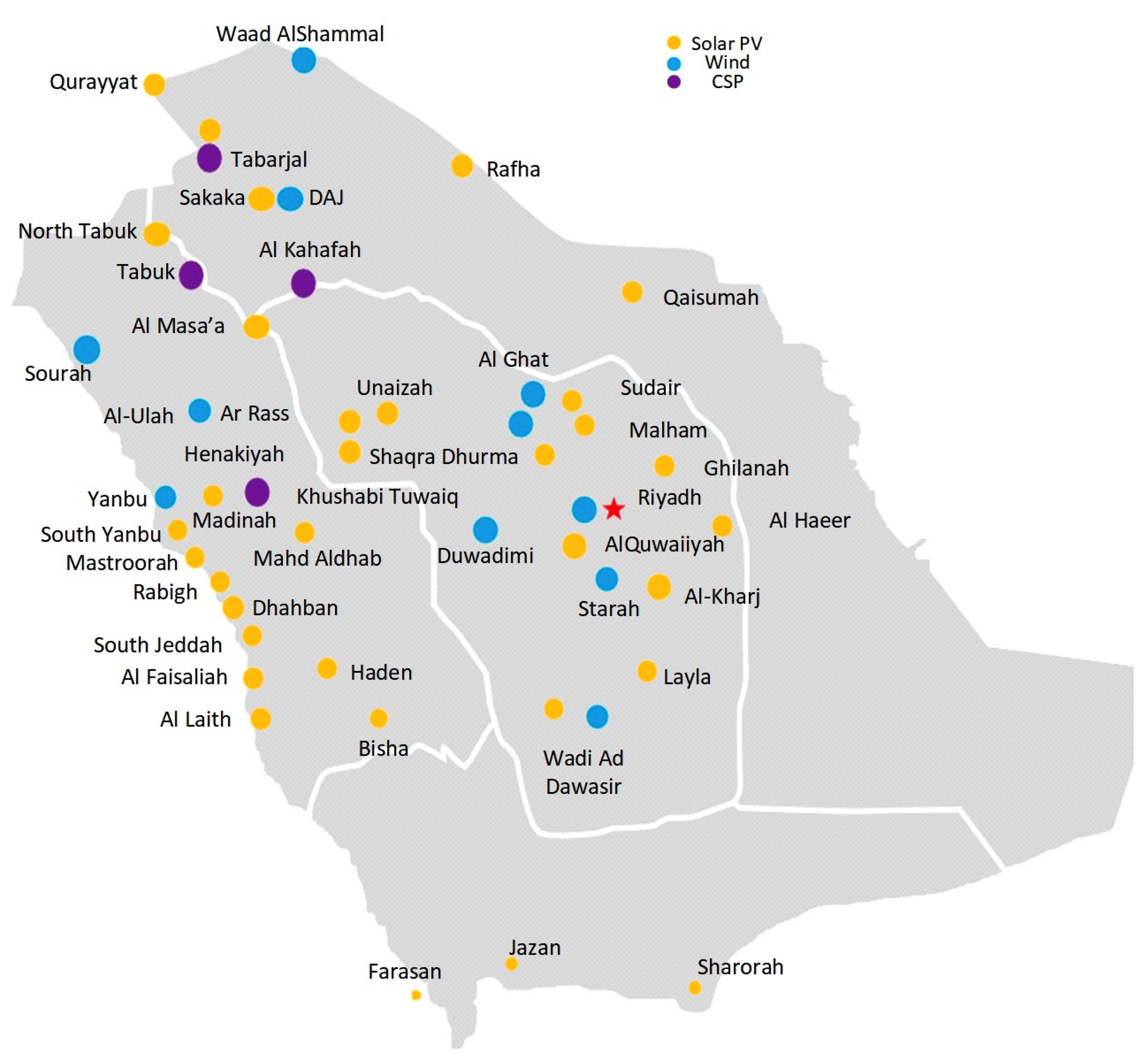

Figure 4 illustrates the geographic breadth and the pace of solar and wind power installation planned in Saudi Arabia. Yet, in Figure 5, we see that compared to large OECD economies and China, renewable energy roll-outs with state support in the power sector have more developed institutional regimes for the trade and distribution of electricity. As for smaller-scale solar power development in the kingdom, the regulatory environment is still evolving as most of the governance of the grid code and rules for small-scale deployment have only been in place since 2017.

Figure 4: Saudi Arabia Renewable Energy Parks (Planned and Under Construction)53

Figure 5: Saudi Arabia Renewable Energy Policies in Comparison to US/Europe/China/India54

United Arab Emirates

The electricity sector in the UAE is characterized by vertically integrated, sub-national government-owned utilities that are responsible for power generation, transmission, and distribution. Each emirate may have its own utility or energy authority overseeing the electricity sector, although federal ministries have some powers of oversight. The electricity generated in Abu Dhabi, Dubai, Sharjah, and the northern emirates is exclusively sold to Emirates Water and Electricity Company (EWEC), DEWA, Sharjah Electricity, Water, and Gas Authority, and Etihad Water and Electricity (formerly Federal Electricity and Water Authority) respectively under long-term PPAs and then sold to distribution companies via annual bulk supply tariff agreements. In Abu Dhabi, for example, EWEC manages this process, which includes pre-qualifying bidders for power projects, soliciting proposals, and selecting the winning bidder.

