Introduction

North Africa has entered a food security crisis. Tunisia, Algeria, and Morocco are witnessing food inflation levels not seen since the civil unrest of the Arab Spring a decade ago. Then, soaring food costs, particularly skyrocketing bread prices, helped fuel the popular protest movements against corruption and injustice that ousted Tunisia's long-time dictator Zine El Abidine Ben Ali and toppled other autocratic regimes in the Middle East and North Africa (MENA). In Morocco and other MENA countries, the social unrest prompted significant political and socio-economic reform. Although the Maghreb's current food crisis was precipitated by the local and global economic shocks brought on by the onset of the COVID-19 pandemic in 2020 and its 2021 aftermath, the structural fragility of the food systems in Tunisia, Algeria, and Morocco is responsible for severity of the problem. At the core of this fragility is the failure to implement adequate measures to address the impact of increased water scarcity and debilitating climate change.

The Maghreb's main vulnerability is its high dependency on cereal grain imports, both for human consumption and for animal feed. The global average price for cereals increased 27.3% in September 2021 compared to September of the previous year and prices have since continued to climb at an even faster rate. In households across Tunisia, Algeria, and Morocco, the food crisis is felt most acutely in the price of bread. The price of soft wheat used in bread manufacture stood at $271 per ton at the end of 3Q 2021, a 22% year-on-year increase. The price in 4Q 2021 has shot up further as global inventories have shrunk as the U.S., Canada, Russia, and the rest of the Black Sea region producers have experienced crop damage due to droughts, frost, and heavy rain. In the U.S. itself, for example, the wheat stockpile is projected to be just 580 million bushels by June 1, 2022, the smallest in 14 years.

The rise in grain prices has been compounded by the soaring costs of nitrogen-based fertilizers, which have been driven in turn by the climbing costs of the natural gas or coal used in their manufacture. In the case of wheat fertilizer, about 80% of the production cost comes from natural gas, the price of which has risen five-fold for European fertilizer manufacturers and about 1.5 times for manufacturers in the U.S. As a consequence of all these factors, the soft wheat price on the Chicago Board of Trade on Nov. 1, 2021 stood at $7.95 per bushel, representing a 57% spike from July 1, 2021 and a price not seen since January 2013.

When viewed as a stress a test of the state of economic, agricultural, and environmental management in Tunisia, Algeria, and Morocco, the 2021 cereal grains crisis has revealed that the food systems across the Maghreb nations exhibit dangerous fragilities that could translate into social and political instability. However, such outcomes are not inevitable and can be mitigated through appropriate policies, some of which have begun to be implemented in the region.

Tunisia

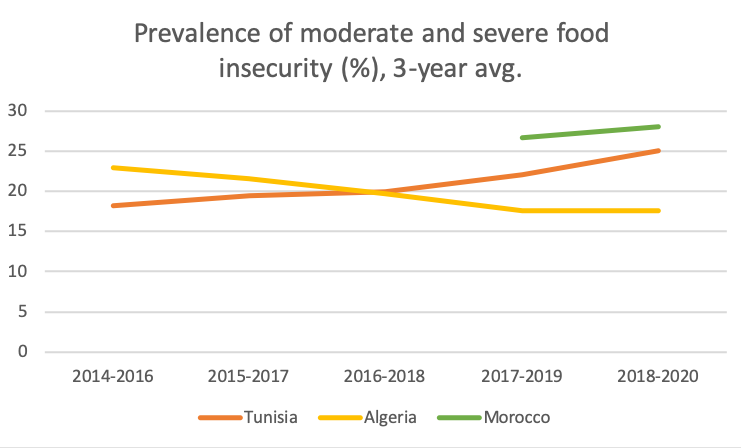

Rising food insecurity in Tunisia has become a driving factor in the country's precarious political condition since the 2014 adoption of a democratic constitution. In the period following that landmark event in Tunisia's progress toward liberal democracy, food insecurity has been increasing at an accelerating pace. According to the U.N. Food and Agriculture Organization’s (FAO) three-year average, 25.1% of Tunisians were in a state of moderate to severe food insecurity during 2018-20, compared to 18.2% during 2014-16. Although Tunisia has attained self-sufficiency in dairy products, vegetables, and fruit, the country remains extremely dependent on foreign cereal purchases, importing 50% of cereals used for human consumption and 60% of those used for livestock feed. Tunisian consumers have been somewhat sheltered from the high cost of these foreign imports through government food subsidies. The economic shock of COVID-19 followed by the perfect storm of soaring global cereal grain prices in the face of local drought conditions means Tunisia's food subsidies are no longer tenable given its fragile public finances.

