Summary

The Middle East and North Africa region is set to experience substantial growth in demand for energy during the remaining years of the present decade. Factors driving this growth vary enormously by sub-region and individual country, but there are broad similarities in the forms of both primary and final energy demand growth that are expected to materialize by 2030. Additionally, as most regional energy consumption is minimally integrated with global markets due to the availability of local supply, there is often an insufficient amount of attention paid to the granular aspects of demand growth from the region itself, as oil and gas exports from this part of the world, particularly the Gulf Cooperation Council (GCC) region as well as Iraq, are major determinants of the global supply and demand balance.

Indeed, the GCC region has largely been able to guarantee energy security for its population via the development of local supply, although there have been some exceptions to this dynamic. For example, strong natural gas demand growth in Kuwait, driven heavily by the power sector, has led the country to become a major importer of liquefied natural gas (LNG).

Additionally, the abundance of local supply does not guarantee that local demand growth can be met. This challenge becomes evident when taking a closer look at the natural gas balances of countries like Egypt and Iran, where local supply is increasingly constrained due to demand growth that has been largely unmanaged on the policy side. This will be a key area to watch in the coming years; major forecasters expect the region’s electricity demand to grow by between 29% and 37% from 2020 to 2030.

The policy brief summarizing this research can be found here.

Introduction

The Middle East and North Africa is typically viewed from afar as a region of major energy exporters rather than consumers. Consumption patterns vary significantly within the region itself, but a variety of factors warrant giving its energy demand much closer attention than it generally receives on an international level. The range of factors that will determine the changes in demand from every country in the region, each with their respective intricacies, are far too numerous to examine in the space of this study. However, many of the key drivers that are expected to have a broad impact on shaping the evolution of regional demand to the end of the current decade deserve critical review.

As increased attention is given to the impact of the availability of local oil and gas supply, this dynamic warrants continued discussion as a central driver of total energy demand across the region, in addition to the ways in which availability of various forms of supply will impact the overall trajectory and composition of demand. Abundant resources do not guarantee efficient or effective governance of the energy sector, and as a result the presence of domestic resources can often drive demand to such an extent that the over-exploitation of these resources begins to act as a constraint. The term “energy security” has been used far more frequently since Russia’s invasion of Ukraine in 2022 resulted in a sweeping reconfiguration of many aspects of the global energy trade. Yet even before this monumental event took place, governments across the MENA region have sought to guarantee the security (and increasingly the efficiency) of cost-effective energy supplies through a variety of strategies.

In the Gulf Cooperation Council (GCC) sub-region, this has primarily taken the shape of investment in increased natural gas output to ensure stable electricity supplies for citizens as well as to guarantee low-cost feedstocks that anchor significant swathes of the region’s economic growth plans in both oil and non-oil industries. Progress in developing renewable power resources has been less consistent but remains a key feature of efforts to promote the security of energy supply and shift hydrocarbon resources toward exports or higher-value applications, as they are expected to remain the economic lifeblood of the Gulf for at least the remainder of the present decade. Elsewhere, investing in natural gas supply in countries like Egypt, Algeria, and Israel is clearly a priority, but faces a more mixed outlook despite relatively well-assured demand prospects.

As a result, this study will place strong emphasis on reviewing prospects for the balance of energy supply and demand across much of the region, though it will not be limited to examining supply as a critical driver of demand and will also review other potential demand drivers and constraints. Yet when considering future demand prospects in a resource-rich region, it is impossible to decouple supply dynamics from the trajectory of overall demand, especially when development of national resources is frequently viewed as a strategic priority across the region’s capitals and among its national oil companies (NOCs).

The study will also devote special attention to the prospects for natural gas demand growth in the region, as gas is expected to be the form of energy that will see the most significant demand growth out to 2030 and beyond, in addition to the fact that most available forecasts also suggest that MENA will be one of the top regions for gas demand growth worldwide. Once supply dynamics have been reviewed, the sections examining prospective demand growth by segment will begin with an outlook for the region’s current trajectory until 2030 (and in some cases beyond, depending on the forecast period used by various organizations), and will then delve deeper into key countries central to much of the region’s demand growth, reviewing what major demand drivers are likely to look like, as well as where potential constraints may emerge.

Individual country cases in this study will not receive equal attention in a deliberate approach designed to highlight the wide and complex varieties of consumption across the MENA region. Some of the most energy-intensive economies, such as Saudi Arabia, the United Arab Emirates, and Qatar in the GCC region as well as Egypt and Algeria in North Africa, will receive greater focus. Within this area of concentration, the availability of various energy demand forecasts may also lead to some areas of analysis being more robust than others. Economies that do not account for significant portions of regional energy demand, such as Tunisia and Bahrain, will receive less attention due to the fact that, while their respective consumption patterns will doubtlessly evolve in their own ways, they are unlikely to have major implications for the regional demand outlook as a whole. Finally, a series of regional states designated as “wildcards” will be reviewed to indicate why the drivers of demand in each country are typically unclear, as their unique and often volatile circumstances due to political upheaval, conflict, or economics make forecasting demand difficult or in some cases almost futile. Included in this section will be Iran, Libya, Yemen, Sudan, and Lebanon, among others.

Speculation on regional energy demand across oil, natural gas, and electricity is a complicated, mammoth task. Unfortunately, it is often the case that since MENA is frequently thought of as more of an energy-producing region than a consuming one, industry-leading demand outlooks have not generally devoted significant attention to the complexities of regional energy consumption, although in recent years a wider range of forecasters in multilateral organizations, academic institutions, and firms within the energy industry itself have placed greater focus on a more granular projection of demand for the region. Energy consumption throughout MENA will continue to evolve based on national policy, economic developments, new energy technologies and sources of supply, and perhaps most critically of all, on the availability of said supplies themselves. While this study is not an exhaustive account of every demand driver taking place in each country, it will attempt to provide context for the MENA region’s broad direction of future demand trends for the remainder of the current decade, and to suggest where some of the developments currently expected to take place may deviate from this path.

Review of Major Non-Energy Indicators

Although this study will emphasize the availability of supply in the region as a major driver — or in some cases a constraint — impacting energy demand growth, this is of course far from the only factor that will determine the trajectory of energy demand. As a result, a brief overview of non-energy indicators likely to impact this direction of travel is certainly warranted.

Population growth is highly likely to be among the main variables driving increases in demand across the MENA region before the end of this decade. This is due in large part to the fact that expectations for economic growth are mixed from country to country, and even vary significantly within sub-regions. Additionally, these growth prospects are far from certain due to variables that are more difficult to anticipate, such as the outbreak of conflicts or the impact of sanctions across the region in countries such as Libya and Iran. Additionally, many expectations for growth in the GCC region are partly linked to major economic diversification initiatives, especially in Saudi Arabia and the UAE. As the ability of each state to fund mega-projects and economic diversification initiatives is closely linked to hydrocarbon export revenues, developments in global oil and gas markets — which experienced extreme volatility in 2020 and 2022 — may have notable impacts on the trajectory of these goals. Strong policy and fiscal support from Gulf states currently points to low levels of downside risk, but future market developments still hold the potential to force significant revisions to this outlook.

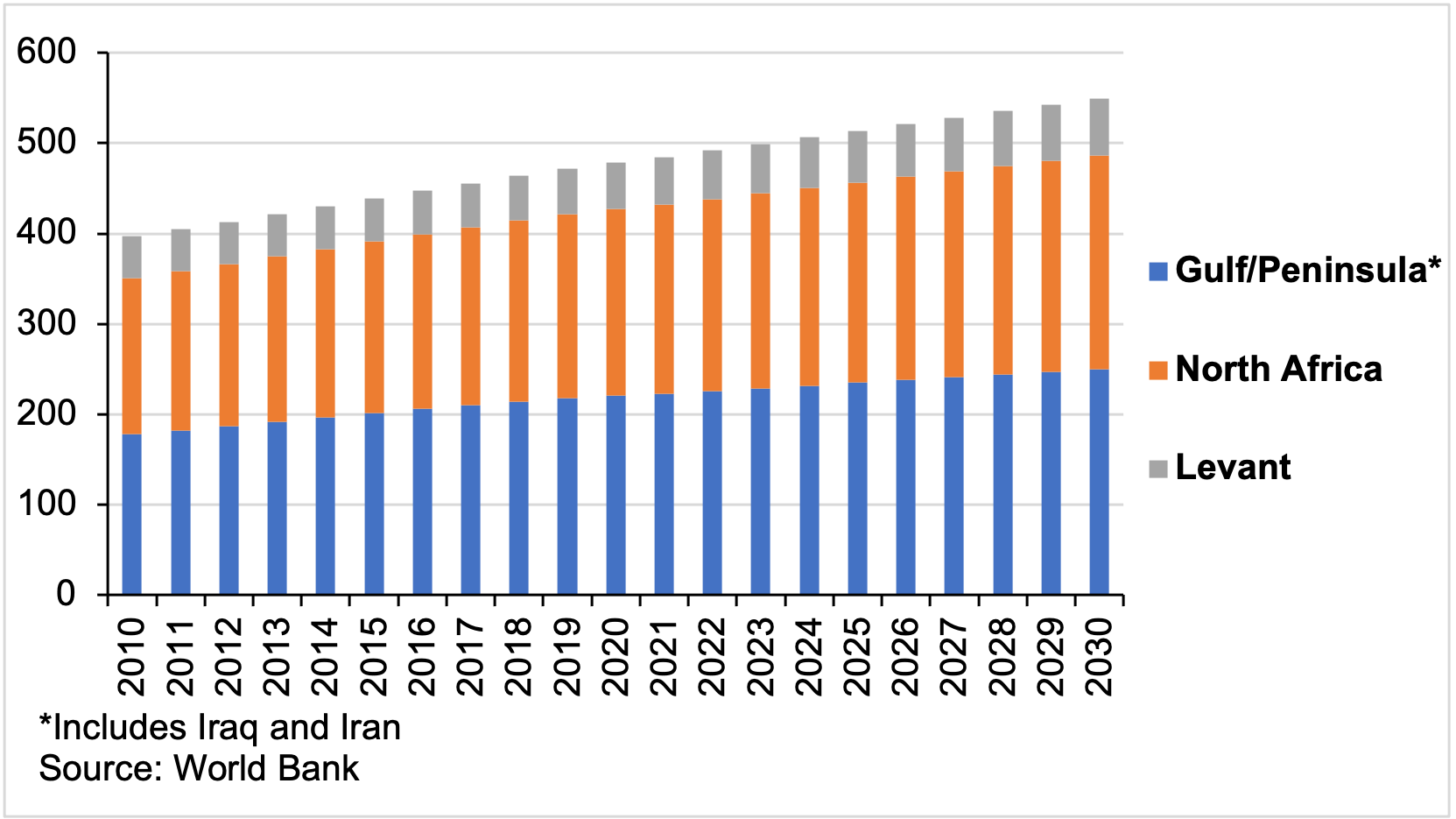

Projections from the World Bank point to a 15% increase in the region’s estimated population from 2020 to 2030, translating into a total population increase of about 69 million people. Somewhat surprisingly, the two countries underpinning a significant portion of this outlook are Iraq and Syria, which have been wracked by conflict for much of the previous decade. Though Syria’s population declined after the start of its civil war in 2011, it returned to growth in 2019 and is expected to add more than 9 million people to its population by 2030. By contrast, Iraq has seen consistent population growth since 2010, and this is expected to continue through the end of the decade, resulting in its population increasing by nearly 25% from 2020 to 2030, adding just over 10 million people.1

Figure 1: MENA population growth outlook (million people)

In fact, more than half the countries in the MENA region are expected to see population increases of 10% or more by 2030, with most others expecting at least 5% growth. Countries in the Levant and North Africa appear likely to make the largest contributions to regional growth, although as mentioned above Iraq is a notable exception. In the Gulf region, Saudi Arabia and Oman are the only two countries projected to experience population growth of more than 10% this decade, with expectations slightly lower for the UAE, Bahrain, and Kuwait. Qatar is expected to see the slowest growth at just 3%. Overall, population growth in the Gulf region is expected to be the lowest contributor to overall growth in the region.

