Egypt, like much of the Middle East and North Africa (MENA), is experiencing an unprecedented digital transformation. Governments throughout the region are embracing emerging technologies, particularly in governance and, increasingly, financial management. Countries across MENA are adopting information and communication technology (ICT) strategies, such as the ICT Vision 2030 in Egypt. Egypt’s plan aims to develop a knowledge-based society by means of a strong digital economy built on reliable, affordable, and equitable access to digital tools. Developing safe, equitable, and well-managed digital payment systems will be key to the country’s ICT strategy and to its economic development efforts more broadly. Effective use of digital payment systems to administer cash-based social aid programs, including huge social programs such as “Takaful and Karama,” could have an enormous impact on Egypt's economy and serve as a model for other developing digital markets. Poorer segments of society stand to benefit the most because they tend to rely on cash aid programs but often lack access to the formal financial sector. With this transformation, Egypt could strengthen its overall social contract by providing greater economic inclusion.

Egypt’s tech transformation

In line with the presidential directives intended to turn the country into a digital corridor and tech hub, Egypt has made important strides to enhance its digital transformation. An enormous emerging market with the potential to boost its economy by fully utilizing digital technologies, Egypt has made significant progress in this arena during the COVID-19 pandemic. According to a study by Google, Egypt is one of 16 countries that will collectively account for 13% of global GDP, 16% of the global population, and 19%% of global internet users. Given these high stakes, it is crucial to understand Egypt’s digital evolution, in terms of its geopolitics and local political context.

COVID-19: A forced pathway to the digital economy

Egypt’s government chose to expand the use of e-payments over the course of the devastating COVID-19 pandemic. Like many countries in MENA and the Global South, Egypt found itself at a crossroads at the beginning of the pandemic. Constrained by the imperative of social distancing, it took tentative steps toward more technology-enabled financial governance, particularly for social assistance programs, whose recipients largely belong to the unbanked segment of Egypt’s population. For the first time, aid was delivered by cashless transactions, including e-wallets. E-wallets are a mobile service that gives users access to their available monetary balance for cash withdrawals, transfers, payment for government services, utilities, and payment for purchases through points of sale (POS) or QR codes. Some have argued that cashless transactions can democratize financial systems and services worldwide, particularly for those who lack access to traditional banking.

Background: The current ICT landscape in Egypt

In 2020, the COVID-19 outbreak and related public health efforts accelerated Egypt’s digital transformation. Adapting to COVID-19 precautionary measures, people staying at home relied on the internet and ICT-related applications to work, study, connect with friends and family, shop for essential goods, and more. In Egypt during 2020, the number of peak hours for internet usage climbed to 15 hours per day, compared to pre-COVID peak averages of seven hours per day. Moreover, the internet usage on cell phones increased by 35%, and the usage of apps like Zoom, Telegram, and YouTube increased by 3465%, 1100%, and 115%, respectively.

Alongside these developments, the Ministry of Communication and Information Technology (MCIT) in Egypt formulated an ICT 2030 Strategy and Digital Egypt Strategy. The plan rests on three pillars — digital skills and jobs, digital transformation, and digital innovation — all of which progressed by leaps and bounds during COVID-19.

Cashless transactions in Egypt: Gateway to economic equity

As of 2021, Egypt’s National Telecommunication Regulatory Authority (NTRA), the telecommunication regulatory authority under MCIT, reported a dramatic surge in the usage of e-wallets. During the first quarter of 2021, the NTRA reported 81 million e-transactions, as compared to 29.5 million e-transactions in the first quarter of 2020, an increase of 175%.

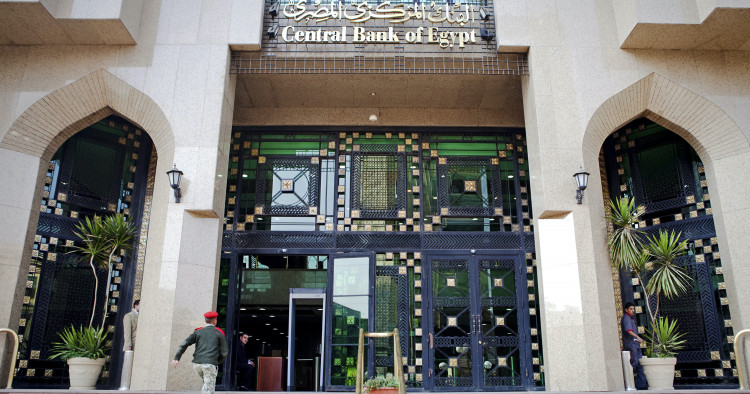

This is perhaps attributable to the decision by the Central Bank of Egypt to waive fees for e-wallets and increase the limits of e-wallets via mobile phones to EGP 30,000 per day and EGP 100,000 per month for individuals (roughly $1900 and $6350) and to EGP 40,000 per day and EGP 200,000 per week for corporations (roughly $2550 and $12,725). The stunning growth in e-payments indicates a nation-wide trend toward more decentralized and non-traditional forms of payment.