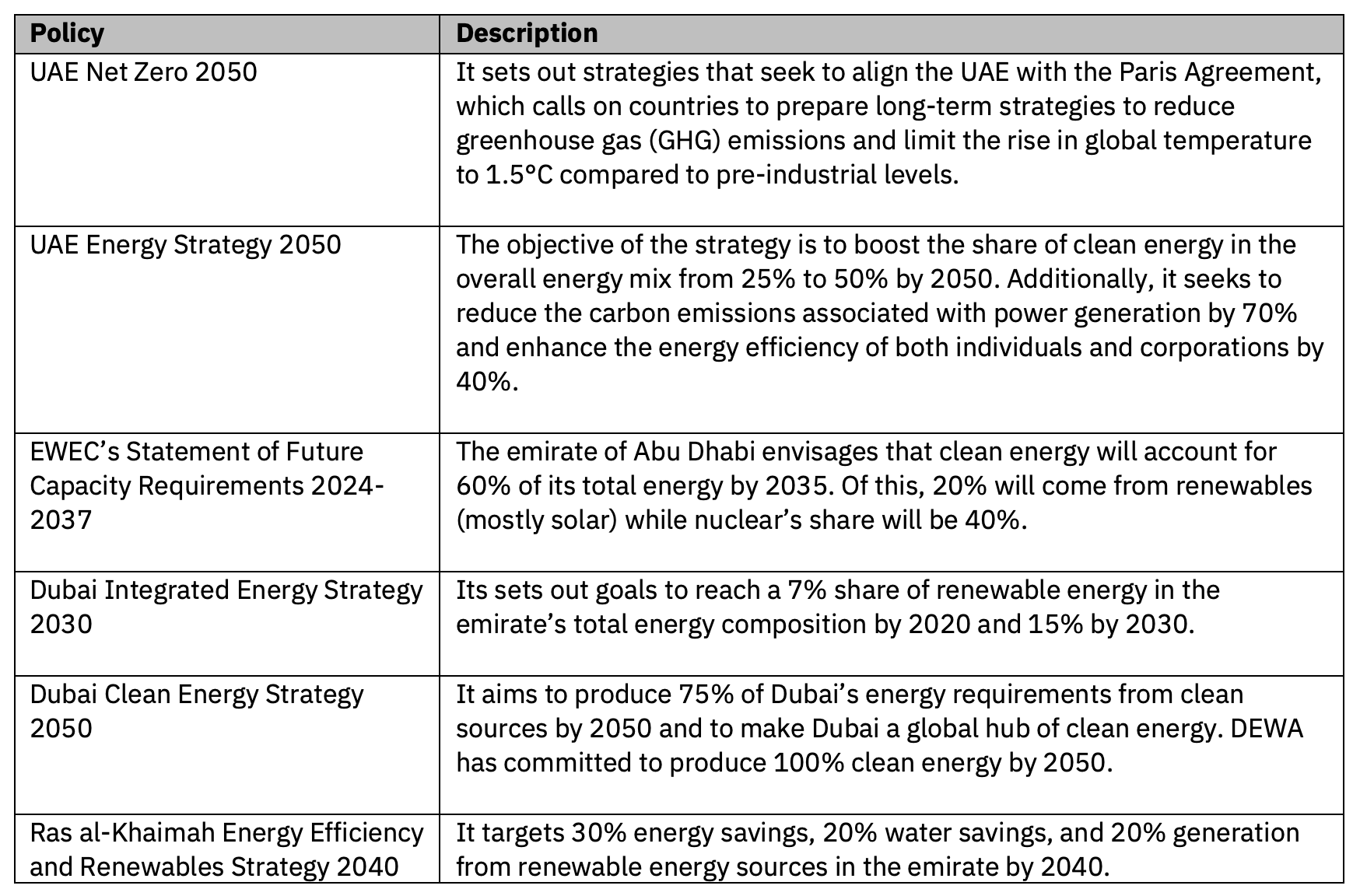

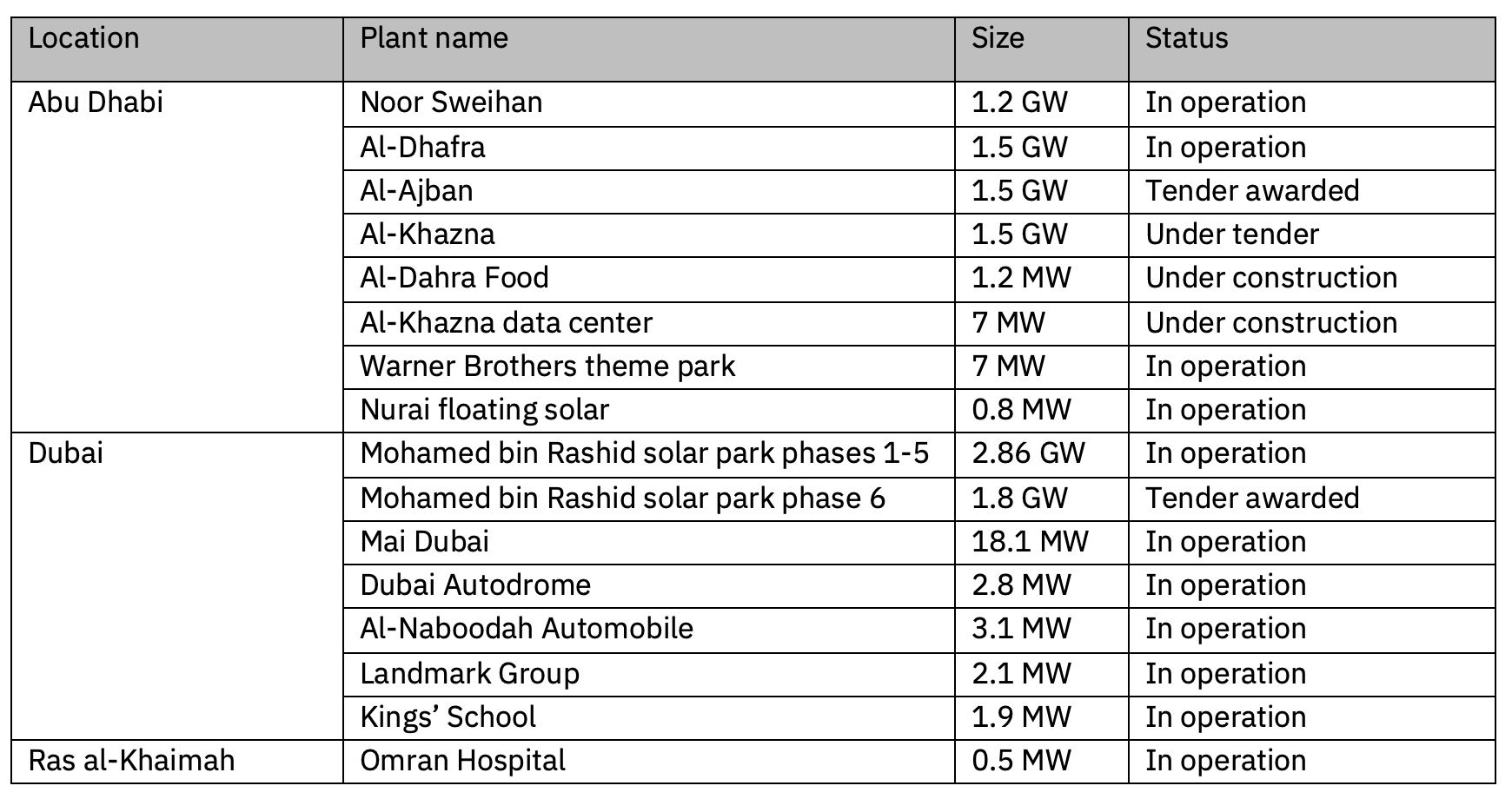

The UAE has been actively pursuing renewable energy initiatives, such as the development of solar and wind projects, in line with key policy documents listed in Table 5.

Table 5: Key Policy Initiatives in the UAE at the Federal and Emirate Levels55

With an abundance of electricity generation, particularly during the winter months, thanks to nuclear power reactors in Abu Dhabi, the UAE is well-positioned to be a source of electricity generation for export through the regional grid managed by the GCCIA.

The UAE does not have a fully established electricity spot market. While DEWA operates the Dubai Wholesale Electricity Market platform to facilitate trading among electricity generators, distributors, retailers, and consumers in Dubai, Abu Dhabi is just beginning to explore this sector.