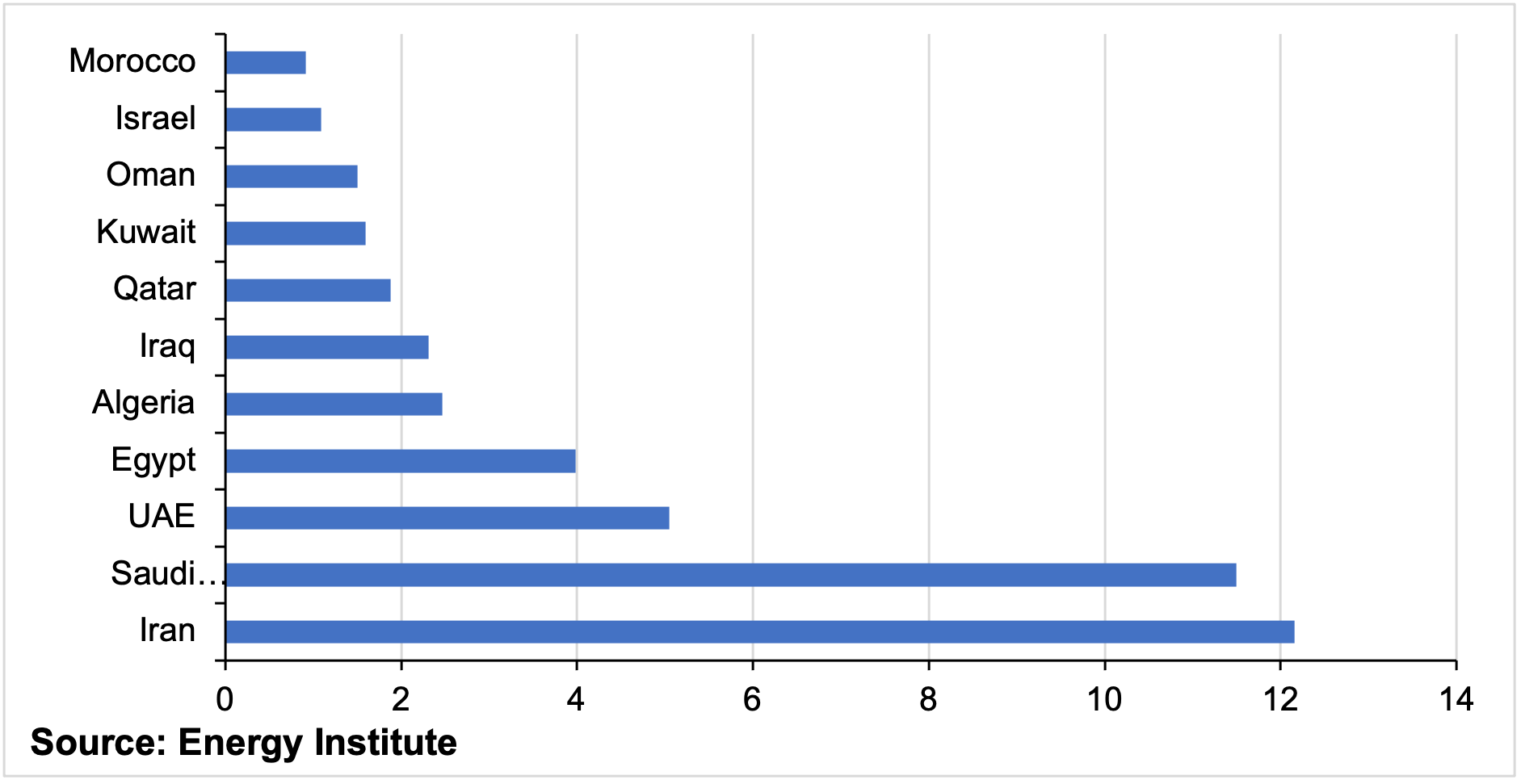

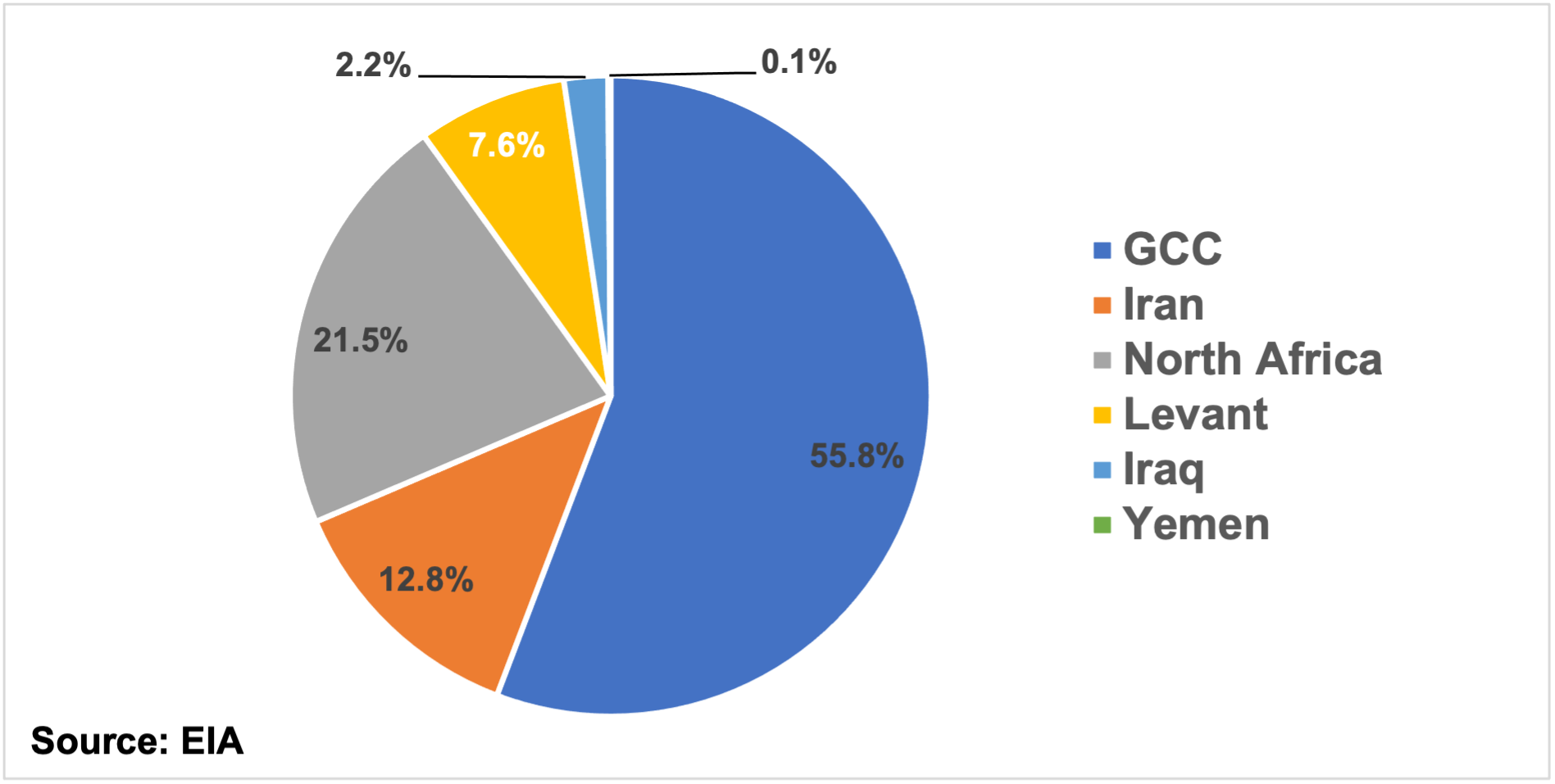

Yet there are important caveats to the impact of population growth on regional energy demand. The first of these is that, while population growth does act as a critical demand driver, a plethora of other factors affect per capita energy consumption, such as national policy, a state’s fiscal position, and the availability of resources. Although the populations of the Arab Gulf states (aside from Saudi Arabia) are by no means the largest in the region, per capita energy consumption in these countries is among the highest in the region and in some cases, the world. As of 2019, Qatar was the highest per capita consumer of energy worldwide at an average of 723 million British thermal units (MMBtu) per person.2 The only country in this sub-region with a smaller population is Bahrain, which ranked third globally. In fact, four out of the top ten per capita energy consumers worldwide in 2019 were GCC states, with Saudi Arabia and Oman (the remaining two in the bloc) taking places 12 and 13, underscoring the importance of per capita consumption relative to population growth. Data from the United States Energy Information Administration (EIA) indicates that despite its somewhat smaller population, in 2021 the GCC accounted for 55.8% of the region’s total primary energy consumption, followed by North Africa at 21.5%. Iran was the largest individual consumer in the region with 12.8% of the total primary consumption.3

Another key item for consideration is national energy policy, specifically energy subsidies, the sustainability of which may become a concern if population growth continues without corresponding fiscal and economic growth. Although subsidized sales of energy and other commodities are frequently associated with resource-rich states like those in the GCC, the practice of subsidizing energy sales is common across the MENA region, regardless of whether or not it is something a state can realistically afford. This has the effect of keeping energy prices, be they for electricity, natural gas, or transportation fuels, artificially low, causing demand to grow at rates often exponentially higher than they likely would if prices were set using a market-based system.