As a result of COVID-19, Tunisia's fiscal deficit in 2020 reached 11.5% of GDP, the largest deficit in almost 40 years. In order to cope with the immediate health crisis and the pandemic's devastating economic impact, the government of then-Prime Minister Hichem Mechichi agreed to accept a $750 million emergency loan from the International Monetary Fund (IMF) in April 2020. With its economy battered and its government paralyzed by dysfunctional parliamentary party politics, Tunisia entered 2021, the 10th anniversary of its experiment with democratic transition, in a more anxious than celebratory mood. The long-simmering discontent over declining living conditions driven by the continued poor quality of the country's basic services was further exacerbated by Tunis' feeble COVID-19 vaccine rollout. Amid soaring food prices not witnessed since the Arab Spring, a new wave of protests broke out starting in the northern city of Siliana.

Having experienced an 8.8% contraction in its 2020 GDP growth, Tunisia still needed to cover debt repayments of $5.8 billion, $1 billion of which was due in July and August 2021. In late May 2021, Tunisia's Central Bank governor warned that not accepting further IMF assistance would lead to soaring, triple-digit inflation and result in a "Venezuela scenario." During Q1 2021, Tunisia's food trade balance posted a deficit of 251.7 million Tunisian dinars (DT), reversing the DT 176.8 million surplus in the same period of the previous year. On March 31, the powerful Tunisian General Labor Union (UGTT) had agreed to accept economic reform, including the elimination of food subsidies, as a necessary prerequisite for Prime Minister Mechichi's government enter into talks with the IMF. However, by June 2021, UGTT reversed its support for Mechichi. Claiming the government had not provided a sufficient safety net, the UGTT criticized the increases in food and other commodity prices, attributed to the implementation of IMF-inspired cost-cutting measures.

In 2021, it has been estimated that Tunisia will need to import 70% of its total grain needs and 90% of soft wheat used to make flour for bread and baked goods. In H1 2021, the increase in the rate of Tunisia's cereal imports was 20.9%, contributing to a food trade imbalance of $290.9 million during the period, up from $49.4 million during the same period in 2020. Tunisia's grain agency bought 50,000 metric tons of soft wheat from European traders in June and then an additional 100,000 metric tons in July, as well as 100,000 metric tons of barley for livestock feed. But these efforts proved too little too late to stabilize prices and help ease civil discontent.

On July 25, 2021, President Kais Saied, posing in the role of national savior, dismissed Prime Minister Mechichi and suspended Tunisia's parliament based on a controversial interpretation of Article 80 of the constitution. Saied subsequently extended the suspension beyond the constitutionally prescribed one-month period and announced that he would rule by presidential decree. Tunisia's food security outlook so far has not improved under direct presidential rule. The food trade imbalance by the end of 3Q 2021 stood at DT 1.32 billion, with imported grain prices rising 23.9% for soft wheat and 12.6 % for durum. Animal feed grain prices likewise increased, with barley seeing a 18.4% jump and corn a 46.9% spike.

Increasing Tunisia's domestic cereals production will be neither quick nor easy. Tunisia has a problem securing sufficient fertilizer supplies, amid a global supply crunch, as soaring energy prices have curtailed production in many countries across Asia, Europe, and North America and caused fertilizer prices to spike. In October 2021, Tunisia could only satisfy 25% of its domestic fertilizer demand. Domestic supplies were also drastically reduced by the six-month closure, from November 2020 to May 2021, of the Mdhilla chemical fertilizer plant in Gafsa due to repeated strike actions and protests. Even though the government authorized supplementary imports, Tunisian farmers experienced a 30-50% increase in fertilizer costs.