Figure 6: UAE Electricity Generation Mix, 2010 to Projected 205056

With the adoption of the UAE Energy Strategy 2050, the country set out to increase the of clean energy to 7% by 2020 and 44% by 2050 by investing mainly in solar and nuclear energy.57 This will, in turn, dramatically change the domestic power mix as noted in Figure 6. Already in 2023, almost 40% of Abu Dhabi’s power was from low carbon sources, namely nuclear (32.3%) and solar (6.3%).58 The UAE offers extremely competitive tariff rates, with solar PV available for as low as 1.35 cents per kilowatt hour, although Saudi Arabia holds the current world record at 1.04 cents per kilowatt hour at the time of writing.59 Examples of solar power plants are listed in Table 6.

Table 6: Examples of Utility-Scale and Distributed Solar Power Projects in the UAE as of September 202460

Totaling 500 MW at the end of 2022, the installed capacity of distributed solar is a drop in the bucket compared to that for utility-scale plants in the country. Nevertheless, incentivized by Dubai’s net metering scheme, paperless application process, quick approvals process, and electricity tariffs that are the highest in the country, rooftop solar power has found favor with the commercial and industrial sectors in the emirate. The regulatory amendment by DEWA in June 2022 to reduce the maximum installed capacity for grid-connected rooftop solar systems from 2.08 MW to 1.0 MW in 2020 is likely to slow its hitherto blistering pace of expansion because of more limited economies of scale. The resulting exit of some distributed solar developers from Dubai is expected to benefit other markets in the region that have less restrictive distributed solar policies.

Qatar

In Qatar, the Qatar General Electricity & Water Corporation, or KAHRAMAA, is the only buyer of power generated from IPPs under long-term PPAs. KAHRAMAA is also the only operator of the electricity system in Qatar and responsible for generating electricity, buying from IPPs, and distributing power. Qatar Petroleum (now QatarEnergy) and Qatar Electricity and Water Company (QEWC) formed a collaborative entity, named Siraj Energy, to produce electricity using solar power in 2015, although the former has since become the sole owner of the entity. Qatar has high potential for solar energy. Despite its limited land size, the official Qatar National Vision 2030 plans to generate 20% of energy from renewables by 2030 (with a target of 5 GW of solar by 2035) through QatarEnergy and KAHRAMAA, in coordination via tenders to global developers to participate in their projects. A senior Qatari official has since suggested the target should be increased to 30% by 2030.61 The process and regulatory oversight of these tenders, however, are less clear, although KAHRAMAA has published a list of qualified developers for its solar projects.

Table 7 describes the status of solar power plants in the country. Similar to the co-benefits between clean energy (solar and nuclear power) and the production of premium “green” aluminum and steel in the UAE, the commissioning of Qatar’s second and third solar plants in the industrial cities of Mesaieed and Ras Laffan is tied to the sustainability of the country’s hydrocarbon revenues. By providing power to operate a carbon capture and storage facility for its massive North Field LNG gas expansion project, the solar plants will reduce the project’s carbon footprint and render its LNG more marketable in target markets such as Europe and Japan.62

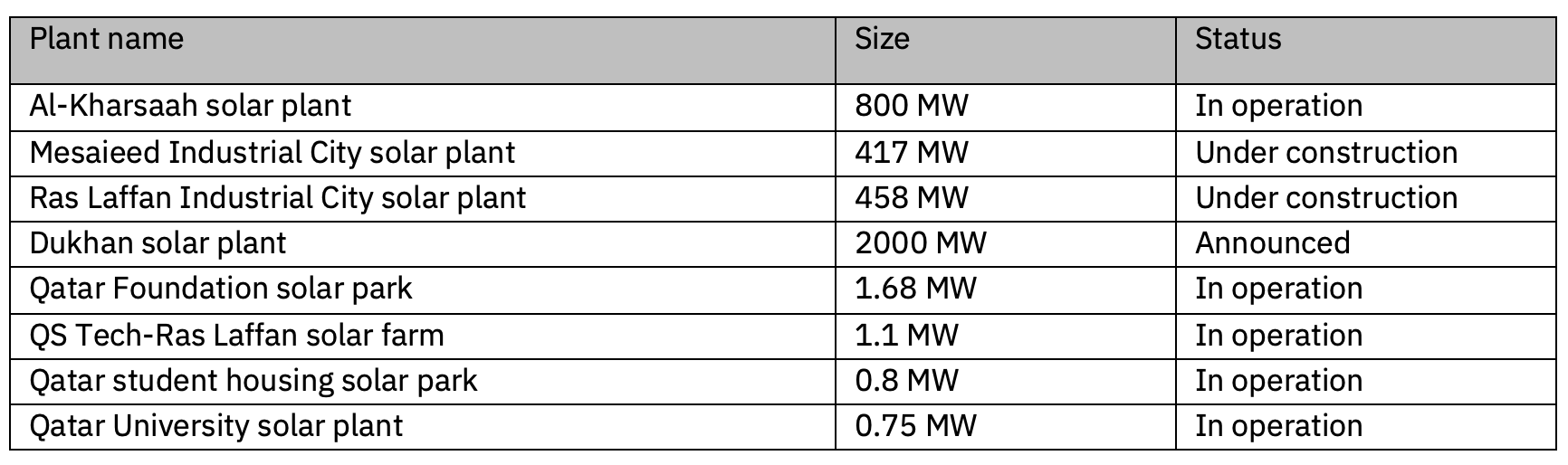

Table 7: Solar Power Plants in Qatar as of September 202463

Oman

The electricity sector in Oman is mainly overseen by the Oman Power and Water Procurement Company (OPWP), which is responsible for planning and ensuring the procurement of electricity and water. OPWP is a government-owned entity that plays a key role in managing the procurement process, including issuing requests for proposals and PPAs with IPPs. All current generation companies in Oman have undergone competitive tendering processes and are entirely privately owned except for the Wadi al-Jizi and al-Ghubra power plants.64 There are a number of initiatives the Omani government has announced to accelerate its renewable power sector growth, such as:

-

Solar rooftop initiative SAHIM, which aims to enable distribution companies to serve as intermediaries for OPWP to procure rooftop PV-generated electricity from consumers, implementing minimum technical requirements for rooftop PV systems and instituting a net metering mechanism to reimburse for electricity produced by rooftop PV panels;65

-

Approval of economic gas pricing policy and National Energy Strategy to 2040;66

-

Oman's state-owned Petroleum Development Oman (PDO), with partners including Energy Development Oman, Shell, TotalEnergies, and PTTEP of Thailand, plans to source 30% of its power needs from renewable projects by 2026. This is a notable rise from its current level of around 10% and a slight extension of its original goal of 2025.67

In January 2022, Oman launched the Middle East’s first fully functioning electricity spot market; volumes are still too low for meaningful analysis. Public procurement of power capacity and the sale of electricity through PPAs will continue but this spot market means that OPWP can also purchase electricity through short-term trading.

To encourage large consumers to get more involved in the energy transition, cost-reflective tariffs (CRTs) were adopted in 2017. These unsubsidized tariffs based on the actual cost of electricity production and transmission have been applied only to end users whose consumption exceeds 100 MW/h per year. Since the cost of electricity is no longer distorted by government subsidies, CRTs should incentivize large end users to reduce overall energy consumption and in turn promote the use of less expensive renewable power. As of year-end 2023, Oman boasted a number of utility-scale solar power projects, both operational and planned, as per Table 8.