As an example, Egypt effectively abolished its electricity subsidies in 2016 and saw household electricity consumption fall the following year, although moderate growth has continued since 2019 and total power demand reached record levels in 2022, illustrating the limited ability of subsidy reform to act as a demand management measure when population growth remains strong.4 Egypt’s population is expected to continue growing rapidly, with an additional 15 million people added to its population over the course of this decade.5

Figure 2: Primary energy consumption in 2022 (Exajoules)

Another critical example of this dynamic is Algeria, where subsidized gas and power sales have led demand growth to surge, with domestic natural gas consumption exceeding 51% of the country’s total production in 2020.6 While it has since moderated somewhat, this type of unchecked demand growth may be strongly detrimental to the country, as its large gas reserves and proximity to Europe have led it to be seen as one among several regional producers that might provide the continent with additional gas resources via existing pipeline connections as a part of the search for alternate supplies to Russian gas, providing Algeria with a critical economic lifeline that few other sectors can match. Critically, this also holds the potential to reinvigorate upstream interest in Algeria’s oil and gas sector, but the sort of domestic demand growth described above may be viewed as a risk by international oil companies (IOCs). Though Algeria has little precedent of redirecting supply away from exports to the domestic market in times of a shortage, a similar trend that first emerged in Egypt in 2012-13 has reemerged a decade later, illustrating the very real operational risks posed by the subsidy policy. 7

Finally, one of the more difficult, non-energy variables to predict in this study will be the impact of climate change and extreme weather, both for their effects on energy demand and on the availability of specific energy supplies, such as renewable energy powered by solar and wind resources. Temperatures throughout the region are expected to keep rising year after year, subjecting the region’s inhabitants to some of the most extreme heat conditions on the planet. While this will certainly place upward pressure on electricity demand, more vulnerable states have already demonstrated that factors brought about by climate change may actually have the ability to constrain demand due to the damage potentially caused to infrastructure and economic activity.8 Additionally, the dependency of renewable energy on either solar irradiance (the power from the sun that reaches a surface unit per area) or minimum wind speeds to generate power may be affected by changing weather patterns in ways that are currently unforeseeable.9

Figure 3: Primary energy consumption by sub-region in 2021 (Quadrillion Btu)

Regional Supply Outlook

Most of the region’s major economies — and thus drivers of demand growth — are net exporters of hydrocarbons. Where there are exceptions to this general rule, countries such as Egypt still boast large domestic oil and gas industries. While Egypt still exports crude oil, refined products, and liquefied natural gas (LNG), difficulties managing its domestic energy markets have required it to import incrementally greater volumes of hydrocarbons, particularly natural gas via pipeline linkages to neighboring Israel.

As a result, a brief survey of the outlook for supply growth on a regional level is a necessary part of examining the overall trajectory of demand drivers, as the relative health of these industries will have profound impacts on a country’s energy demand in multiple ways. Developing new sources of supply or investing in the preservation of existing production will be crucial to ensuring that exporters retain global market share, which in turn funds national budgets that are in many cases closely linked to non-oil growth prospects, as well as subsidized domestic energy sales. Additionally, development of domestic resources and associated capacities contributes, in theory, to each country’s own energy security.

Perhaps the most important of the above is the ability of exporters to use these new sources of supply and their competitive advantages in global markets as an attempt to ensure long-term market share for these exports, which has also been termed “security of demand” by some scholars.10 For exporters, external demand security is linked to a steady flow of revenue that enjoys a greater degree of predictability. Where revenues can be reinvested in new production, be this traditional oil and gas production or development of renewable energy capacity, domestic energy security may receive considerable support. For oil exporters, these arrangements may take a variety of shapes. For example, the NOC of Saudi Arabia, Saudi Aramco, has long maintained a strategy of investing in overseas firms with sizeable downstream capacity, or partnering with them for greenfield refining and petrochemical projects. This is notable for the fact that these transactions are usually accompanied by agreements to supply a key asset with crude oil exports from Saudi Aramco, thereby locking down long-term demand in significant quantities.11 These agreements have enabled the NOC to secure between 1.01 million barrels per day (bpd) and 1.3 million bpd in long-term crude offtake.

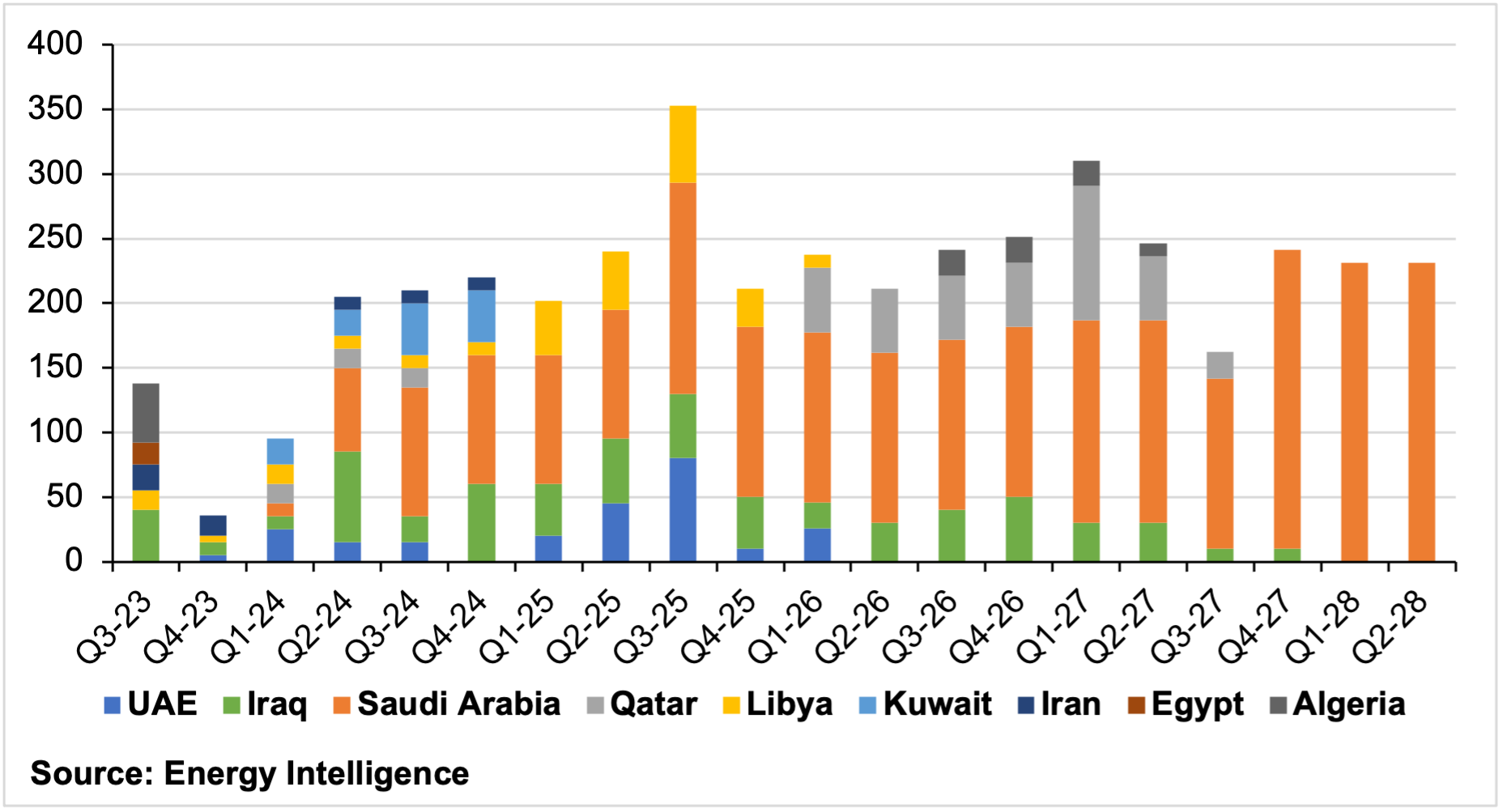

Oil Supply

Primary considerations for the availability of oil supply across the region will be both ongoing upstream expansions in the major producing countries of the Gulf sub-region and the potential for more minor upstream growth in other parts of the wider MENA region. Naturally, the main project to consider is the Abu Dhabi National Oil Company (ADNOC) plan to complete its expansion from 4 million bpd to 5 million bpd in 2027.12 Of the potential 4.28 million bpd in liquids supply growth from the Middle East identified by Energy Intelligence between late 2023 and mid-2028, Saudi and Emirati capacity gains are expected to account for 63% of this total figure, heavily underscoring the importance of these producers to global supply, and by extension to the security of supply across the broader Middle East. While supply growth in Saudi Arabia and the UAE will account for most of the region’s oil production capacity additions before 2030, discussion around the outlook for this additional supply is generally limited. Upstream work in both countries is proceeding on schedule at the time of writing, and in some cases has reached completion ahead of schedule.13 Both countries and their NOCs enjoy fiscal positioning that leaves little doubt as to their ability to fund these expansions, and in the case of Abu Dhabi, strong investor confidence in the oil sector leaves ADNOC with no shortage of willing international partners to support capacity growth.

Nearby, QatarEnergy (formerly Qatar Petroleum) is mostly focused on its upstream natural gas expansion, which will be covered in a subsequent section. Although the company is less focused on its liquids’ output, its expanded gas production is expected to provide a substantial increase to its output of condensates. Both phases of its North Field Expansion project are expected to add over 375,000 bpd in condensates to total production, pushing total output above 1.1 million bpd.14 Condensate production typically receives less attention than crude oil production, but its use as a feedstock for the production of jet fuel makes it highly valuable to the region’s massive civil aviation industry.

A recent example of this is QatarEnergy’s 10-year agreement with the Dubai-based Emirates National Oil Company (ENOC) to supply it with condensate volumes of up to 33,000 bpd.15 ENOC’s condensate splitters are mostly focused on jet fuel production to service demand from the civil aviation sector in Dubai, which is home to one of the world’s busiest airports, thereby making its status as a commercial hub critically dependent on its ability to ensure the security of its jet fuel supply.16 This dynamic is not limited to Dubai alone, and while intra-regional politics previously made such an arrangement untenable, recent diplomatic progress in this realm has improved the outlook for the regional trade in oil and refined products.

Figure 4: Upstream capacity growth (‘000 bpd)

The majority of additional oil and gas production capacity will likely facilitate continued exports to what producers view as key growth markets across Asia. The economic growth across the MENA region itself, combined with the potential for production declines in other regional states, would likely mean that the intra-regional oil trade and broader trade in liquids will increase. It is also true that the aforementioned agreement between ENOC and QatarEnergy is likely to be an early example of at least one way that regional trade can both broaden and deepen. Data from commodities intelligence firm Kpler suggest that the regional liquids trade surged in 2017 and has remained elevated since, with flows of crude, condensate, and refined products remaining above 1.2 million bpd for the better part of five years, with 2020 being a significant exception.17

Other states in the region are seeking to expand upstream oil production capacity, yet their ability to achieve this is less certain than the expected gains coming from Saudi Arabia and the UAE. Formidable and consistent government cohesion in the aforementioned countries, combined with strong state backing for upstream growth and a highly attractive and competitive resource base, all support the strong supply growth outlook. Yet in other major regional producers, the trajectory of targeted supply growth is much less certain.

Elsewhere in the Gulf, Kuwait’s oil sector is frequently viewed as something of a laggard relative to those of its regional peers. Despite having one of the largest oil production capacities within the Organization of Petroleum Exporting Countries (OPEC) and OPEC+ (10 additional oil-producing countries), Kuwait’s sector is notorious for chronic project delays and, until recently, significant losses to its production capacity, amounting to a staggering ~570,000 bpd in 2021.18 19 However, progress has reportedly been made in reversing these losses, with officials claiming an upstream rebound from a low point of 2.6 million bpd back to 2.9 million bpd, with a further 300,000 bpd in growth expected to push capacity to 3.2 million bpd by 2025.