Digital payment as a key socio-economic growth factor

Mobile money constitutes a key driver for socio-economic growth and a gateway to the digital economy. Several nations fostering digital technology, with a particular focus on mobile money as a major tool for financial inclusion, have reduced poverty rates. One well-known example of this phenomenon is Kenya’s mobile money transfer system, known as M-Pesa. The system, first created in 2007, enables users to deposit money, execute transfers, and withdraw money at retail stores by presenting their national identification card. M-Pesa functions as a convenient payment tool, with users utilizing it to pay their utility bills at schools, hospitals, and retail stores, make and receive different business payments, transfer money abroad, and access credit. The system recorded 8.5 million users in 2009, with total transactions worth $3.7 billion, and expanded into other African countries like Tanzania, Mozambique, and the Democratic Republic of the Congo. As of 2021, M-Pesa has over 50 million overall users. The system has increased access to financial services and products by 56% from 2006 to 2019, and contributed to lifting 2% of Kenyan households out of extreme poverty.

Worldwide, over $1.3 billion is processed daily by means of mobile payments, and more than $866 million has been registered to mobile accounts in 90 countries. Perhaps most significant from a development perspective, mobile money has facilitated access to money for previously unbanked and underbanked individuals. Globally, about half of unbanked adults, who lack a formal financial history or savings, come from the poorest 40% of households. As such, mobile money or e-wallets have improved the welfare of households by allowing them to access cash, in addition to using it at POS and withdrawing money from automated teller machines.

E-wallets have provided disadvantaged groups with an opportunity to break out of poverty by giving them a reliable and inexpensive means to access finance that eliminates the previously insurmountable barriers of wait times and expenses such as transportation. Research has also shown the reliability of e-money in providing security to the unbanked poor during natural disasters, such as floods or droughts, and other instances in which quick access to cash can be a matter of survival.

Use of e-wallets in social welfare programs

Globally, e-wallets have frequently been used to save social welfare recipients both time and expenses. During COVID-19, the World Bank noted that a total of 200 countries implemented 1,055 social protection measures, 50% of which were safety net measures that included cash transfers. In the Middle East, 16 countries adopted social assistance responses to COVID-19 in the form of cash transfers or food assistance. Egypt, for its part, offered a payment of 1500 EGP ($95) to 2 million workers in the informal sector, over a three-month time period with 500 EGP ($32) paid per month, registered at the database of the Egyptian Ministry of Labor and Manpower. The payment was completed through banks, post offices, and e-wallets. E-wallets increased the efficiency of aid transfers to informal workers while also respecting social distancing measures.

Although the global economy has resumed in fits and starts, the economic precarity engendered by the pandemic has left many Egyptians, particularly those working in the informal sector, in dire need of cash-based assistance. Egypt’s flagship cash transfer social protection program, Takaful and Karama, was established by the Ministry of Social Solidarity in 2015. Tafakul (“Solidarity”) is a program that supports poor families with children under 18, while Karama ("Dignity") supports the elderly poor and people with disabilities. Takaful and Karama, with a budget of 19.3 billion EGP (almost $1.23 billion) as of 2020, assists at least 3.8 million households. The monthly payment has been made through smart cards used at 4,270 post offices across Egypt’s 27 governorates. This method of dispatching the payments has continued during and after the peak of COVID-19. However, during the most urgent phase of economic precarity associated with the pandemic, the operating hours of the post office were extended and other measures were taken to facilitate social distancing. The Egyptian government’s decision to digitize Takaful and Karama payments has not only reduced human interaction, but also eased beneficiaries’ transportation costs, freeing up financial resources for essential utilities.

Conclusion and way forward

With social protection being key to Egypt’s renewed vision for its economic future, building effective and efficient aid programs will continue to be essential. To this end, the government has also developed an evolving methodology to better target those who are entitled to benefits under the social protection program, and exclude those who are not. As such, there is a dire need for the government to thoroughly assess its usage of digital technology, including digital payments and e-wallets, for the purpose of improving social service provision. In conclusion, the Egyptian government could better utilize digital payment solutions, in particular e-wallets, not only to efficiently deliver its cash-transfer program, Takaful and Karama, but to also further strengthen its social contract with citizens.

Alaa Mazloum is a Graduate Fellow with MEI’s Cyber Program. She previously worked as a Senior Public Policy Analyst at a consultancy firm in Egypt, where she researched policy issues related to the digital transformation in Egypt. The views expressed in this piece are her own.

Photo by Shawn Baldwin/Bloomberg via Getty Images

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.