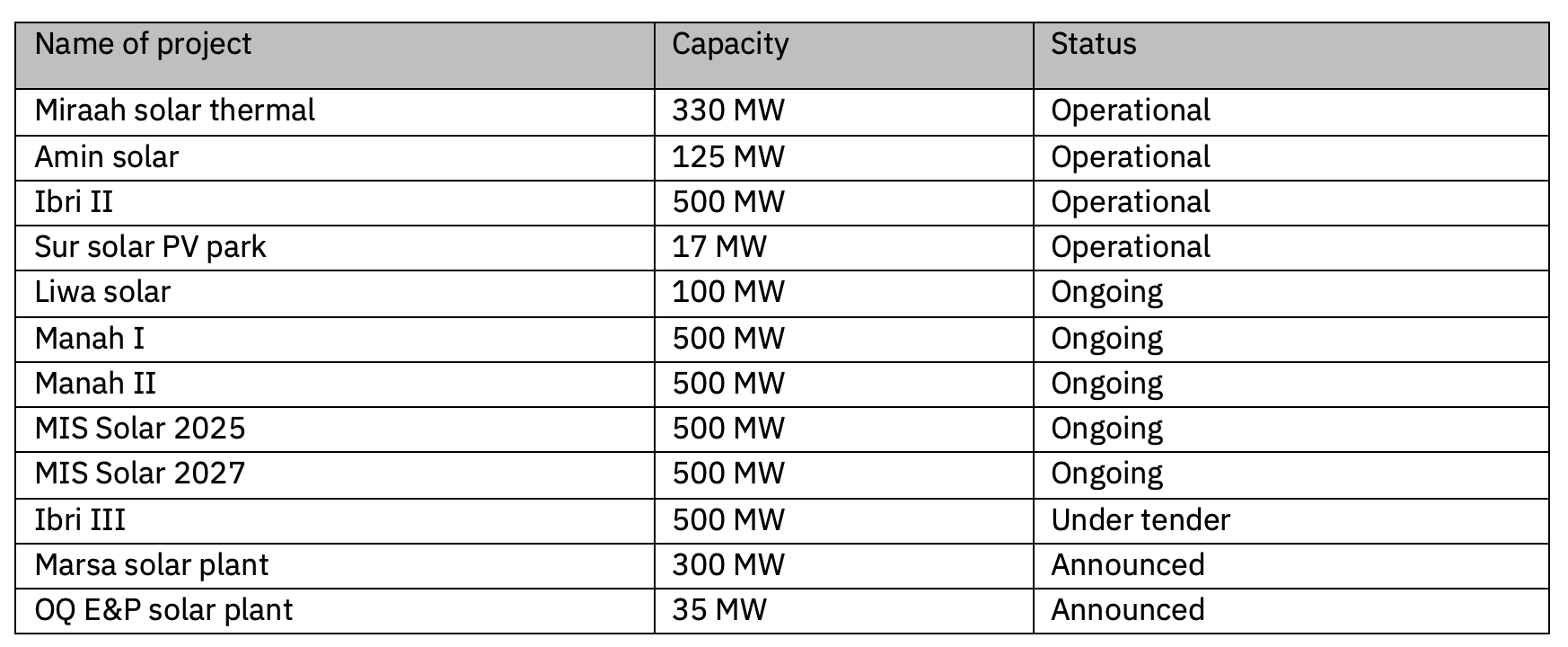

Table 8: Oman Solar Power Projects as of September 202468

Intra-GCC Comparison

The UAE, Saudi Arabia, Oman, and Qatar are not equal in their ambitions for renewable targets (Figure 3) or in their ability to accelerate clean energy deployment, through financial support from the state or their r›egulatory incentives (Table 4). However, these four are ahead of efforts in Bahrain and Kuwait. Some comparison of the regulatory environment, in particular the tender of renewable power generation, shows a familiar pattern of state champions with full or partial state ownership, especially in the Saudi and Emirati cases, which are also the cases with the most successful volume of new generation capacity.

Oman is somewhat distinct, in that it does not have a national champion entity to roll out renewable generation in coordination with the state. In addition, its regulator appears to be creating policy that privileges renewable power and allows greater access to its grid system. One report suggested that the Authority for Public Services Regulation (APSR) in Oman would not tender any new gas-fired electricity plants and its acceleration of wind and solar energy would also include new regulations to support bilateral agreements and wheeling charges, which are fees charged by a utility or transmission service provider for the transportation or “wheeling” of electricity from one location to another through its transmission or distribution system.69 In contrast, no other GCC country has announced a moratorium on new gas-fired plants; the UAE and Saudi Arabia are even commissioning new ones.

Another complexity to increased renewable power generation in Oman, as well as in some other Gulf states, is the consideration of who will consume the power and whether it can be connected to grid systems for larger consumer areas (whether domestically or through the GCC interconnector). In the Omani case, new power generation is associated with economic diversification aspirations in the hydrogen sector, with one study estimating that 60% of Oman’s total prospective utility-scale solar and wind capacity is earmarked for export as green hydrogen.70 There are major plans to develop green hydrogen hubs in Duqm and Dhofar, in line with Oman's ambition to produce up to 1.25 million tons a year of green hydrogen by 2030. The proposed projects would connect renewable energy plants to supply power to the electrolyzer plants, which split water into hydrogen and oxygen. As a policy incentive, the Omani government has made land deals to encourage international consortiums to build green hydrogen and ammonia facilities.71 These new industrial zones and energy centers are “captive power” and not necessarily to be connected to other power demand centers, or the Omani utility. The electrolyzer plants will also require water, meaning increasing energy demand for desalination as well.

A final area of comparison is the regulatory framework for renewable energy certificates (REC), a form of energy attribute certificate. Each REC certifies that the bearer (for instance, the developer of a solar plant) owns one megawatt-hour (MWh) of electricity generated from a renewable energy resource. Subsequently, the REC can be sold and redeemed for use by other entities wishing to make reliable claims, usually backed by a global standard-setting foundation, about their renewable energy usage. At the same time, it provides solar (and wind and nuclear) IPPs with an additional revenue stream. Currently, only Saudi Arabia, the UAE, and Oman have globally recognized authorized issuers and products, with the UAE boasting the most active REC trading market: RECs are bought by ADNOC, Emirates Global Aluminium, property developers, and UAE-based multinational companies.72 Bahrain has begun a pilot project to issue RECs, but they are absent from Qatar and Kuwait, although Doha is expected to implement the process soon to verify the solar power origin claims of its future North Field LNG sales.