This is perhaps why more recent targets are notable for their modesty relative to previous goals, which were often highly ambitious and involved lengthy time horizons.20 Relative to these unrealized aspirations, targets such as increasing oil production by about 450,000 bpd in a four-year period seem much more likely to be realized. If these targets can be reached, they may pave the way for further incremental growth in years to come. However, the likelihood of Kuwait reaching its stated goal of 4 million bpd by 2035 will be highly contingent on its ability to successfully post near-term oil sector growth.21 Energy Intelligence’s upstream project tracker has identified just one sanctioned project that will likely result in 120,000 bpd in liquids gains, though the balance of Kuwait’s targets may be accounted for by projects whose details are yet to be disclosed.22

Such near-term progress is less contingent on the ability of those working in Kuwait’s oil sector than on the structural factors that have prevented realization of previous goals and precipitated capacity losses. These factors very much remain present in Kuwait, forcing most analysts to adopt something of a “wait and see” approach when it comes to progress in the oil sector. Political volatility is a key consideration, as this has resulted in high turnover among oil sector leadership. Kuwait reappointed its oil minister three times in 2023, and appointed Emad al-Atigi to the role in early 2024, although he was retained after the dissolution of parliament later that year.23 24

A possible justification for cautious, near-term optimism has been recent progress in the downstream segment. Long-delayed refining and petrochemical projects, such as the major 615,000 bpd al-Zour refinery, have recently been completed.25 While these projects are managed by separate state-owned subsidiaries in the oil sector, their completion ostensibly frees up capacity at the Kuwait Petroleum Corporation (KPC), the umbrella organization that oversees the entirety of the country’s oil operations. Yet other structural obstacles will remain; cuts to KPC’s budget in 2023 may still cast some shadow of doubt on Kuwait’s ability to reach these goals, which hold the potential to limit gas supplies that Kuwait would then need to import, or turn to liquid fuels to ensure sufficient generation capacity, thus illustrating further how supply factors seemingly unrelated to national demand in a major oil-exporting country may affect demand trajectories.26

While Saudi Arabia and the UAE have strongly positioned themselves to lead most of the region’s crude supply growth over the course of this decade, other producers have exhibited chronic difficulties increasing their production for a variety of reasons. Kuwait’s political volatility, combined with an upstream sector that is closed to international investment, can hardly be viewed as a formula for success, and there is little likelihood of significant change to this model on the horizon. Kuwait’s Emir Sheikh Mishal Al Ahmad Al Sabah, who ascended the throne in late 2023, is widely seen as a guardian of the status quo that has ostensibly resulted in many of the difficulties now faced by the country’s oil sector.27

Iraq’s status as OPEC’s second-largest producer behind Saudi Arabia is a distinction it has been able to retain against seemingly significant odds, despite the usual challenges associated with its ability to expand oil production. The Iraqi oil sector has been wracked by over a decade of armed conflict and struggles to attract new upstream investment due to commercial terms that are notoriously unattractive to IOCs. The string of attempts to exit the country by major IOCs like ExxonMobil has cast something of a dark shadow over the sector, though the recent closure of a deal for an integrated mega-project operated by French major TotalEnergies may signal a reversal in fortunes, if the projects can be implemented.28 Baghdad’s long-term, lofty targets are mostly unlikely to be realized; its 2027 target of between 7 million and 8 million bpd would require a massive level of investment that is highly unlikely to materialize without a drastic change of circumstances throughout both the Iraqi oil sector and the wider Iraqi operating environment itself.29

Yet the recent vote of confidence from Total, which envisions an oil production increase of 125,000 bpd, in addition to a long-delayed project that would supply 5 million bpd of seawater for injection at maturing fields (a technique used to reverse production declines) holds some potential, albeit limited, to at least slow declining investor interest in Iraq’s oil sector. While this is critical for Iraq due to its extremely high dependency on the revenues it earns from oil exports, it is perhaps more critical to reinvigorate interest in its downstream sector. Iraq’s refining fleet has long produced excess volumes of fuel oil, which does not attract high value once exported. The inability to produce sufficient quantities of transportation fuels from its domestic industry has somewhat ironically forced Iraq to import refined products, especially gasoline, at international market rates, which it then sells domestically at subsidized prices (and thus at a loss).30 As the majority of these imported volumes are sourced from the UAE and Oman, this also emphasizes previously made points on the importance of supply growth to the intra-regional trade in oil and refined products.31

Iraq’s struggle to secure the investment needed to spur oil production growth comes from its reliance on IOC partnerships with state-owned firms. Other producers in the region such as Egypt and Algeria (though the latter has seen something of a reversal of fortunes since 2022) have similarly struggled to attract investment that has either led to production declines or difficulties maintaining current capacity levels. What each of these three states has in common with respect to difficulties growing oil production is that their fiscal terms have for years been viewed as unattractive for IOCs, leading to consistent declines in production, or have eroded investor confidence in the country’s upstream to such a degree that significant declines appear imminent without a near-term influx of investment in the oil sector.32

This may in turn have the potential to exert downward pressure on demand for refined products in some countries, particularly in the event that high volumes of crude or refined products may themselves need to be imported. As mentioned above, this dynamic has already emerged in Iraq, with the devaluation of the Iraqi dinar exacerbating the problem due to high-priced, dollar-denominated fuel imports.33 Although Egypt’s downstream sector has fared better than Iraq’s, it oscillates between being a net importer and net exporter of refined products, and the sinking value of the Egyptian pound in combination with state subsidies for fuel sales has the potential to considerably erode state finances and foreign exchange reserves.34 Egypt nominally moved to eliminate subsidies on transportation fuels like gasoline and diesel in 2019, but implementation of a pricing mechanism intended to move retail fuel rates closer to market prices has been sluggish in practice. This effectively means that, despite significant increases in prices, Egyptians still purchase transportation fuels at a significant discount, with the difference being borne by Cairo’s balance sheet.35

Natural Gas Supply

The outlook for upcoming gas supply is mixed, though the MENA region’s share of global gas production is only expected to grow, likely through ongoing major upstream expansions. Accordingly, the GCC states that are expanding their upstream gas production are doing so in a manner consistent with policies that seek both the security of domestic supply and the demand security mentioned at the outset of the study. Saudi Arabia, which is already self-sufficient in natural gas, continues to support development of unconventional and non-associated gas reserves to ensure the ongoing security of domestic supply, but will additionally seek to direct gas resources toward higher-value applications like petrochemical production, and to a lesser extent, production of blue hydrogen and ammonia.

For MENA states outside of the Gulf, prospects for significant growth in regional gas suppliers are less linked to the more secure, state-backed investment underpinned by NOCs with world-beating balance sheets and are more dependent on the abilities of host governments to attract significant new levels of upstream investment from IOCs. Despite expectations that the Russia-Ukraine war would facilitate greater upstream investments in North Africa and the Eastern Mediterranean, significant supply growth, or commitments to support it, has been fairly slow to materialize. Algeria is likely to benefit the most from this dynamic, due in part to reforms made to its hydrocarbons law that have been implemented in phases beginning in 2019. In Egypt, issues with managing local demand and high decline rates at major gas projects have resulted in a much greater degree of apprehension from IOCs, despite persistent interest in using Cairo’s offshore infrastructure and liquefaction capacity to facilitate exports from gas production in neighboring countries like Israel and Cyprus.36

These dynamics point to a stark contrast in outlook for demand growth between those countries in the region that appear poised to successfully develop their local resources, and in most cases, those that have already done so.

The supply of associated gas in Saudi Arabia and the UAE will increase along with each state’s respective upstream oil expansions, in addition to non-associated and unconventional resources that each plans to develop. Saudi Aramco, which, as in the case of oil production, dominates the kingdom’s upstream gas sector, has stated that it plans to grow production by between 50% and 70% by 2030, with most of its gains to be sourced from the Jafurah unconventional gas project, where it expects production to reach 2 billion cubic feet per day (Bcf/d) by 2030.37 Other gains in associated gas production are expected to come from oil capacity expansions currently underway at its offshore fields.

The UAE is targeting “self-sufficiency” in natural gas by 2030, and while it does not specify the exact production level at which it expects to accomplish this, there is little doubt among industry observers that it will be able to achieve this goal.38 The UAE currently imports LNG at a floating storage and regasification unit (FSRU) in Dubai on a seasonal basis, while approximately 25% of its total demand is met by imports from Qatar via the Dolphin pipeline.39 It is unlikely to be a coincidence that the agreement for these imports will expire in 2032.40

Development of non-associated and unconventional gas resources is a strategic priority for Saudi Arabia and the UAE due to their major production role in OPEC/OPEC+, which sees the spare capacity of each country occupy a critical position in the alliance’s market balancing strategies. OPEC+ cuts have played a major role in oil markets in the space of the last decade, and output reductions are typically led by Saudi Arabia and to a lesser extent the UAE. Yet a frequently overlooked consideration is that the availability of associated gas, which is extracted from oil reservoirs, is reduced in tandem with oil production cuts. This had previously linked the security of each country’s gas supply to OPEC/OPEC+ policy, and in the 1980s even resulted in gas shortages in Saudi Arabia.41 As a result, developing non-associated gas resources has worked to decouple the link between either country’s oil production levels and available gas supply, thereby supporting energy security with greater assurance that gas supplies will not be interrupted.

Of course, it would be impossible to discuss expanding natural gas production in the region without mention of Qatar’s North Field expansion project, which is being managed by QatarEnergy. Upon completion in 2030, it will catapult Qatari liquefaction capacity from its 2023 size of 77 million tons per annum (mtpa) to 142 mtpa and ensure that the small Gulf state remains a major player in global LNG markets for the foreseeable future.42 43

Although there are few LNG consumers in the MENA region, Qatar’s expansion still enables it to play an important role as a regional supplier by ensuring security of supply for the Dolphin pipeline, which exported 20 billion cubic meters (bcm) to the UAE and on to Oman in 2022.44 Additionally, the startup of operations at Kuwait’s 22 mtpa al-Zour LNG terminal in 2021 allowed Kuwaiti LNG imports to rise to 1.5% of total volumes imported on a worldwide basis the following year, almost 50% of which it sourced from Qatar at a level of 3.9 bcm.45 Although importing LNG as a major oil and gas producer may be far from ideal, Kuwait’s exposure to a nearby, friendly, and low-cost LNG source will certainly support its energy security and provide some insulation from gas market volatility when its import needs are high.

Greater availability of supply from Qatar may lead to further growth in the regional LNG trade. It is unlikely that countries like Egypt, which was previously a seasonal LNG importer, are viewed by Qatar as a target market, with QatarEnergy instead likely to prefer buyers with better prospects of steady, long-term growth such as India and others in South Asia. Yet Egypt has become ever-more reliant on neighboring Israel to service its demand growth, and without any major domestic projects that will raise gas production in the near term (examined in the next section), turning to other regional suppliers may eventually become one of Cairo’s best options. As recently as 2022, Iraq, which has never imported LNG in its history, expressed possible interest in importing Qatari LNG as well.46

The outlook for gas supply in the Levant and North Africa varies significantly from country to country. While the offshore gas resources of the Eastern Mediterranean have generated significant enthusiasm in recent years, especially in the aftermath of Russia’s invasion of Ukraine and the push by many European states to replace imported volumes of Russian pipeline gas and LNG, the pace of development in this region has been somewhat underwhelming. Still, further integration of regional gas markets remains a distinct possibility, given the unclear prospects for long-term gas demand in Europe. Additionally, the reluctance of some IOC operators to rely on Egyptian liquefaction capacity, given Cairo’s history of diverting gas to its domestic market in times of shortage, may also stall exports from the region. The development of new LNG export capacity is a time- and capital-intensive process, and options for building new capacity outside of Egypt are highly limited, constraining the options for new, alternate export routes from the region.