Water scarcity is an even larger obstacle to boosting Tunisia's agricultural production, dangerously exacerbated by the poor stewardship of the country’s scant water resources, about 80% of which are used for agriculture. Tunisia has experienced record high temperatures and droughts alternating with bouts of torrential rain and flooding that have wreaked havoc on the country's agriculture and human water supply. Poor water management and faulty infrastructure make the country highly vulnerable to extreme weather events brought on by climate change. In some areas of Tunisia, as much as much as 50% of water is lost before reaching the tap due to poor water distribution infrastructure. Drought has also caused a severe decline in water reserves. In September 2021, water volumes in Tunisia's dams stood 730 million cubic meters (mcm), down from 1.1 billion cubic meters (bcm) during the same period in 2020. Tunisia's water storage capacity is also declining because of the increasing silting of its dams. By 2035, the dams in Mellègue and R'mili will become completely silted, with the same fate awaiting Siliana's dam in 2047.

There are solutions to many of the problems contributing to Tunisia's food and water crisis but there are few immediate fixes. The construction of new dams, irrigations systems, and desalination facilities, along with the additional power plants to run them, will all require time and capital investment. Most of all, the solutions to Tunisia's problems will require expert policy planning and the good governance to implement the measures.

Algeria

Algeria faces similar economic and climate challenges to Tunisia when it comes to ensuring food security for its population, but the challenges are on a more daunting scale. With about 17.4% of its mostly desert territory consisting of agricultural land, Algeria is Africa's largest importer of food. Prior to COVID-19, Algeria's food imports provided for nearly 75% of the needs of its population of 45 million. Despite the scale of the challenge, Algeria had been making some progress in reducing food insecurity before the outbreak of the pandemic. According to the FAO's three-year average, the percentage of the population experiencing moderate to severe food insecurity dropped to 17.6% for 2018-20 period, down from 22.9% for 2014-16. Nonetheless, prior to COVID-19, an estimated 24 million Algerians spent over 60% of their incomes just to meet their food needs. Despite its hydrocarbon wealth, Algeria's continuation of its current policy of food import subsidies amid runaway global food inflation and domestic production shortfalls brought on by drought has become a difficult burden for its public finances to manage.

Algeria's most critical food imports are cereal grains, which contribute 43% of the total calories and 46% of the protein in the Algerian diet. Prior to the current global supply crunch, Algeria's annual expenditure on cereal imports was around $1.3 billion. Even in years when its domestic production yields good harvests, Algeria still relies heavily on cereal imports, typically 70% of which is soft wheat used to make bread.

Algeria's cereals agriculture is highly vulnerable to severe weather events. Its domestic grain production is expected to plummet by 38% for the 2021/22 marketing year (MY) due to insufficient rainfall. Consequently, its wheat import requirements for MY 2021/22 are projected to be 8.1 million metric tons, 25% above last year's imports. Most of its wheat imports come from the European Union (EU), with France traditionally the largest supplier. However, with the global pressure on grain supplies, this year German grain exports have overtaken those from France. Beyond the effects of severe weather events and COVID-19-related supply chain disruptions, the global supply shortage has been exacerbated by an increase in China’s wheat imports, including French wheat, to cover its livestock feed requirements. Beijing is working to rapidly replenish its local pig population after an African swine fever epidemic wiped out half of its pigs, with an eye to ensuring its supply of animal protein.

To meet Algeria's increased import needs, the government of President Abdelmadjid Tebboune has sought to diversify its suppliers from within the EU as well as to look beyond the bloc to Russia and as far afield as the United States and Canada. In late October 2021, Poland shipped 60,000 metric tons of wheat to Algeria. Algiers also purchased 60,000 metric tons from Russia's Demetra Trading, the country’s first Russian wheat imports since 2016. Despite diversifying its suppliers, the global supply shortage means that Algiers still needs to cope with skyrocketing prices. As an immediate response, the Algerian government has postponed its plan to lift wheat subsidies indefinitely. Besides wheat, the rise in the cost of Algeria's imported barley and corn, used mainly as animal feed, increases the prices of red and white meats. The lack of rain in the high plateau region, where wheat and barley are mostly grown, has led to higher barley imports. Algeria will also import 5 million metric tons of corn for animal feed this year.