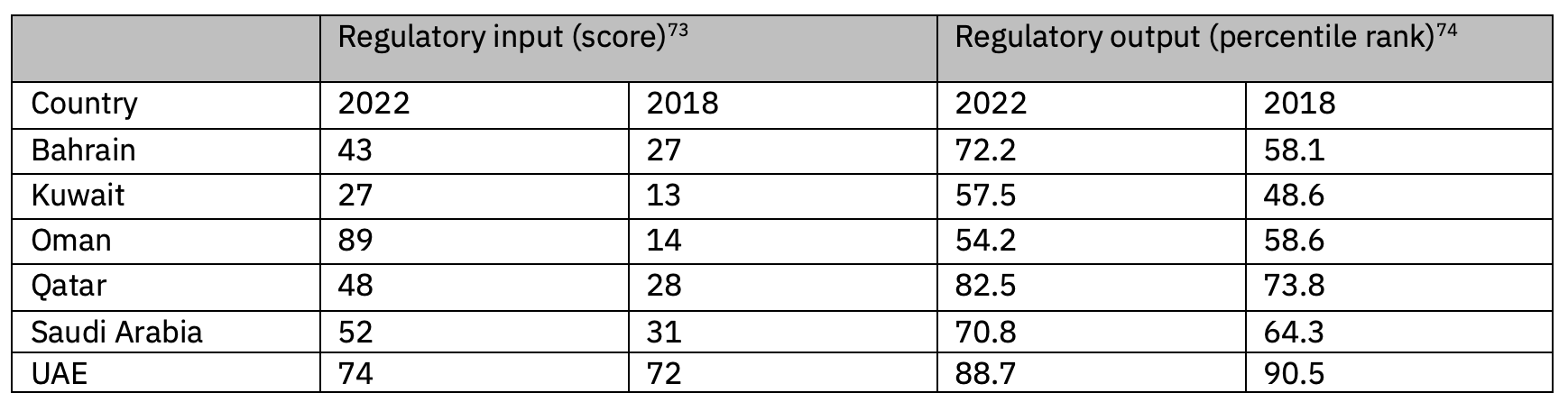

Overall, the regulatory landscape for renewable power in the GCC continues to evolve and, for the most part, has become more investor-friendly, as indicated by improvements in policy adoption and implementation over the past four years in Table 9. This aligns with the objectives of Gulf states to meet the growing demand for power at a cost-effective price while leveraging the project management and technical expertise of international power developers.

Nevertheless, advances in the legal, planning, governance, and policy aspects of regulation have been insufficient to drive the wider and faster deployment of solar power. Implementation and consistency of regulations, as measured by government effectiveness, have been found wanting in some cases. Oman is a case in point (see Table 9): In 2022, it was assessed by established indexes as the best performer among the Gulf states for formulation and policy institutionalization (what we term “regulatory input”) related to renewable power legislation; however, it scored poorly for actual effectiveness and implementation (or “regulatory output”) of those regulations. This discrepancy is likely to have disincentivized renewable power investors and partly explains the country’s laggard status in solar deployment. The effects will probably be temporary, however, because recent improvements to fiscal stability and bureaucratic efficiency have resulted in sovereign credit upgrades for Oman. This will re-risk the operating environment for investors, including power developers.

In comparison, the UAE does well on both counts, while Saudi Arabia has shown significant improvement because systemic risks to investment are being minimized thanks to their regulatory regimes. This is particularly important for owners of renewable IPPs as such plants have a relatively higher initial capital cost and lower operating expenditures compared to those that run on fossil fuel.

Table 9: Assessment of the Regulatory Environment in the GCC States, 2018-22

Firm-Level Experiences as Power Developers in the GCC

To understand the impact of the landscape of renewable power generation and its regulatory regimes in Section 3, interviews were conducted with nine executives at large state-owned or state-investor solar power developers as well as with smaller privately owned distributed solar power firms based in the GCC. Two other stakeholders in the regulatory environment were also interviewed, namely, a senior executive from a public utility in the UAE and the International Renewable Energy Agency (IRENA). These 11 interviews, most of which were not for attribution, took place over the course of 2023 and early 2024. Coding of the interviews identified several pathways, presented below, through which regulations influenced the direction and pace of solar power deployment in the Gulf.

Uneven Playing Field

Smaller-scale distributed power developers invariably perceived the existence of an uneven playing field in the way regulators and utilities embraced their presence and ability especially to feed into the grid system. Moreover, large firms, especially in retail, appeared to have more success in gaining permits and grid access for distributed generation.

I think the main conclusion is most of the time the rules aren't clear. The application processes are opaque and a lot comes down to how much wasta you bring along, particularly around the edge of the rules. And I think that's not necessarily super conducive to a growing market and certainly not to low transaction costs because it means that you're inducing much higher soft costs on top of the construction cost, much higher financing uncertainty, and ultimately randomness into the connection process that benefits nobody. Maybe it benefits the powers that be and maybe the bigger families, but I don't think that's an intended side effect, it's more wastage really.

--Founder/former CEO of a Gulf-based distributed solar developer

Another distributed solar power developer had similar insights on the competitive landscape and obstacles for smaller firms competing in a market more sympathetic to state-owned or state-invested operators.

The government [of Saudi Arabia] doesn't care about distributed solar. Of the 9 GW 2023 goal, only 1.2 GW is commissioned so far. The bigger firms [like ACWA] can act as quick developers, but also are better incentivized as it is an equity sponsor of projects and takes developer fees. And the pricing of distributed solar that goes back to the grid is generally very low — for example, we are paid 0.05 riyals when 17.5 riyals is our cost.

--Distributed power developer in Saudi Arabia

The bias in favor of utility-scale solar projects did not appear to be a concern for public utilities. A senior executive at a Gulf-based utility shrugged when asked about the role of distributed generation in the country’s future power mix. He explained that there was no commercial case for the latter when the utility-scale power it was procuring was offered to end users at half the price of distributed solar power. Nevertheless, he pointed out, end users were free to decide for themselves and a relevant regulatory framework for distributed generation was in place.

In contrast to his peers, a Bahrain-based distributed solar developer felt that there should be more regulatory incentives for utility-scale projects since “the missing link in the solar ecosystem is utility-scale developers” that could facilitate wider solar deployment. While Ebrahim Raisi, managing director of Green Innova in Bahrain, was cognizant that the country’s land constraints may disincentivize large-scale projects and hence big developers, he suggested that Bahrain’s territorial sea of up to 22 kilometers could host floating solar PV plants. In this regard, he cited Masdar’s 100 MW floating solar plant in Cirata, Indonesia, as an example.

Regulatory Inconsistency and Lack of Transparency

Like most private sector firms, what solar power developers sought most, notably those without the benefit of state investment or ownership, was transparency in the regulatory environment and visibility in a timeline of proposed reforms. As one executive put it, while the publication of national climate targets and renewable energy roadmaps were welcome signals of government intent and commitment, he continued to have concerns and his top priorities and requests from state regulators were:

1. A clear and credible commitment and timeline for energy subsidy reform. This would facilitate investment in the sector, because there would be clarity on savings.

2. A time-of-use tariff for the industrial sector. As governments have shown reluctance to increase industrial rates amidst an industrial revival, one way to encourage PV installation would be to introduce an increased tariff only for the mid-day hours.

3. Effective and clear implementation of the regulations that are already in place, and the replacement of conflicted parties, like for-profit utilities, with neutral entities, in their roles as decision makers as part of the regulatory regime.