Israel currently holds the most potential to continue delivering new gas supply on a regional basis.47 While the prospects for substantially greater volumes of LNG exports from the region to European markets are currently questionable, this has done little to dampen international enthusiasm for entry into the Israeli upstream. Chevron’s 2020 acquisition of US-based Noble Energy marked the inaugural entry of a major Western IOC into Israel’s offshore gas sector, and an agreement between Israel and the UAE to normalize ties with one another the same year paved the way for Abu Dhabi sovereign wealth fund Mubadala to clinch a 22% stake in the Tamar gas field, although this was later halved to 11%.48

Security risks are likely to remain a consideration with respect to Israel’s upstream operating environment, especially following the outbreak of a major war between Israel and Hamas in the Gaza Strip after Oct. 7, 2023, which was still ongoing as of December 2024. But the conflict has not yet presented a fundamentally different set of risks aside from those that were already known, meaning that the outlook for upstream growth in Israel (and by extension the potential for supply to neighboring Egypt and Jordan) has been minimally affected by the war.49 The results of Israel’s fourth offshore bid round (OBR4) were announced in late October 2023, with several new major IOC entries into the Israeli gas sector.50 Although the bids would have predated the conflict and no exploration activity is officially required to start for at least three years, there have not been any public statements from the consortia receiving the awards indicating these firms are deterred from future exploration activity in the Israeli offshore. Although ADNOC had also been in negotiations to enter the Israeli upstream through a partnership with BP to acquire a 50% stake in NewMed Energy (formerly Delek Drilling), which holds stakes in major Israeli gas fields as well as other assets in Cyprus, no such agreement has materialized.51 This may be an indicator that the conflict will serve as an obstacle to further regional integration of the oil and gas industry between Israel and Arab states with which it has signed normalization agreements, but it is also highly likely that political considerations ultimately added to obstacles the parties were already facing in commercial negotiations.52

While Egypt has long boasted the presence of major IOCs both on and offshore, it has struggled to retain interest in recent years, and fairly bearish sentiment on exploration prospects in Lebanon (addressed in a later section) places enthusiasm for Israel’s upstream sector in stark contrast to its neighbors. This level of interest certainly does not guarantee massive volumes of new supply, which would be unlikely to materialize at a significant level before the end of the decade, assuming future exploration successes.

Yet even without new discoveries, new supply from Israel is essentially a foregone conclusion at the time of writing. The Chevron-led consortium that operates the Leviathan gas field — the largest in Israel — took a final investment decision (FID) on an expansion that will see the field’s output rise 200,000 cubic feet per day by 2025, while the consortium that operates the Tamar field has sought to boost production to 1.6 Bcf/d by the same year, although the outlook for this project is slightly less certain as it is geared toward higher export volumes to neighboring countries.53 Israel’s current export policy essentially reserves 60% of available supply for domestic consumption, while the remaining 40% will be exported. Proposed changes to this policy would essentially reverse the current ratio, allowing for export of up to 60% of supplies, for which the operators in Israel’s upstream appear enthusiastic.

One obstacle to further integration of regional gas markets supported by Israeli supply may come in the form of the composition of Israel’s current government. Some cabinet members have previously raised questions about changes to export policy, and the ongoing debate essentially sees those in favor of higher export volumes fearful of stranded asset risks and erosion of the strong enthusiasm for investment in Israel’s gas sector.54 Opposition to a relaxed export policy generally centers around energy security concerns and arguments that lower supply would raise domestic energy prices, though this dynamic is somewhat more nuanced as a reduced appetite for upstream investment would also have the potential to result in lower volumes of supply. Political volatility stemming from Israeli anger over the security failures that preceded the attacks of Oct. 7, 2023, and the ongoing hostage crisis may also generate uncertainty within Israel’s energy policy landscape, which had already persisted due to the number of elections the country had held in recent years.

Yet most industry observers expect a broadly amenable approach to higher export volumes from Israel, as its industry demonstrably continues to attract new interest, and as discussed in the central section of the study covering demand, natural gas demand prospects in the region are almost universally bullish well beyond the end of the current decade. A key indicator that is particularly supportive of this dynamic was the impact of the Tamar gas field shutting down for nearly a month at the outset of the conflict, which initially resulted in a collapse in gas flows to Egypt. The ensuing shortfall underscored Cairo’s dire need for Israeli pipeline gas in the absence of new domestic supply, as its only alternative would be to turn to more expensive LNG imports. Likewise, Jordan has also been insulated from the need to import LNG due to its access to Israeli supply, although between the two, Egypt by far represents greater potential demand growth. While it is quite likely that domestic politics may produce opposition to greater imports of Israeli gas, neither Cairo nor Amman currently has imminently available, cost-effective alternatives, pointing to a near-term trajectory in which Israeli supply likely has a growing role to play in servicing this demand growth.

While Algeria is not a major exporter of natural gas to other countries in the MENA region, its domestic consumption is a significant driver of wider MENA demand, and being self-sufficient in gas means that the security of its domestic supply is paramount to the outlook for Algerian demand growth in the remainder of this decade. Algeria emerged as one of the most likely alternative sources of gas supply for the European market in the aftermath of the Ukraine crisis, and this factor combined with its reformed hydrocarbon law has been advantageous to its ability to attract new upstream investment.55 In 2022 its NOC, Sonatrach, signed major agreements with the large operators already present in the country, which chiefly consist of Eni, TotalEnergies, and Occidental Petroleum.56 In mid-2023, it signed further agreements with Indonesia’s Repsol and Pertamina, signaling that the interest in developing Algerian supply appears set to continue.57 Sonatrach plans to allocate 75% of its $40 billion, five-year spending plan to upstream exploration and production, which mainly focuses on natural gas.58

Algeria had previously announced plans to hold a new bid round in 2023, which would likely be the most serious gauge of international interest in its upstream sector to date, and would reveal important indicators on future prospects for greater gas supply from the country.59 To be sure, recent agreements that will provide fresh investment in Algeria’s oil and gas sector do much to brighten the outlook around Algerian gas supply, but announcements carrying such a degree of significance that are not met with any subsequent action somewhat depress the outlook for substantial supply growth, as well as more generally proactive announcements in areas such as badly needed development in the renewable power sector (for which many of the same authorities are responsible) and growing concerns around the country’s ability to manage surging gas demand growth year-to-year.

The Energy Institute figures pointed to Algerian gas production reaching 9.5 Bcf/d in 2022, and despite representing a 2.9% decline in production from the previous year, this was attributable partly to the tapering of OPEC+ cuts in 2022.60 Algeria reinjects a portion of its natural gas production for enhanced oil recovery (EOR) purposes, and as a result the need to produce more oil in compliance with its OPEC+ quota therefore reduced its available gas supply. The effects of this were also visible in gas consumption, which fell 7.2% in the same year to 4.3 Bcf/d. However, this does highlight a growing problem for Algeria. Consumption in 2022 represented 45% of its total production, whereas a decade ago in 2012 this ratio was closer to 38%. Supply growth ostensibly represents a strong energy security guarantee for the Algerian gas market in the coming years, but Algeria’s relative complacency in managing demand growth holds strong potential to seriously constrain exports (in a similar manner to what has taken place in Egypt). Given the centrality of hydrocarbon exports to the Algerian economy, a limited ability to export gas to key markets holds the prospect to limit economic and thus energy demand growth in Algeria years into the future. Incremental new gas supply may mitigate this impact prior to 2030, but a lack of long-term steps to manage rapidly growing demand will only see this problem worsen going forward.

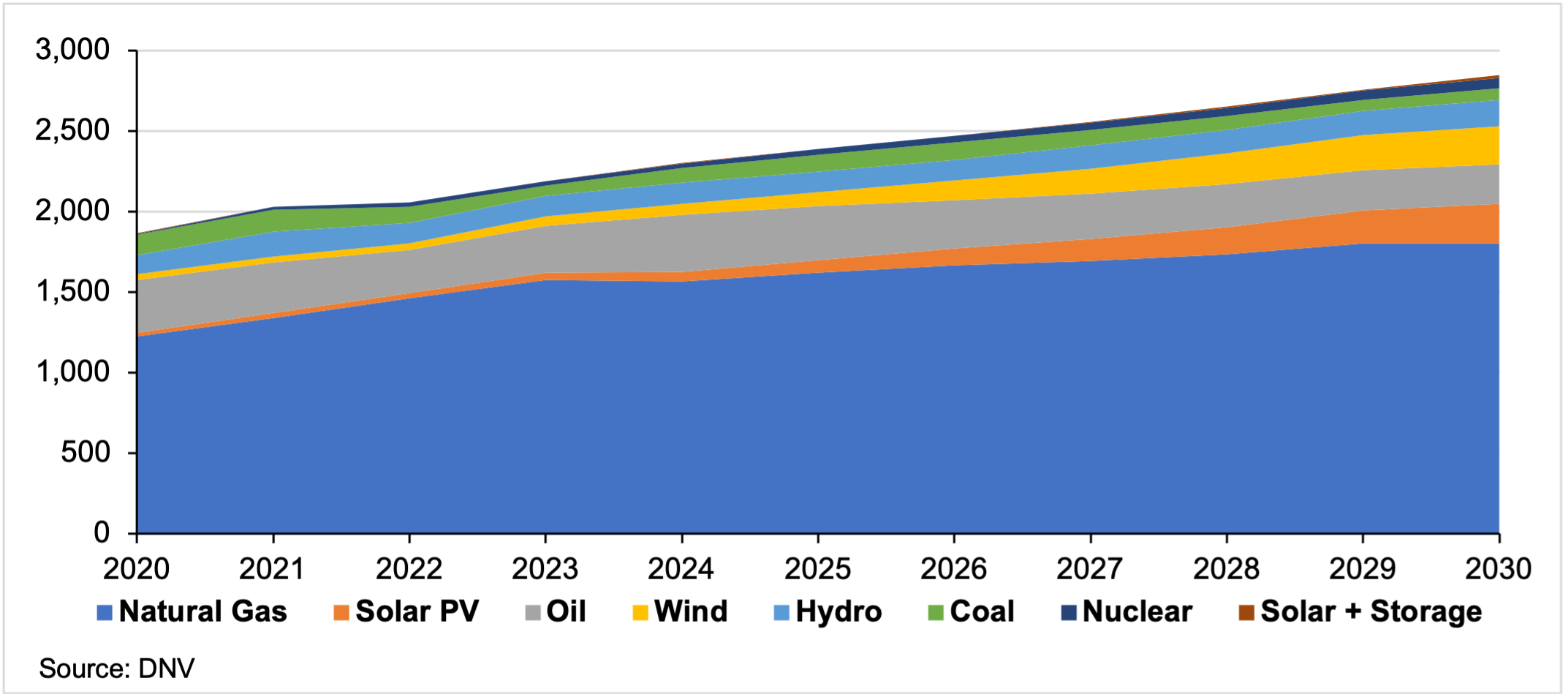

Figure 5: MENA power mix evolution (TWh/yr)

Electricity and Renewables

As with many other variables examined in this study, renewable energy growth across the region is widely varied despite almost all countries having strong renewable power potential, especially in the field of solar photovoltaic (PV) power but also, to a lesser extent, onshore and offshore wind. However, according to the International Renewable Energy Agency (IRENA), investment in fossil fuel energy was 28 times higher than investments in renewable energy during 2022, which points to a significant lag in regional investment despite progress during the last decade. From 2015 to 2020, most investment in the region was, unsurprisingly, geared toward upstream oil and gas, with downstream investments running in second and fossil fuel power generation accounting for the remainder. Even though fossil fuel power generation represented the smallest category for investment in the hydrocarbon sector, it was still significantly greater than that for renewable power.