Unlike other countries in the Maghreb, Algeria is also facing a milk supply crisis. Milk is the main source of animal protein in the Algerian diet, providing an estimated 16% of average daily protein intake — outstripping red meat, white meat, and eggs combined, which account for only 10.24%. Algeria is the world's second-largest importer of dry whole milk powder, with 2021 estimated imports of 255,000 metric tons, and the fifth-largest importer of nonfat dry milk powder, estimated at 160,000 metric tons. In 2020, Algeria did register a 3.8% increase in milk production resulting from a rise in the amount of land allocated to dairy production as well as a new government prohibition on using subsidized milk powder to manufacture pasteurized milk. While an improvement, these measures are far from closing the gap. In 2017, Algeria maintained approximately 200,000 dairy cows, but in 2021 the country would need over 1 million cows to satisfy its current milk demand solely with domestic production. Moreover, the considerable increase in grain-based cattle feed likely required for such an effort would put a further strain on the country's cereal imports.

Algeria's current approach to food security largely depends on the extent to which state subsidies can cushion local consumers from the impact of food price increases on the global market. As a hydrocarbon rentier state in which oil and gas accounts for around 95% of export revenues, Algiers has relied on hydrocarbon revenues to fund its food subsidies. The economic shock of the COVID-19 pandemic severely reduced its capacity to finance these subsidies. In 2020, Algeria's economy experienced a 4.6% contraction in real GDP, with the country's crude oil and liquefied natural gas exports each experiencing about a 30% drop. While recovering energy prices should push Algeria into positive economic growth — the World Bank's spring 2021 forecast projected 3.7% growth in 2021 and 2.5% in 2022 — some of this growth could be offset by Algeria's soaring food import bills, aggravated by the sinking value of the Algerian dinar. With the dinar having declined steadily from 118 against the U.S. dollar on Jan. 1, 2019 to 138 at the end of October 2021, it will become increasingly difficult for Algiers to meet the rising costs of its food imports and subsidies.

Like Tunisia, Algeria's increased fertilizer use and improved water management capabilities are critical for boosting domestic agricultural production. Although Algeria is rich in natural gas and phosphates, two of the main resources used in fertilizer manufacturing, the country's agricultural sector typically uses much less fertilizer than its neighbors. In 2018, fertilizer consumption for Algerian agriculture was 20.7 kilograms (kg) per hectare of arable land, compared to 44.2 kg in Tunisia and 74.9 kg in Morocco. To help alleviate the problem, Algeria’s state-owned energy company Sonatrach signed an agreement in 2018 with China’s CITIC Construction to build a $6 billion integrated phosphate production complex. The mega-plant would see Algeria’s annual phosphate output rise to 10 million metric tons, resulting in increased annual fertilizer output worth around $2 billion on global markets, while greater domestic use of fertilizer would lead to higher crop yields in the future.

Water scarcity is a more fundamental challenge for Algeria. Similar to Tunisia, Algeria has suffered from poor stewardship of its scant water resources. In 2012, its fresh groundwater withdrawal was 3 bcm, about double the annual recharge rate. According to the FAO, the withdrawal rate jumped to 8.1 bcm in 2017. Algeria's inadequate water management has been exacerbated by faulty infrastructure that results in water transportation losses to urban areas of about 30%. Like Tunisia, Algeria's dams are heavily impacted by siltation and contamination. To increase its water supply, the government has turned to energy-intensive desalination technology and renewed its efforts to upgrade and develop seawater desalination plants. Algeria has 11 desalination plants spread over nine provinces and the Tebboune government is in the processes of rehabilitating and upgrading four of them, with plans to build an additional three.