--Gulf distributed solar power developer, executive, and founder

Even the privileged larger firms sometimes struggled to navigate the regulatory landscape. When we interviewed the bigger players in the solar power landscape in the GCC, we found that there are hurdles as well for firms with good access to large tenders and equity stakes in power development, but that profitability and margins were not necessarily consistent across engagements with the state. The large developer in the Saudi context has a specific business development and relationship management team for its domestic operations; in some ways the corporate structure is bifurcated to service the domestic market and the international operations, given the political importance of its mandate in the kingdom. But that too has risk in keeping a very demanding client satisfied.

Delays to Project Lead Times

As a consequence of the above-mentioned issues of an uneven playing field and of inconsistencies in the regulatory environment, project delays were not uncommon. The UAE’s federal system that allows wide latitude for each emirate in energy matters, Oman’s four different regional power systems and their respective utilities (see below), as well as Saudi Arabia’s two lead agencies for renewable power deployment (namely, REPDO and PIF) were identified as part of overlapping governance challenges. The following suggestions were made to improve timeliness:

Simplifying and expediting the permitting process can significantly reduce project lead times. Establishing a single-window clearance system and providing clear guidelines will also enhance efficiency and attract more developers.

--David Provenzani, Yellow Door’s Country Director for UAE/Oman

Using more digitalized platforms for permit applications. Introduction of a centralized renewable agency to coordinate and expedite project approvals and grid integration.

--Khaled Chebano, Yellow Door’s Country Director for Saudi Arabia

In the global context, lengthy permitting and grid interconnection queue times have been identified as critical barriers to the faster transition to renewable energy. For instance, permitting times (that is, excluding actual construction) of two to six years for solar projects and of three to nine years for offshore wind projects are routine in the larger countries in Europe.75 In the US, waiting times for reliability and safety assessments prior to obtaining approvals to connect to the grid have grown from 2.1 years in 2000 to 3.7 years in 2021; this amounted to a staggering 2 million MW of renewable power ready to be put into operation but on hold due to backlog.76 Much of these delays have been attributed to local opposition based on competing land use and ownership rights.77 In Germany, rules distancing communities from onshore wind infrastructure eliminate around 60% of the country’s suitable land, while Italy’s limitations on the use of cropland affect 80% of land not impacted by technical constraints.78

By contrast, our research underlines that project delays in the Gulf are much more about regulations that have to do with overlapping jurisdictions and less about societal objections.79

An Independent Regulator

Among interviewees, there was some concern about the issue of self-dealing or conflict of interest, especially with regard to how the Saudi Electricity Company (SEC) acts as a regulatory authority but was also a competitor in the power market since it owns two-thirds of generation capacity. The SEC is both buying power from independent producers at low prices and reselling to consumers at higher prices, but not all consumers pay the same rate, especially in state industry. At the same time, though, it also sets the regulation of how much installation can occur in the system. One of the solutions proposed was the establishment of an independent regulator to improve regulatory independence, transparency, and investor/consumer protection. This would replicate the governance model in many member countries of the International Energy Agency; such a regulator also existed previously in Abu Dhabi and currently operates in Oman in the form of the APSR.

Not all interviewees felt that the lack of an independent regulator was a major barrier to wider solar deployment in the Gulf. The number of stakeholders in the energy sector in each country appeared to be a consideration when assessing the utility of an independent regulator. In the words of an executive reflecting on the case of Abu Dhabi:

Do keep in mind that this is still a very small place. I mean, you're not looking at a European grid or a US interconnection system with hundreds of participants. The number of players on the distribution or even on the transmission grid here is a handful. In case of Abu Dhabi you have really EWEC, you have ADNOC still a player [at that time], you've got the aluminum plants, they are all state owned. So you've a handful of 3-4 actors. You can try to impose an external regulatory structure, and they did, but it was mostly paper pushing left to right. … In the end, regulators work well when you have a powerful regulator and lots of small actors. They don't work well when everybody's owned by the same party and playing the same political games.

Dubai is even more extreme. Because in Abu Dhabi, there was at least a little bit of a balance between ADNOC, EWEC, and aluminum plants. So you have three players who had a bit of ‘oomph.’ In Dubai, you have one player that is DEWA and nobody else matters, and so the regulator idea never got anywhere.

This isn't a big problem for the big projects because in the end the big boys like ACWA Power will negotiate a contract and they're big enough for a billion-dollar project to negotiate that with or without the regulator.

--Founder/former CEO of a Gulf-based distributed solar developer

In the case of Saudi Arabia, an interviewee from an intergovernmental organization said:

I'm not sure whether that [an independent regulator] is the right thing for each and every country, and I can't tell whether it's the right thing for a country like Saudi Arabia. The country has such a centralized electricity supply system and citizens also expect to a certain degree not to be paying European-style utility bills. And it’s also a place there may be a merit to say we're not a purely commercially driven market economy, like the US or UK style. Saudi population is a lot larger … there are more different income groups than in the UAE that have to be born in mind. There are low-income groups and middle-income households that need to be protected from huge price increases. There are also major industries, et cetera, so all that's very complex. I would just caution against thinking that a prescription like this will solve all the issues at hand.

--Laura el-Katiri, International Renewable Energy Agency

A Single Standard for the Entire Country

Developers pointed out that in some cases, the regulatory regimes and entities that control them (national electricity companies and utilities, along with sub-federal level entities) have different incentives than national renewable targets set by the government at large. As one solar power developer noted, the regulatory differences between the different emirates and their power systems can be significant:

In Abu Dhabi, the attitude is the tariff is low and if you want to produce your own, be free. But we're not going to pay you for reverse feeding into the grid. So, they are fairly laissez-faire, they have neither support nor a blocking approach.

Dubai is a little bit more complicated in that, on the one hand, they have in the past promoted this very heavily. But at the same time [they] have put in very restrictive, very complicated, and very technical restrictions too, while publicly promoting net metering, in private actually strongly limiting the revenue impact of the net metering program, which was starting to bite as particularly the larger industrial customers were rapidly going to install their own solar systems. That has changed again a few weeks ago when DEWA loosened the restrictions … for industrial manufacturing customers … particularly but kept the restrictions for other types of customers. So, if you have a large manufacturing facility, you can fill the roof with solar pretty much up to any capacity. But if you have a large logistics facility, you can't. And the hypothesis that I've heard in the market is that this is in reaction to the much lower tariffs being offered for industrial facilities. The program for low-cost electricity for manufacturers DEWA did not want to match or want to open the can of worms regarding electricity tariffs. So, they kept theoretically the same 44 fils for everyone, but giving a back door discount to the manufacturers who can put solar on their roofs and the solar on the grid would be about half the price and much closer to Abu Dhabi. So, it's a bit of a selective discount.

--Founder/former CEO of a Gulf-based distributed solar developer

The above interviewee eventually took his distributed generation business to another GCC state instead, as well as to other MENA markets.