IRENA points to fossil fuel subsidies, which make up 1.56% of MENA GDP on average, as a critical driver of this dynamic.61 MENA countries’ ability to, in most cases, continue providing low-cost or locally produced feedstock for this method of power generation is likely viewed as something of the “path of least resistance” to support energy security despite the long-term implications of highly subsidized energy sales. Yet the same report also notes that 39% of capital directed toward renewable energy investment in the MENA region from 2013 to 2020 originated from international sources. This dependency somewhat blurs the outlook for external financing in the region, which is more likely to impact countries outside the GCC, such as Egypt, where external financing for renewable power has been critical to Cairo’s progress developing its capacity. By contrast, Gulf capitals have shown signs of marshalling ever-greater state resources to support energy strategy targets, which include developing renewables and more conventional power generation sources.

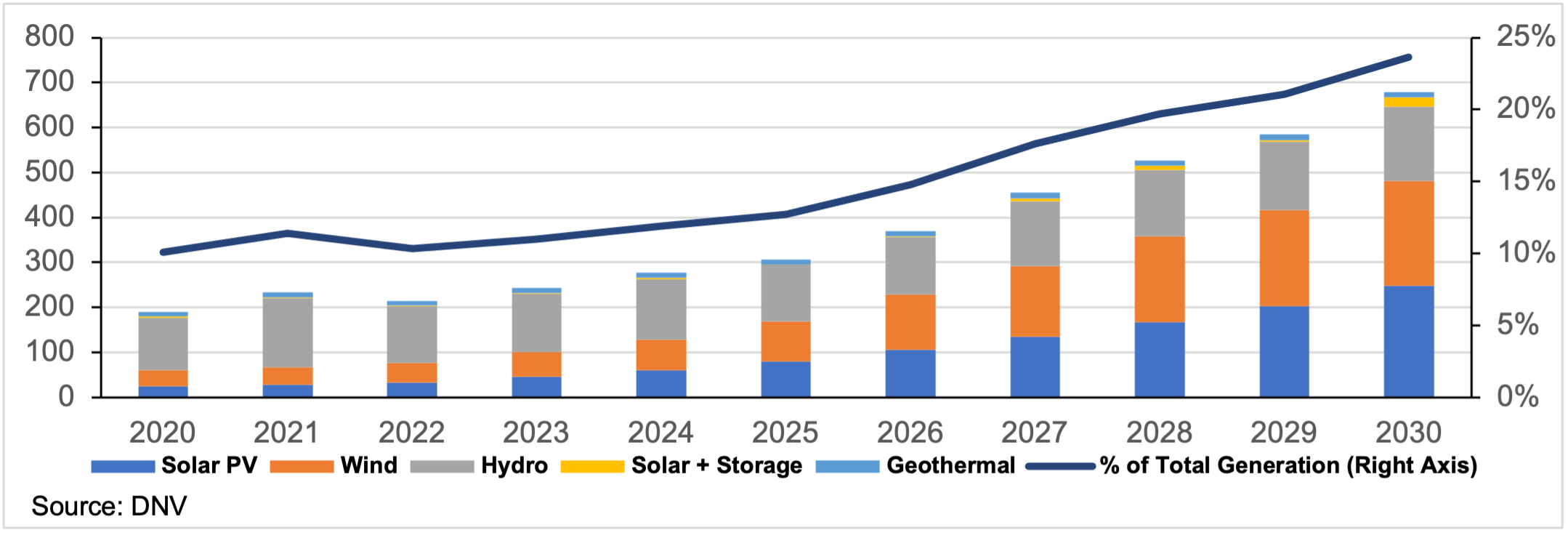

Notably, projections from Det Norske Veritas (DNV) do point to exponential regional growth for onshore wind and solar PV for 2020-30, especially in the second half of the decade.62 The same figures suggest power generation from renewable sources will reach close to 23.7% of the region’s power mix by 2030. The majority of this is made up of solar PV and wind sources, although around 24% of total renewable power generation in this scenario is represented by hydroelectric power generation.

Figure 6: MENA renewable power growth (TWh/yr)

Similar to that of the wider MENA region, the pace of renewable energy development across the GCC has been somewhat uneven. Saudi Arabia, the UAE, Qatar, and Oman have all made varying degrees of progress in developing renewable power capacity, while Kuwait and Bahrain appear to lag significantly by comparison. Though economic and fiscal positioning also varies across the GCC, its member states all share relatively similar incentives for developing their capacity, not least of which is access to abundant and low-cost solar power resources, in addition to wind resources in the cases of Saudi Arabia and Oman. The development of low-cost solar resources on a scale that displaces as many hydrocarbons from the regional power mix as possible would undoubtedly benefit Gulf producers due to the fact that subsidized electricity sales are still common in the GCC sub-region. The initial cost of developing utility-scale power projects has fallen considerably in recent years, and the lack of any associated fuel cost with this form of power generation would in theory help Gulf policymakers avoid the need to drastically increase the rates at which power is sold to domestic consumers. This would potentially mitigate the need for unpopular subsidy reforms that would translate into increased living costs for citizens long accustomed to artificially low electricity prices.

Additionally, recent adoption of highly ambitious targets for “clean” hydrogen production is very likely to see targets around renewable power capacity increase. While there is substantive, necessary debate around what constitutes “clean hydrogen,” for the purposes of this study these will be viewed as both blue and green hydrogen, given the categorization regional producers are expected to use in determining their targets.

Where green hydrogen and its impact on power demand is concerned, a key question surrounding this issue pertains to the ways in which states plan to tender or otherwise plan the development of green hydrogen production capacity. Thus far, it appears likely that Gulf states will tender both renewable power and electrolyzed capacity either in tandem or in an arrangement similar to the hydrogen “valley” or “oasis” framework that was revealed in Abu Dhabi’s draft hydrogen strategy during 2022.63 This essentially entails electrolyzed capacity being developed in a designated plot of land that will then be supplied with power and water by captive renewable energy and desalination capacity developed for each specific site. This would provide a clearer outlook for emerging supply sources given that associated infrastructure would function independently from the UAE’s power grid and water infrastructure. Though this has not yet been finalized as an official policy, the UAE’s updated energy strategy from 2023 does mention hydrogen “oases.”64

Oman has taken a somewhat similar approach with the development of specific areas of the country designated as regions for green hydrogen production using both wind and solar resources. Its national target of up to 1.5 mtpa in green hydrogen production is expected to require up to 20 gigawatts (GW) of renewable power capacity and 15 GW of electrolyzed capacity being tendered for green hydrogen projects.65 Although some awards had been made before the development of its current strategy and regulatory framework, most projects are likely to be developed from auctions held by Hydrom, a state-owned firm that has been set up to manage Oman’s nascent hydrogen sector.66

As with much of the rest of the region, progress developing renewable energy capacity in North Africa has been uneven. While Egypt and Morocco stand out as regional leaders in deploying renewables with a considerable pipeline of upcoming wind and solar projects, Algeria and Libya have some of the region’s greatest solar power potential due to high solar irradiance and large surface area, much of which is uninhabited and ideal in many ways for large-scale solar power capacity. In the case of Libya, the country’s long-running conflict and political volatility are clearly the main obstacles to renewable energy growth, in addition to the continued monopoly its state utility holds on the entire electricity value chain (covered in a subsequent section).

As with Algeria’s oil sector, struggles attracting foreign investment are a key contributor to the lack of renewable power capacity in the country, although there are some limited signs of this dynamic changing. In the long term, Algeria sees itself eventually becoming a major supplier of green hydrogen to Europe using its vast solar power potential and existing natural gas pipeline connections to European markets.67 Yet these designs should not be viewed as highly likely to materialize in the long term, given questions about the development of global hydrogen markets, the ability of Algerian pipelines to transport hydrogen gas on a technical basis, and most importantly, Algeria’s lack of almost any substantial solar or other renewables capacity at the time of writing. Still, if Sonelgaz (the state utility firm) can successfully award and advance the tender it has issued for 2,000 megawatts (MW) in solar capacity, it may signal a jump-start to what has otherwise been an underwhelming renewables program thus far.68

Demand Outlook

Overview

On a broad scale, forecasters expect the countries that make up the MENA region to post significant growth in primary energy demand by 2030. Demand for oil products, addressed in the subsequent section, is expected to undergo moderate growth until the end of the decade, but primary energy demand will be driven most strongly by consistent increases in natural gas consumption. Final energy consumption looks set to receive much of its support from higher electricity demand, although much of this segment will be accounted for by gas-fired sources of power generation. This section conducts a major review of the anticipated trends in overall demand growth from the MENA region across oil, natural gas, and electricity. As many of the factors driving demand growth differ by sub-region and individual countries, especially in relation to overall scale, a subsequent section will attempt to give a closer review of demand growth on a country-by-country basis.

According to BP’s 2023 Energy Outlook, the Middle East was predicted to see primary energy demand growth of less than 1.0% per year for the period 2019-50, which is down from more rapid growth of over 4% per year during the past two decades. Its outlook expects this to result in cumulative primary energy demand growth of between 20% and 30% by 2050.69 Yet it should also be noted that none of the scenarios in BP’s outlook reveals when it expects most of this growth to take place, obscuring its views on demand growth during the remainder of the current decade relative to that of the 2030s and 2040s.