Morocco

Morocco shares many of the same food security challenges as Tunisia and Algeria, but the manner in which it is experiencing the current crisis has been shaped by its unique emphasis over the past 10 years on developing high-value agricultural exports. Morocco's agricultural planning over the past 20 years, and particularly during the past decade, has succeeded in boosting its export production while reducing undernourishment to below 5% of the population. Despite these achievements, the three-year average for moderate to severe food insecurity in Morocco from 2018 to 2020 stands at 28%. While self-sufficiency in food has been a fundamental tenet of the kingdom's development strategy since independence, Morocco's growing dependency on key subsidized food imports represents an increasing danger to its socio-economic fabric. Similar to its neighbors, Morocco is heavily dependent on imported cereal grains.

In 2008, the kingdom launched its Green Morocco Plan (Plan Maroc Vert, PMV), a multi-faceted program running from 2010 to 2020 to promote socio-economic development by boosting production of high-value agricultural exports. The PMV succeeded in raising the value of country's agricultural exports by 117% to roughly $3.5 billion and created 342,000 new jobs. In 2019, Morocco's agricultural sector accounted for 13% of GDP and 38% of national employment — including 74% of jobs in rural areas. Since the proportion of the population employed in agriculture in Morocco is higher than in any other Mediterranean basin economy, the development of higher-value-added agri-food production for export has been viewed as key to raising the living standards of a large swath of society. As a result of the PMV, Morocco's agri-food sector now accounts for 21% of its exports.

Halfway through the PMV's implementation, imported cereals accounted for 54% of Morocco's total cereal consumption, over three times the global average of 16%. Because of the PMV's emphasis on export agriculture, Morocco has continued to reduce the amount of agricultural land devoted to cereal production. Even with these reductions, cereal production in 2019 still used 59% of Morocco's agricultural land. To boost cereal yields, the PMV focused on modernizing production methods and introducing climate-tolerant wheat varieties. In 2021, these efforts paid off and Morocco enjoyed a banner year for wheat and barley production, harvesting 5.06 million metric tons of soft wheat, 2.48 million metric tons of durum wheat, and 2.78 million metric tons of barley. Its 2021 wheat production was three times that of the drought-stricken year of 2020 and 58% higher than the 2016-20 average. Morocco's barley production outstripped previous years by an even wider margin. Having already projected 2021 to be a record breaking year for domestic wheat production, Rabat sought to further promote the sector by imposing a 135% import duty on foreign soft wheat in April 2021 and a 170% import duty on durum wheat in June 2021.

As the world's 13th-largest wheat importer, Morocco has not made sufficient progress in boosting domestic wheat production to escape the current crisis. As bread prices started climbing in September and October, the government was forced to change tack on Oct. 27, 2021, suspending the import duties on soft wheat and durum effective Nov. 1. To ensure the stability of the price of bread manufactured from soft wheat, Morocco's Compensation Fund covers the difference through subsidies. At the end of 2015, Morocco began to implement a phased program to reform the system as the Compensation Fund's ballooning subsidies since the 2008 global financial crisis had become an unbearable burden on state finances. Although the program's second phase was supposed to liberalize the prices of Morocco's most consumed commodities, the government suspended the program indefinitely to ensure price stability during the current crisis, which may turn out to be protracted. The Ministry of Economy and Finance anticipates that wheat subsidies alone will cost the government $161.1 million in fiscal year 2022.

Morocco is expanding on its PMV with a new 10-year initiative called Green Generation 2020-2030 intended to enhance the resilience and sustainability of the country's agricultural production for export and domestic consumption while elevating 400,000 households into the middle class. To attain these goals, Morocco will need to mitigate its vulnerability to the impact of climate change and the increasing prevalence of drought. Rising temperatures and prolonged drought conditions are causing land degradation, with almost half of Morocco's land facing soil erosion.

The PMV put a total of 542,000 hectares under drip irrigation systems compared with only 128,000 hectares in 2008, with these irrigated areas accounting for at least half of agricultural GDP growth since the PMV's launch. In 2019, irrigated land generated 75% of Morocco's agricultural exports. However, only 16% of the kingdom’s agricultural land is under irrigation from local dams, causing cereal production to be highly variable and vulnerable to weather events.