Oman’s lack of a unified approach was also highlighted as an issue:

In Oman, various energy utilities cover distinct territories, and each utility adopts a distinct approach to handling applications for solar energy projects. … Several different energy utilities applied different size limitations that don’t help the commercial and industrial sector to invest in [distributed] solar.

--David Provenzani, Yellow Door’s Country Director for UAE/Oman

This is because Oman does not have a fully integrated power system, although reforms are underway. The Main Interconnected System covers most parts of the sultanate’s North region of a million customers and comprises 90% of Oman’s total electricity peak demand. The Dhofar Power System covers the city of Salalah and the surrounding areas of the Governorate of Dhofar, serving around 100,000 customers and contributing 10% of peak demand. The Duqm Power System, located on the eastern coastline of the Wusta region, and the Musandam Power System in Musandam Governorate are the country’s other two, small and isolated, power systems.

Local Content and Labor

At the firm level, these inconsistencies in operating costs and ability to feed power back into the grid system can mean their operating models, which already have thin profit margins due to intense competition in Dubai in particular, face additional stress and vulnerabilities. This can impact hiring decisions and ability to attract talent. For labor markets in clean energy in the GCC, there are implications. One solar power developer described labor market pressures as limited when it comes to attracting talent, but also growing in terms of locally trained nationals entering the job market. Indeed, some power developers are involved in programs to upskill locals, both men and women, for the renewable energy industry. In Bahrain, Green Innova has partnered with the Nasser Vocational Training Center while ACWA Power has a partnership with the Higher Institute for Water and Power Technologies in Riyadh to offer a renewable energy and occupational safety program as part of the institute’s curriculum.

But similar to contracting awards, local talent is quickly absorbed by large state-related firms.

The limited availability and quality of human resources has an impact on power projects in the Gulf. Most experienced engineers are coming from Jordan, Egypt, and lately from the UAE to KSA. There are some young Saudi engineers with skills but little experience, and by and large they are absorbed by large SOEs or state institutions.

--Saudi solar power developer

The growth of renewables all over the world is also expected to complicate competition for talent and labor.

Gulf markets are, however, heterogenous when it comes to labor as the following sentiments testify:

Presently, the human resource in the UAE boasts a considerable pool of highly skilled professionals specializing in various aspects of solar energy, including design engineer, project managers, sales personnel, finance managers, and more.

--David Provenzani, Yellow Door’s Country Director for UAE/Oman

We have huge shortage of the green skills. … Definitely, a shortage on the labor and installer, a shortage on the engineer level.

--Ebrahim Raisi, Managing Director of Green Innova, Bahrain

Oman might need to rely on importing external labor resources in the coming years, progressing to a more mature stage by the end of the decade.

--Khaled Chebaro, Yellow Door’s Country Director for Saudi Arabia

Given that importing labor, particularly blue-collar workers, is not a hugely onerous process in the Gulf states compared to North America and Europe, some Gulf developers have cautiously welcomed local content rules (LCR). The latter refer to policies requiring firms to use a minimum level of domestically manufactured goods or services. An increasing number of countries have imposed LCRs for solar and wind energy, most recently the Investment and Jobs Act in the US and the European Union’s Net Zero Industry Act. In Saudi Arabia, local content requirements were set at 17% and 18%, respectively in the second and third rounds of the NREP aimed at raising the share of renewables in the country’s power mix. Companies within a winning consortium that fall short of an audited 11.5% final local content score could potentially face a three-year exclusion from participation in future rounds. In Oman, bidders for state-tendered renewable projects are required to meet a minimum of 8% Omani content, defined as expenditures on Omani goods and services as a percentage of total spend.

In contrast, there are no local content requirements in the UAE, Qatar, and Bahrain. In the case of the UAE, the public utility was cognizant that LCRs could potentially reduce the pace of solar energy deployment and by extension, the benefits of lower energy costs, which is a key mandate of the entity.

Explaining the company’s response to local content, a Yellow Door executive said:

Currently, manpower, engineering, and ancillary items are sourced domestically, while key components, namely modules and inverters, are acquired through local distributors, predominantly opting for tier-1 brands known for their reliability, warranty, and bankability. … Unless major manufacturers choose to relocate a portion of their production to these countries, the imposition of local content requirements on modules and inverters will not facilitate the initiation of solar developments in the local commercial and industrial (C&I) sector. … We contend that imposing more than a 25% to 30% maximum local content could potentially pose constraints, advocating instead for market flexibility to utilize modules and inverters from international sources.

--David Provenzani, Yellow Door’s Country Director for UAE/Oman

While procuring cables and labor locally helped to de-risk renewable projects to a certain degree, a state-owned power developer felt that this regulatory requirement did not guarantee supply chain security.

Of course, having a PV module manufacturing base close by helps a lot for the sustainability and the supply chain security of those projects. But … nothing is guaranteed. … You never know because some companies go bankrupt, some products become old and obsolete. Then you have to replace the supplier and products. So we need to make sure that our plans are flexible enough to adapt to those changes and to have back-ups. And that's part of the embedded part of the strategy when we decide how we develop a project that lasts a few decades.

--Gulf-based state-owned power developer

In the interview data collected among utility-scale and smaller, privately owned power producers, we found consistency in perceptions that the regulatory environment could be improved to leverage the clear policy priorities in the Gulf in favor of solar power expansion. These regulatory challenges pertained to governance, competition among developers, procurement, labor markets, and evenness across markets, even in the same federal or state-level jurisdiction. Unsurprisingly, state-owned power developers expressed fewer reservations about the impact of regulations than privately owned developers. Both sets of developers, however, agreed that residential solar was a non-starter in the Gulf (due to the high upfront costs that the mostly expatriate tenants would have to pay), that there was a selective case for commercial and industrial distributed solar projects, and that utility-scale projects will continue to drive deployment.

Conclusion

In this research, we have examined a subset of the renewable energy landscape of the GCC states, taking a very close look at firm-level experiences of regulation in the solar power industry. Some of the largest and most innovative solar power plants in the world are under construction across the Arabian Peninsula. How this process unfolds will have lessons for many domestic political environments, especially in the role of state champions and policy mandates for decarbonization of the power sector. As Gulf states, their sovereign wealth funds, their national oil companies, and their industrial champions seek to explore the business case for fuels and industrial products that derive from renewable energy sources — such as green hydrogen, green aviation fuel, green steel, and green aluminum — the demands on local power sectors will evolve. This research sheds some early, empirical light on regulatory challenges power developers might encounter in meeting those demands. It makes clear that business in the Gulf will continue to be even more reliant on the governance, regulatory, and implementation capacities of the state.

About the Authors

Dr. Li-Chen Sim is an Assistant Professor at Khalifa University in the UAE and a Non-Resident Fellow at MEI. She holds a PhD in Politics from Oxford and is a specialist in the political economy of Gulf and Russian energy and its intersection with domestic politics as well as international relations. Her interests include the politics of energy in the Gulf, Gulf-Asia exchanges, and Russia-Gulf interactions.