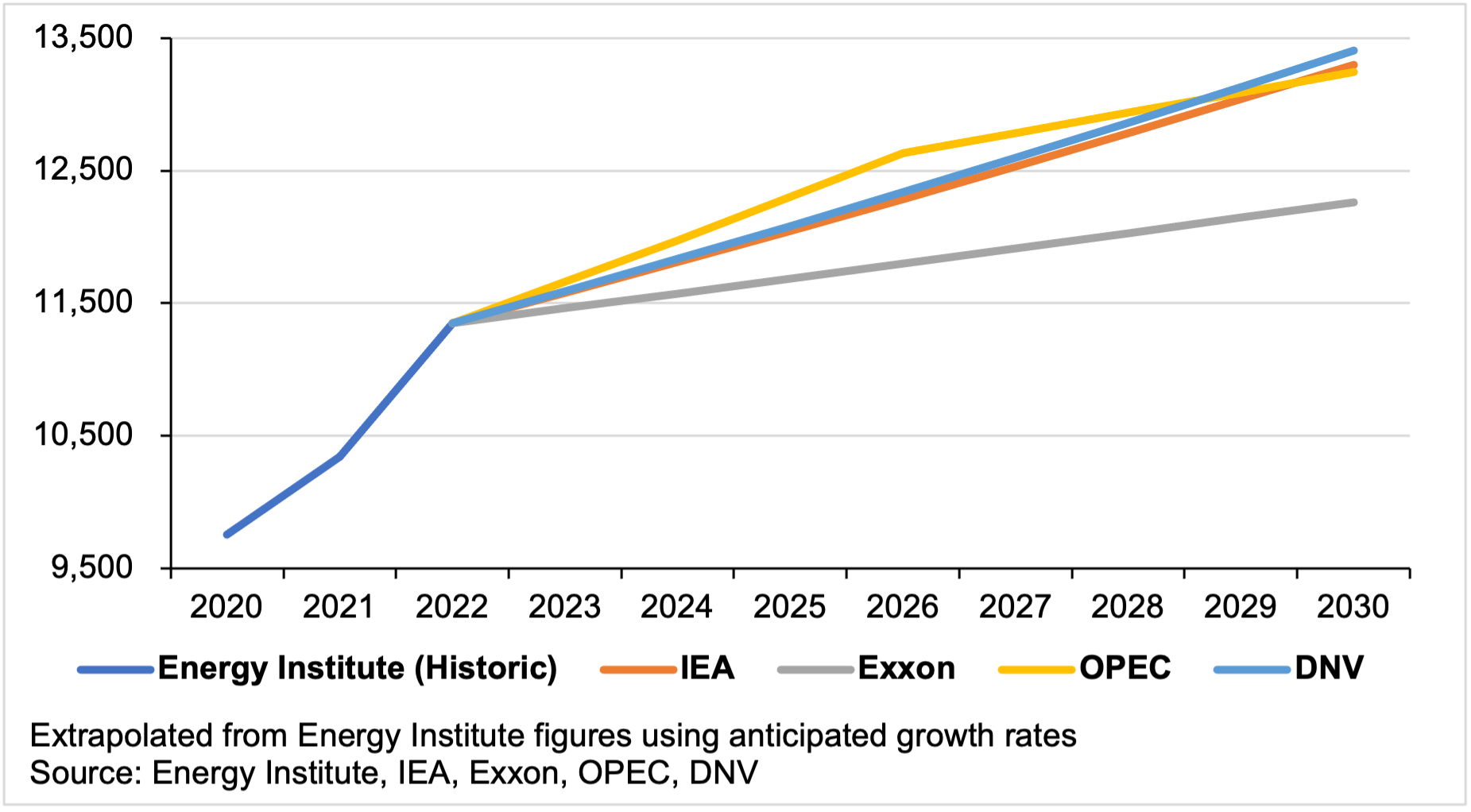

The International Energy Agency (IEA) anticipates that the region’s final energy consumption will grow by 22% between 2020 and 2030, and by segment most of this increase is expected to come from buildings at 37%, followed by industry at 31%, and transportation at 21%. This constitutes an overall rise of 5.1 exajoules, but despite the building segment posting the largest percentage gain during the forecast period, the industrial sector is expected to account for the majority of the increase at 3.0 exajoules, or nearly 60% of total expected growth.70 ExxonMobil’s energy outlook foresees a fairly similar growth rate, with a 22.8% total increase in final energy consumption by 2030 across the region, a number which is inclusive of 37% growth in electricity demand — significantly more bullish than the IEA’s expectations of a 29% increase.71 Nonetheless, while the forecasts considered in this study contain divergent outlooks on the sources and levels of growth used in their various scenarios, their views tend to converge around the strong trajectory of electricity demand growth fueled by natural gas and renewable generation sources.

These increases will likely be supported by highly ambitious economic growth strategies across the GCC sub-region, especially in Saudi Arabia and the UAE, combined with anticipated population growth and continued energy subsidies around the MENA region as a whole. Oil demand is expected to continue rising at a more modest pace, with most of its gains attributable to the transportation sector, though expansion in the petrochemicals industry will be a crucial driver. Oil-fired power generation is expected to experience a major decline by 2030, although it will still account for a considerable share of the region’s generation mix.

Additionally, investment in renewable energy resources is expected to grow, with solar PV resources and to a lesser extent onshore wind set to post exponential growth during the remaining years of the current decade. While growing power demand will not act as a specific driver of renewable power growth, renewable energy enjoys significantly greater policy support across the region than it has in the recent past, although there are still significant hurdles remaining to many countries exploiting the extent of their regional renewable power potential. In some cases, gains have been slow to materialize even in countries that ostensibly have adequate resources to support additional capacity, and in spite of solar PV boasting some of the lowest generation costs worldwide in the MENA region.72 The delay in advancing more significant development of the sector is likely to explain forecasts that do not see renewable power generation growing to account for a major share of the generation mix until after the current decade.

The diversity of governance structures and practices as well as the range of economic circumstances found throughout the MENA region require a differentiated approach to exploring the major factors driving or constraining energy demand growth, as a variety of unique variables will alter demand prospects to the up or downside. On a region-wide basis, however, primary energy consumption is broadly expected to make significant gains by 2030, but growth is likely to be slower than during the previous decade.

On a country-by-country basis in 2023, Iran is the largest total primary energy consumer in the region, though it is closely followed by Saudi Arabia, whose economy is not subject to economic sanctions or the same level of political and economic isolation that Tehran is currently experiencing. Perhaps unsurprisingly, the UAE occupies third place, though its consumption is approximately half that of Iran and Saudi Arabia. Most data point to the vast majority of the region’s primary consumption being sourced from oil products and natural gas.73

Throughout the region, the subsidized sale of refined oil products, natural gas, electricity, and water are some of the foremost drivers of energy demand. The ability to provide these subsidies is also closely linked to cheaply available local supply. As the GCC resource base enjoys some of the lowest production costs worldwide, it should perhaps be no surprise then that in an IEA list of the top 15 countries for per capita fossil fuel subsidy spending from 2021, the first five countries are GCC states.74 Though the data points to a wide range of subsidy spending, Qatar topped the list at over $2,300 per person, while all other GCC states (with the exception of Oman, which was not included due to lack of data availability) spent over $1,000 per person on fossil fuel subsidies. The other MENA countries on the list were Libya, Iran, and Algeria, which ranked 7th, 9th, and 14th, respectively. Outside of the low-cost, abundant resources available in the GCC region, it is no coincidence that these three other producers are countries that, despite some constraints, are typically able to guarantee abundantly available local supply.

Oil and Liquids Demand

Most forecasts for regional oil demand point to a moderate growth trajectory, which is likely due to an increasing reliance on natural gas for power generation (covered in a subsequent section). However, it does appear likely that regional demand for oil and refined products will continue to grow until the end of the decade in a signal that the region’s consumption patterns will likely deviate from global trends that expect to see declining use of oil toward 2030. Along with energy subsidies, the aforementioned growth in regional supply is also likely to support this trend. Although long-term, global market share anchors much of the logic surrounding massive upstream oil growth, regional consumption patterns suggest that security of local supply will doubtlessly represent an added benefit consideration for the MENA region.

Figures from DNV suggest oil demand growth of about 16% from 2021 to 2030, which is relatively consistent with figures from OPEC that currently project 20% growth in oil demand for non-Organization for Economic Cooperation and Development (OECD) states at just under 4.5 million barrels of oil equivalent per day (boe/d) over the course of this decade, although the latter figure includes a wide range of countries outside of the MENA region. It should also be taken into consideration that OPEC generally supports a more bullish long-term view of oil demand than many other forecasters.

Figure 7: Oil demand growth forecasts (‘000 bpd)

IEA projections fall in line similarly, forecasting growth of about 20% for the period 2020-30 at close to 1.5 million bpd across the region. ExxonMobil’s outlook is, curiously, much lower than others, expecting just 5.8% in liquids demand growth with 5.6% growth in oil for 2021-30. However, its forecast for natural gas demand growth is much more bullish at nearly 24% over the course of this decade, which may partly explain its less optimistic outlook for oil.

By segment, data from OPEC suggest that of the 2.07 million bpd in demand growth expected between 2021 and 2030, road transportation will account for the majority at about 41%, while petrochemicals will follow at 26%. Critically, the petrochemical segment will also see the most growth during this period, with demand rising 46% from 2021 levels. Although aviation fuel will technically see the largest increase with demand growing 136% by 2030, this segment represents the third smallest share of overall demand by 2030 at just 13%, with only marine bunkers and power generation posting smaller gains. As a result, the likely combination of ongoing subsidies for transportation fuels, population growth, and the impact of industrial growth on demand from the petrochemical sector appear to be key drivers of regional oil demand gains.

Anticipated demand from the road transport sector points to a more bearish prospect for greater electric vehicle (EV) penetration across the region. DNV data points to EV sales in the total MENA region remaining below 1% of market share until the mid-decade point for both passenger and commercial vehicles. Additionally, it is likely that EV sales in the region may be concentrated in wealthier markets depending on the overall affordability of these vehicles as well as access to charging infrastructure. Yet this is not to suggest that EVs do not play a role in the evolving energy mix of the region, as the UAE has projected sales of over 370,000 EVs by 2030 in its 2023 energy strategy update.75 Figures used in that strategy point to the UAE currently representing the largest regional EV market, making up 1.1% of the total fleet, whereas in Saudi Arabia, a much larger economy and energy consumer, EVs purportedly make up 0.2% of the total fleet, with the GCC-wide figure at 0.4% in 2022. Aspirations on the penetration of EVs relative to the total passenger fleet in the UAE are less clear, as its 2030 target includes both EVs and hybrid vehicles in its goal of 13% of the total fleet, with electric and hybrid buses targeting a similar 14%, and with an aim of reaching 879 charging stations in the same year.

Saudi Arabia is also likely to play a role in regional growth through its investment in the EV industry, with its Public Investment Fund (PIF) having taken a majority stake in Lucid Motors and planning to localize part of its manufacturing operation to the kingdom in addition to launching Ceer, a Saudi EV brand.76 Riyadh has also committed to purchasing 100,000 Lucid vehicles over the next decade, likely to be deployed for government use. Recent moves point toward Riyadh providing greater policy support for EV deployment across Saudi Arabia as well, with the PIF moving to establish a joint venture with the Saudi Electricity Company (SEC).77 The Electric Vehicle Infrastructure Company, which is 75%-owned by the PIF with SEC holding the remaining stake, plans to install over 5,000 fast chargers across the kingdom by 2030. This would represent a significant improvement in the availability of charging infrastructure in Saudi Arabia; while no official data on the number of charging stations exists, one service designed to help EV owners locate chargers indicates that Saudi Arabia had only 101 charging stations installed nationwide as of November 2024.78

Yet in the case of Saudi Arabia, Riyadh’s plans to localize production of Lucid and Ceer brand EVs raise critical questions around the affordability of EVs. Setting issues with underdeveloped charging infrastructure aside, it is unclear as to how major investments in EV production inside Saudi Arabia may impact Riyadh’s policies toward imports of EVs produced elsewhere that may be more affordable than those made locally. Should Saudi policymakers move to limit the range of EVs available to Saudi consumers, overall EV uptake may be reduced in the near term if internal combustion engine (ICE) vehicles are seen as more economical by the majority of Saudis. The scale of Saudi investment in EVs is likely to result in more clearly articulated policies and targets around this segment in the coming years, but such policies will surely need to balance the desire to support local manufacturing against the degree to which it intends to promote EV uptake among its citizens.