As with Tunisia and Algeria, Morocco faces the challenge of addressing the siltation of its aging large dams, which experience a siltation rate of 75 mcm per year. In February 2021, Rabat announced that it will begin the construction of five new large dams with an aggregate storage capacity of 525 mcm as part of the 2020-27 phase of its national water plan, which seeks to raise the country's total dam capacity to 27 bcm. Rabat has also completed 65% of the construction of a new seawater desalination plant at Agadir that will supply drinking water as well as water for agriculture through a newly constructed irrigation system.

Conclusions

The solutions for the Maghreb's food insecurity exist but they are neither quick nor easy. Agri-tech, including precision irrigation operating on power from renewable energy sources, would go a long way in improving the region’s agricultural yields, especially when combined with state-of-the-art water management technologies. Seawater desalination is energy intensive and would either add burdensome energy costs or require additional power generation capacity from renewable energy sources. All of these measures require significant capital investment. Morocco's National Water Plan 2020-2050, which envisages the construction of new dams and desalination plants as well as the expansion of irrigation networks, among other measures, to promote sustainable agriculture and the preservation of ecosystems, is estimated to cost approximately $40 billion.

While holistic approaches are optimal, more limited measures can also result in significant positive impacts. Expanded irrigation is essential to boost cereal production across the Maghreb. In Algeria, only 43% of the agricultural land under irrigation is planted with cereals. In late 2020, Algiers issued a 2020‑24 roadmap strategy for several key agricultural products to reduce its food import expenditures. In the wheat sector, the proposed modernization of irrigation is expected create a two- to three-fold increase over currents yields, potentially producing upwards of 7 million metric tons of wheat per year by 2024.

In addition, the Maghreb nations need to bolster their strategic reserves. Algeria has set a goal to construct 31 metal silos that would create 670,000 metric tons of additional storage capacity. On Oct. 8, 2021, Morocco's King Mohammed VI raised the issue to a public national priority in a televised speech inaugurating the country's new parliament. In his speech, the king "insisted" that Morocco establish an "integrated national system" of strategic reserves for essential food, medical, and energy supplies to manage shocks from future global supply shortages and other emergencies. Tunisia, which has been comparatively slower to take action commensurate with the scope of its food insecurity problem, signed an agreement in January 2021 with the United Nations' World Food Programme to establish a food security monitoring system.

The Maghreb's need to implement such large-scale measures opens possibilities for the U.S. and its European allies to deepen their partnerships with Tunisia, Algeria, and Morocco — engaging in new areas of cooperation that, in some cases, could reset the terms of the relationship. In the absence of proactive engagement by the members of the trans-Atlantic community, China, the Arab Gulf states, and other nations are likely to fill the gap and increase their influence in the region.

The 2021 cereal grains crisis in the Maghreb should not be ignored by the international community. The crisis has revealed severe structural fragilities in the food systems of Tunisia, Algeria, and Morocco that are ultimately caused by the failure to implement adequate measures to address the impact of increased water scarcity and debilitating climate change. The cost of inaction or too little action could be quite high, as the failure to begin implementing appropriate policies could result in dangerous social and political instability in the near future.

While some of the necessary policies have begun to be implemented to varying extents, good governance to carry out the required measures will be critical to determining the success of efforts in Tunisia, Algeria, and Morocco. Solutions to ameliorate the Maghreb's food insecurity exist, but as global food prices are likely to keep increasing in 2022 as climate-driven challenges to agricultural production continue to intensify, Tunisia, Algeria, and Morocco — along with their international partners — have little time to lose if catastrophic consequences are to be avoided.

Professor Michaël Tanchum is a non-resident fellow with the Middle East Institute's Economics and Energy Program. He teaches at Universidad de Navarra and is a senior fellow at the Austrian Institute for European and Security Policy (AIES) and visiting fellow in the Africa program at the European Council on Foreign Relations (ECFR). The views expressed in this piece are his own. The author would like to thank Rafaella Vargas Reyes and María del Pilar Cazali Castañón for their research assistance.

Photo by FADEL SENNA/AFP via Getty Images.

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.