Dr. Karen E. Young is a political economist focusing on the Gulf, the broader MENA region and the intersection of energy, finance and security. She is a Senior Research Scholar at the Columbia University Center on Global Energy Policy. She is a Non-Resident Senior Fellow at MEI and Chair of the Advisory Council of MEI’s Program on Economics and Energy.

Disclaimer

This work was carried out with the aid of a grant from the International Development Research Centre (IDRC), Ottawa, Canada. The views expressed herein do not necessarily represent those of IDRC or its Board of Governors.

Endnotes

1IRENA, “Renewable capacity statistics 2024,” International Renewable Energy Agency, March 2024, https://www.irena.org/Publications/2024/Mar/Renewable-capacity-statisti….

2 IRENA, “Renewable Energy in the Arab Region: Overview of Developments,” International Renewable Energy Agency, 2016, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2016/IRENA….

3 ESMAP, “Global Photovoltaic Power Potential by Country,” World Bank, June 2020, https://documents1.worldbank.org/curated/en/466331592817725242/pdf/Glob….

4 IRENA, “Renewable energy markets: GCC 2023,” International Renewable Energy Agency, 2023, p. 19, https://www.irena.org/Publications/2023/Dec/Renewable-energy-market-ana….

5 Kasandra O’Malia, Nagwa Abdallah, Julie Macuga, Shradhey Prasad, Nassos Stylianou, and Ingrid Behrsin, “MENA grows renewables by half but clings to risky hydrogen and gas,” Global Energy Monitor, September 2023, p.4, https://globalenergymonitor.org/report/mena-grows-renewables-by-half-bu….

6 IRENA, “Renewable capacity statistics 2024;” 2024; IRENA, "Renewable Energy Statistics 2024," International Renewable Energy Agency, Abu Dhabi, 2024, [Online], Available: https://www.irena.org/Publications/2024/Jul/Renewable-energy-statistics….

7 TAQA-Bloomberg Media Studios, “Future of Utilities Study,” TAQA, January 2024, p. 26, https://assets.contentstack.io/v3/assets/blt57caa63e0368f6e8/blt42ba6ff….

8 Bloomberg News, "China Solar Firms Ink Deals with Saudis for Global Expansion," Bloomberg, July 16, 2024, https://www.bloomberg.com/news/articles/2024-07-16/china-solar-firms-sa….

9 DNV, “Energy Transition Outlook 2022,” Det Norske Veritas, October 13, 2022, https://www.dnv.com/energy-transition-outlook/download.html.

10 See data in World Bank-ESMAP, “RISE 2016: Regulatory Indicators for Sustainable Energy,” World Bank, 2016, http://documents1.worldbank.org/curated/en/538181487106403375/pdf/11282…; ESMAP, “Regulatory Indicators for Sustainable Energy 2022: Building Resilience,” World Bank, December 1, 2022, https://rise.esmap.org/data/files/reports/2020-full-report/RiseReport-0….

11 Faisal AlAzmeh, Michele Della Vigna, Dalat Darwich, and Waleed Jimma, “GCC Capex Wave Series: The rise in low-carbon capex,” Goldman Sachs, November 28, 2023, https://www.goldmansachs.com/pdfs/insights/pages/gs-research/gcc-capex-….

12 Amory Lovins, Soft Energy Paths: Towards a Durable Peace, New York: Harper & Row, 1976; Lewis Mumford, "Authoritarian and Democratic Technics," Technology and Culture 5, no. 1, 1964; Robin Mills and Li-Chen Sim, eds., Low Carbon Energy in the Middle East and North Africa, London: Palgrave Macmillan, 2021.

13 Yasemin Atalay, Frank Biermann, and Agni Kalfagiann, "Adoption of renewable energy technologies in oil-rich countries: Explaining policy variation in the Gulf Cooperation Council states," Renewable Energy 85, January 2016,https://doi.org/10.1016/j.renene.2015.06.045.

14 IRENA, “Renewable Energy Market Analysis: GCC 2019,” International Renewable Energy Agency, January 15, 2019, https://www.irena.org/Publications/2019/Jan/Renewable-Energy-Market-Ana…; Aisha Al-Sarihi and Noura Mansouri, "Renewable Energy Development in the Gulf Cooperation Council Countries: Status, Barriers, and Policy Options," Energies 15, no. 1, March 6, 2022, https://doi.org/10.3390/en15051923; Robin Mills, “Solar market across the GCC: Opportunities for Dutch entities,” Qamar Energy, June 2021, https://www.qamarenergy.com/sites/default/files/Solar%20Market%20across….

15 Farkhod Aminjonov and Li-Chen Sim, "The Gulf states and the energy transition in the Indo-Pacific," Journal of the Indian Ocean Region, October 3, 2023, https://doi.org/10.1080/19480881.2023.2262269; EY, “Five ways GCC energy companies can maximize profitability and ensure sustainability,” EY, July 4, 2022, https://www.ey.com/en_ae/sustainability/five-ways-gcc-energy-companies-….

16 IRENA, “Renewable Energy Markets in the GCC,” 2023, p.18.

17 For a more comprehensive discussion of these and other conditions see Harry Apostoleris et al., "Evaluating the factors that led to low-priced solar electricity projects in the Middle East," Nature Energy 3, no. 12 (2018), https://doi.org/10.1038/s41560-018-0256-3; IRENA, “Renewable energy markets: GCC 2023,” 2023, pp.67-77; Joel Krupa and Rahmatallah Poudineh, “Financing renewable electricity in the resource-rich countries of the Middle East and North Africa: A review,” Oxford Institute of Energy Studies, February 2017, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2017/02/Financing….

18 Samantha Gross, “Renewables, land use, and local opposition in the United States,” Brookings, January 2020, https://www.brookings.edu/research/renewables-land-use-and-local-opposi….

19 See Al-Sarihi and Mansouri, "Renewable Energy Development in the Gulf Cooperation Council Countries: Status, Barriers, and Policy Options," 2022; Md. Alam Hossain Mondal et al., "The GCC countries RE-readiness: Strengths and gaps for development of renewable energy technologies," Renewable and Sustainable Energy Reviews 54, February 2016, https://www.sciencedirect.com/science/article/abs/pii/S1364032115011776; UNESCWA, “Case Study on Policy Reforms to Promote Renewable Energy in the United Arab Emirates,” United Nations Economic and Social Commission for Western Asia, January 2017, https://archive.unescwa.org/sites/www.unescwa.org/files/publications/fi…; IRENA, “Future of Solar Photovoltaic,” International Renewable Energy Agency, November 2019, https://www.irena.org/publications/2019/Nov/Future-of-Solar-Photovoltaic.

20 Steve Griffiths, "Renewable energy policy trends and recommendations for GCC countries," Energy Transitions 1, no. 3, June 20, 2017, p.5, https://doi.org/doi.org/10.1007/s41825-017-0003-6. See also Chris Charles, Tom Moerenhout, and Richard Bridle, “The Context of Fossil-Fuel Subsidies in the GCC Region and Their Impact on Renewable Energy Development, International Institute for Sustainable Development,” May 2014, https://www.iisd.org/gsi/sites/default/files/ffs_gcc_context.pdf.