Even in wealthier economies like those of the GCC, the cost of EVs remains an obstacle to greater rollout, similar to issues frequently cited in other economies. A study carried out in Kuwait in 2022 found that attitudes toward purchasing an EV generally improved with the possibility of policy support from the government, presumably in the form of a subsidy, that would reduce the cost of buying an EV or that made it comparable to that of an ICE vehicle.79 Other factors affecting attitudes included availability of charging infrastructure as well as the potential availability of EV-designated “fast lanes” on major highways.

Another area that is likely to sustain limited support for oil demand is the power sector. Although DNV figures anticipate demand for oil-fired power to peak before the mid-decade point, the same data indicates that solar PV is expected to overtake oil-fired power by volume only in 2030.80 Yet its decline seems assured, with data pointing to a 25% decrease by the end of the decade. Wealthier states, like those in the GCC sub-region, are generally expected to significantly phase down or phase out oil-fired power generation entirely based on current targets. While some liquids use in the power sector may remain, GCC states are generally seen as intent on redirecting liquids toward exports or higher-value sectors, as mentioned elsewhere in the study. Saudi Arabia — the only GCC state whose oil use in the power sector warranted mention in the Energy Institute’s review of 2022 data — generated 131.4 terawatt-hours (TWh) from oil in 2022.81 It appears this figure likely peaked in 2015, and despite some fluctuation, the general trend points toward decline, most likely due to the development of non-associated gas resources and the expansion of renewable power capacity.

Yet the persistent share of oil-fired power in the MENA region’s generation mix underscores the ability of regional energy supply dynamics to continue impacting the composition of each demand segment moving forward. Countries that continue to rely on oil-fired power capacity are most likely to do so due to constrained natural gas supplies, as well as the relatively easier process of transporting oil and refined products compared to that of gas and LNG. For instance, although Iranian use of oil-fired power declined since 2020, it remains higher than it did toward the end of the previous decade, when by 2018 generation from oil had declined to 27.6 TWh, versus 31.2 TWh in 2022. Looking ahead, Iran’s ability to maintain natural gas production in line with local demand is likely to be an important variable in its oil-fired power use, especially as its ability to export oil remains questionable due to international sanctions. Egypt tells a similar story, as its rising natural gas demand has outstripped its ability to maintain production, leading oil-fired generation to reach a five-year high in 2022 at 17.6 TWh after falling to just 7 TWh in 2020.82

As petrochemical products are expected to be one of the few segments of oil demand that do not see significant declines for decades to come, the region’s existing petrochemical capacity and planned expansions are likely to be a key factor propping up regional oil demand to the end of the decade and beyond. Growth in the petrochemical industry is viewed as a primary way that oil-exporting countries can diversify their hydrocarbon sector beyond the extraction and export of crude oil and associated liquids. Demand forecasts from OPEC see ethane, liquid petroleum gas (LPG), and naphtha — all of which are crucial feedstocks for petrochemical production — each experiencing more than 50% demand growth between 2021 and 2035 (nearly 70% in the case of ethane), which is supportive of the assertion that petrochemical production will be a significant driver of demand for oil and other associated feedstocks.83 Advances in crude-to-chemicals (C2C) technology, which is a central area of focus for Saudi Aramco, will also be a supporting segment as the NOC seeks to allocate an additional 1.6 million bpd of its crude production to in-kingdom chemicals processes.84 The majority of added petrochemicals production capacity is likely to come from the GCC region, although other projects in Egypt and Algeria may see the North African sub-region also providing greater support for oil demand from the petrochemicals segment.

The need to diversify revenue streams within the oil sector has also led many regional states and their respective NOCs to pursue downstream expansions that place greater emphasis on petrochemical production. Growth in this segment is currently underway — with varied degrees of scale — in Saudi Arabia, the UAE, Qatar, and Oman. These projects, along with upcoming advances in C2C technology, are likely to see the most growth in Saudi Arabia. Notably, figures used by ADNOC in 2023 suggest that its downstream growth will drive most of the UAE’s gas demand before the end of this decade.85 While this will be covered in more detail in the section specifically examining the UAE’s demand drivers and constraints, this data point holds importance for the rest of the region, especially where significant downstream growth is being targeted.

Figure 8: Gas demand growth forecasts (bcm/yr)

Natural Gas Demand

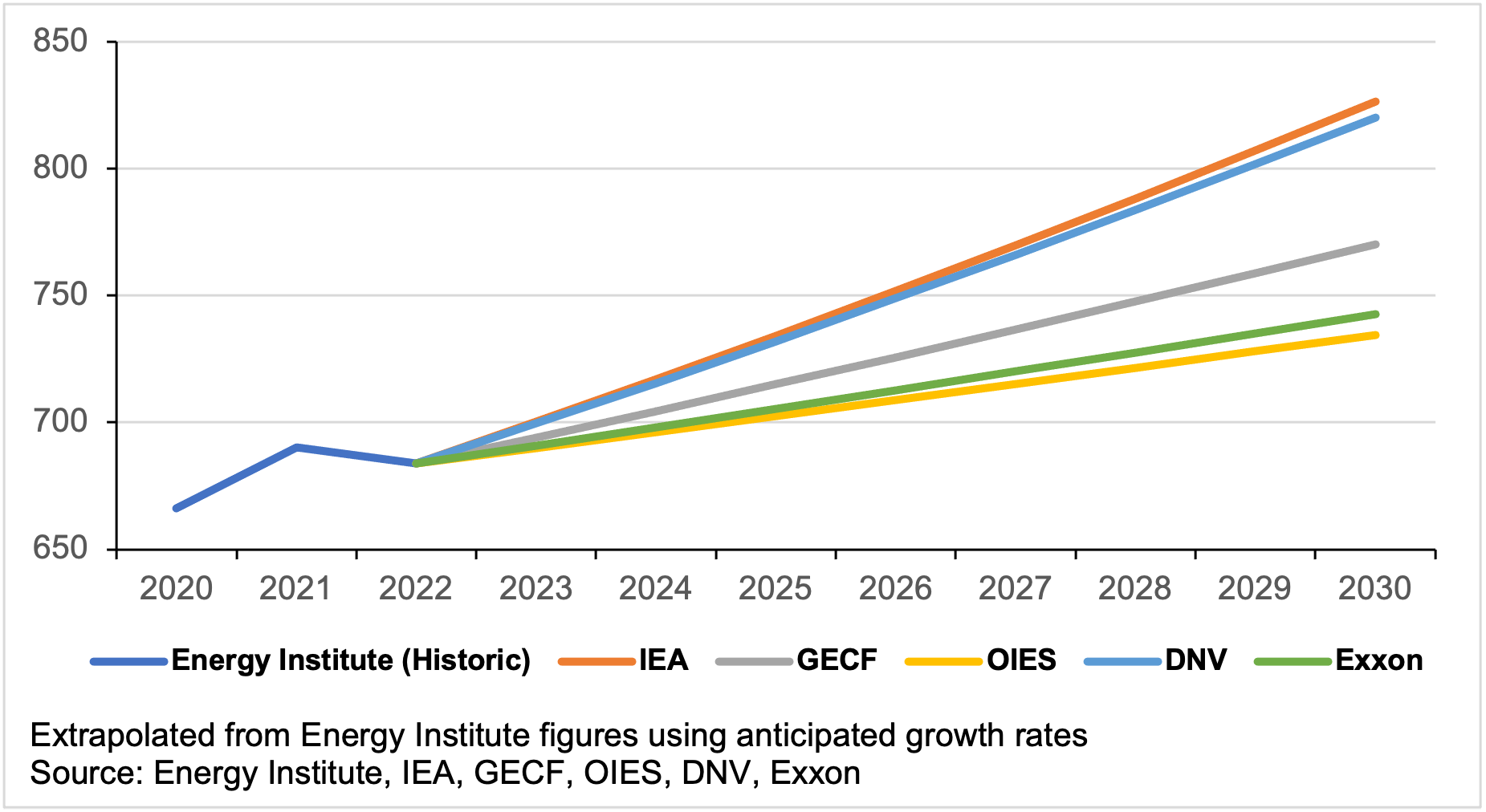

Natural gas is by far expected to experience the most significant demand growth across the MENA region to the end of 2030 and beyond. Support for such an increase will come from continued efforts to provide security of supply as countries develop their domestic resources, turn to LNG imports, invest heavily in expanding the petrochemical industry, and promote other gas-intensive industrial growth. Forecasters expect the MENA region to account for a significant share of global gas demand growth over the course of the next several decades, and projections are generally in alignment.

The Gas Exporting Countries Forum (GECF) expects an average annual demand growth rate of 1.6% per year out to 2050 from a level of 545 bcm in 2021.86 This rate points to region-wide demand growth of about 84 bcm by 2030. Notably, GECF figures do not take much of North Africa into account, where Egypt and to a lesser extent Algeria are expected to represent much of this sub-region’s demand; North African gas consumption represented about 18% of the MENA region’s total in 2022. However, supply constraints may limit Egyptian demand growth in the near term, which will be examined more closely in a section below. As a result, it is distinctly possible that demand growth in Algeria, where gas supplies are much more abundant relative to the size of the local market, will outstrip that of Egypt despite the latter being a significantly larger consumer.

Trends from the previous decade up until 2022 would point to this as a likely outcome, with Energy Institute data indicating 4% average growth in annual gas consumption in Algeria for 2012-22, with Egyptian demand growing just 1.8% per year over the same period.87 Egypt’s mid-decade energy crisis — another instance of energy shortages spurred by the lack of local supply — will have seriously affected this figure as actual consumption was significantly limited by rapidly growing demand across the country.

ExxonMobil’s 2023 outlook anticipated a similar growth rate across the region at 1.3% per year, while a recent report by the Oxford Institute for Energy Studies (OIES) is slightly more bearish, anticipating 1.0% annual demand growth. However, as the OIES considers North Africa separately from the “Middle East,” this may account for the lower figure as its total demand numbers point to much more growth in the North African sub-region than in the Middle East.88 This is also a possible explanation for the lower projections from ExxonMobil, as some forecasters tend to group North African countries with the wider African region rather than what is traditionally thought of as MENA. Projections from the IEA, as well as DNV, are somewhat more bullish, expecting annual demand growth of 2.4% and 2.3%, respectively. DNV figures on energy demand for power generation point to gas retaining its dominant position in the sector until 2030, adding 577.6 TWh across the region by the end of the decade and posting 47.2% growth from 2020.89 Although solar PV will undergo a higher growth rate, its low starting point relative to gas-fired power explains this and thus makes the two difficult to compare.